Sponsored by Battle Quest Comics

By Brian Hibbs

“There are three kinds of lies: Lies, Damned Lies, and Statistics”

Ludicrously, this is the twentieth annual report of something that is hard to exactly perceive and understand: the size and shape of the sales of graphic novels and trade paperbacks through the book store market, as seen through the prism of NPD BookScan.

There is a tremendous amount that goes into making these reports, and a whole lot of detail of how these lists get generated, but my wise editor believes that most folks just want to get to the numbers. So, if you are interested in how the sausage gets made, please go down to the bottom of the column for lots of in-depth details.

I will summarize a few things top level concepts up-front however: all sales reported here are generated by The NPD Group, which runs NPD BookScan. These reflect actual sales made through bookstores that report to NPD, which includes Amazon. NPD believes that some 85% or more of book sales are captured by them – so even best-case scenario, these are a little light. They also include a few comic book specialty stores via those stores that use the “ComicsHUB” point-of-sale system, though it is extremely unclear just how much of comic store sales they are capturing. HUB is absolutely no better than the #2 POS system, and they could be significantly smaller as reporting says “over 100” stores use ComicsHUB – last industry wide data suggests there are over three thousand comics stores. (More comprehensive records of Direct Market purchases in 2022 can be found in the excellent reports by John Jackson Miller’s Comichron)

But this BookScan report obviously only includes books sold through the venues that report to NPD BookScan – it certainly doesn’t include sources of sales like, for example, school library purchases, or direct-to-consumer sales through things like the Scholastic book fairs. In some cases, those numbers could potentially be many multiples of the retail trade. I certainly expect that something as broadly popular as “Cat Kid” (the #1 book in 2022’s BookScan report) is selling at least twice as many copies (and maybe much much more!) through academic channels. However, this is very much beyond the scope of this survey.

This also only includes physical books sold! No digital of any kind. (Broadly, digital is an insignificant channel, comprising single digit percentages of printed books)

Also for a top-level note: I am myself a Direct Market (comic book store) retailer – while my individual focus is on book-format material, I have a lot biases, both visible and invisible that I bring to these reports. Please bear these in mind as you read my analysis! Question authority!!!

I have historically divided the data between the “Top 750” because a) that’s all the data I was initially leaked back in 2003, b) it’s a “manageable” chunk of data, and c) “as above, so below” – the top 750 represents about half or more of sales. However, since 2007, I’ve received the “entire” database, which now gives us a solid sixteen years of data to track. I refer to this as “the Long Tail”. This year’s “Long Tail” has more than 50k items! That’s a lot! And a whole lot of those books are selling copies that don’t even add up to one hundred copies sold in a year.

I also do a rough calculation of if you multiply the number of copies sold (a firm number) against the cover price, what you the calculated retail dollar sales be. This is not actually a real number, because a significant percentage of these books sold for less than cover price (thanks Amazon!)

[Editor’s note: as is our custom, we’ve provided a chart of the Top 750 comics, with sales figures removed. This is the raw Top 750 Bookscan chart with non comics titles – such as Wimpy Kids books – removed by the author. Without this correction the #1 book would be Diary of a Wimpy Kid: Diper Överlöde.]

The first thing that I have to do once I receive the report from NPD BookScan is to edit the data I am sent, removing all of the things that are not comics. I literally hand-checked thousands of items every YEAR against Amazon’s “Look Inside” feature” to say “is this a comic or not?” I defined “comics” like this: either a) it has multiple panels sequentially producing a narrative (those don’t have to be on ONE PAGE, so someone like Mo Williams is certainly comics) OR b) a single image that, taken solely by itself, provides a complete thought. So, “The Far Side” is comics, but, no, “Diary of a Wimpy Kid” is NOT (but very glad to see that number as a comparative)

Using these working definitions, starting in 2018 I decided to cut some items that had previously been included: chief among best-sellers would be Rachel Renee Russell’s “Dork Diaries” – they have words, they have pictures, but they don’t work together in the way I’d think we’d commonly agree is “comics”. I also removed prose-driven books like DK Publishing’s “Marvel Encyclopedia”, which, while nominally about comics or comics culture, is factually an encyclopedic prose book with pictures. Or “Wonder Woman: Warbringer” which is a straight-up prose novel that happens to feature a comics character, or “DC Super Heroes: My First Book of Girl Power” where the Amazon “Look Inside” clearly shows is an illustrated reader for 2nd graders, or even “The Bloody Crown of Conan”, which is a prose book that features a character that originally was created in prose, and that I have had to delete from my reports for literally every of the twenty years I have done this.. There is clearly an enormous market for these kinds of material – in fact, in many cases a larger market than for the actual comics themselves – it just isn’t the “comics” market, as I would define it.

And since I am the one writing this analysis, I get to make the definitions.

The Big Picture

Here’s the big picture for just the Top 750 in 2022:

| Year | Total Unit | Growth | Calculated Retail Value | Growth |

| 2003 | 5,495,584 | ——- | $66,729,053 | ——– |

| 2004 | 6,071,123 | 10.5% | $67,783,487 | 1.6% |

| 2005 | 7,007,345 | 15.4% | $75,459,669 | 11.3% |

| 2006 | 8,395,195 | 19.8% | $90,411,902 | 19.8% |

| 2007 | 8,584,317 | 2.3% | $95,174,425 | 5.3% |

| 2008 | 8,334,276 | -2.9% | $101,361,173 | 6.5% |

| 2009 | 7,634,453 | -8.4% | $93,216,014 | -8.0% |

| 2010 | 6,414,336 | -15.9% | $85,266,166 | -8.5% |

| 2011 | 5,696,163 | -11.2% | $79,961,951 | -6.2% |

| 2012 | 5,438,329 | -4.53% | $89,918,354 | 12.45% |

| 2013 | 5,654,351 | 3.97% | $96,062,709 | 6.83% |

| 2014 | 6,659,031 | 17.77% | $112,768,709 | 17.39% |

| 2015* | 8,762,983 | 31.60% | $141,226,518 | 25.24% |

| 2016* | 9,967,907 | 13.75% | $159,510,075 | 12.95% |

| 2017 | 10,310,682 | 3.44% | $154,026,517 | -3.44% |

| 2018 | 11,755,903 | 14.02% | $165,885,527 | 7.70% |

| 2019 | 15,537,520 | 32.17% | $226,370,566 | 36.46% |

| 2020 | 18,245,279 | 17.43% | $274,308,460 | 21.18% |

| 2021 | 30,698,081 | 68.25% | $443,735,058 | 61.76% |

| 2022 | 31,010,409 | 1.02% | $471,444,963 | 6.25% |

2022 brought the single highest set of totals we’ve seen in the history of tracking BookScan, but the overall growth dropped to nearly flat. Still, anything that beat, even by an inch, the record setting numbers of the pandemic-related boom in 2021 is a thing to be praised. Sales are up just over 1% for the Top 750 in quantity sold, and the Hibbs-created Calculated Retail Value, which is almost certainly wrong because many books are sold at a discount, is up six-and-a-quarter percent

(I want to remind you that while I asterisk 2015-2016 in terms of the sheer number of data points that I was getting was probably edited, it appears to be that the top 750 itself was fairly rock solid – there is more on this down below in the sausage making section)

The trend for print books in general (not just looking at comics) through bookstores in 2022, according to the NPD group and NPD BookScan appears to show a general drop of 6.5%, which does nothing but continue the now nine-year trend of comics-material being significantly stronger than the general curve!

As I discuss in the boilerplate below, I primarily write about the top 750 because a) that’s all the data I was initially leaked back in 2003, b) it’s a “manageable” chunk of data, and c) “as above, so below” – the top 750 represents about half of sales. However, since 2007, I’ve received the “entire” database, which now gives us a solid fifteen years of data to track, that’s“the Long Tail”.

Here’s what the sales of all comics sales NPD BookScan tracks in this category looks like – but, seriously, let me remind you that the dataset changes enough each year this can be an awkward set of comparisons! Even putting aside “the asterisk years”, prior to 2013 this didn’t include Walmart, for just one example (of scores!) of the lack of direct comparison.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 13,181 | —– | 15,386,549 | —– | $183,066,142 | —– | 1167 | $13,889 |

| 2008 | 17,571 | 24.98% | 15,541,769 | 1.00% | $199,033,741 | 8.02% | 885 | $11,327 |

| 2009 | 19,692 | 12.07% | 14,095,145 | -9.31% | $189,033,736 | -5.02% | 716 | $9,560 |

| 2010 | 21,993 | 11.68% | 12,130,232 | -13.94% | $172,435,244 | -8.78% | 552 | $7,840 |

| 2011 | 23,945 | 8.88% | 11,692,058 | -3.61% | $175,634,490 | 1.86% | 488 | $7,335 |

| 2012 | 23,365 | -2.42% | 9,562,236 | -18.22% | $164,415,366 | -6.39% | 409 | $7,037 |

| 2013 | 24,492 | 4.82% | 10,153,628 | 6.18% | $176,419,370 | 7.30% | 415 | $7,326 |

| 2014 | 26,976 | 10.14% | 11,820,324 | 16.41% | $207,598,355 | 17.67% | 438 | $7,696 |

| 2015* | 22,431 | -16.85% | 15,269,550 | 29.18% | $259,807,532 | 25.15% | 681 | $11,583 |

| 2016* | 21,295 | -5.06% | 17,302,891 | 13.32% | $293,583,180 | 13.00% | 813 | $13,786 |

| 2017 | 35,338 | 65.95% | 18,385,086 | 6.25% | $302,300,435 | 2.97% | 520 | $8,555 |

| 2018 | 38,424 | 8.73% | 19,965,469 | 8.60% | $318,345,707 | 5.31% | 520 | $8,855 |

| 2019 | 40,745 | 6.06% | 24,694,686 | 23.69% | $399,322,754 | 25.44% | 606 | $9,801 |

| 2020 | 44,316 | 8.76% | 29,251,619 | 18.45% | $480,408,257 | 20.31% | 660 | $10,841 |

| 2021 | 47,630 | 7.48% | 51,822,538 | 77.16% | $826,280,847 | 72.00% | 1088 | $17,348 |

| 2022 | 50,056 | 5.09% | 52,614,342 | 1.53% | $863,574,176 | 4.51% | 1051 | $17,252 |

Overall, this is our Topline conclusion for the whole NPD BookScan 2022: Up more than 5% in total number books listed, essentially flat with 1.5% growth of Units Sold, and up 4.5% in the calculated retail value if all books sold for cover price (they didn’t, not in the “bookstore” market) – as you read through individual publisher listings, you can compare their “long tail” performance this year against those benchmarks to see if they overperformed or underperformed the market.

But, as amazing as those topline numbers look, please remember that it really is largely “hits” that are driving the business – the “average” book still only sold approximately 1,051 copies, nationwide, in the entire year. Almost no one can earn a living from that (including book sellers!)

