By Brian Hibbs

“There are three kinds of lies: Lies, Damned Lies, and Statistics”

It’s time to look at graphic novel sales in 2018. Implausibly, this is the sixteenth annual report of something that is hard to exactly perceive and understand: the size and shape of the sales of graphic novels and trade paperbacks through the book store market, as seen through the prism of BookScan.

To read about our methodology, what Bookscan measures, and other technical details of how these reports have been made, you can go to the end of the piece, Bookstores that have POS systems are able to report their sales to BookScan, a subsidiary of The NPD Group (they bought it from Nielsen).

BookScan tracks the specific sales to consumers through its client stores. I had several well trained spies who have, for many years, provided me with access to the BookScan reports at the end of each year. However, I am very excited to say that we are now getting the BookScan reports directly from The NPD Group, with no filter or middleman! This is our second year of doing so.

However, getting “official” detail has brought a major change this year: NPD Group no longer wants us releasing the complete data in chart form, although we are allowed to quotes numbers. Even the pretty tight “Top 750” as has been our historical practice, will no longer include total sales outside the top 20. I am fairly certain that, if you know how to search the internet, you could probably turn up previously published links from 2003 through 2017, but going forward, you will have to trust my abstract of the charts, rather than seeing the charts themselves. So sorry!

(For points of comparison, try these links to the earlier pieces:

2017: My Analysis

2016: My Analysis

2015: My Analysis

2014: My Analysis

2013: My Analysis

2012: My Analysis

2011: My Analysis

2010: My Analysis

2009: My Analysis

2008: My Analysis

2007: My Analysis

2006: My Analysis

2005: My Analysis

2004: My Analysis

2003: My Analysis)

2018 Overview

The main thing that has to be done in editing the data I am sent is removing all of the things that are not comics. I literally hand-checked thousands of items against Amazon’s “Look Inside” feature” to say “is this a comic or not?” I defined “comics” like this: either a) it has multiple panels sequentially producing a narrative (those don’t have to be on ONE PAGE, so someone like Mo Williams is certainly comics) OR b) a single image that, taken entirely by itself, provides a complete thought. So, “The Far Side” is comics, but, no, “Diary of a Wimpy Kid” is NOT (but very glad to see that number as a comparative)

Using my new working definition, I have decided to cut some items that had previously been kept in: chief among those is Rachel Renee Russell’s “Dork Diaries” – they have words, they have pictures, but they don’t work together in the way I’d think we’d commonly agree is “comics”. I also removed prose-driven books like DK Publishing’s “Marvel Encyclopedia”, which, while nominally about comics or comics culture, is factually an encyclopedic prose book with pictures. Or “Wonder Woman: Warbringer” which is a straight-up prose novel that happens to feature a comics character, or “DC Super Heroes: My First Book of Girl Power” where the Amazon “Look Inside” clearly shows is an illustrated reader for 2nd graders. There is clearly an enormous market for this kind of material – in fact, in many cases a larger market than for the actual comics themselves – it just isn’t the “comics” market, as I would define it.

Here’s the big picture for just the Top 750 in 2018:

| Year | Total Unit | Growth | Calculated Retail Value | Growth |

| 2003 | 5,495,584 | ——- | $66,729,053 | ——– |

| 2004 | 6,071,123 | 10.5% | $67,783,487 | 1.6% |

| 2005 | 7,007,345 | 15.4% | $75,459,669 | 11.3% |

| 2006 | 8,395,195 | 19.8% | $90,411,902 | 19.8% |

| 2007 | 8,584,317 | 2.3% | $95,174,425 | 5.3% |

| 2008 | 8,334,276 | -2.9% | $101,361,173 | 6.5% |

| 2009 | 7,634,453 | -8.4% | $93,216,014 | -8.0% |

| 2010 | 6,414,336 | -15.9% | $85,266,166 | -8.5% |

| 2011 | 5,696,163 | -11.2% | $79,961,951 | -6.2% |

| 2012 | 5,438,329 | -4.53% | $89,918,354 | 12.45% |

| 2013 | 5,654,351 | 3.97% | $96,062,709 | 6.83% |

| 2014 | 6,659,031 | 17.77% | $112,768,709 | 17.39% |

| 2015* | 8,762,983 | 31.60% | $141,226,518 | 25.24% |

| 2016* | 9,967,907 | 13.75% | $159,510,075 | 12.95% |

| 2017 | 10,310,682 | 3.44% | $154,026,517 | -3.44% |

| 2018 | 11,755,903 | 14.02% | $165,885,527 | 7.70% |

I want to remind you that while I asterisk 2015-2016 in terms of the sheer number of data points that I was getting was probably edited, it appears to be that the top 750 itself was fairly rock solid.

The trend for print books in general (not just looking at comics) through bookstores, according to the NPD group and BookScan appears to be a general growth of 1.3% in 2018, while the US Census Bureau According to Bookscan data, comics/graphic novels are outperforming the rest of the market and were up 7.5% in units from 2018 over 2017.

(For what it is worth, overall book [only] sales through Diamond in the Direct Market appear to be down by about 8%, (in dollars, ComicChron isn’t calculating pieces here) so the book market performed significantly better in the book category. Diamond only directly reports the Top 300 best-sellers each month, and those Top 300s in the DM sum up to $73.56m worth of books sold, though obviously there’s a LOT of periodicals on top of that [another $319m]. Deep deep into the micro, my own individual sales in the book category were down about 5.4% in dollars at my main store in 2018.)

As I noted in the intro boilerplate, I primarily write about the top 750 because a) that’s all the data I was initially leaked back in 2003, b) it’s a “manageable” chunk of data, and c) “as above, so below” – the top 750 represents about half of sales. However, since 2007, I’ve received the “entire” database, which now gives us a solid ten years of data to track. Sometimes we refer to this as “the Long Tail”.

Here’s what the sales of all comics sales BookScan tracks in this category looks like – but, seriously, let me remind you that the dataset changes enough each year this is a kind of meaningless set of comparisons! Even putting aside “the asterisk years”, prior to 2013 this didn’t include Walmart, for just one example of the lack of direct comparison.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 13,181 | —– | 15,386,549 | —– | $183,066,142 | —– | 1167 | $13,888.64 |

| 2008 | 17,571 | 24.98% | 15,541,769 | 1.00% | $199,033,741 | 8.02% | 885 | $11,327.40 |

| 2009 | 19,692 | 12.07% | 14,095,145 | -9.31% | $189,033,736 | -5.02% | 716 | $9,599.52 |

| 2010 | 21,993 | 11.68% | 12,130,232 | -13.94% | $172,435,244 | -8.78% | 552 | $7,840.32 |

| 2011 | 23,945 | 8.88% | 11,692,058 | -3.61% | $175,634,490 | 1.86% | 488 | $7,334.91 |

| 2012 | 23,365 | -2.42% | 9,562,236 | -18.22% | $164,415,366 | -6.39% | 409 | $7,036.82 |

| 2013 | 24,492 | 4.82% | 10,153,628 | 6.18% | $176,419,370 | 7.30% | 415 | $7,325.63 |

| 2014 | 26,976 | 10.14% | 11,820,324 | 16.41% | $207,598,355 | 17.67% | 438 | $7,695.56 |

| 2015* | 22,431 | -16.85% | 15,269,550 | 29.18% | $259,807,532 | 25.15% | 681 | $11,582.52 |

| 2016* | 21,295 | -5.06% | 17,302,891 | 13.32% | $293,583,180 | 13.00% | 813 | $13,786.48 |

| 2017 | 35,338 | 65.95% | 18,385,086 | 6.25% | $302,300,435 | 2.97% | 520 | $8,554.54 |

| 2018 | 38,424 | 8.73% | 19,965,469 | 8.60% | $318,345,707 | 5.31% | 520 | $8,855.07 |

Overall, this is out Topline conclusion for BookScan 2018: Up 9% in total books listed, up 9% in Units Sold, and up 5% in the calculated retail value if all books sold for cover price (they didn’t, not in the “bookstore” market)

Let’s take a look at the Top 20 best-selling graphic novels on the 2018 chart; it looks like this, including sales

| DOG MAN AND CAT KID | PILKEY, DAV | 716,647 |

| DOG MAN: LORD OF THE FLEAS | PILKEY, DAV | 692,576 |

| DOG MAN | PILKEY, DAV | 317,157 |

| DOG MAN UNLEASHED | PILKEY, DAV | 317,093 |

| DOG MAN: A TALE OF TWO KITTIES | PILKEY, DAV | 314,950 |

| DOG MAN: BRAWL OF THE WILD | PILKEY, DAV | 199,755 |

| DRAMA | TELGEMEIER, RAINA | 174,550 |

| SMILE | TELGEMEIER, RAINA | 149,751 |

| SISTERS | TELGEMEIER, RAINA | 132,812 |

| THE BABY-SITTERS CLUB: DAWN AND THE IMPOSSIBLE THREE | MARTIN, ANN M. | 112,054 |

| GHOSTS | TELGEMEIER, RAINA | 108,797 |

| KRISTY’S BIG DAY | MARTIN, ANN M. | 108,164 |

| KRISTY’S GREAT IDEA: FULL-COLOR EDITION (THE BABY-SITTERS CLUB GRAPHIX #1) | MARTIN, ANN M. | 101,250 |

| THE ADVENTURE ZONE: HERE THERE BE GERBLINS | MCELROY, CLINT | 94,434 |

| POPULARMMOS PRESENTS: A HOLE NEW WORLD | POPULARMMOS | 93,332 |

| POSITIVELY IZZY | LIBENSON, TERRI | 90,587 |

| SUPERNOVA | KIBUISHI, KAZU | 87,628 |

| BIG NATE: SILENT BUT DEADLY | PEIRCE, LINCOLN | 84,005 |

| PHOEBE AND HER UNICORN (PHOEBE AND HER UNICORN SERIES BOOK 1) | SIMPSON, DANA | 82,225 |

| THE DRAGONET PROPHECY | SUTHERLAND, TUI T. | 80,681 |

Nineteen of the twenty are aimed at younger readers – only “The Adventure Zone” breaks through the kids-orientation. The first Manga book in the charts isn’t until #25 (“My Hero Academia v1”) and the first Superhero comic comes in at #29 (“The Infinity Gauntlet”)

Clearly, Dav Pilkey and his “Dog Man” series of books are the current Rulers of comic sales in the bookstores. What’s critical to remember about this is that Scholastic is also presumably selling a metric shedload of these books through the Scholastic Book Fairs, to elementary and middle school libraries, and any number of other places that don’t report to BookScan. This here is just the tip of the iceberg.

So strong is Pilkey’s hold on the current charts that he takes the first Six spots on the charts. The #1 best-seller (“Dog Man and Cat Kid”) sells almost 717k copies. No, that’s not a misprint – almost three quarters of a million copies are sold through BookScan reporters.

At #2 is “Lord of the Fleas” (693k), #3 is v1 just titled “Dog Man” (317k), #4 is “Unleashed” (317k), #5 is “A Tale of Two Kitties” (315k), and #6 is “Brawl of the Wild” with just under 200k copies sold. Any one of those, in any other year, would be an insanely high number by itself – add them all together and you have 2.6 million copies of one single series sold in one single year.

Let’s underline just how insane this is: these six volumes together represent thirteen percent of all comics sold through BookScan.

The only thing that breaks these two author’s hold on the top 10 is also a “Baby-Sitter’s Club” adaptation, this time from Gale Galligan where v5 (“Dawn and the Impossible Three”) is #10 with 113k sold. Galligan is also spot #12 with “Kristy’s Big Day”, which comes in at 108k.

This also means that publisher Scholastic has completely locked up the first thirteen spots of the charts – an unprecedented achievement in all of the time we’ve tracked these things.

Coming in at #14 is the first book aimed at adults “The Adventure Zone: Here There Be Gerblins” by the McEllroy’s, featuring a new adventure spinning out of their extremely popular D&D-based podcast. They rack up 94k copies sold of the book.

Then the next five slots get back to nothing but kid’s comics — #15 is something I previously knew nothing about: a Minecraft-based comic (but illustrated, not screencapped) “PopularMMOs Presents: A Hole New World” which sells 93k copies.

#16 is “Positively Izzy” by Terri Libenson (91k), #17 is the eight volume of Kazu Kibuishi’s “Amulet:, “Supernova” (88k), #18 is Lincoln Peirce’s “Big Nate” in “Silent But Deadly” (84k), #19 is v1 of Dana Simpson’s “Pheobe and Her Unicorn” (82k), and #20 is the first volume of the “Wings of Fire” adaptation: “The Dragonet Prophecy” (81k)

If I were you, I would consider the fact that not one of these books was created “for” the traditional Direct Market audience, and that the DM (as represented by Diamond at least) does a mediocre job stocking or selling any of these books – in fact, of the top 500 DM best-sellers in 2018, only two of the BookScan top 20 even appear at all – “The Adventure Zone” at #144 (4k copies) and “Amulet v8” way down at #309 (2800 copies). And there is at least one (“PopularMMOs Presents: A Hole New World”) that has never been carried by Diamond at all.

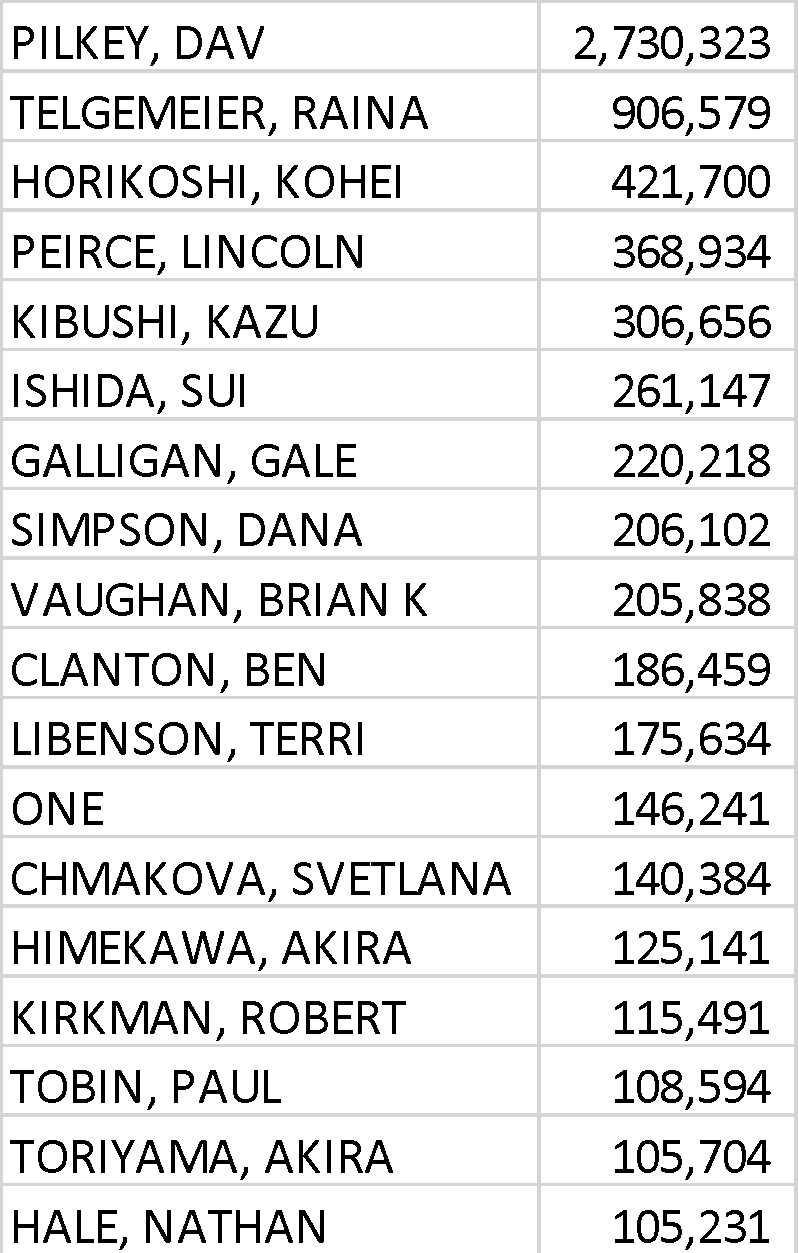

How about if we sort things by author? Here are people who sold more than 100k copies in the Top 750:

These eighteen people represent fifty-eight percent of sales in the Top 750!

What you can take from this is that only a small number of creators drive the majority of the business in comics (and books in general, I think); and conversely, this probably means that the numerical majority comics aren’t actually significantly profitable any given year.

Let’s switch our attention to looking how publishers performed.

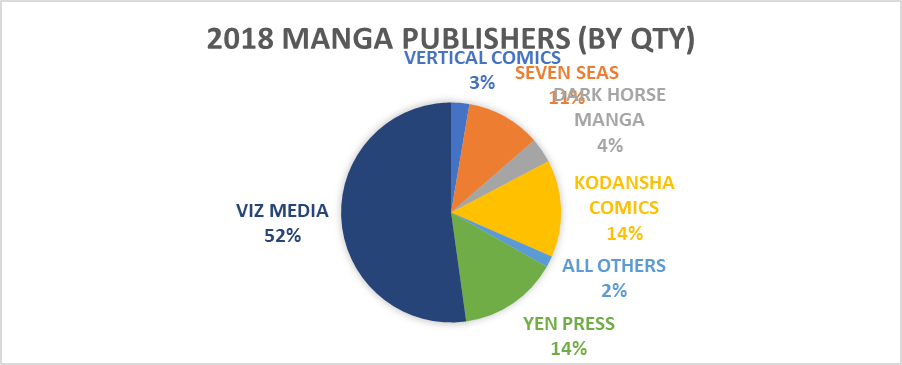

As a way to make the publisher breakdowns more readable, I split the chart into “eastern” (Manga) and “western” comics, because I think there are a few clear market distinctions between those categories. So, without further ado:

2018 Manga

Overall sales are up a bit for the Manga category in 2018 – about 8% in pieces within the Top 750, and just over 1% in calculated dollars.

Here’s a year-to-year comparison chart for the Top 750:

| Year | # of placing titles | Unit sales | Calculated Retail Value |

| 2003 | 447 | 3,361,966 | $34,368,409 |

| 2004 | 518 | 4,603,558 | $45,069,684 |

| 2005 | 594 | 5,691,425 | $53,922,514 |

| 2006 | 575 | 6,705,624 | $61,097,050 |

| 2007 | 575 | 6,837,355 | $61,927,238 |

| 2008 | 514 | 5,624,101 | $53,033,579 |

| 2009 | 451 | 4,414,705 | $41,068,604 |

| 2010 | 436 | 3,117,019 | $30,212,561 |

| 2011 | 392 | 2,627,570 | $27,017,081 |

| 2012 | 367 | 1,908,186 | $21,324,368 |

| 2013 | 315 | 1,665,487 | $21,256,777 |

| 2014 | 271 | 1,748,185 | $22,601,720 |

| 2015* | 279 | 2,033,534 | $26,191,474 |

| 2016* | 311 | 2,629,366 | $35,915,488 |

| 2017 | 284 | 2,427,380 | $35,433,489 |

| 2018 | 299 | 2,641,158 | $35,955,537 |

All three indicators are up for the category in 2018, but things are still far from their heights ten years ago. In part this is likely driven by the near-exclusive domination of series in the manga world – when there’s not a strong anime driving sales, manga tankobon series start to perform more like periodicals than books (albeit over a much wider horizon); rather than building a strong core backlist that sells forever, year-in-and-year out, manga tends instead to ebb and flow with culture and fashion.

Being “hit driven” in that manner makes things a bit more volatile in the manga space, and a single hit can have an outsized impact on sales. This year’s “It” manga was clearly “My Hero Academia”, with v1 being the year’s best-selling volume of manga, hitting just under 61k. Compare that to 2017’s winner, “Tokyo Ghost” – in 2017 the first volume of that only sold a bit over 34k, a pretty large difference. “My Hero Academia” has seven volumes that exceeded 30k in 2018 – the only series to cross that particular “band”, and every volume of the series (including the spinoff “My Hero Academia: Vigilantes”) places within the top 750; with none doing under approximately 12k in unit sales.

In fact, the success of “My Hero Academia” means that roughly one-in-five manga books sold in 2018, within the Top 750, was a volume of this series.

One other thing that the nature of multi-book series means that there tends to be less diversity overall in what’s being promoted – of the 299 different “manga” books, I only counted only eighty-one distinct “series” this year. This is down from eighty-four in 2017.

Manga, as a category, has a “long tail”, where we’re looking at all sales for the year, and not just within the Top 750 best-sellers:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 6231 | —— | 11,323,487 | —— | $108,770,537 | —– | 1817 | $17,456 |

| 2008 | 7842 | 20.54% | 10,173,091 | -11.31% | $100,800,283 | -7.91% | 1297 | $12,854 |

| 2009 | 8756 | 11.66% | 8,148,490 | -19.90% | $81,770,442 | -18.78% | 931 | $9,339 |

| 2010 | 8764 | —— | 6,239,725 | -23.42% | $67,092,668 | -17.95% | 712 | $7,655 |

| 2011 | 8991 | 2.59% | 5,690,327 | -8.80% | $62,810,728 | -6.38% | 633 | $6,986 |

| 2012 | 6332 | -29.57% | 3,510,057 | -38.32% | $40,943,613 | -34.81% | 554 | $6,466 |

| 2013 | 7024 | 10.93% | 3,516,208 | 0.01% | $44,651,823 | 9.06% | 501 | $6,357 |

| 2014 | 7452 | 6.09% | 3,914,385 | 11.32% | $51,557,925 | 15.47% | 525 | $6,919 |

| 2015* | 4412 | -40.79% | 4,580,434 | 17.02% | $62,253,624 | 20.75% | 1038 | $14,110 |

| 2016* | 4968 | 12.60% | 5,821,892 | 27.10% | $81,314,479 | 30.62% | 1172 | $16,368 |

| 2017 | 10,248 | 106.8% | 5,865,412 | 0.75% | $85,581,224 | 5.25% | 572 | $8,351 |

| 2018 | 10,839 | 5.77% | 6,100,260 | 4.00% | $87,421,299 | 2.15% | 563 | $8,065 |

I want to make sure that you’ve read all of the methodology to understand what you’re seeing in this chart, and the ones below. It’s really clear that my ’15 and ’16 data was incomplete now! It appears to be on the lower end of the charts – the “onesie, twosie” sellers – which leads me to conclude that my giver did some level of “currently in print?” pass those years. Thankfully, that’s no longer a problem.