Let’s take a look at the Top 20 best-selling items on the 2022 chart, including actual sales, which we’re allowed to run. It looks like this:

| Position | Unit sales | Title | Author |

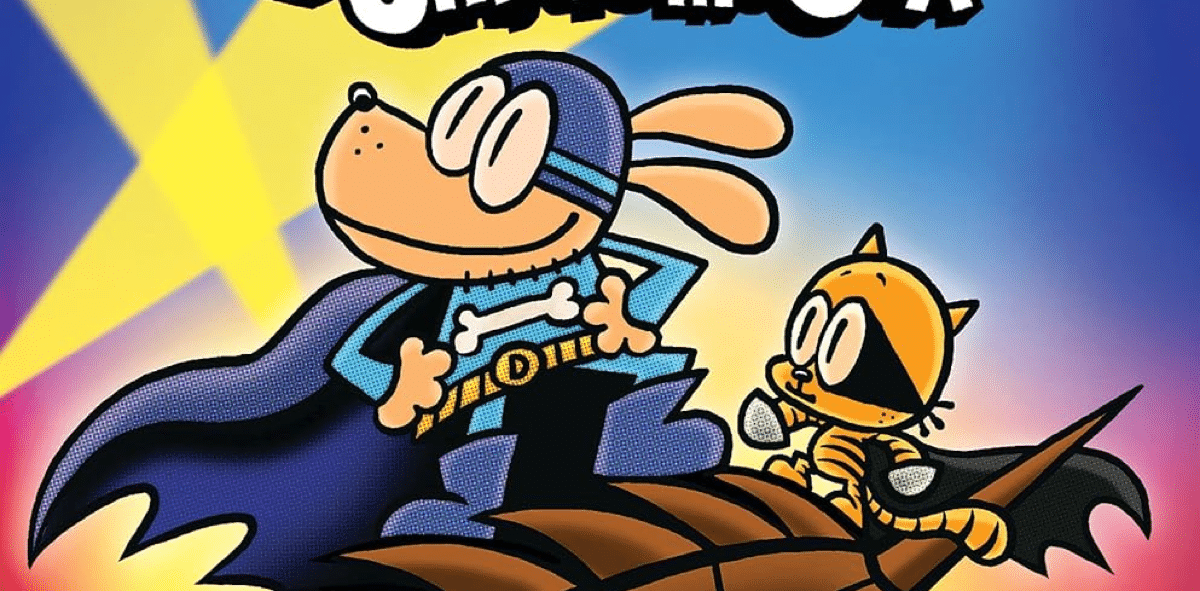

| #1 | 623,348 | CAT KID COMIC CLUB v3 : ON PURPOSE | PILKEY, DAV |

| #2 | 400,367 | CAT KID COMIC CLUB v2: PERSPECTIVES | PILKEY, DAV |

| #3 | 325,719 | CAT KID COMIC CLUB v4 : COLLABORATIONS | PILKEY, DAV |

| #4 | 285,335 | DOG MAN v10: MOTHERING HEIGHTS | PILKEY, DAV |

| #5 | 283,452 | FIVE NIGHTS AT FREDDY’S v3: THE FOURTH CLOSET | CAWTHON, SCOTT |

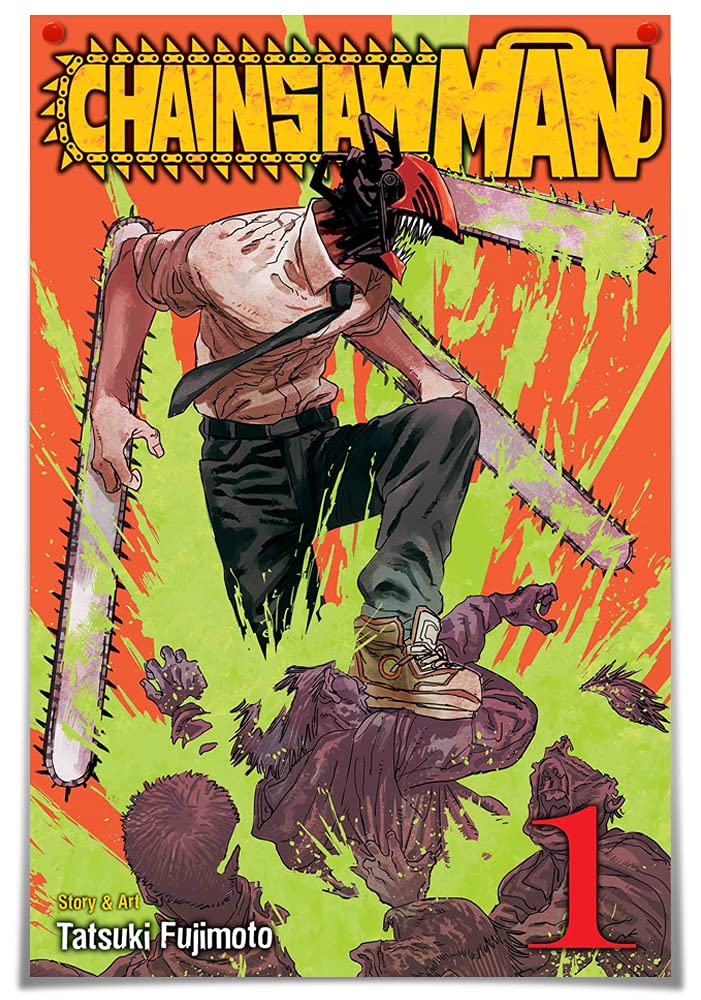

| #6 | 276,761 | CHAINSAW MAN, VOL. 1 | FUJIMOTO, TATSUKI |

| #7 | 271,376 | SPY X FAMILY, VOL. 1 | ENDO, TATSUYA |

| #8 | 264,824 | DEMON SLAYER: KIMETSU NO YAIBA, VOL. 1 | GOTOUGE, KOYOHARU |

| #9 | 255,269 | THE BABY-SITTERS CLUB v11: GOOD-BYE STACEY, GOOD-BYE | EPSTEIN, GABRIELA |

| #10 | 252,762 | DOG MAN v9: GRIME AND PUNISHMENT | PILKEY, DAV |

| #11 | 247,520 | WINGS OF FIRE v5: THE BRIGHTEST NIGHT | SUTHERLAND, TUI T. |

| #12 | 239,088 | CAT KID COMIC CLUB v1 | PILKEY, DAV |

| #13 | 227,641 | DOG MAN v7: FOR WHOM THE BALL ROLLS | PILKEY, DAV |

| #14 | 223,736 | CHAINSAW MAN, VOL. 2 | FUJIMOTO, TATSUKI |

| #15 | 214,662 | DEMON SLAYER: KIMETSU NO YAIBA–STORIES OF WATER AND FLAME | HIRANO, RYOJI |

| #16 | 211,865 | FIVE NIGHTS AT FREDDY’S v2: THE TWISTED ONES | CAWTHON, SCOTT |

| #17 | 207,081 | FIVE NIGHTS AT FREDDY’S v1: THE SILVER EYES | CAWTHON, SCOTT |

| #18 | 187,523 | DOG MAN v8: FETCH-22 | PILKEY, DAV |

| #19 | 186,627 | HEARTSTOPPER v2 | OSEMAN, ALICE |

| #20 | 181,895 | DOG MAN v1 | PILKEY, DAV |

Depending on your exact definitions of intended audiences, it appears that fifteen of the Top Twenty is intended for children or middle readers. The other five of the Top Twenty are Manga, and if you are looking for a “Marvel / DC-style superhero” comic, you are not even in the top two hundred-and-fifty! In fact, the first DC superhero comic to appear is at #257 with Batman: Year One. Jinkies! As for Marvel? Their very first appearance isn’t until all the way down at #483 with Moon Knight by Lemire & Smallwood. Ultimately this means that a comic that started as an homage/parody of Frank Miller’s writing (Teenage Mutant Ninja Turtles) skunked their master (The Last Ronin came in at #115), and that Scholastic’s license of Marvel trounced anything that Marvel published natively (Miles Morales: Shock Waves came in at #204) (We’ll talk more about this below)

Not a single book in the Top Twenty sells less than 182k copies! (it was 150k in 2021, and not even 100k as recently as 2019), and the combined circulation of the Top Twenty is over 5.3 million copies – that is: just over 10% of the unit sales of all 50k different graphic novels sold by BookScan reporters in 2022 (52m copies) was being generated by just twenty books. We appear to have become a “blockbusters”-driven business.

American comics aimed at adults are a small minority at the top of the charts – of the top 100, fifty-three are manga, forty-one are kids books, and a mere six are American comics aimed at adults: three versions of Maus and three volumes of Lore Olympus. For the second year in a row, manga sells the greatest number of copies overall: of the 52 million graphic novels sold via BookScan in 2022, 29m are manga (roughly 56%)

Dav Pilkey and his various series of books (Cat Kid and Dog Man) remain the current Rulers of comic sales in the bookstores – he is the Top four best-sellers, inclusive, and nine of the Top Twenty. What’s critical to remember about this is that Scholastic is also presumably selling a metric shedload of these books through the Scholastic Book Fairs, to elementary and middle school libraries, and any number of other places that don’t report to NPD BookScan. This here continues to be just the tip of the iceberg.

Pilkey’s hold on the charts is very strong, if declining a bit: The #1 best-seller (Cat Kid v3: On Purpose) sold 623k copies via BookScan in 2022, a bit under half of the 1.3 million copies the same placement (Dog Man v10: Mothering Heights) sold in 2021.

At #2, Pilkey places Cat Kid v2: Perspectives with a bit over 400k, at #3 is Cat Kid v4: Collaborations (326k), while #4 is the first placement of Dog Man (the aforementioned v10, Mothering Heights) with 285k sold. Then others interrupt his streak and Pilkey’s next placement is #10 with “Dog Man v9” (253k), #12’s “Cat Kid v1” (239k), #13 with “Dog Man v7” (228k), #18 with “Dog Man v8” (188k), and #20 with “Dog Man v1” (182k)

Pilkey’s success isn’t just a trend or a fluke – it is very deep and long lasting. There are sixty-five Pilkey comics that place on the chart in 2022 (this includes Spanish translations and boxed sets and so on), with nineteen of them in the Top 750. All combined, Pilkey sells 3.7m copies in 2022, which amounts to just over 7% of all comics sold via BookScan! That’s pretty massive!

But the Top Twenty is not only Dav Pilkey! What first breaks his hold on the market? Why, it is more material from the Graphix imprint from Scholastic! At #5 is v3 of Five Nights at Freddy’s (The Fourth Closet) with 283k sold, while #9 is v11 of Baby Sitter’s Club (Goodbye Stacey, Goodbye) with 255k sold. #11 is Wings of Fire v5 (The Brightest Night with 248k sold), while #16 & #17 go back to Five Nights at Freddy’s – v2 at 212k and v1 at 207k, respectively. And at #19 is the 2nd volume of Heartstopper (187k)

Altogether, Scholastic takes fifteen of the Top Twenty best-sellers in 2022, the same number as last year. Those fifteen books represent 4.1 million copies sold, or a bit over ten percent of the total of every single book of comics combined sold for the year – these fifteen books are 7.8% of the total sum of all comics sold to BookScan reporters this year. The best-seller drives the fortunes of publishing more than almost anything else.

Scholastic’s hold on the Top Twenty is not total, however, and Viz gets its piece: Book #6 is our first Manga, Tatsuki Fujimoto’s Chainsaw Man v1 (277k), while #7 is Tatsuya Endo’s Spy X Family (271k) and #8 is Koyoharu Gotouge’s Demon Slayer: Kimetsu No Yaiba v1 (267k). Viz sweeps up the last of the Top Twenty with v2 of Chainsaw Man at #14 (224k) and Stories of Water & Flame another Demon Slayer volume at #15 (215k)

No other publisher that Viz or Scholastic places a book in the Top Twenty, and it’s the first volume of Art Spiegelman’s “Maus” at #25 (177k) from Pantheon that first breaks that streak, as well as the first US-produced comic intended for adults.

“Hits!” is the word of 2022 as there are 68 comics that sold over 100k copies – that was 52 in 2021 and just 22 in 2020. Book #20 sold 182k in 2022, while in 2021 that same placement sold 129k: the floor has risen 41% for slot #20 in a year.