Without “My Hero Academia” turning into a broad hit in 2018, the bottom line “long tail” numbers for the category would likely have gone negative.

Within the Top 750, the picture is very similar: The #1 publisher is Viz who takes 179 of the 299 manga spots in the Top 750, once again keeping them as the overwhelmingly dominant manga player with nearly sixty percent of the placing titles! Within the Top 750, Viz charted about 1,891,034 pieces, for almost $25 million of calculated retail dollars – this is another year of strong growth for Viz, up roughly 21% from the previous year in pieces placed.

Viz controls the manga charts as they have for a very long time now. It is nearly impossible envisioning anyone really challenging them substantially for that role because they are closing on being four times larger than their nearest competitor in their segment (!) Just to give you a sense of scale here, while every manga competitor places at least one book selling over 10k, not one of them sells over 15k. Meanwhile, Viz has thirty-nine releases that sold over 15k.

As noted, Viz’s #1 Best-seller is “My Hero Academia” – v1 sells about 61k, v2 is at 42k, and it has five more volumes that place over 30k, and seven more after that which beat 20k. All sixteen volumes make the Top 750, as do both volumes of the spinoff series “My Hero Academia: Vigilantes”. Nothing sells under 12k, and even that one only had a bare two months of release. Eight of Viz’s Top 10 are “MHA”, as are fourteen of the Top 20. It’s a success, selling nearly a half-million books combined this year! This is dramatically up from about 134k combined in 2017.

Viz’s second best-selling series is “Legend of Zelda: Twilight Princess v3” coming a bit under 29k. The other three volumes of the sub-series all sell something pretty close to 17k, while nine “Zelda” books place in the Top 750 altogether, totaling a bit more than 125k pieces.

Viz’s third best-seller (coming in at #10 for overall manga sales) is “Tokyo Ghoul” at a bit under 28k. This is down from 34k in 2017 when it was the #1 manga of the year (and it did 54k in 2016). If you include the spin-off series of “Tokyo Ghoul: RE”, all twenty-three different volumes of the series place within this year’s Top 750, summing to over 261k in unit sales (down from 272k in 2017)

Fourth for Viz (#13 in overall manga sales) is RWBY, with a hair under 25k. Four volumes of this series place in the Top 750, summing to a bit over 64k

At fifth for Viz is “Splatoon” (nearly 21k for v1, #15 best-selling manga overall). Five volumes chart for almost 60k in combined sales.

At sixth is “Dragon Ball Super v2”, also selling close to 21k (#17 best-selling manga overall) – between the three different series, “Dragon Ball” places eleven volumes in the Top 750, totally a bit over 100k.

And “bringing up the rear” (as the #20 manga overall) is “One Punch Man”, with v13 racking up 20k sold. There are fourteen volumes of “One Punch Man” in the Top 750, selling a combined 141k copies.

Also worth mentioning for Viz is the success of the Junji Ito books – “Uzumaki” comes in at #26 with 18k copies sold, while “Shiver” does about 17k at #32. Other books selling over 10k include “Death Note” (v1 of the “black edition” does nearly 17k), “Assassination Classroom” (v1 does almost 15k), Naruto (v1 of the 3-in-1 edition does about 14k), “Fullmetal Alchemist” (v1, also of the 3-in-1 editon, does about 13k), as well as “Super Mario Adventures” (just under 13k), and, of course, “Pokemon” with 12k of $55 (!) boxed set of “Red & Blue”

Let’s take a look at the “long tail” of Viz?

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 2018 | —— | 6,249,324 | —— | $55,123,347 | —– | 3097 | $27,315.83 |

| 2008 | 2447 | 21.26% | 5,536,286 | -11.41% | $50,311,791 | -8.97% | 2263 | $20,560.60 |

| 2009 | 2793 | 14.14% | 4,819,407 | -12.95% | $44,310,790 | -11.93% | 1726 | $15,864.94 |

| 2010 | 3088 | 10.56% | 3,576,671 | -25.79% | $35,041,305 | -20.92% | 1158 | $11,347.57 |

| 2011 | 3393 | 9.88% | 3,276,297 | -8.40% | $32,766,960 | -6.49% | 966 | $9,657.22 |

| 2012 | 3518 | 3.68% | 2,099,560 | -35.92% | $22,433,721 | -31.54% | 597 | $6,376.84 |

| 2013 | 3636 | 3.35% | 1,853,211 | -11.73% | $21,586,923 | -3.77% | 510 | $5,937.00 |

| 2014 | 3765 | 3.55% | 1,855,161 | 0.11% | $22,732,074 | 5.30% | 493 | $6,037.74 |

| 2015* | 2264 | -39.87% | 2,150,656 | 15.93% | $28,134,971 | 23.77% | 950 | $12,427.11 |

| 2016* | 2405 | 6.23% | 2,811,978 | 30.75% | $38,854,681 | 38.10% | 1169 | $16,155.79 |

| 2017 | 4443 | 84.74% | 2,958,351 | 5.21% | $41,594,729 | 7.80% | 666 | $9,361.86 |

| 2018 | 4637 | 4.37% | 3,184,274 | 7.64% | $44,423,434 | 6.80% | 687 | $9,580.21 |

Their long tail is outpacing the front of the market, which is a perfectly fine place to be. Viz in 2018 has one book over 60k, another over 40k, five more over 30k, thirteen more over 20k, and thirty-eight more over 10k. I’d call that a healthy midlist.

In second place among manga publishers, we have Kodansha Comics, which places forty-four titles within the top 750, with 284k in sales, and $3.6 million in calculated retail dollars (compared to 348k and $5.4m in 2017, and 469k and $5.6m in 2016). Kodansha’s performance in the Top 750 accelerates their decline of the last few years.

Kodansha’s licenses formerly were both the original backbone of Tokyopop, as well as being the majority of Del Rey Manga. Kodansha pulled Tpop’s license in March of ’09 and Del Rey in October of ’10. You may want to look at those publisher’s listings below to get a better historical overview.

Kodansha’s current best-seller is “Fairy Tail”, where v1 is at just under 15k (this was 17k last year). As there are an astounding sixty-four volumes of this series in print, but only five of those are in the Top 750, this continues to be a clear example of the “Hammock Principle” in practice. Briefly stated, books in a series generally sell in a sales pattern that looks like a hammock if you chart it out: the first few volumes and the last few volumes sell the best, with the ends running down into the middle volumes which have the lowest sales, like the sagging part of a hammock. The problem with this, as both stores that don’t have infinite rack space, as well as publishers that need a certain volume and velocity to keep things in print, that sagging middle becomes unsustainable for most series over time, and stores start to only carry the first and last few volumes – See also, “The Walking Dead” in a bit.

Coming in at #2 for Kodansha is v1 of the smaller inexpensive version of “Sailor Moon” – it sells almost 13k copies. The bigger, thicker editions also charts, with v1 there doing a bit under 7k

At #3 & 4 is “Attack on Titan”, where v 1 drops to under 12k in 2018 – this volume did around 19k in 2017, 26k in 2016 and 34k in 2015. “Attack” is clearly a weakening brand, with just ten of the twenty-six volumes from the main series placing into the Top 750 – twenty-three of them placed in 2017.

And for #5, and their last book to chart over 10k copies, is “Wotakoi: Love is Hard for Otaku”

These Long Tail figures are just for Kodansha-published titles, and they reflect that Kodansha, itself, first started publishing in 2010:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2010 | 9 | —— | 13,291 | —— | $322,717 | —— | 1477 | $35,857.44 |

| 2011 | 108 | 1200.00% | 197,021 | 1482.36% | $2,537,221 | 786.21% | 1825 | $23,492.79 |

| 2012 | 246 | 127.78% | 324,827 | 64.87% | $4,026,770 | 58.71% | 1320 | $16,368.98 |

| 2013 | 320 | 30.08% | 501,554 | 54.41% | $6,299,487 | 56.44% | 1567 | $19,685.90 |

| 2014 | 442 | 38.13% | 821,298 | 63.75% | $10,481,008 | 66.38% | 1858 | $23,712.69 |

| 2015* | 455 | 2.94% | 855,347 | 4.15% | $10,938,531 | 4.37% | 1880 | $24,040.73 |

| 2016* | 587 | 29.01% | 981,386 | 14.74% | $12,596,281 | 15.16% | 1672 | $21,458.74 |

| 2017 | 895 | 52.47% | 917,596 | -6.50% | $13,616,224 | 8.10% | 1025 | $15,213.66 |

| 2018 | 1060 | 18.44% | 870,940 | -5.08% | $12,612,501 | -7.37% | 822 | $11,898.59 |

In 2018, Kodansha has just five titles that sell over 10k.

The #3 manga publisher as represented by the BookScan Top 750 is Seven Seas, which places 32 titles for almost 199k copies sold combined, and a bit over $3 million in calculated retail value. This is a strong rise over 2017 when they had 20 titles, for 162k and $2.5 million in sales.

Seven Seas’ main success is “The Ancient Magus’ Bride”, with v1 selling nearly 12k copies, and v8 hitting 11k (the “hammock”, remember?) – all nine volumes in the series chart, for a bit over 62k combined.

Also just a bit under 10k is “My Lesbian Experience With Loneliness”, a book my stores have done extremely well with, usually turning a copy every other week.

Seven Seas’ Long Tail shows them with a very strong growth this year.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 54 | —— | 50,641 | —— | $558,450 | —– | 938 | $10,341.67 |

| 2008 | 76 | 41.74% | 80,112 | 58.20% | $833,667 | 49.28% | 1,054 | $10,969.30 |

| 2009 | 97 | 27.63% | 74,967 | -6.42% | $807,666 | -3.12% | 773 | $8.326.45 |

| 2010 | 93 | -4.12% | 75,764 | 1.06% | $875,612 | 8.41% | 815 | $9,415.18 |

| 2011 | 118 | 26.88% | 116,360 | 53.58% | $1,426,618 | 62.93% | 986 | $12,089.98 |

| 2012 | 151 | 27.97% | 124,262 | 6.79% | $1,684,994 | 18.11% | 823 | $11,158.90 |

| 2013 | 223 | 47.68% | 204,419 | 64.51% | $2,942,608 | 74.64% | 917 | $13,195.55 |

| 2014 | 300 | 34.53% | 284,484 | 39.17% | $3,979,338 | 35.23% | 948 | $13,264.46 |

| 2015* | 304 | 1.34% | 374,715 | 31.72% | $5,177,568 | 30.11% | 1233 | $17,031.47 |

| 2016* | 417 | 37.17% | 491,947 | 31.29% | $6,960,634 | 34.44% | 1180 | $16,692.17 |

| 2017 | 554 | 32.85% | 478,336 | -2.77% | $6,801,527 | -2.29% | 863 | $12,277.12 |

| 2018 | 906 | 63.54% | 667,556 | 39.56% | $9,511,591 | 39.84% | 737 | $10,498.45 |

Seven Seas has just two titles that sell over 10k.

The fourth largest publisher of manga in 2017, on the Top 750 of BookScan is Yen Press, which once again places 27 titles in the Top 750, for about 159k copies sold (down from 165k copies sold last year), and nearly $2.4 million of calculated retail gross (down from $2.6 million retail gross last year). Yen is a division of Hachette (more on them later).

Yen’s sole significant seller is “Black Butler”, where v1 brings in just a hair under 11k in the bookstore market. They sell nothing else over 10k.

In the Long Tail Yen is down for the second year in a row.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 10 | —— | 12,896 | —— | $147,449 | —– | 1,290 | $14,744.90 |

| 2008 | 90 | 800.00% | 110,126 | 753.95% | $1,237,860 | 739.52% | 1,224 | $13,754.00 |

| 2009 | 211 | 134.44% | 330,962 | 200.53% | $3,697,113 | 198.67% | 1,569 | $17,521.86 |

| 2010 | 344 | 63.03% | 560,983 | 69.50% | $6,650,871 | 79.89% | 1,680 | $19,333.93 |

| 2011 | 460 | 33.72% | 764,125 | 36.21% | $9,953,966 | 49.66% | 1,661 | $21,639.06 |

| 2012 | 548 | 19.13% | 647,948 | -15.20% | $8,735,264 | -12.24% | 1,182 | $15,940.26 |

| 2013 | 654 | 19.34% | 692,380 | 6.86% | $9,715,421 | 11.22% | 1,059 | $14,855.38 |

| 2014 | 776 | 18.65% | 682,135 | -1.48% | $9,985,502 | 2.78% | 776 | $12,867.92 |

| 2015* | 649 | -16.37% | 917,620 | 34.52% | $13,248,445 | 32.68% | 1414 | $20,413.63 |

| 2016* | 793 | 22.19% | 1,072,008 | 16.82% | $15,520,207 | 17.15% | 1352 | $19,571.51 |

| 2017 | 1403 | 76.92% | 928,962 | -13.34% | $13,866,675 | -10.65% | 662 | $9,883.59 |

| 2018 | 1737 | 23.81% | 890,228 | -4.17% | $13,051,751 | -5.88% | 513 | $7,513.96 |

Yen Press has only one title selling over 10k copies in 2018

Staying as the #5 manga publisher is Dark Horse, with only thirteen placing titles in the Top 750, for almost 80k copies sold and $1.2m in calculated retail value (that’s down from last year)

The best-selling DH title continues to be “Berserk” v1, scoring just under 14k copies sold.

Looking at the Long Tail, this is what Dark Horse’s (manga only!) recent performance looks like – it’s down, but after three strong years of growth, it’s probably fine. There is much more on Dark Horse down below in the “Western Publishers” section.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 341 | —— | 249,943 | —— | $3,329,464 | —– | 733 | $14,744.90 |

| 2008 | 420 | 23.17% | 248,981 | -0.38% | $3,176,870 | -4.58% | 593 | $7,563.98 |

| 2009 | 455 | 8.33% | 226,497 | -9.03% | $2,915,693 | -8.22% | 498 | $6,408.12 |

| 2010 | 473 | 3.96% | 194,494 | -14.13% | $2,633,077 | -9.69% | 411 | $5,566.76 |

| 2011 | 497 | 5.07% | 189,329 | -2.66% | $2,602,230 | -1.17% | 381 | $5,235.86 |

| 2012 | 493 | -0.80% | 112,373 | -40.65% | $1,631,038 | -37.32% | 228 | $3,308.39 |

| 2013 | 521 | 5.68% | 103,538 | -7.86% | $1,678,563 | 2.91% | 199 | $3,221.81 |

| 2014 | 559 | 7.29% | 100,894 | -2.60% | $1,617,251 | -3.65% | 180 | $2,893.11 |

| 2015* | 303 | -45.80% | 135,444 | 34.24% | $2,238,167 | 38.39% | 447 | $7,386.69 |

| 2016* | 225 | -25.74% | 174,298 | 28.69% | $2,291,355 | 2.38% | 775 | $10,183.80 |

| 2017 | 527 | 234.22% | 238,089 | 36.60% | $3,795,506 | 65.64% | 452 | $7,202.10 |

| 2018 | 531 | 0.76% | 224,010 | -5.91% | $3,579,135 | -5.70% | 422 | $6,740.37 |

Dark Horse Manga has one book over 10k.

The sixth largest publisher of manga as measured by the BookScan, and the final one to appear in the Top 750, is Vertical. They place just four books into the Top 750, 28k copies, for $600k – that’s a big soften from the previous year.

Their best-seller is “The Complete Chi’s Sweet Home” with v1 selling just over 11k.

The Long Tail also declines

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 25 | —— | 23,444 | —— | $417,914 | —— | 938 | $16,716.56 |

| 2008 | 34 | 36.00% | 21,003 | -10.41% | $343,109 | -8.21% | 617 | $10,091.44 |

| 2009 | 39 | 14.71% | 19,434 | -7.47% | $325,437 | -5.15% | 498 | $8,344.54 |

| 2010 | 62 | 58.97% | 33,097 | 70.30% | $494,098 | 51.83% | 534 | $7,969.32 |

| 2011 | 84 | 35.48% | 49,062 | 48.24% | $699,253 | 41.52% | 584 | $8,324.44 |

| 2012 | 118 | 40.48% | 45,026 | -8.23% | $671,086 | -4.03% | 382 | $5,687.17 |

| 2013 | 159 | 34.75% | 61,906 | 37.49% | $1,128,252 | 68.12% | 389 | $7,095.92 |

| 2014 | 187 | 17.61% | 83,312 | 34.58% | $1,491,984 | 32.24% | 446 | $7,978.53 |

| 2015* | 162 | -13.37% | 110,172 | 32.24% | $1,956,167 | 31.11% | 680 | $12,075.10 |

| 2016* | 185 | 14.20% | 172,792 | 56.84% | $2,931,568 | 49.86% | 934 | $15,846.31 |

| 2017 | 269 | 45.41% | 181,216 | 4.88% | $3,178,964 | 8.44% | 674 | $11,817.71 |

| 2018 | 339 | 26.02% | 162,840 | -10.14% | $2,784,106 | -12.42% | 480 | $8,212.70 |

Vertical has a single book over 10k

There’s only one other Manga title that places over 10k copies this year, this is from Ten Speed Press: “The Life Changing Manga of Tidying Up”, which sells just a hair over that 10k sold.

There is nothing else in the Top 750 that isn’t from one of the above publishers – it’s looking more like a closed system every year.

2018 Western Publishers

When I say “Western” here, I mean publishers/work from Europe and America, as opposed to Asia, not publishers of the genre of “western” comics!

I’d like to continue to remind you that back in 2008 there was some sort of behind-the-scenes recategorization in what got sent to me – I now know this is probably a change in BISAC codes! – and most of the “cartoon-strip humor” books like “Calvin & Hobbes” and “The Far Side” suddenly disappeared, so there’s kind of a not-strictly apples thing going on with the pre-2008 numbers here. Do keep that in mind when making comparisons both in the Top 750 chart, as well as the Long Tail.

BookScan itself does not try to control how data gets initially logged (or changed), leaving that all to publishers. I think that I understand this reasoning: the publisher is the customer, and they should have some level of control over how they are represented, but as a person who tries to decipher the data each year, I know that I would prefer some sort of internally-consistent (and externally-petionable!) method of categorizing titles that doesn’t seem to change in some fashion from year-to-year – Books will appear and disappear, almost seemingly willy-nilly, and it makes showing you anything even resembling consistent data staggeringly difficult. All of this is a function of how publishers assign BISACs and in what order – see the preamble above!

Another observation I have is that BookScan tracks (theoretically at least, since again, publishers set their own BISACs) Adult reading distinctly from YA and Kids. I don’t. Part of this is that I’m a bookseller, and I’m rather agnostic about who specifically buys books as a result. But I have to be certain to make this point as clearly as I can: the market for who is buying comics is changing, and it is changing for the wider and the better. The eight year old who is inhaling Dav Pilkey in 2018 is going to be the comics-literate adult of 2030 (or whatever), which is going to change what comics readers in the ‘30s will want or expect from comics. The kids reading comics in 1965 totally imagined what the 1980’s comics scene could and would be, which is why we’re where we are today, but the shape of the Western industry in the future is absolutely what today’s children read and see.

Ignore this at your peril.

OK, enough editorializing, let’s look at the market!

Here’s the Top 750 over time:

| Year | # of placing titles | Unit sales | Calculated Retail price |

| 2003 | 304 | 2,133,618 | $32,360,644 |

| 2004 | 233 | 1,467,535 | $22,713,802 |

| 2005 | 142 | 1,315,920 | $21,537,155 |

| 2006 | 174 | 1,689,571 | $29,314,852 |

| 2007 | 175 | 1,746,962 | $33,247,187 |

| 2008 | 236 | 2,710,175 | $48,327,594 |

| 2009 | 299 | 3,219,748 | $52,147,410 |

| 2010 | 314 | 3,297,317 | $54,515,605 |

| 2011 | 358 | 3,068,593 | $77,254,870 |

| 2012 | 383 | 3,530,143 | $68,593,986 |

| 2013 | 435 | 3,988,864 | $74,805,932 |

| 2014 | 479 | 4,910,846 | $90,166,989 |

| 2015* | 471 | 6,729,449 | $115,035,044 |

| 2016* | 439 | 7,338,541 | $123,594,588 |

| 2017 | 466 | 7,846,357 | $117,761,519 |

| 2018 | 451 | 9,114,745 | $129,929,990 |

Up 16% in pieces, up 10% in calculated retail dollars, the highest totals in this tranche that we have ever seen – it’s a very good year for Western comics, as reported to BookScan in 2018!