I will continue to underline the fact that not one of these books was created “for” the traditional Direct Market audience, and that the DM (as purchased through Diamond at least) likely does a mediocre job stocking or selling any of these books – although Diamond eliminated sales reports during the pandemic so there’s not actually any way to be certain of what the DM is selling, any longer. And, to be fair, many DM stores are buying these books from non-Diamond sources (because Diamond uniformly has the worst wholesale pricing for each and every book in the Top Twenty, on top of catastrophically usurious shipping charges)

How about if we sort things by author? There are 10,839 different names on the entire NPD BookScan list for 2022. Here are people who sold more than 100k copies combined via NPD BookScan reporters in 2022:

| 3,671,400 | PILKEY, DAV |

| 1,900,904 | FUJIMOTO, TATSUKI |

| 1,849,850 | GOTOUGE, KOYOHARU |

| 1,441,404 | AKUTAMI, GEGE |

| 1,114,995 | HORIKOSHI, KOHEI |

| 1,071,230 | ENDO, TATSUYA |

| 850,478 | TELGEMEIER, RAINA |

| 846,556 | SUTHERLAND, TUI T. |

| 814,487 | AIDAIRO |

| 799,667 | MIURA, KENTARO |

| 789,913 | CAWTHON, SCOTT |

| 767,924 | ISAYAMA, HAJIME |

| 558,371 | ITO, JUNJI |

| 543,361 | ODA, EIICHIRO |

| 522,292 | TORIYAMA, AKIRA |

| 502,589 | ODA, TOMOHITO |

| 413,179 | SMYTHE, RACHEL |

| 409,700 | OSEMAN, ALICE |

| 382,159 | ISHIDA, SUI |

| 371,641 | ONE |

| 365,618 | EPSTEIN, GABRIELA |

| 352,733 | GREEN, JOHN PATRICK |

| 347,714 | PEIRCE, LINCOLN |

| 345,958 | ARAKI, HIROHIKO |

| 345,008 | SPIEGELMAN, ART |

| 335,161 | FURUDATE, HARUICHI |

| 326,376 | FARINA, KATY |

| 324,471 | OHKUBO, ATSUSHI |

| 315,569 | OHBA, TSUGUMI |

| 312,973 | CHUGONG |

| 301,981 | SHIRAI, KAIU |

| 296,685 | FGTEEV |

| 283,943 | MATSUMOTO, NAOYA |

| 282,910 | CHAU, CHAN |

| 262,387 | GAIMAN, NEIL |

| 251,248 | TOGASHI, YOSHIHIRO |

| 248,181 | TARSHIS, LAUREN |

| 227,787 | KISHIMOTO, MASASHI |

| 223,163 | TABATA, YUKI |

| 220,018 | GALLIGAN, GALE |

| 218,480 | MILLER, KAYLA |

| 214,662 | HIRANO, RYOJI |

| 210,001 | TAKEUCHI, NAOKO |

| 199,195 | FUJITA |

| 190,585 | YANG, GENE LUEN |

| 189,036 | CLANTON, BEN |

| 180,107 | HIMEKAWA, AKIRA |

| 174,572 | ARAKAWA, HIROMU |

| 171,535 | SIMPSON, DANA |

| 169,791 | MASHIMA, HIRO |

| 169,474 | KIRKMAN, ROBERT |

| 166,787 | KIBUISHI, KAZU |

| 164,984 | KUSAKA, HIDENORI |

| 161,378 | LIBENSON, TERRI |

| 159,681 | FUKUDA, SHINICHI |

| 158,932 | BONASTRE TUR, MÃRIAM |

| 154,261 | OSBORNE, MARY POPE |

| 153,004 | HAYASHIDA, Q. |

| 152,791 | MATSUI, YUSEI |

| 152,135 | YAMAGUCHI, TSUBASA |

| 148,451 | ITAGAKI, PARU |

| 145,506 | CRAFT, JERRY |

| 145,179 | TAKAYA, NATSUKI |

| 143,421 | HALE, SHANNON |

| 139,492 | ASANO, INIO |

| 137,325 | KUBO, TITE |

| 134,578 | FLYNN, IAN |

| 133,295 | YAZAWA, AI |

| 133,256 | KAKU, YUJI |

| 133,088 | ASAGIRI, KAFKA |

| 132,944 | YUKIMURA, MAKOTO |

| 132,561 | HALE, NATHAN |

| 128,186 | WATTERSON, BILL |

| 124,919 | CARIELLO, SERGIO |

| 118,380 | KASAMA, SANSHIRO |

| 118,329 | OSHIMI, SHUZO |

| 112,114 | KANESHIRO, MUNEYUKI |

| 111,907 | INOUE, TAKEHIKO |

| 111,583 | SNYDER, SCOTT |

| 109,763 | URASAWA, NAOKI |

| 107,657 | KIZU, NATSUKI |

| 107,275 | AKASAKA, AKA |

| 103,819 | MOORE, ALAN |

| 103,379 | JAMIESON, VICTORIA |

| 102,853 | INAGAKI, RIICHIRO |

| 102,297 | NANASHI |

| 102,202 | HUNTER, ERIN |

| 101,033 | MIYAJIMA, REIJI |

| 100,753 | SUZUKI, NAKABA |

These 89 people represent 62% of all sales of NPD BookScan-reported sales in 2022. What you can take from this is that only a tiny number of creators drive the vast majority of the business in comics (and books in general, as far as I can tell); and conversely, this probably means that the numerical majority of comics published aren’t actually significantly profitable any given year. I think it’s further worth noting that historically US comics aimed at adults are created by paying a page rate, so that the very creation of comics could allow a living wage for their creators.

Conversely, a great many of the graphic novel creators on this list are either being paid an advance-on-royalties, or in a few cases initially worked for free for the “streaming services”; or in the case of many of the Manga-ka, the creative costs have already long ago been paid from the original publication in Japan. When you add together those points, along with the “average” sale of a book in the Bookscan-reported market being just around 1000 copies, it would seem very safe to infer that most people making comics today aren’t even making US minimum wage to do so, while just a small minority of people hit the royalty targets to properly “earn out” a living.

There is potentially a lot of money in comics on the higher end, but most creative people aren’t actually seeing much of a financial reward, because the creation of comics is extremely labor intensive.

Let’s now switch our attention to looking at how publishers performed.

As a way to make the publisher breakdowns more readable, I split the chart into “eastern” (Manga) and “western” comics, because I think there are a few clear market distinctions between those categories. So, without further ado:

2022 Manga

Overall sales are up again for the Manga category in 2022 – sales are up by nearly a million pieces within the Top 750 (6%), and rose to 13% in calculated dollars. For the second year running, Manga is the majority of sales in the US marketplace.

Here’s a year-to-year comparison chart for the Top 750:

| Year | # of placing titles | Unit sales | Calculated Retail Value |

| 2003 | 447 | 3,361,966 | $34,368,409 |

| 2004 | 518 | 4,603,558 | $45,069,684 |

| 2005 | 594 | 5,691,425 | $53,922,514 |

| 2006 | 575 | 6,705,624 | $61,097,050 |

| 2007 | 575 | 6,837,355 | $61,927,238 |

| 2008 | 514 | 5,624,101 | $53,033,579 |

| 2009 | 451 | 4,414,705 | $41,068,604 |

| 2010 | 436 | 3,117,019 | $30,212,561 |

| 2011 | 392 | 2,627,570 | $27,017,081 |

| 2012 | 367 | 1,908,186 | $21,324,368 |

| 2013 | 315 | 1,665,487 | $21,256,777 |

| 2014 | 271 | 1,748,185 | $22,601,720 |

| 2015* | 279 | 2,033,534 | $26,191,474 |

| 2016* | 311 | 2,629,366 | $35,915,488 |

| 2017 | 284 | 2,427,380 | $35,433,489 |

| 2018 | 299 | 2,641,158 | $35,955,537 |

| 2019 | 332 | 3,539,031 | $49,900,429 |

| 2020 | 358 | 5,419,328 | $77,703,520 |

| 2021 | 495 | 15,945,960 | $218,310,280 |

| 2022 | 458 | 16,905,898 | $246,052,418 |

Sales and calculated dollars are up for the category in 2022, while the number of placing books is down a bit. And, once again this is the best year for Manga since we’ve been tracking! Be clear, however, that calculated dollars is a pretty fictional measurement because no one anywhere knows how much any individual book is actually selling for. For at least part of 2022, manga was also hampered by the “North American Manga Shortage” that began as a result of COVID lockdowns, as well as massive paper shortages – although these factors appear to have been largely fixed by the end of the year.

Once again, despite the record setting unit sales it is still not the greatest number of titles placing – that was the 594 books back in 2005.

As is typical with Manga, this is driven by the near-exclusive domination of series in the manga world – when there’s not a strong anime driving sales, manga tankobon series start to perform more like periodicals than books (albeit over a wider horizon); rather than generally building a strong core backlist that sells forever, year-in-and-year out, manga tends instead to ebb and flow with culture and fashion (and especially what anime is airing currently!) – manga sales are broadly not about specific graphic novels selling, they’re all about the series.

While there are 458 individual volumes of manga placing in the Top 750 this year, those only represent 127 distinct properties. For example, the best-selling Manga this year is Chainsaw Man – there are eleven different volumes of this series that place in the Top 750. The number two series, Spy X Family, has all eight volumes chart. Number three is Demon Slayer: Kimetso No Yaiba, which has 25 entries, number four is Jujutsu Kaiden with 19 books, while number five is My Hero Academia with 29 entries. Just these five series are more than 20% of the number of volumes placing in the Top 750 – those five series are nineteen of the Top Twenty, with only Berserk left to crack that group

Manga, as a category, has a “long tail”, where we’re looking at all sales for the year, and not just within the Top 750 best-sellers:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 6231 | —— | 11,323,487 | —— | $108,770,537 | —– | 1817 | $17,456 |

| 2008 | 7842 | 20.54% | 10,173,091 | -11.31% | $100,800,283 | -7.91% | 1297 | $12,854 |

| 2009 | 8756 | 11.66% | 8,148,490 | -19.90% | $81,770,442 | -18.78% | 931 | $9,339 |

| 2010 | 8764 | —— | 6,239,725 | -23.42% | $67,092,668 | -17.95% | 712 | $7,655 |

| 2011 | 8991 | 2.59% | 5,690,327 | -8.80% | $62,810,728 | -6.38% | 633 | $6,986 |

| 2012 | 6332 | -29.57% | 3,510,057 | -38.32% | $40,943,613 | -34.81% | 554 | $6,466 |

| 2013 | 7024 | 10.93% | 3,516,208 | 0.01% | $44,651,823 | 9.06% | 501 | $6,357 |

| 2014 | 7452 | 6.09% | 3,914,385 | 11.32% | $51,557,925 | 15.47% | 525 | $6,919 |

| 2015* | 4412 | –40.79% | 4,580,434 | 17.02% | $62,253,624 | 20.75% | 1038 | $14,110 |

| 2016* | 4968 | 12.60% | 5,821,892 | 27.10% | $81,314,479 | 30.62% | 1172 | $16,368 |

| 2017 | 10,248 | 106.8% | 5,865,412 | 0.75% | $85,581,224 | 5.25% | 572 | $8,351 |

| 2018 | 10,839 | 5.77% | 6,100,260 | 4.00% | $87,421,299 | 2.15% | 563 | $8,065 |

| 2019 | 9928 | -8.40% | 7,461,077 | 22.31% | $110,577,066 | 26.49% | 752 | $11,138 |

| 2020 | 12,423 | 25.13% | 10,766,492 | 44.30% | $161,611,294 | 46.15% | 867 | $13,009 |

| 2021 | 13,006 | 4.69% | 27,717,479 | 157.44% | $396,260,629 | 145.19% | 2131 | $30,468 |

| 2022 | 14,595 | 12.22% | 29,593,184 | 6.77% | $438,873,124 | 10.75% | 2028 | $30,070 |

This continues to be terrific general “Long-Tail” growth in the category overall – number of books available hits a new record at over 14k items, while both units sold and calculated dollars are show solid growth. Average sales per title are down a smidge, but this is still a lot of books sold!