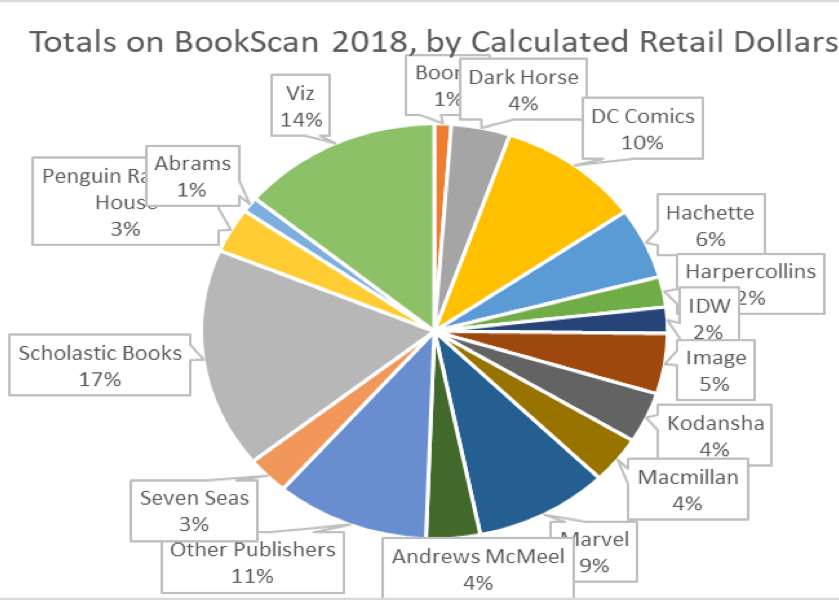

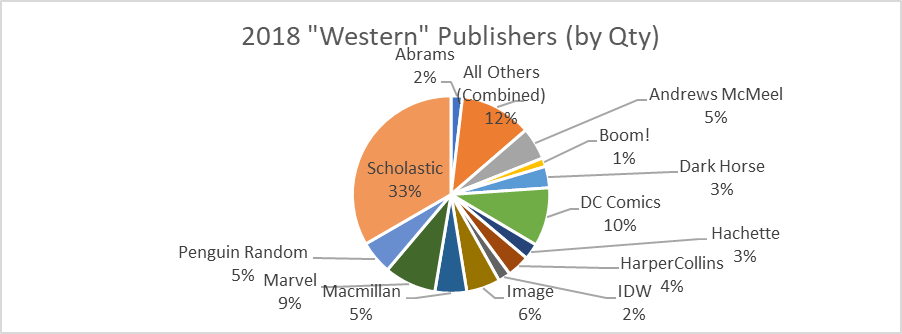

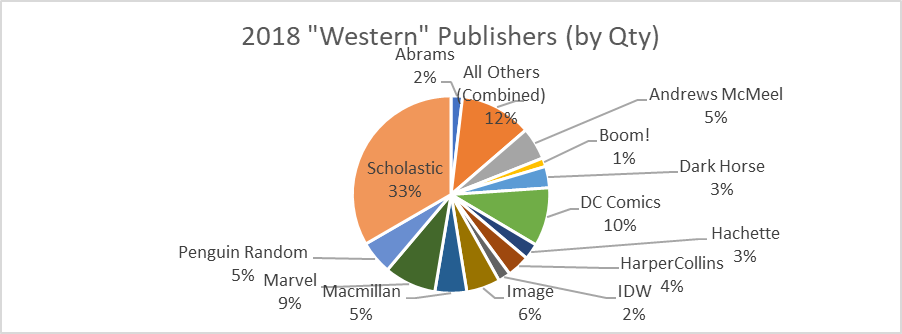

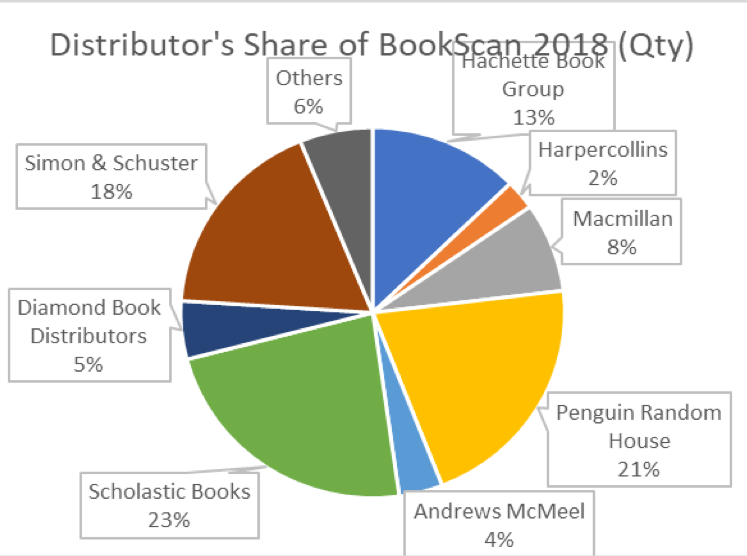

If we were to look at the entirety of BookScan’s reported numbers for the total 27,853 “Western” comics, things look generally like this – there are 1236 publishers listed in the 2018 chart, but only 13 of them manage to capture more than 1% of the market

This is not quite as lopsided as the Manga chart…. But it is getting there a little?

Let’s start with a look at the Long Tail for Western publishers collectively:

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail Value | % Change | Av. Sale per title | Av $ per title |

| 2007 | 6950 | — | 3,029,039 | — | $74,595,605 | — | 436 | $10,733.18 |

| 2008 | 9728 | 39.97% | 5,368,678 | 77.24% | $98,233,459 | 31.69% | 552 | $10,098.01 |

| 2009 | 10,936 | 12.30% | 5,946,595 | 10.76% | $107,263,294 | 9.19% | 544 | $9,808.27 |

| 2010 | 13,229 | 20.97% | 5,890,507 | -0.01% | $105,342,577 | -0.02% | 445 | $7,963.00 |

| 2011 | 14,954 | 13.04% | 6,001,731 | 1.89% | $112,823,763 | 7.10% | 401 | $7,544.72 |

| 2012 | 17,031 | 13.89% | 6,052,179 | 0.84% | $123,471,753 | 9.44% | 355 | $7,249.82 |

| 2013 | 17,468 | 2.57% | 6,637,420 | 9.67% | $131,767,547 | 6.72% | 380 | $7,543.37 |

| 2014 | 19,524 | 11.77% | 7,905,939 | 19.11% | $156,040,431 | 18.21% | 405 | $7,992.24 |

| 2015* | 18,019 | -7.71% | 10,689,116 | 34.44% | $197,553,909 | 26.60% | 593 | $10,963.64 |

| 2016* | 16,328 | -9.38% | 11,516,867 | 7.74% | $212,698,759 | 7.67% | 705 | $13,026.63 |

| 2017 | 25,183 | 54.23% | 12,544,715 | 8.92% | $217,360,776 | 2.19% | 498 | $8,631.25 |

| 2018 | 27,583 | 9.53% | 13,865,209 | 10.53% | $230,924,408 | 6.24% | 503 | $8,371.98 |

Fantastic collective performance, and one that really points out the errors in the ’15-’16 data – as noted above, I now believe that the leaked data those years was only for “in print” books. Comics are pretty clearly a growing medium, by like a million copies a year (!) Compare that first year of long-tail to the current one: more than 400% growth in pieces, wow!

The challenge for the market is for how we grow and adapt to the changes in taste that are becoming clear: “traditional” genres and sellers are starting to suffer in the face of a new widening of the market. From 20,000 feet this seems pretty healthy, even though it seems clear that every participant isn’t going to be able to thrive. We’ll cover that in the weeds, below!

Next, we’ll survey each of the publishers, and their best-selling titles, ranking them by the number of pieces they sold this year with the Top 750 of BookScan. We’ll also look at the “long tail” for each entry discussing the entirety of BookScan.

It is now the fourth year in the row that our #1 Western publisher in the Top 750 is Scholastic. This is no longer an amusing anomaly: this is the new reality. Look at the overall market, and pause and wonder at that dominating 33% market share of pieces sold. Consider for a moment that Scholastic has done this with only two hundred and twenty four books, total! Consider for a second moment that Scholastic only started “doing” comics in 2005.

Just limiting ourselves to the Top 750, Scholastic surges forward in sales this year by selling an absolutely staggering 4.5 million copies, from 58 placing books This is an unbelievable 67% growth from last year (2.7 million copies), which was up 42% from 2016 (1.9 million). In calculated retail dollars, we’re looking at almost $53 million dollars in sales.

This is even more incredible when you start to think that these are sales to book stores (and Amazon) only – none of these numbers (as far as I know) include the direct-to-families sales that happen via the incredibly successful Scholastic Book Fairs. Nor does this count any sales that are being done to elementary and middle school libraries, numbers that likely exceed retail sales. Possibly by a multiple.

Also consider that the next largest publisher sold a combined 661k copies, less than a sixth of their volume.

Scholastic has several imprints – besides the Graphix imprint, they also publish Arthur A. Levine and Blue Sky.

In alphabetical order by imprint:

Arthur A. Levine places one book into the Top 750 just as they have for years, and it’s the same book: just a bit over 9k copies of “The Arrival” by Shaun Tan.

Blue Sky is also just one book in the Top 750 – Dav Pilkey’s “Ook & Gluk, Kung-Fu Cavemen” shifting 27k copies, much of that on the sidestream of the success “Dog Man”.

The Graphix imprint has 43 placing titles, for just nearly 4.3m in sales, and is where the big hits live: the aforementioned “Dog Man” and all of Raina Telgemeier’s books (“Sisters”, “Smile”, “Drama”, and the first four “Baby Sitter’s Club” adaptations), all of which are discussed up top. “Dog Man” alone shifts nearly 2.7 million books, to recap. Telgemeier sells “only” 916k.

The post-Telgemeier “Baby Sitter’s Club” steamrolls without her – the two Gale Galligan-adapted books sell more than 220k copies.

Graphix also does fantastic with Kazu Kibuishi’s “Amulet” – volume 8, “Supernova” sells nearly 88k copies. All eight volumes of the series chart, as well as various permutations of box sets – which, can I tell you, are giant dollar generators for Scholastic: I calculate the box set of #1-7 alone generated more potential retail dollars than the release of v8. Altogether, nearly 302k copies of Amulet books are sold within the Top 750.

The first book of the adaptation of “Wings of Fire”, “The Dragonet Prophecy” flies in with almost 81k sold

They don’t quite make Scholastic’s Top 20, but Jennifer Holm’s “Sunny” books do excellent as well: selling a combined 66k copies between the two books. There’s also a notable launch of Jarrett Krosoczka’s “Hey Kiddo” at just over 21k, as well as Kristen Gudsnuk’s “Making Friends” at almost 17k

Jeff Smith’s “Bone”, which largely launched Graphix, places four of the nine volumes into the Top 750 this year. V1, “Out From Boneville”, sells almost 13k copies this year.

Scholastic also publishes as “Scholastic”, straight up, and they place 13 more titles that way. The big hit is more Dav Pilkey, as “The Adventures of Super Diaper Baby” roars back with some 41k copies sold, while Jeffrey Brown’s “Jedi Academy” books continue to score: the first volume of that perennial series sold about 22k copies this year

The Long Tail for Scholastic looks like this – more insane growth:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail price | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 28 | —— | 203,900 | —— | $2,018,694 | —– | 7282 | $72,096.21 |

| 2008 | 39 | 39.29% | 346,134 | 69.76% | $3,498,012 | 73.28% | 8875 | $89,692.62 |

| 2009 | 52 | 33.33% | 432,070 | 24.83% | $4,654,686 | 33.07% | 8309 | $89,513.19 |

| 2010 | 60 | 15.38% | 361,086 | -16.43% | $4,084,718 | -12.25% | 6018 | $68,078.63 |

| 2011 | 72 | 20.00% | 419,010 | 16.04% | $4,708,860 | 15.28% | 5819 | $65,400.83 |

| 2012 | 76 | 5.56% | 325,088 | -22.42% | $3,955,249 | -16.00% | 4277 | $52,042.75 |

| 2013 | 91 | 19.74% | 437,590 | 34.61% | $5,365,921 | 35.67% | 4809 | $58,966.16 |

| 2014 | 97 | 6.59% | 846,277 | 93.39% | $10,204,175 | 90.17% | 8725 | $105,197.68 |

| 2015* | 140 | 44.33% | 1,449,296 | 71.26% | $17,170,714 | 68.27% | 10,352 | $122,647.96 |

| 2016* | 131 | -6.43% | 1,940,760 | 33.91% | $23,919,704 | 39.31% | 14,815 | $182,593.16 |

| 2017 | 166 | 26.72% | 2,823,345 | 45.55% | $33,884,541 | 41.66% | 17,008 | $204,123.74 |

| 2018 | 224 | 34.94% | 4,623,212 | 63.75% | $54,645,209 | 61.27% | 20,639 | $243,951.83 |

Scholastic has one book over 700k, one more over 600k, another three over 300k, eight more over 100k, six more over 50k, thirteen more over 20k, and another ten over 10k. Whew! Any other publisher would be satisfied with half of that.

Scholastic seems more and more like an unstoppable juggernaut to me: the vast majority of their portfolio is extremely likely to go on to “perennial seller” status. Can you even imagine what might happen if they decided to do two streams of revenue and serialized first?

In what I can only categorize as the first of several “complete upsets”, the #2 publisher is now Andrews McMeel. Andrews is a publisher that sometimes has frustrated me by how they’ve been represented by BookScan – as I noted, it used to be that “humor” books like “Far Side” and “Calvin & Hobbes” used to rule the BookScan charts. Until, one day, poof! Almost of those books disappeared entirely from the dataset I was given, throwing off a whole lot of my comparables. And, for the most part, comic strip reprints have stayed out of these charts for half a decade. But, they’ve started creeping back into the listings for the last few years. I’m actually fine with comic strips and comic books co-existing in the same places – at least they’re both comics – but the inconsistency just drives me nucking futz.

I found 34 titles from Andrews in the Top 750 in 2018, for 661k copies and $10.5 million in sales, but clearly that number would scale up to some large degree if it listed all of the strip collections they publish. What’s interesting about Andrews McMeel is that, for the most part, their “graphic novels” are reformatted/repackaged newspaper strips. In other words, this is basically the other paid-for way one can serialize work: through syndicated newspaper pages

Lincoln Pierce and “Big Nate” is the big star player for Andrews McMeel – there are fifteen different “Big Nate” volumes in the Top 750, summing up to almost 340k copies combined. The best seller (“Silent But Deadly” sells around 84k copies)

The other big winner is Dana Simpson’s “Pheobe and Her Unicorn” which does nearly as well, with v1 selling just over 82k copies, and placing all eight volumes into the Top 750, summing to 206k total sold.

There’s also a smattering of “traditional” strips here: I can see the $100 “Complete Calvin & Hobbes” here (26k copies, which would make that the #6 dollar book in the entire chart) as well as the same for $100 “The Complete Far Side” (11k copies). There’s also 16k copies of “Herding Cats” from Sarah Andersen’s “Sarah’s Scribbles” and almost 15k of a Trump-focused “Doonesbury” volume. But I’m still missing most of the rest of Watterson, Larsen, and Trudeau.

Andrews McMeel’s Long Tail chart is just about the most useless one of all because they publish a whole lot of comics (humor strips, like “Calvin & Hobbes”) where the BISAC changed to something we’re having a hard time properly getting – almost certainly they’re doing several times better than this chart would suggest because of those books. Further, things appear and disappear in a way I’ve never been able to make sense of – it might be them changing BISACs after the fact. Most of my comparatives are terrible and counterproductive here, and I really apologize for the weakness of my data in this specific instance.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 22 | —— | 29,835 | —— | $461,238 | —– | 1,356 | $20,965.36 |

| 2008 | 20 | -9.09% | 25,115 | -15.82% | $388,965 | -15.67% | 1,256 | $19,448.25 |

| 2009 | 21 | 5.00% | 26,205 | 4.34% | $401,982 | 3.35% | 1,248 | $19,142.00 |

| 2010 | 19 | -9.52% | 47,181 | 80.05% | $544,852 | 35.54% | 2,483 | $28,676.42 |

| 2011 | 17 | -10.53% | 116,850 | 147.66% | $1,222,171 | 124.31% | 6,874 | $71,892.41 |

| 2012 | 31 | 82.53% | 225,546 | 93.02% | $2,737,935 | 124.02% | 7,276 | $88,320.48 |

| 2013 | 43 | 38.71% | 343,681 | 52.38% | $3,747,799 | 36.88% | 7,993 | $87,158.12 |

| 2014 | 59 | 37.21% | 373,713 | 8.74% | $4,387,252 | 17.06% | 6,334 | $74,360.21 |

| 2015* | 76 | 28.81% | 502,061 | 34.34% | $5,950,368 | 35.63% | 6,606 | $78,294.32 |

| 2016* | 85 | 11.84% | 472,145 | -5.96% | $5,147,673 | -13.49% | 5,555 | $60,560.86 |

| 2017 | 140 | 64.71% | 520,554 | 10.25% | $5,644,031 | 9.64% | 3,718 | $40,314.51 |

| 2018 | 273 | 95.00% | 735,184 | 41.23% | $11,862,349 | 210.18% | 2,693 | $43,451.83 |

Andrews McMeel has three books over 50k, four more over 20k, and seventeen others over 10k.

Moving up to #3 is the first of the so-called “Big Five” traditional book publishers: Penguin Random House. They land thirty-eight titles, selling 548k copies for nearly $8m in gross sales.

Like a lot of the “big five” book publishers, these companies have lots and lots of imprints built up over decades of publishing books. Penguin Random House, as best as I can tell, has thirteen (sheesh!) distinct imprints that appear in the Top 750 list for 2018 – Alfred A. Knopf, Ballantine, Clarkson N. Potter, Crown, Del Rey, Dial, Pantheon, Random House Books For Younger Readers, Ten Speed, Triangle, Tundra, Viking, and Yearling

They’re also, in the long tail: (deep breath!) Ace, Bantam, Berkley, Broadway Books, Doubleday, Dutton, Emblem, Golden, Gotham Books, G.P. Putnam & Sons, Grossett & Dunlap, Hudson Street, InkLit, McClelland & Stewart, Montena, New American Library, Penguin, Philomel, Plume, Price Stern Sloan, Puffin, Putnam, Razorbill, Riverhead, Schocken, Schwartz & Wade, Three Rivers, Villard, and Watson-Guptill. (whew!) However, they are not (Brian writes down here so he remembers this research next year) the PRH-distributed-only Campfire, Frog In Well, Library of America, Overlook Press, Powerhouse, Quirk, Shambhala, Universe, or Verso

Looking at those imprints in alphabetical order:

Alfred A. Knopf Books For Younger Readers places two books into the Top 750, starting with “The Cardboard Kingdom” by Chad Sell, which sells 12k. There’s also the first volume of Jarrett J. Krosocza’s “Lunch Lady” series at a bit over 8k.

Ballantine places eight titles in the Top 750: Seven different “Garfield” volumes ranging from 4100-7200 copies each, as well Bryan Lee O’Malley’s “Seconds”, which sells just under 5k copies in its fifth year of release.

Clarkson N Potter does a huge 41k with Mari Andrews’ “Am I There Yet? The Loop-de-loop Zigzagging Journey to Adulthood”

Crown Books for Younger Readers has a volume of Jeffrey Brown’s “Lucy & Andy Neanderthal” (“Bad to the Bones”) which does 4500 copies.

Del Rey publishes the Dave Wenzel adaptation of “The Hobbit” for about 7k copies.

Dial places two books by Victoria Jamieson: “Roller Girl”, at almost 47k, and “All’s Faire in Middle School” with 37k in its second frame.

Pantheon is their “literary” comics wing, and has some of PRH’s best-sellers – but this year, hrm, I seem to be missing most editions of “Maus” and “Persepolis”? Why did I not notice this until I was halfway through writing? Ugh. Typically there are nine or so Pantheon books in the Top 750, but I only have two now: 23k copies of art spiegelman’s “Complete Maus” in HC (but not the two softcovers that almost always sell much better), and just over 10k of the adaptation of “Anne Frank’s Diary” by Ari Folman.

Random House Books For Younger Readers

Ten Speed Press brings us a single title, a comics biography of Alexander Hamilton, with just over 4k sold. (plus they have that single volume of Manga of the adaptation of “The Life-Changing Manga of Tidying Up”, listed in the manga section.)

Triangle Square also places a single title: 5200 copies of “Sex is a Funny Word: A Book about Bodies, Feelings, and You”

Tundra has PRH’s best-selling titles with Ben Clanton’s “Narwahl: Unicorn of the sea” series, another juvie-aimed title. V3 launches at 52k, while the softcover of v1 does almost 44k. All together in all formats, it places 186k copies between six editions.

Viking comes along with “Caveboy Dave: More Scrawny Than Brawny” with just over 7k.

And finally, Yearling is (for some reason), the new home of the softcovers of Jeffrey Brown’s “Lucy & Andy”, with two volumes adding up to about 9600 copies.

Penguin Random House formed out of a merger in 2013 – prior to that they were separate publishers Penguin and Random House. Here’s what the Long-Tail for the combined Penguin Random House looked like in 2017:

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail Value | % Change | Av. Sale per title | Av $ per title |

| 2013 | 282 | ——- | 447,174 | ——- | $7,259,364 | ——- | 1,586 | $25,742.43 |

| 2014 | 252 | -10.64% | 428,634 | -4.15% | $7,415,712 | 2.15% | 1,701 | $29,427.43 |

| 2015* | 450 | 78.57% | 513,611 | 19.83% | $8,517,761 | 14.49% | 1,141 | $18,928.36 |

| 2016* | 293 | -34.88% | 435,877 | -15.13% | $7,150,087 | -16.06% | 1,488 | $24,403.03 |

| 2017 | 409 | 39.59% | 664,858 | 52.53% | $10,136,224 | 41.76% | 1,626 | $24,782.94 |

| 2018 | 613 | 49.88% | 760,314 | 14.36% | $11,136,058 | 9.86% | 1,240 | $18.166.49 |

However, I’m not willing to pull an “We’ve always been at war with Eastasia” moment, so let’s look at the individual pieces of the past. This is what Penguin Putnam (Ace, Berkley Books, Dial, Dutton, Gotham Books, Grossett & Dunlap, Hudson Street, InkLit, New American Library, Penguin, Philomel, Plume, Price Stern Sloan, Puffin, Putnam, Razorbill, Riverhead and Viking) used to look like alone)

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail Value | % Change | Av. Sale per title | Av $ per title |

| 2007 | 18 | —— | 13,545 | —— | $178,260 | —— | 753 | $9,903.33 |

| 2008 | 28 | 55.56% | 28,606 | 111.19% | $310,856 | 74.38% | 1022 | $11,102.00 |

| 2009 | 39 | 39.29% | 40,288 | 40.84% | $444,928 | 43.13% | 1033 | $11,408.41 |

| 2010 | 45 | 15.38% | 50,628 | 25.67% | $623,650 | 40.17% | 1125 | $13,858.89 |

| 2011 | 53 | 17.78% | 123,749 | 144.43% | $1,576,161 | 152.73% | 2335 | $29,738.89 |

| 2012 | 60 | 13.21% | 121,769 | -1.60% | $1,499,660 | -4.85% | 2029 | $24,994.33 |

This is what Random House (Alfred A. Knopf, Ballantine, Bantam, Broadway, Crown, Del Rey, Doubleday, Pantheon, Random House, Schocken, and Three Rivers) looked like alone:

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail value | % Change | Av. Sale per title | Av $ per title |

| 2007 | 74 | — | 216,580 | — | $2,890,347 | — | 2,927 | $39,058.74 |

| 2008 | 77 | 5.47% | 383,105 | 76.89% | $5,698,922 | 97.17% | 4,975 | $74,011.97 |

| 2009 | 109 | 41.56% | 405,598 | 5.87% | $5,398,890 | -5.26% | 3,721 | $49,531,10 |

| 2010 | 132 | 21.10% | 389,410 | -3.99% | $5,831,814 | 8.02% | 2,950 | $44,180.41 |

| 2011 | 144 | 9.09% | 397,143 | 1.99% | $6,356,212 | 8.99% | 2,760 | $44,140.36 |

| 2012 | 185 | 28.47% | 375,254 | -5.51% | $7,124,794 | 12.09% | 2,028 | $38,512.40 |

Penguin Random House has one title over 50k, eight additional books over 20k, and another six books over 10k.