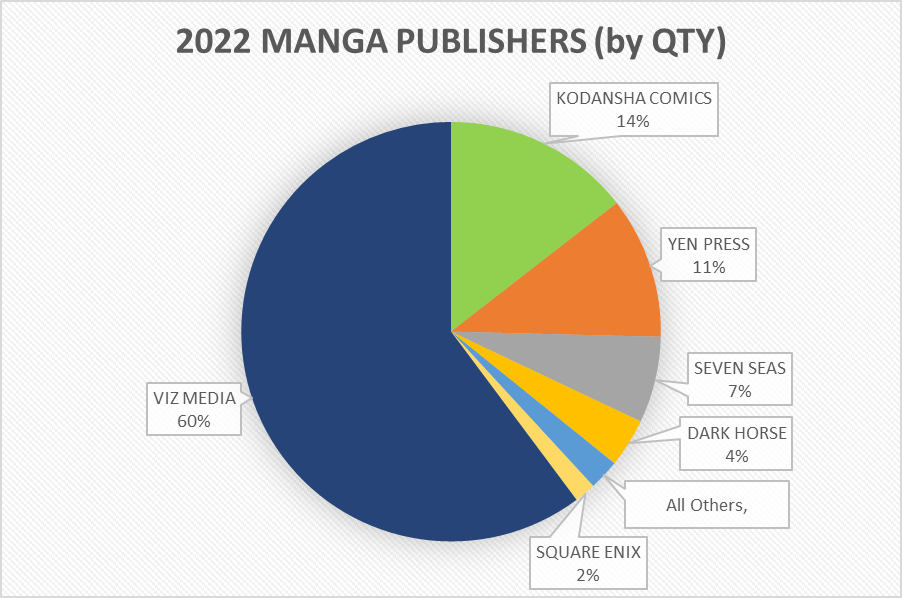

When you start breaking down the manga portion of the chart by publisher, there’s really not any contest at all: there’s a two-ton gorilla, and then a bunch of smaller houses struggling in their shadow. This chart represents all 14,595 books that are “manga” in NPD BookScan in 2022, by quantity sold, and represents the entire “long tail” of the charts:

Viz is unquestionably the dominant player, selling 60% of all manga sold in 2022. This is up from 57% last year.

If we look solely within the Top 750, the picture is very similar: The #1 publisher is Viz who takes 301 of the 458 manga spots in the Top 750, keeping them as the overwhelmingly dominant player with almost two thirds of the placing titles! Within the Top 750, Viz (and their Yaoi sub-imprint of Sublime) charted about 12.6 million pieces, for more than $158 million of calculated retail dollars – this is yet another year of strong growth for Viz: they sold 10.8m books the previous year.

Viz controls the manga charts as they have for a very long time now. It is nearly impossible to envision anyone really challenging them substantially for that role because they are more than four times the size than their nearest competitor in their segment.

Viz’s #1 Best-seller is Chainsaw Man, and v1 is the year’s best-selling manga with nearly 277k sold, and there are four volumes within Viz’s Top Ten (at places #4, #8, and #9), and all eleven released volumes make the Top 750 – together, those eleven volumes sell 1.8m copies. This is a great example of a book which appears to be driven significantly by the anime adaptation.

I’d say much the same for Viz’s #2 seller, “Spy X Family” – v1 is the #2 book, with 271k sold, two volumes in the Top Ten (v2 is #10, with 174k), and all eight released volumes are in the Top 750, with combined sales of nearly 1.1m. It looks to me that sales are driven as much by the anime as not.

“Demon Slayer: Kimetsu No Yaiba” is Viz’s #3 most popular property in 2022, with two volumes placing in their top ten (v1 shifts 265k, while “Stories of Water and Flame” sells about 215k at #5), and all twenty-three volumes (and the box set – 49k copies sold!) place in the Top 750. Combined this property shifts 2.1 million units. It was only 1.6m units in 2020. Again, it also has a recent anime release.

“Jujutsu Kaisen” has volume 0 placing as Viz’s #6 best seller (182k), and all nineteen volumes of the series place in the Top 750, selling 1.4m combined

The last unique title placing in Viz’s Top Ten, at #7 is “My Hero Academia” with v1 shifting 180k copies. There are 32 volumes total, plus another three spin-off series with another 20 volumes (“Smash!!”, “Team Up Missions” and “Vigilantes” are the series) with 29 of the 52 combined appearing in the Top 750. If you combine every MHA title, you come up with 1.3m copies sold of those fifty-two books (that was just about 2m copies last year, so it’s a real drop)

MHA is a great example of “The Hammock Principle”. Briefly stated, this is books in a series that generally sell in a sales pattern that looks like a hammock if you chart it out: the first few volumes and the last few volumes sell the best, with the ends running down into the middle volumes which have the lowest sales, like the sagging part of a hammock. The problem with this is both that stores don’t have infinite rack space, as well as publishers that need a certain volume and velocity to keep things in print, so that sagging middle becomes unsustainable for most series over time, and many stores start to only carry the first and last few volumes. In the case of MHA, v1 sold 180k, v30 sold 123k, which the worst selling of the main series, v15 sold “only” 8600 copies this year. That’s a pretty massive gap in sales that is running down the hammock, and shows just how hard it is for retail stores to carry every volume in a series so wide.

Other strong series for Viz outside of their Top Ten include “Kaiju No. 8” (#20 for v1 at 118k sold), Junji Ito’s “Uzumaki” (#28, with 106k sold – Ito also sells 60k copies of “Tomie”), “Komi Can’t Communicate” (#32 for v1 at 96k), “Haikyu!!” (#34 for v1 at 94k), “Death Note” (“Short Stories” places #37 and 87k sold, while v1 of the “Black Edition” is #44 with 76k sold), as well as Deadpool: Samurai, a manga version of the Marvel comic, that sells 74k of v1 at #45 for Viz. It’s worth noting here that the best-selling comic Marvel itself is able to sell is a relatively paltry 17k copies of “Moon Knight” (more on that below), less than a quarter of what Viz was able to do.

Viz also sells 70k copies of v1 of “Tokyo Ghoul”, 67k copies of “The Promised Neverland” v1, 63k copies of the newest volume (v15) of “Dragon Ball Super”, 57k copies of v1 of “One Punch Man”, 52k copies of v1 of “One Piece” and 50k copies of v1 of “Naruto”. All-in-all Viz sells a staggering seventy-two individual books over 50k copies. That is ginormous!

For Viz’s Yaoi imprint, Sublime, the best-seller is “Given”, where v1 shifts 33k, with v2 at 15k and v3 at 13k. The imprint also places, in the Top 750, “Links” (15k), as well as “Dick Fight Island” (15k for v1, and 13k for v2)

Let’s take a look at the “long tail” of Viz? This is their sales of all products sold for the entire year, whether or not it made the Top 750

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 2018 | —— | 6,249,324 | —— | $55,123,347 | —– | 3097 | $27,316 |

| 2008 | 2447 | 21.26% | 5,536,286 | -11.41% | $50,311,791 | -8.97% | 2263 | $20,561 |

| 2009 | 2793 | 14.14% | 4,819,407 | -12.95% | $44,310,790 | -11.93% | 1726 | $15,865 |

| 2010 | 3088 | 10.56% | 3,576,671 | -25.79% | $35,041,305 | -20.92% | 1158 | $11,348 |

| 2011 | 3393 | 9.88% | 3,276,297 | -8.40% | $32,766,960 | -6.49% | 966 | $9,657 |

| 2012 | 3518 | 3.68% | 2,099,560 | -35.92% | $22,433,721 | -31.54% | 597 | $6,377 |

| 2013 | 3636 | 3.35% | 1,853,211 | -11.73% | $21,586,923 | -3.77% | 510 | $5,937 |

| 2014 | 3765 | 3.55% | 1,855,161 | 0.11% | $22,732,074 | 5.30% | 493 | $6,038 |

| 2015* | 2264 | -39.87% | 2,150,656 | 15.93% | $28,134,971 | 23.77% | 950 | $12,427 |

| 2016* | 2405 | 6.23% | 2,811,978 | 30.75% | $38,854,681 | 38.10% | 1169 | $16,156 |

| 2017 | 4443 | 84.74% | 2,958,351 | 5.21% | $41,594,729 | 7.80% | 666 | $9,362 |

| 2018 | 4637 | 4.37% | 3,184,274 | 7.64% | $44,423,434 | 6.80% | 687 | $9,580 |

| 2019 | 4702 | 1.40% | 4,329,369 | 35.96% | $60,817,993 | 36.91% | 921 | $12,934 |

| 2020 | 4856 | 3.28% | 6,614,179 | 52.77% | $94,768,000 | 55.82% | 1362 | $19,516 |

| 2021 | 5183 | 6.73% | 15,804,613 | 138.95% | $208,440,832 | 119.95% | 3049 | $40,216 |

| 2022 | 5270 | 1.68% | 17,816,487 | 12.73% | $233,268,459 | 11.91% | 3381 | $44,263 |

Viz’s long-tail is incredibly impressive, with an under 2% growth of products, but nearly a 13% growth in circulation this year, all on their highest totals of sales as long as we have recorded this. Viz in 2022 has five books over 200k, an additional 25 books over 100k, 42 more over 50k, another 44 over 30k, an additional 44 over 20k, and an incredible 178 others over 10k. They are a very very very strong publisher in short, and they completely blow past the scales we’ve invented to describe other publishers.

In second place among manga publishers, we have Kodansha Comics (They also publish as Vertical, which they completed purchase of in 2020), which places 65 titles within the top 750, with just under 1.6 million in units sold (compared to 3m in sales in 2021), and $23.8 million in calculated retail dollars ($40.6m in 2020). Kodansha lost a great deal of market share in 2022.

Kodansha’s licenses formerly were both the original backbone of Tokyopop, as well as being the majority of Del Rey Manga. Kodansha pulled Tpop’s license in March of ’09 and Del Rey in October of ’10. You may want to look at those publisher’s listings below to get a better historical overview.

Kodansha’s #1 best-seller is Attack on Titan, with v1 shifting nearly 88k units in 2022 – this is a big drop from 170k last year. Attack on Titan takes five of the ten top spots for Kodansha, and within the Top 750, 17 volumes place, selling 570k copies – the first seven and the most recent six, the first three 3-in-1 omnibus, and two box sets. The rest are down in “the hammock”. As noted, v1 sold 88k, with v34 selling 72k, but v24 is down at about 3400 copies. That is only about 5% of the higher ends of “the hammock” All told there are 95 different volumes of “AoT” (and spinoffs) on BookScan 2022, and they sum up to 800k sold.

Also within the Top Ten for Kodansha is “Sailor Moon” (v1 is #4 with 59k, v2 is #9 at 40k), “Wotakoi: Love is Hard for Otaku” (v1 is #5 at 57k, v6 is #7 at 53k) and v1 of “Blue Lock” at #8 and 51k. They only have eight books over 50k this year.

The best-seller of the Vertical imprint is v1 of The Complete Chi’s Sweet Home, which registers a bit over 17k sold.