Surging forward to #4 (they were at #9 last year) is Holtzbrinck, which owns Macmillan, is considered one of the “big five”, and is also one of those publishers with lots and lots (and lots) of imprints: Farrar Straus Giroux, Feiwel & Friends, FirstSecond, Hill + Wang, and Square Fish are the only five to make the Top 750, but there are others down into the Long Tail as well – I have also identified Henry Holt, Metropolitan, Picador, Roaring Brook, Rodale Press, St. Martins Griffin, Times books, and Tor. Holtzbrinck also distributes several other publishers they don’t own (including Bloomsbury, Drawn & Quarterly, Papercutz, and Seven Seas) Holtzbrinck-owned companies placed 33 titles in the Top 750, for about 506k and about $7.9m combined.

By imprint, we start alphabetically with Farrar Straus Giroux which has three placers in the Top 750: “All Summer Long” by Hope Larson (just over 19k), Emily Carroll’s adaptation of “Speak” (about 12k), and the hardcover version of the “Wrinkle in Time” adaptation (about 6k)

Feiwel & Friends brings two volumes of “Wires and Nerve”, with v2 moving 12k, and v1 about 5500 copies.

FirstSecond is their strongest imprint, with 24 books placing into the Top 750, and where they score their biggest hit with the McEllroy’s “The Adventure Zone”, which blows out a huge 94k copies sold in its debut year. They also do terrific with “Real Friends” by Shannon Hale (70k), Vera Brosgol’s “Be Prepared” (38k), and Jen Wang’s “The Prince and the Dressmaker” (about 21k)

Square Fish’s deal is cheaper repackaging from other imprints (I don’t personally get this business model) and has four placing titles. The softcover of Hope Larson’s adaptation of “A Wrinkle In Time” sells a giant 52k, while Gene Yang’s “American Born Chinese” does almost 35k

Here’s Holtzbrinck’s Long Tail (again, I might have missed an imprint somewhere – trying to tease them all out is a difficult task from their Byzantine org chart). Another great year of growth for them.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 39 | —— | 31,452 | —— | $559,681 | —– | 806 | $14,350.79 |

| 2008 | 66 | 69.23% | 63,473 | 101.81% | $1,132,767 | 102.40% | 962 | $17,163.14 |

| 2009 | 88 | 33.34% | 84,090 | 32.48% | $1,438,044 | 26.95% | 956 | $16,341.41 |

| 2010 | 108 | 22.73% | 68,599 | -18.42% | $1,085,311 | -24.53% | 635 | $10,049.18 |

| 2011 | 139 | 28.70% | 114,243 | 66.54% | $1,794,084 | 65.31% | 822 | $12,907.08 |

| 2012 | 165 | 18.71% | 126,745 | 10.94% | $2,077,143 | 15.78% | 768 | $12,588.75 |

| 2013 | 187 | 13.33% | 142,375 | 12.33% | $2,395,569 | 15.33% | 761 | $12,810.53 |

| 2014 | 222 | 18.72% | 190,682 | 33.93% | $3,096,858 | 23.27% | 859 | $13,949.81 |

| 2015* | 104 | -53.15% | 99,223 | -47.96% | $1,804,001 | -41.75% | 954 | $17,346.16 |

| 2016* | 272 | 161.54% | 272,668 | 174.80% | $4,240,075 | 135.04% | 1,002 | $15,588.51 |

| 2017 | 336 | 23.53% | 437,258 | 60.36% | $6,616,130 | 56.04% | 1,301 | $19,690.86 |

| 2018 | 427 | 27.08% | 723,096 | 65.37% | $11,701,046 | 76.86% | 1,693 | $27,402.92 |

Holtzbrinck has three books over 50k, three more over 20k, and five others over 10k.

Moving up to #5 largest publisher with Western comics in BookScan Top 750 in 2018 is another of the “big five”: HarperCollins. Harper places twenty books into the Top 750 for a total of 448k copies sold, and $6.5 million. There’s a lot of imprints with the word “Harper” in the title in the Long Tail (Harper, Harper Paperbacks, Harper Teen, Harper Festival, Harper Teen, and so on), and Harper is also Amistad and Blazer & Bray (in the Top 750), and IT books, William Morrow, and Zondervan (out of the Top 750)

Amistad has a single book: 4700 copies of “Monster: A Graphic Novel” by Walter Dean Myers.

At Balzer & Bray it is all about Terri Libenson, and “Positively Izzy” (a staggering 91k) and “Invisible Emmie” (77k). There’s also a box set of the two which moves over 8k copies.

At the various Harper-named imprints, their biggest hit is from “Minecraft-inspired YouTube star PopularMMOs” with “PopularMMOs Presents A Hole New World” which sells a staggering 93k. The second best-seller is a similar YouTube-based comic from “DanTDM”, with “DanTDM: Trayaurus and the Enchanted Crystal” (29k in softcover, and 16k in hardcover) They also do well with nearly 23k copies sold of “Everyone’s a Aliebn When UR a Aliebn Too”

Harper also does great with “Warriors: Graystripe’s Adventure” (almost 15k), Noelle Stevenson’s “Nimona” (14k), a volume of Lincoln Pierce’s “Big Nate” – “Triple Play” sells just under 13k. They also sell almost 12k copies of the adaptation of “To Kill A Mockingbird”

Nothing else is over 10k, so here is the Long Tail:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 18 | —— | 36,940 | —— | $600,540 | —– | 2052 | $33,363.33 |

| 2008 | 36 | 100.00% | 48,264 | 30.66% | $863,808 | 43.84% | 1341 | $23,994.67 |

| 2009 | 42 | 16.67% | 81,774 | 69.43% | $1,308,891 | 15.53% | 1947 | $31,164.07 |

| 2010 | 41 | -2.38% | 64,429 | -21.21% | $719,328 | -45.04% | 1571 | $17,544.59 |

| 2011 | 50 | 21.95% | 75,394 | 17.02% | $1,083,609 | 50.64% | 1508 | $21,672.18 |

| 2012 | 80 | 60.00% | 159,573 | 111.65% | $2,113,744 | 95.07% | 1995 | $26,421.80 |

| 2013 | 68 | -15.00% | 197,595 | 23.83% | $2,667,933 | 26.22% | 2906 | $39,234.31 |

| 2014 | 115 | 69.12% | 158,193 | -19.94% | $2,398,836 | -10.09% | 1376 | $21,042.42 |

| 2015* | 109 | -5.22% | 188,181 | 18.96% | $2,646,378 | 10.32% | 1726 | $24,278.70 |

| 2016* | 108 | -0.09% | 261,183 | 38.79% | $4,473,589 | 69.05% | 2418 | $41,422.12 |

| 2017 | 107 | -0.09% | 357,972 | 37.06% | $5,530,994 | 23.64% | 3346 | $51,691.53 |

| 2018 | 148 | 38.32% | 517,800 | 44.65% | $7,506,751 | 35.72% | 3499 | $50,721.29 |

Harper has three books over 50k, two books over 20k, and another five more over 10k

Image Comics in now our #6 Western publisher via the BookScan reporters; Image has 42 titles placing within the Top 750 in 2018, that sell 402k copies and just a notch over $11m in calculated retail value. That’s a huge drop from last year’s 909k, and almost $7.6m.

Because Image is a primarily Direct Market retailer, we’ve always built a special year-by-year chart for them in the Top 750 (Hey! I have my biases!), and this is what Image’s performance has looked like for the last sixteen years:

| Year | # of placing titles | Unit sales | Calculated Retail Value |

| 2003 | 1 | 2,328 | $30,148 |

| 2004 | 1 | 402 | $5,206 |

| 2005 | 3 | 8,699 | $100,236 |

| 2006 | 1 | 5,311 | $113,465 |

| 2007 | 4 | 28,349 | $344,026 |

| 2008 | 9 | 55,033 | $830,574 |

| 2009 | 11 | 78,874 | $1,210,094 |

| 2010 | 22 | 289,044 | $6,479,930 |

| 2011 | 27 | 367,265 | $8,670,917 |

| 2012 | 33 | 701,050 | $20,389,762 |

| 2013 | 38 | 651,390 | $19,371,269 |

| 2014 | 47 | 691,804 | $17,554,492 |

| 2015 | 71 | 878,262 | $22,587,672 |

| 2016 | 72 | 908,655 | $22,917,758 |

| 2017 | 52 | 556,196 | $11,092,960 |

| 2018 | 42 | 402,584 | $7,611,777 |

And, yeah, doesn’t look good at all. In fact, its kind of a rout after years of flying high with volume down 56% from height, and dollars down almost 2/3. Ow.

Image’s success is currently lead by Brian K Vaughan and Fiona Staples’ “Saga”, where v8, the 2018 release with twelve full months of sales, racks up almost 45k copies. This is about the same as v7 did in 2017, so the book is clearly staying strong. V9 (released just in October) sells about 29k. Possibly troubling is that v1 “only” sells 17k (down from 20k in 2017), and that the “sag” of the “hammock” (discussed in the manga section) means that v3-6 have all dropped substantially under 10k for the first time. And I don’t think anyone knows what is going to happen in 2019 and beyond while “Saga” is on a (at least?) one-year hiatus, but at least in 2018 “Saga” seems to be hanging in there. Image just needs a few more books that can hit those bigger peaks. Altogether, in all formats, “Saga” sells about 161k copies into the bookstores.

A large portion of Image’s chart retreat, of course, is from the sinking sales of “The Walking Dead”. Two years ago, “TWD” in the Top 750 placed 37 titles selling more than a half-million copies for $17.5 million calculated dollars, while this year only 13 “TWD” books make the Top 750, and sell only 115k copies for $3.1m in calculated retail dollars. That’s an extremely sharp drop in velocity. Most of those calculated dollars come from the “Compendium” (the package with 48 issues for $60) – v1 barely tops 9700 copies in 2018, when it sold 19k in 2017 and a staggering 71k in 2016. This was all “free” money (being the fourth time getting paid for the same work), but its still got to hurt a little. 2018’s best-selling individual volume of “TWD” was v29 (released in July ‘18) – it sells about 26k copies. For comparison v27 sold 36k in 2017 (released in March ‘17) – not exactly apples to apples, but it looks like the frontlist portion of “TWD” is starting to slow down too (it was 43k in 2016, for what it is worth)

If you look at the entire “long tail” for 2018, then there are 78 books in various formats (HC, SC, en espanol, covers, whatever) branded as “TWD”. They sell 166k copies for $4.6m calculated dollars at full retail in 2018 – in 2017, that was 266k and $7.1m, so not all of the Long Tail pain below is “TWD” this year.