These Long Tail figures are for Kodansha-published titles, and they reflect that Kodansha, itself, first started publishing in 2010. I have adjusted the figures from 2011 on to now include Vertical as well:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2010 | 9 | —— | 13,291 | —— | $322,717 | —— | 1477 | $35,857 |

| 2011 | 192 | 2033.33% | 246,083 | 1751.50% | $3,236,474 | 902.88% | 1282 | $16,857 |

| 2012 | 364 | 89.58% | 369,853 | 50.30% | $4,697,856 | 45.52% | 1016 | $12,906 |

| 2013 | 479 | 31.59% | 563,460 | 52.35% | $7,427,739 | 58.11% | 1176 | $15,507 |

| 2014 | 629 | 31.32% | 904,610 | 60.55% | $11,972,992 | 61.19% | 1438 | $19,035 |

| 2015* | 617 | -1.91% | 965,519 | 6.73% | $12,894,698 | 7.70% | 1565 | $20,899 |

| 2016* | 772 | 25.12% | 1,154,178 | 19.54% | $15,527,849 | 20.42% | 1495 | $20,114 |

| 2017 | 1164 | 50.78% | 1,098,812 | -4.80% | $16,795,188 | 8.16% | 944 | $14,429 |

| 2018 | 1399 | 20.19% | 1,033,780 | -5.92% | $15,396,607 | -8.33% | 739 | $11,005 |

| 2019 | 1564 | 11.79% | 1,152,720 | 11.51% | $18,674,181 | 21.29% | 737 | $11,940 |

| 2020 | 1740 | 11.25% | 1,548,349 | 34.32% | $24,524,651 | 31.33% | 890 | $14,095 |

| 2021 | 1975 | 13.51% | 5,655,992 | 265.29% | $84,299,372 | 243.73% | 2864 | $42,683 |

| 2022 | 2255 | 14.18% | 4,289,828 | -24.15% | $69,249,595 | -17.85% | 1902 | $30,709 |

In 2022, Kodansha took a pretty big hit – despite having 14% more books, sales are down nearly a quarter. Much of this is the receding tide from “Attack on Titan”. Kodansha has eight books selling over 50k, four more over 30k, fifteen others over 20k, and fifty-three more titles that sell over 10k – this is still a solid performance, but it pales next to the giant that is Viz.

The #3 publisher of Manga in 2022 is Yen Press, which places 46 titles into the Top 750, for about 1.5 million copies sold (up about 200k copies from the previous year), and $47.9 million of calculated retail gross. Yen is a division of Hachette (more on them later).

Yen’s major hit is Toilet-Bound Hanako-Kun, which takes six of their ten best-selling spots. V1 (their #1 best-seller) sells 123k copies in 2022, while v2 (#2) pulls in 96k, v0 (#5) sells 63k, v3 (#7) racks up 62k. They also place v13 (#9 and 52k) while v4 sells about 45k copies at position #10.

Yen’s other four Top Ten best-sellers is completed by Solo Leveling where v1 (#3) sells almost 89k, v4 (#4) does 65k, v2 is #6 with 63k, and v3 is #8 at 52k. Nothing else from Yen sells over 50k.

Finally, Yen has a Korean comics sub-imprint called “Ize Press” (this is technically “Manwha”, rather than “Manga” if you want to split hairs) that began this year. It places a single title in the Top 750, Villains Are Destined to Die, which sold around 13k

In the Long Tail Yen things show solid growth

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 10 | —— | 12,896 | —— | $147,449 | —– | 1,290 | $14,745 |

| 2008 | 90 | 800.00% | 110,126 | 753.95% | $1,237,860 | 739.52% | 1,224 | $13,754 |

| 2009 | 211 | 134.44% | 330,962 | 200.53% | $3,697,113 | 198.67% | 1,569 | $17,522 |

| 2010 | 344 | 63.03% | 560,983 | 69.50% | $6,650,871 | 79.89% | 1,680 | $19,334 |

| 2011 | 460 | 33.72% | 764,125 | 36.21% | $9,953,966 | 49.66% | 1,661 | $21,639 |

| 2012 | 548 | 19.13% | 647,948 | -15.20% | $8,735,264 | -12.24% | 1,182 | $15,940 |

| 2013 | 654 | 19.34% | 692,380 | 6.86% | $9,715,421 | 11.22% | 1,059 | $14,855 |

| 2014 | 776 | 18.65% | 682,135 | -1.48% | $9,985,502 | 2.78% | 776 | $12,868 |

| 2015* | 649 | -16.37% | 917,620 | 34.52% | $13,248,445 | 32.68% | 1414 | $20,414 |

| 2016* | 793 | 22.19% | 1,072,008 | 16.82% | $15,520,207 | 17.15% | 1352 | $19,572 |

| 2017 | 1403 | 76.92% | 928,962 | -13.34% | $13,866,675 | -10.65% | 662 | $9,884 |

| 2018 | 1737 | 23.81% | 890,228 | -4.17% | $13,051,751 | -5.88% | 513 | $7,514 |

| 2019 | 1846 | 6.28% | 884,596 | -0.63% | $13,008,175 | -0.33% | 479 | $7,047 |

| 2020 | 2010 | 8.88% | 1,090,002 | 23.22% | $15,797,758 | 21.44% | 542 | $7,860 |

| 2021 | 2147 | 6.82% | 3,018,454 | 176.92% | $43,696,021 | 176.60% | 1406 | $20,352 |

| 2022 | 2297 | 6.99% | 3,224,346 | 6.82% | $47,913,494 | 9.65% | 1404 | $20,859 |

Yen Press in 2022 grows unit sales by 6.8%, and has one book over 100k, another eight titles over 50k, eight more over 30k, another nine selling over 20k copies, and twenty-four more that place over 10k. This is a great performance.

Moving up a bit to the #4 manga publisher as represented by the NPD BookScan Top 750 is Seven Seas, which places 11 titles for almost 201k copies sold combined and a calculated value that comes out just over $4.1 million.

Seven Seas also includes Ghost Ship, though that imprint doesn’t place anything in the Top 750 this year.

Seven Seas’ biggest success in 2022 is the Omnibus editions of Tokyo Revengers: v1 (#1) sells almost 38k, while v2 (#4) is at 18k. The omnibus edition of I Want to Eat Your Pancreas (#2) sells 29k, while “Orange” v1 (#3) does 21k, and v2 (#8). And the back of the Top Ten is brought up with Seaside Stranger (v1, #5, 16k and v2, #6, 15k), the omnibus hardcover of The Girl From The Other Side: Siúil, a Rún (#7, 14k), v1 of Cat Massage Therapy (#8, 14k) and v1 of Creepy Cat with 11k at #10.

The best-seller for the Ghost Ship imprint is Darling in the Franxx at 10k

Seven Seas’ Long Tail shows another “best year ever”, with growth beating most of their Manga peers

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 54 | —— | 50,641 | —— | $558,450 | —– | 938 | $10,342 |

| 2008 | 76 | 41.74% | 80,112 | 58.20% | $833,667 | 49.28% | 1054 | $10,969 |

| 2009 | 97 | 27.63% | 74,967 | -6.42% | $807,666 | -3.12% | 773 | $8.326 |

| 2010 | 93 | -4.12% | 75,764 | 1.06% | $875,612 | 8.41% | 815 | $9,415 |

| 2011 | 118 | 26.88% | 116,360 | 53.58% | $1,426,618 | 62.93% | 986 | $12,090 |

| 2012 | 151 | 27.97% | 124,262 | 6.79% | $1,684,994 | 18.11% | 823 | $11,159 |

| 2013 | 223 | 47.68% | 204,419 | 64.51% | $2,942,608 | 74.64% | 917 | $13,196 |

| 2014 | 300 | 34.53% | 284,484 | 39.17% | $3,979,338 | 35.23% | 948 | $13,264 |

| 2015* | 304 | 1.34% | 374,715 | 31.72% | $5,177,568 | 30.11% | 1233 | $17,031 |

| 2016* | 417 | 37.17% | 491,947 | 31.29% | $6,960,634 | 34.44% | 1180 | $16,692 |

| 2017 | 554 | 32.85% | 478,336 | -2.77% | $6,801,527 | -2.29% | 863 | $12,277 |

| 2018 | 906 | 63.54% | 667,556 | 39.56% | $9,511,591 | 39.84% | 737 | $10,498 |

| 2019 | 1049 | 15.78% | 671,362 | 0.57% | $9,498,329 | -0.14% | 640 | $9,055 |

| 2020 | 1230 | 17.25% | 699,127 | 4.14% | $9,913,480 | 4.37% | 568 | $8,060 |

| 2021 | 1518 | 23.41% | 1,590,317 | 127.47% | $22,972,596 | 131.73% | 1048 | $15,133 |

| 2022 | 2031 | 33.79% | 1,967,627 | 23.73% | $30,001,482 | 30.60% | 969 | $14,472 |

Seven Seas has the one title that sells over 30k, two more over 20k, and an additional thirteen more over 10k.

Falling back a step to #5 manga publisher in the Top 750 in 2022 is Dark Horse. They place 20 titles in the Top 750, whose combined sales represent 732k copies sold (up from 596k in last year) and $31.8m in calculated retail.

The best-selling DH series continues to be Berserk with the $50 hardcover editions outselling the cheaper softcovers: 16 of Dark Horse’s placing books are Berserk. The HC of v1 (#1 for Dark Horse) racked up an impressive 146k sold – this is up from 57kk last year. V2 (#2) sells more than 82k, v3 (#3) racks 54k, v10 (#4) does 46k, v4 (#5) does 45k, and v5 (#6) moves 43k. Then we shift to the softcover of v1 (#7) that sells 34k, and then we shift back to HC for v6 (#8) with 33k, v11 (#9) with 31k, and v7 rounding out at #10 and 31k. Altogether, all Berserk combined sells 799k copies for Dark Horse.

Other than Berserk, Dark Horse also does well with Mob Psycho 100 where v1 sells almost 27k

Looking at the Long Tail, this is what Dark Horse’s (manga only!) recent performance looks like – like most manga in 2022 it’s growing! There is much more on Dark Horse down below in the “Western Publishers” section.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 341 | —— | 249,943 | —— | $3,329,464 | —– | 733 | $14,745 |

| 2008 | 420 | 23.17% | 248,981 | -0.38% | $3,176,870 | -4.58% | 593 | $7,564 |

| 2009 | 455 | 8.33% | 226,497 | -9.03% | $2,915,693 | -8.22% | 498 | $6,408 |

| 2010 | 473 | 3.96% | 194,494 | -14.13% | $2,633,077 | -9.69% | 411 | $5,567 |

| 2011 | 497 | 5.07% | 189,329 | -2.66% | $2,602,230 | -1.17% | 381 | $5,236 |

| 2012 | 493 | -0.80% | 112,373 | -40.65% | $1,631,038 | -37.32% | 228 | $3,308 |

| 2013 | 521 | 5.68% | 103,538 | -7.86% | $1,678,563 | 2.91% | 199 | $3,222 |

| 2014 | 559 | 7.29% | 100,894 | -2.60% | $1,617,251 | -3.65% | 180 | $2,893 |

| 2015* | 303 | -45.80% | 135,444 | 34.24% | $2,238,167 | 38.39% | 447 | $7,387 |

| 2016* | 225 | -25.74% | 174,298 | 28.69% | $2,291,355 | 2.38% | 775 | $10,184 |

| 2017 | 527 | 234.22% | 238,089 | 36.60% | $3,795,506 | 65.64% | 452 | $7,202 |

| 2018 | 531 | 0.76% | 224,010 | -5.91% | $3,579,135 | -5.70% | 422 | $6,740 |

| 2019 | 384 | -27.68% | 329,034 | 46.88% | $7,280,058 | 103.40% | 857 | $18,958 |

| 2020 | 472 | 22.92 | 430,762 | 30.92% | $11,111,354 | 52.63% | 913 | $23,541 |

| 2021 | 431 | -8.69% | 1,009,527 | 134.36% | $26,954,363 | 142.58% | 2342 | $62,539 |

| 2022 | 455 | 5.57% | 1,113,260 | 10.28% | $39,082,966 | 45.00% | 2447 | $85,897 |

It’s a good performance in units, but it’s an exceptional performance with Calculated retail. In fact, Dark Horse is earning more per copy sold than any other manga publisher, by a serious margin (at least… theoretically, Calculated retailer is mostly a fiction) – those $50 hardcovers sure add up. Dark Horse Manga has one book over 100k, two more over 50k, eight more over 30k, another two over 20k, and seven more books over 10k. Pound for pound Dark Horse is doing superb with Manga.

Finally for the Manga category in the Top 750 in 2022, we have, at #6 placement, relatively new imprint Square Enix – they launched in late 2019. This year within the Top 750, they place eleven titles that combine for 242k sold, and just over $4 million in calculated dollars.

Square Enix’s best seller is My Dress-Up Darling, which takes six of the top ten. V1 (#1) sells 36k while the other five all sell between 22 and 28k, a surprisingly grouped sales pattern. This is broken by Soul Eater v1 (#4) at 25k, v2 (#9) at 14k and v5 (#10) at just under 14k, and followed at #8 by A Man and His Cat with 18k.

Because this is the first time they’ve placed books over 10k sold, and is their second year directly printing books under this imprint’s name, this will be the first time that I’ll be building a Long Tail for them, which looks like this:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2020 | 20 | ——– | 49,251 | ——- | $703,806 | ——- | 568 | $8,060 |

| 2021 | 50 | 150% | 294,520 | 498.00% | $4,298,970 | 510.82% | 5890 | $85,979 |

| 2022 | 99 | 98% | 485,713 | 64.92% | $7,516,321 | 74.84% | 4906 | $75,922 |

Square Enix has one book over 30k, six more over 20k, and another four over 10k.

Finally for Manga in 2022, we have a new first: we’ve got several books that qualified for the Top 750, but are not from sources where it is valuable to create full Long Tail listings for.

The first such book is Hayao Miyazaki’s Shuna’s Journey which sells an impressive 40k copies in Hardcover. It is published by FirstSecond, an imprint of Macmillan. Since that’s basically the only Manga coming from FirstSecond, it will be reflected in the “Western” Long Tail down below.

Next, we have Disney Manga: Time Burton’s The Nightmare Before Christmas – Mirror Moon, quite a long-winded title! While it makes the Top 750, it’s down towards the bottom, with right around 16k sold. This is a Tokyopop book, and is the first Tpop book to show in the charts in quite some time. However, despite it having a BISAC listing that identifies it as Manga, none of the creators are Asian, and the Amazon Look Inside shows a book that very much looks like a Western comic to this viewer, rather than Manga. I’ll let you decide, though my guess is that this book won’t show in next year’s chart, making real debate fairly moot.

And finally for the Manga category, we wrap up with v1 of I Hear the Sunspot: Limit (about 13k sold) from One Peace Books.

2022 Western Publishers

When I say “Western” here, I mean publishers/work from Europe and America, as opposed to Asia, not publishers of the genre of “western” comics!

NPD BookScan itself does not try to control how data gets initially logged (or changed), leaving that all to publishers. I think that I understand this reasoning: the publisher is the customer to BookScan, and they should have some level of control over how they are represented, but as a person who tries to decipher the data each year, I know that I would prefer some sort of internally-consistent (and externally-petionable!) method of categorizing titles that doesn’t seem to change in some fashion from year-to-year – Books will appear and disappear, almost seemingly willy-nilly, and it makes showing you anything even resembling consistent data staggeringly difficult. All of this is a function of how publishers assign BISACs and in what order – please please read the long section below on how the sausage is made!X

I’d also like to continue to give you a top-level reminder that back in 2008 there was some sort of behind-the-scenes recategorization in what got sent to me – I now know this is probably a change in BISAC codes! – and most of the “cartoon-strip humor” books like “Calvin & Hobbes” and “The Far Side” suddenly disappeared, so there’s kind of a not-strictly apples thing going on with the pre-2008 numbers here. Do keep that in mind when making comparisons both in the Top 750 chart, as well as the Long Tail.

Another observation I have to repeat is that NPD BookScan tracks (theoretically at least, since again, publishers set their own BISACs) Adult reading distinctly from YA and Kids. I don’t. Part of this is that I’m a bookseller, and I’m rather agnostic about who specifically buys books as a result. But I have to be certain to make this point as clearly as I can: the market for who is buying comics is changing, and it is changing for the wider and the better. The eight year old who is inhaling Dav Pilkey in 2022 is going to be the comics-literate adult of 2035 (or whatever), which is going to change what comics readers in the 2030s will want or expect from comics. The kids reading comics in 1965 totally imagined what the 1980’s comics scene could and would be, which is why we’re where we are today, but the shape of the Western industry in the future is absolutely what today’s children read and see.

Ignore this at your deadliest of perils: the future is always shaped by the present, even if that isn’t what you personally want.

OK, enough editorializing, let’s look at the market!

Here’s the Western Top 750 over time:

| Year | # of placing titles | Unit sales | Calculated Retail price |

| 2003 | 304 | 2,133,618 | $32,360,644 |

| 2004 | 233 | 1,467,535 | $22,713,802 |

| 2005 | 142 | 1,315,920 | $21,537,155 |

| 2006 | 174 | 1,689,571 | $29,314,852 |

| 2007 | 175 | 1,746,962 | $33,247,187 |

| 2008 | 236 | 2,710,175 | $48,327,594 |

| 2009 | 299 | 3,219,748 | $52,147,410 |

| 2010 | 314 | 3,297,317 | $54,515,605 |

| 2011 | 358 | 3,068,593 | $77,254,870 |

| 2012 | 383 | 3,530,143 | $68,593,986 |

| 2013 | 435 | 3,988,864 | $74,805,932 |

| 2014 | 479 | 4,910,846 | $90,166,989 |

| 2015* | 471 | 6,729,449 | $115,035,044 |

| 2016* | 439 | 7,338,541 | $123,594,588 |

| 2017 | 466 | 7,846,357 | $117,761,519 |

| 2018 | 451 | 9,114,745 | $129,929,990 |

| 2019 | 418 | 11,998,489 | $176,470,137 |

| 2020 | 392 | 12,825,951 | $196,604,939 |

| 2021 | 255 | 14,752,121 | $225,424,778 |

| 2022 | 292 | 14,104,511 | $225,392,545 |

2022 NPD BookScan’s Top 750 for Western publishers is doing passably: more titles placed this year than last, but sales are down within the Top 750 by 4.4% in units (and are essentially flat in calculated dollars) It’s a broadly poor performance when you compare it to Manga for the year, but it’s still the second largest total sales that we’ve tracked in twenty years of doing this.

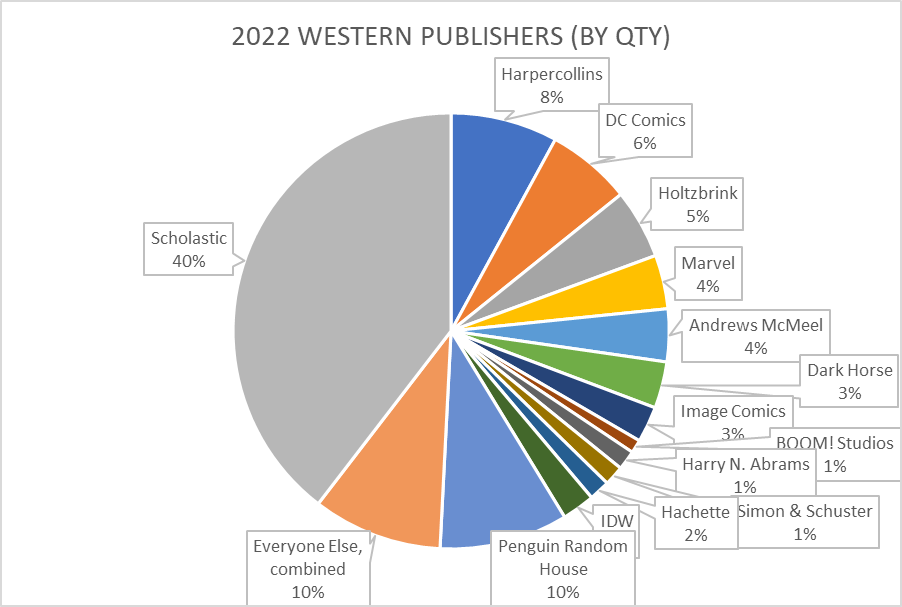

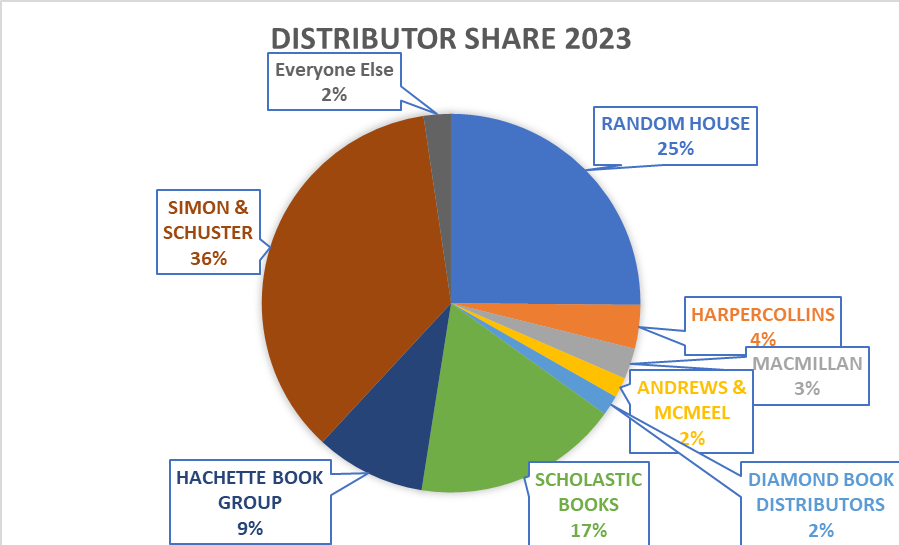

If we were to look at the entirety of all of NPD BookScan’s reported numbers for the total 35,461 distinct “Western” comics, things look generally like this – there are 1891 publishers listed in the 2022 chart, but only 14 of them manage to capture 1% or more of the market

This is not quite as lopsided as the Manga chart… But it is still a bit overwhelming that one publisher (Scholastic) is 40% of all graphic novels sold. And that Marvel and DC combined are only 10% in the book market.

Let’s start with a look at the Long Tail for Western publishers collectively. As you see the comparison against the Top 750 is leaning harder on best-sellers – the best-selling books in the Top 750 sell around 60% of the volume of all graphic novels sold in 2021 as reported to NPD BookScan. Please pay attention: the “other” 34,000+ books really don’t sell all that well. This is how books work.

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail Value | % Change | Av. Sale per title | Av $ per title |

| 2007 | 6950 | — | 3,029,039 | — | $74,595,605 | — | 436 | $10,733 |

| 2008 | 9728 | 39.97% | 5,368,678 | 77.24% | $98,233,459 | 31.69% | 552 | $10,098 |

| 2009 | 10,936 | 12.30% | 5,946,595 | 10.76% | $107,263,294 | 9.19% | 544 | $9,808 |

| 2010 | 13,229 | 20.97% | 5,890,507 | -0.01% | $105,342,577 | -0.02% | 445 | $7,963 |

| 2011 | 14,954 | 13.04% | 6,001,731 | 1.89% | $112,823,763 | 7.10% | 401 | $7,545 |

| 2012 | 17,031 | 13.89% | 6,052,179 | 0.84% | $123,471,753 | 9.44% | 355 | $7,250 |

| 2013 | 17,468 | 2.57% | 6,637,420 | 9.67% | $131,767,547 | 6.72% | 380 | $7,543 |

| 2014 | 19,524 | 11.77% | 7,905,939 | 19.11% | $156,040,431 | 18.21% | 405 | $7,992 |

| 2015* | 18,019 | -7.71% | 10,689,116 | 34.44% | $197,553,909 | 26.60% | 593 | $10,964 |

| 2016* | 16,328 | -9.38% | 11,516,867 | 7.74% | $212,698,759 | 7.67% | 705 | $13,027 |

| 2017 | 25,183 | 54.23% | 12,544,715 | 8.92% | $217,360,776 | 2.19% | 498 | $8,631 |

| 2018 | 27,583 | 9.53% | 13,865,209 | 10.53% | $230,924,408 | 6.24% | 503 | $8,372 |

| 2019 | 30,816 | 11.72% | 17,233,606 | 24.29% | $288,745,613 | 25.04% | 559 | $9,370 |

| 2020 | 31,893 | 3.49% | 18,495,127 | 7.3% | $318,796,963 | 10.41% | 580 | $9,996 |

| 2021 | 34,624 | 8.56% | 24,105,059 | 30.33% | $430,020,217 | 34.89% | 696 | $12,420 |

| 2022 | 35,461 | 2.42% | 23,021,158 | -4.50% | $424,701,052 | -1.24% | 649 | $11,977 |

The Long Tail is not looking fantastic for the Western graphic novel in 2022 – nearly 2.5% more products, but sales are down by 4.5%. Much of this is drops at the top of the sales charts, but it’s still a thing to watch to see if it continues.

Next, we’ll survey each of the publishers, and their best-selling titles, ranking them by the number of pieces they sold this year with the Top 750 of NPD BookScan. We’ll also look at the “long tail” for each entry discussing the entirety of NPD BookScan.

It is now the eighth year in the row that our #1 Western publisher in the NPD BookScan Top 750 is Scholastic. Given that they only started “doing” comics in 2005, and in that time they’ve grown to 40% of the market with only 520 SKUs… well, I think that is a hell of an achievement. Further, it seems unlikely to get supplanted anytime soon unless kids collectively decide that they suddenly don’t like Dav Pilkey any longer.

Within the Top 750, Scholastic sells a staggering 8.5 million copies, from 91 placing books – but this is a real drop from 9.4 million copies sold the previous year. Every number reported here is only from retail sales through NPD BookScan reporters – this doesn’t count what I will assume are much larger numbers of copies that happen via the incredibly successful Scholastic Book Fairs, direct to students. Nor does this count any sales that are being done to elementary and middle school libraries, numbers that likely exceed retail sales. Possibly by a multiple?

Also consider that the next largest publisher sold a combined 1.5m copies in the Top 750, or only about a sixth of Scholastic’s volume. Or, how about this: if you combine the Top 750 performance of all of the traditional Direct Market “Premiere” publishers (Boom!, Dark Horse, DC, Dynamite, IDW, Image and Marvel) those combined best-sellers only amount to 890k books sold combined, or about a tenth of Scholastic alone. Scholastic is, quite simply, the ruler of the Top 750 in the Western charts.

Scholastic has several imprints – besides the Graphix imprint, they also publish as AFK, Arthur A. Levine and Blue Sky, as well as “Scholastic”, itself (although almost of the big sales action is at Graphix)

In alphabetical order by imprint:

Virtually none of Scholastics imprints don’t fit inside the Top 750 this year, including our alphabetical first: AFK’s best-seller is not quite 4500 copies of “Bendy: Crack-Up Comics Collection” which is material from the 1930s and 1940s

Arthur A. Levine does a bit better: a bit over 6k copies of “The Arrival” by Shaun Tan.

Blue Sky not only misses the Top 750, but they do almost nothing at all in this year’s BookScan – the best-selling book labeled as being from Blue Sky on the comics charts is Dav Pilkey’s The Adventures of Ook and Gluk, Kung-Fu Cavemen From The Future, which sells, erm, all of 29 copies this year. I think I expected more, given the rampaging success of “Dog Man” and “Cat Kid”!

The Graphix imprint is where all of the action is. Up above at the top of the column in the “Top Twenty” section we talked about Dav Pilkey, and “Five Nights at Freddy’s” and “Baby Sitters Club” and “Wings of Fire” and “Heartstopper” so there doesn’t seem to be an enormous need to talk about all of the same books again? And those books are all in Scholastic’s Top 20 as well.

Outside of those, I’m not sure what else to mention? Hm, how about this: while she was once “The Queen of Comics”, Raina Telgemeier’s books have dropped off quite a bit – this year, her self-created titles “Guts” (145k), “Smile” (123k), “Drama” (102k), “Sisters” (70k), and “Ghosts” (61k) have all dropped considerably – between all of the various editions and sets, Raina “only” sells about 560k books, down considerably from a million copies last year. But she’s had five years since her last new book, which is half the life of her mostly-kids audience. Kazu Kibuishi’s “Amulet” has also dropped off considerably, which I will also ascribe to no new releases in a half-decade.

After this, we’re looking at books under 50k, though many of these still sell much better than things you would otherwise expect – one super-clear example is the 42k copies of Scholastic’s Miles Morales: Shock Waves, which sells about three times better than any other Marvel graphic novel published by Marvel. The success of Scholastic is funny to me in that I start drawing arbitrary lines at 50k as “important enough to mention”, when almost any other publisher is incredibly lucky to have more than three or four titles selling that well.

The Long Tail for Scholastic looks like this – they had a real drop this year:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail price | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 28 | —— | 203,900 | —— | $2,018,694 | —– | 7282 | $72,096 |

| 2008 | 39 | 39.29% | 346,134 | 69.76% | $3,498,012 | 73.28% | 8875 | $89,693 |

| 2009 | 52 | 33.33% | 432,070 | 24.83% | $4,654,686 | 33.07% | 8309 | $89,513 |

| 2010 | 60 | 15.38% | 361,086 | -16.43% | $4,084,718 | -12.25% | 6018 | $68,079 |

| 2011 | 72 | 20.00% | 419,010 | 16.04% | $4,708,860 | 15.28% | 5819 | $65,401 |

| 2012 | 76 | 5.56% | 325,088 | -22.42% | $3,955,249 | -16.00% | 4277 | $52,043 |

| 2013 | 91 | 19.74% | 437,590 | 34.61% | $5,365,921 | 35.67% | 4809 | $58,967 |

| 2014 | 97 | 6.59% | 846,277 | 93.39% | $10,204,175 | 90.17% | 8725 | $105,198 |

| 2015* | 140 | 44.33% | 1,449,296 | 71.26% | $17,170,714 | 68.27% | 10,352 | $122,648 |

| 2016* | 131 | -6.43% | 1,940,760 | 33.91% | $23,919,704 | 39.31% | 14,815 | $182,593 |

| 2017 | 166 | 26.72% | 2,823,345 | 45.55% | $33,884,541 | 41.66% | 17,008 | $204,124 |

| 2018 | 224 | 34.94% | 4,623,212 | 63.75% | $54,645,209 | 61.27% | 20,639 | $243,952 |

| 2019 | 270 | 20.54% | 6,868,794 | 48.57% | $88,878,195 | 62.65% | 25,440 | $329,179 |

| 2020 | 343 | 27.03% | 7,164,029 | 4.30% | $95,638,289 | 7.61% | 20,886 | $278,829 |

| 2021 | 436 | 27.11% | 9,987,540 | 39.41% | $137,156,876 | 43.43% | 22,907 | $314,580 |

| 2022 | 520 | 19.27% | 9,236,437 | -7.52% | $135,077,506 | -1.52% | 17,762 | $259,764 |

Scholastic has one book over 500k, another six over 250k, twenty-five more over 100k, eleven others over 50k, thirty-four more over 20k, and an additional seventeen over 10k. Whew! Any other publisher would be satisfied with a tiny fraction of that (as you will clearly see if you keep reading along)

Even with the 7.5% year-over-year drop, Scholastic still feels like a juggernaut to me: the vast majority of their portfolio is extremely likely to continue as “perennial seller” status. And I continue to lustily fantasize about what might happen if they decided to do two streams of revenue and serialized first before eventual collection.

Stepping up a slot to #2 is one of the traditional “Big Five” book publishers: Penguin Random House. They land 38 titles into the 2022 NPD BookScan Top 750, selling 1.5 million copies for just over $28m in calculated gross sales.

Like a lot of the “big five” book publishers, these companies have lots and lots of imprints built up over decades of publishing books. Penguin Random House, as best as I can tell, has ten distinct imprints that appear in the Top 750 list for 2022 – Alfred A. Knopf, Del Rey, Dial, Pantheon, Penguin, Random House Books For Younger Readers, Random House Graphic, Razorbill, Triangle, and Tundra.

They’re also, in the long tail: (deep breath!) Ace, Ballantine, Bantam, Berkley, Blue Snake, Broadway Books, Clarkson N. Potter, Crown, Delacorte, Doubleday, Dutton, Emblem, Golden, Gotham Books, G.P. Putnam & Sons, Grossett & Dunlap, Hudson Street, InkLit, Knopf, McClelland & Stewart, Montena, Nan A. Talese, New American Library, One World, Penguin, Philomel, Plume, Potter Style, Prestel, Price Stern Sloan, Puffin, Putnam, Riverhead, Rodale, Schocken, Schwartz & Wade, Tarcherperigee, Ten Speed, Three Rivers, Viking Books For Young Readers, Villard, Waterbrook, Watson-Guptill and Yearling. (whew!)

However, they are not (Brian writes down here so he remembers this research each year – you’d be shocked how long it take me to sort through this stuff every time!) the PRH-distributed-only Angry Robot, BCN Multimedia, Beacon, Black Balloon, Campfire, Catapult, Charlesbridge, Devil’s Panties, Dragonfly, Fawcett, Frog In Well, Gefen, Library of America, M Press, New York Review, Nobrow, NoStarch, North Atlantic, Overlook Press, Powerhouse, Quirk, Ramble House, Rizzoli, Sasquatch, Seven Stories Press, Shambhala, Smithsonian, Soft Skull, Sonoma Valley Press, Sunday Press, Universe, or Verso (I am sure I missed a few!!)

Looking at those imprints in alphabetical order, within the Top 750:

Alfred A. Knopf Books For Younger Readers places one book into the Top 750, though not within PRH’s Top Twenty: Roughly 19k copies of White Bird: A Wonder Story.

Del Rey has one placing title for 2022, the Dave Wenzel adaptation of The Hobbit for about 18k copies, and this is solid, steady perennial volume that has consistently placed for years and years.

Dial places two books in the Top 750, and both are by Victoria Jamieson: When Stars Are Scattered (#7 for PRH) at almost 70k copies, Roller Girl (not in the Top Twenty) at about 16k.

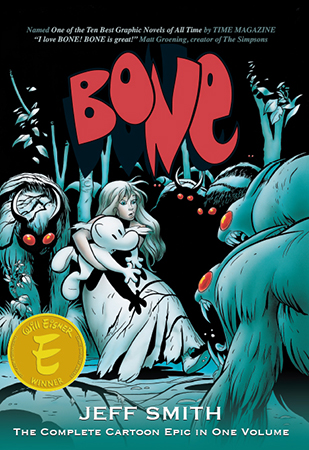

Pantheon is their “literary” comics wing, and has some of PRH’s steadiest-sellers. There are four placing in 2022, including Art Spiegelman’s Pulitzer Prize-winning Maus, where volume 1, My Father Bleeds History (#1 for PRH overall) sells nearly 177k copies. Because I was having a conversation on Facebook recently with another retailer who didn’t know this, it’s perhaps worth mentioning that Maus isn’t a “graphic novel”, per se: it’s a collection of an originally serialized mini-comic that was bound into “Raw” Magazine in the early 1980s. This is one of the reasons it is actually split into two volumes, and v2, And Here My Troubles Began (#6 for PRH overall) sells about 73k copies. The complete hardcover edition of both volumes (#3) also sells another 93k copies. In addition to this, v1 Marjane Satrapi’s Persepolis (#10 for PRH overall) sells just over 50k. As always surprises me with Pantheon books, way way less people read v2 – less than a tenth, at 4200 copies, not even making it into the Top 750! But the Complete edition of Persepolis sells 23k. I’m genuinely not sure that I understand these sales patterns, though my assumption is that Pantheon simply isn’t doing a good job explaining these are multi-volume series.

From Penguin Group is almost 14k copies sold of Penguin Classics: Amazing Spider-Man v1, which reprints a bit more than the first nineteen issues of ASM, along with text essays. It’s worth observing that Marvel itself also publishes this same material: in a slightly smaller “Mighty Marvel Masterworks” format for $16 (vs the $28 here), that doesn’t even crack 5k with that (despite it being Marvel’s 9th best-selling book), as well in the $45 full sized “Epic” collection which sells almost 1800 copies, as well as a $125 hardcover, which trickles out 1600 copies sold. Though it seems significant to me that Marvel is the worst publisher for Marvel comics, with Penguin, Scholastic, and Viz all doing meaningfully better in selling Marvel products.

Random House Books For Younger Readers places three titles into the Top 750, all of which are comics adaptations of Mary Pope Osborne’s Magic Tree prose novels. Dinosaurs Before Dark places at #11 for PRH overall, with nearly 49k sold, while The Knight at Dawn (#13) with about 39k. Also selling is Mummies in the Morning which sells a smidge under 15k.

Random House Graphic (which on some level is a rebrand for the previous imprint) has 11 placing books in the Top 750, led by Sweet Valley Twins: Best Friends (#14 for PRH overall, 38k in sales). Following that is v1 of Katie the Catsitter by Colleen Venable (#19, 27k) – v2 sells 24k. And rounding out the top 20 for PRH is v8 of Judd Winick’s Hilo (#20, 26k). Other successful books in the Top 750 for RHG are Pizza & Taco (four volumes), v1 of Witches of Brooklyn, Five Worlds v5 and Housecat Trouble.

New this year is the imprint called Random House Worlds, which just has one series placing: Lore Olympus by Rachel Smythe, which is natively a webcomic. Interestingly, the hardcover versions sell the best – and strangely v2 is the most successful (#2, 108k), then v1 (#4, 78k), then v3 (#5, 77k). This is immediately followed by the softcover versions, which follow in the much more typical pattern of v1 (#8, 67k), v2 (#9, 54k) and v3 (#19, 28k). This, combined with Hooky from HarperCollins below would appear to clearly show an enormous potential audience for print-editions of successful (free!) webcomics. This is a giant development that shouldn’t be understated, though we will see how sustainable it is over the next few years, as more titles come to print. That this appears to be the opposite result of comics that were sold digital first is the most interesting part of this result, if you ask me?

Razorbill places a single book in the Top 750: about 20k of Paws: Gabby Gets it Together by Nathan Fairbairn.

Triangle Square also places a single book: around 18k of Sex is a Funny Word by Cory Silverberg.

And finally, Tundra has six placing volumes of Ben Clanton’s “Narwahl: Unicorn of the Sea” series. Volume 6, Narwhal’s School of Awesomeness (#12 for PRH overall, 43k sold) leads the pack, followed by v1 (#15, 37k), v4 (#16, 34k) and v7 (#17, 29k). The other two aren’t in PRH’s top 20, but v3 sells 15k, and v2 sells 13k. The “hammock” rules don’t seem to apply to this series!

Penguin Random House formed out of a merger in 2013 – prior to that they were separate publishers Penguin and Random House. Here’s what the Long-Tail for the combined Penguin Random House looked like in 2022:

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail Value | % Change | Av. Sale per title | Av $ per title |

| 2013 | 282 | ——- | 447,174 | ——- | $7,259,364 | ——- | 1,586 | $25,742 |

| 2014 | 252 | -10.64% | 428,634 | -4.15% | $7,415,712 | 2.15% | 1,701 | $29,427 |

| 2015* | 450 | 78.57% | 513,611 | 19.83% | $8,517,761 | 14.49% | 1,141 | $18,928 |

| 2016* | 293 | -34.88% | 435,877 | -15.13% | $7,150,087 | -16.06% | 1,488 | $24,403 |

| 2017 | 409 | 39.59% | 664,858 | 52.53% | $10,136,224 | 41.76% | 1,626 | $24,783 |

| 2018 | 613 | 49.88% | 760,314 | 14.36% | $11,136,058 | 9.86% | 1,240 | $18.166 |

| 2019 | 635 | 3.59% | 1,013,092 | 33.25% | $15,745,448 | 41.39% | 1,595 | $24,796 |

| 2020 | 551 | -13.23% | 1,380,328 | 36.25% | $21,157,243 | 34.37% | 551 | $38,398 |

| 2021 | 809 | 46.82% | 1,901,467 | 37.75% | $30,131,057 | 42.41% | 2,350 | $37,245 |

| 2022 | 760 | -6.06% | 2,330,883 | 22.58% | $41,906,282 | 39.08% | 3,067 | $55,141 |

However, I’m not willing to pull an “We’ve always been at war with Eurasia” moment, so let’s look at the individual pieces of the past. This is what Penguin Putnam (Ace, Berkley Books, Dial, Dutton, Gotham Books, Grossett & Dunlap, Hudson Street, InkLit, New American Library, Penguin, Philomel, Plume, Price Stern Sloan, Puffin, Putnam, Razorbill, Riverhead and Viking) used to look like alone)

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail Value | % Change | Av. Sale per title | Av $ per title |

| 2007 | 18 | —— | 13,545 | —— | $178,260 | —— | 753 | $9,903 |

| 2008 | 28 | 55.56% | 28,606 | 111.19% | $310,856 | 74.38% | 1022 | $11,102 |

| 2009 | 39 | 39.29% | 40,288 | 40.84% | $444,928 | 43.13% | 1033 | $11,408 |

| 2010 | 45 | 15.38% | 50,628 | 25.67% | $623,650 | 40.17% | 1125 | $13,859 |

| 2011 | 53 | 17.78% | 123,749 | 144.43% | $1,576,161 | 152.73% | 2335 | $29,739 |

| 2012 | 60 | 13.21% | 121,769 | -1.60% | $1,499,660 | -4.85% | 2029 | $24,994 |

This is what Random House (Alfred A. Knopf, Ballantine, Bantam, Broadway, Crown, Del Rey, Doubleday, Pantheon, Random House, Schocken, and Three Rivers) looked like alone:

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail value | % Change | Av. Sale per title | Av $ per title |

| 2007 | 74 | — | 216,580 | — | $2,890,347 | — | 2,927 | $39,059 |

| 2008 | 77 | 5.47% | 383,105 | 76.89% | $5,698,922 | 97.17% | 4,975 | $74,012 |

| 2009 | 109 | 41.56% | 405,598 | 5.87% | $5,398,890 | -5.26% | 3,721 | $49,531 |

| 2010 | 132 | 21.10% | 389,410 | -3.99% | $5,831,814 | 8.02% | 2,950 | $44,180 |

| 2011 | 144 | 9.09% | 397,143 | 1.99% | $6,356,212 | 8.99% | 2,760 | $44,140 |

| 2012 | 185 | 28.47% | 375,254 | -5.51% | $7,124,794 | 12.09% | 2,028 | $38,512 |

Penguin Random House has two titles over 100k, another three books over 75k, four more titles over 50k, 14 additional books over 20k, and another 19 books over 10k.

Dropping down a step is the now #3 largest publisher with Western comics in NPD BookScan Top 750 in 2022: HarperCollins. Worth remembering is that HarperCollins completed the purchase of Houghton Mifflin Harcourt in 2021 – HMH was the 11th largest Top 750 NPD BookScan publisher in 2020, if you will recall. Harper places 43 books into the Top 750 for a total of 1.3 million copies sold, and a calculated retail cover price of $19.7 million. There’s a lot of imprints with the word “Harper” in the title in the Long Tail (Harper, Harper Paperbacks, Harper Teen, Harper Festival, Harper Teen, and so on), and Harper is also Blazer & Bray, Clarion/Etch, Katherine Tegan, Mariner, Quill Tree and William Morrow (in the Top 750); as well as Amistad, Dey Street, Ecco, Fourth Estate, Friday Project, Greenwillow, Harvest, Houghton Mifflin Harcourt, Joanna Cotler, IT books, Thomas Nelson, Versify, William Collins and Zondervan (out of the Top 750)

In alphabetical-by-imprint order:

At Balzer & Bray they place seven titles into the Top 750, and it continues to be mostly all about Terri Libenson. Remarkably Ruby is her newest book (it appears to be the sixth book in the series, though HC doesn’t refer to this in titling or metadata) and is the #4 overall best-seller for HarperCollins. It sells nearly 67k, a very strong result. Truly Tyler (#14, 28k) comes next, followed by four other volumes in the series that sell between 11k-18k. Also placing in the Top 750 for this imprint is Almost American Girl, which sells about 16k copies.

Clarion/Etch was a formerly Houghton Mifflin Harcourt middle-grade imprint that is new to the Harper family. Clarion places eleven titles within the Top 750, led by the success of the web-first Hooky by Miriam Bonastre Tur – v1 (#3 overall for HarperCollins) leads with almost 95k copies, while v2 (#6) comes in at 53k sold. This is followed by the success of Kayla Miller, first with Camp (#7, 49k), then Crunch (#8, 44k), Clash (#10, 36k), Besties (#13, 30k), as well as three other books from her which sell between 13k-20k. Clarion also places Crumbs by Danie Stirling (19k) and The Crossover by Kwame Alexander (18k).

At the various Harper-named imprints, they have 13 titles within the overall NPD BookScan Top 750. Their biggest hit is from gaming stars from YouTube. FGTeev’s The Switcheroo Rescue! is #1 for HarperCollins, with almost 150k sold. This is followed by Into The Game! (#5, 64k), Saves The World! in hardcover (#11, 34k) and paperback (#12, 31k), and even Game Break! sells 13k copies. Other big successes are Johnnie Christmas’ Swim Team (#16, 26k), Erin Hunter’s Warriors: Winds of Change (#17, 26k) – Exile from Shadowclan also sells 24k – as well as Alicia Keys’ Girl on Fire (#19, 25k), and Lily Lamotte’s Measuring Up (#20, 24k)

Katherine Tegan’s best-seller in 2022 is The First Cat In Space Ate Pizza (#18 for Harper overall), which sells 26k copies.

Mariner was also a former HMH imprint, and has two in the Top 750: Alison Bechdel’s Fun Home at 19k sold, and an adaptation of George Orwell’s 1984 with a bit under 15k sold.

The Quill Tree imprint places four books, including Harper’s #2 best-seller for the year: Jerry Craft’s New Kid with 95k sold, while at #9 is Craft’s Class Act (37k). And down towards the bottom of the Top 750 is Nate Stevenson’s perennial Nimona, with almost 14k sold.

Finally, the William Morrow imprint is in the Top 750 overall, but not a Top Twenty book for Harper – they sell 11k of the forever perennial Understanding Comics by Scott McCloud.

Here is the Long Tail for Harper, now with HMH included only for this year:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 18 | —— | 36,940 | —— | $600,540 | —– | 2052 | $33,363 |

| 2008 | 36 | 100.00% | 48,264 | 30.66% | $863,808 | 43.84% | 1341 | $23,995 |

| 2009 | 42 | 16.67% | 81,774 | 69.43% | $1,308,891 | 15.53% | 1947 | $31,164 |