Image’s #6 best-selling title is the first volume of Majorie Liu and Sana Takada’s “Monstress”, coming in at a bit over 16k. This is a large drop from 24k in the previous year.

“Paper Girls” by BKV and Cliff Chiang” is #7 in the book stores – that’s 12k on v1. They also sell nearly 11k of v7.

Nothing else from Image sells over 10k this year – “Snotgirl” v1 shifts 7400 copies is as close as they come.

Only one other new Image volume manages to pull in sales over 10k this year: the first volume of Bryan Lee O’Malley and Leslie Hung’s “Snotgirl”, which almost pulls in 11k, along with another 4k or so from a Barnes & Noble exclusive cover. Series that were selling over 10k last year included the first volumes of “Descender”, “Bitch Planet” and “Rat Queens”, but the best-selling of these (“Bitch Planet”) dropped to around 8k this year in the bookstores, and the others are even lower. Image needs to seriously develop a few more new hits.

Here’s what Image’s Long Tail looks like: just like from the top, it’s a brutal cut this year. These are not happy numbers, for a second year in the row.

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Calculated Retail Value | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 438 | —— | 116,015 | —— | $2,313,477 | —– | 265 | $5,281.91 |

| 2008 | 515 | 17.58% | 121,001 | 4.30% | $2,445,765 | 5.72% | 235 | $4,749.06 |

| 2009 | 571 | 10.87% | 156,466 | 29.31% | $3,207,033 | 31.13% | 274 | $5,616.52 |

| 2010 | 642 | 12.43% | 359,238 | 229.59% | $8,152,806 | 254.22% | 560 | $12,699.07 |

| 2011 | 749 | 16.66% | 466,637 | 29.90% | $11,041,187 | 35.43% | 623 | $14,741.24 |

| 2012 | 868 | 15.89% | 794,419 | 70.24% | $22,797,279 | 106.47% | 915 | $26,264.15 |

| 2013 | 994 | 14.52% | 776,507 | -2.25% | $22,085,860 | -3.12% | 781 | $22,219.18 |

| 2014 | 1006 | 1.21% | 830,735 | 6.98% | $20,309,973 | -8.04% | 826 | $20,188.84 |

| 2015* | 842 | -16.30% | 1,070,299 | 28.84% | $26,175,438 | 28.88% | 1271 | $31,087.22 |

| 2016* | 876 | 4.04% | 1,187,316 | 10.93% | $28,267,847 | 7.99% | 1355 | $32,269.23 |

| 2017 | 1531 | 174.77% | 938,991 | -20.91 | $18,564,975 | -34.32% | 613 | $12,126.05 |

| 2018 | 1706 | 11.43% | 769,180 | -18.08 | $14,923,335 | -19.62% | 451 | $8,747.56 |

Image has three titles over 20K, and another eight over 10k.

Coming in as #7 Western publisher within the Top 750 in 2018 is Marvel Comics, which places 44 titles for about 363k copies and $7.9m of calculated retail. This is a small drop in pieces, and a small rise in dollars.

Here is how Marvel looks in the Top 750:

| Year | # of placing titles | Unit sales | Calculated Retail value |

| 2003 | 73 | 455,553 | $8,428,962 |

| 2004 | 50 | 227,985 | $3,756,764 |

| 2005 | 26 | 153,317 | $2,459,027 |

| 2006 | 33 | 294,852 | $5,702,307 |

| 2007 | 37 | 376,918 | $7,599,057 |

| 2008 | 38 | 303,639 | $6,446,359 |

| 2009 | 34 | 226,541 | $5,019,216 |

| 2010 | 33 | 206,273 | $4,979,323 |

| 2011 | 27 | 128,364 | $3,303,496 |

| 2012 | 32 | 141,145 | $3,872,683 |

| 2013 | 39 | 187,598 | $4,229,242 |

| 2014 | 53 | 342,706 | $8,341,787 |

| 2015* | 63 | 478,076 | $10,611,981 |

| 2016* | 60 | 555,715 | $12,088,278 |

| 2017 | 50 | 378,689 | $7,840,198 |

| 2018 | 44 | 363,360 | $7,885,015 |

I mean, dollars are up, so can’t really call this anything bad, but, man when they are generating a billion dollars per movie now in ticket revenue, you’d think some of it would bleed over into sales of the source material – and it did help on the top (as you’ll soon see), but the midlist is languishing which is where you want to some life.

Ultimately, I think the problem is that Marvel’s backlist is kind of scattershot. Very few titles are truly perennial, and the branding and packaging is all over the map. New backlist releases are designed for maximizing revenue, rather than audience size, where price-per-page is very similar to the serialization cost. New backlist releases also have poor “hand”, feeling very thin compared to other books on the shelves. Its hard to follow which sequence individual books come in, and they’re not exactly committed to aggressively reprinting either. I honestly think that Marvel backlist should be selling significantly better than it does – it’s very nearly the crown jewels of comics these days.

On the other hand, they passed DC this year, so you have to give them that.

However, they do for sure have at least one hit this year: “Infinity Gauntlet” moved nearly 54k copies in 2018 – that’s up hugely from 16k in 2017.

Also doing extremely well is the first volume of Ta-Nehisi Coates’ “Black Panther: A Nation Under Our Feet” – 36k copies, which is a rise on 2017’s 28k, but with the billion-dollar Oscar-winning commercial this seriously should have pushed much further. V2 sells 13k, while v3 drops to 9400.

Marvel’s third best-selling comic is “Infinity War”, drafting off of #1. It pulls in a solid 16k.

Coming in at #5, and almost the only Marvel book in the Top 750 that has absolutely no movies advertising it, is “Ms Marvel v1: No Normal”. Sure, people aren’t looking for diversity. It sells 13k.

Slightly below at #6 (by like 125 copies!) is “Deadpool Kills the Marvel Universe”, while #7 & 8 are the most recent “Darth Vader” comic – 11k for v1, and 9400 for v2.

Finally, Marvel’s #10 book is “Civil War” at about 8700 copies. I feel like this should sell twice that, right?

No other Marvel comics top 10k in the bookstore market.

Here is Marvel’s Long Tail.

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail value | % Change | Av. Sale per title | Av $ per title |

| 2007 | 1230 | — | 1,034,023 | — | $19,947,737 | — | 841 | $16,218 |

| 2008 | 1559 | 26.75% | 1,032,394 | -0.001% | $20,128,825 | 0.01% | 662 | $12,911 |

| 2009 | 2067 | 32.58% | 954,335 | -7.56% | $19,608,696 | -2.58% | 462 | $9,487 |

| 2010 | 2551 | 23.42% | 870,597 | -8.77% | $19,485,662 | -0.06% | 352 | $7,638 |

| 2011 | 2852 | 11.80% | 852,187 | -2.11% | $20,225,728 | 3.80% | 299 | $7,092 |

| 2012 | 3083 | 8.10% | 726,542 | -14.74% | $18,848,013 | -6.81% | 236 | $6,114 |

| 2013 | 3203 | 3.89% | 730,826 | 0.59% | $17,820,299 | -5.45% | 228 | $5,564 |

| 2014 | 3352 | 4.65% | 918,595 | 25.69% | $24,369,961 | 36.75% | 274 | $7,270 |

| 2015* | 1882 | -43.85% | 1,114,414 | 21.32% | $28,021,290 | 14.98% | 592 | $14,889 |

| 2016* | 1841 | -2.18% | 1,277,046 | 14.59% | $31,402,330 | 12.07% | 694 | $17,057 |

| 2017 | 3578 | 94.35% | 1,142,061 | -10.57% | $28,201,535 | -10.19% | 319 | $7,882 |

| 2018 | 3662 | 2.35% | 1,180,202 | 3.34% | $29,651,745 | 5.14% | 322 | $8,097 |

Marvel has one book over 50k, one over 20k, and another five that are over 10k.

Our #8 publisher in the Top 750 is DC Entertainment.

This is, frankly, shocking to me. For the first decade-plus I have been doing these charts, DC’s attention to backlist had naturally rendered them the #1 publisher…. With a bullet! And even when, the last few years, they lost the #1 spot to Scholastic, they were still majorly, significantly always at least #2.

In 2018 they placed just 47 titles in the Top 750, for just over 360k units, and just under $7.8 million in calculated retail price. DC has four charting imprints: DC Black Label, DC, DC Zoom and Vertigo. Deep in the long tail we can still track Mad, Wildstorm, Paradox, Minx and CMX.

Here’s a year-to-year comparison chart of the Top 750:

| Year | # of placing titles | Unit sales | Calculated Retail price |

| 2003 | 74 | 336,569 | $6,151,258 |

| 2004 | 39 | 179,440 | $3,135,983 |

| 2005 | 42 | 298,484 | $5,440,001 |

| 2006 | 59 | 551,160 | $10,246,082 |

| 2007 | 58 | 487,467 | $9,953,976 |

| 2008 | 71 | 1,015,864 | $19,805,098 |

| 2009 | 93 | 1,223,733 | $24,061,834 |

| 2010 | 96 | 648,403 | $12,523,128 |

| 2011 | 107 | 660,706 | $13,083,378 |

| 2012 | 104 | 688,870 | $14,811,979 |

| 2013 | 130 | 767,686 | $15,620,981 |

| 2014 | 131 | 931,239 | $19,207,755 |

| 2015* | 119 | 1,074,304 | $21,701,088 |

| 2016* | 117 | 1,234,047 | $23,203,071 |

| 2017 | 101 | 827,544 | $15,234,525 |

| 2018 | 47 | 360,414 | $7,810,753 |

2018 is pretty ugly in the book stores for DC – they haven’t had this tragic of a performance since 2005. And I’m still trying to wrap my head around it from 20,000 feet.

Now, there’s no doubt that the rebranding from “New 52” to “Rebirth” simply did not work in the mid-term – it does not appear that the “civilian” audience understood why continuity was being “reset” again so quickly. And while the “Rebirth” GN numbers were OK to start, they very very quickly bombed out. Here’s an example: the first “Rebirth” “Harley Quinn” launched at 13k in 2017. In 2018, it sold just 1818 copies. Kind of shockingly, v1 of the “New 52” “Harley” outsold it at 1894 copies. You can see this over and over again down the line: “Rebirth” “Batman” v1 sold 24k in 2017, and just over 5600 copies in 2018. “Nightwing” v1 sold 12k in 2017, down to 3k in 2018. In fact, not a single “Rebirth” branded book passes 10k in 2018, and it completely slaughtered the sales of the “New 52” editions as well.

I sort of get all of that, and how the mechanics of that can work… but what I don’t really grasp is why the strong backlist, the stuff that has sold month-in, month-out for (in many cases now, decades), suddenly fell off the cliff, as you’ll see.

To help with your trivia contests sometime in the future, “What is the first ‘Black Label’ book?” Well, it is “Batman: White Knight”. It sells about 18k copies in the bookstores. My larger question is “what is ‘Black Label’ actually going to be?” is still unanswered, though. I think DC has sent extremely mixed messages. This is DC’s #3 best-selling book over all, by the way.

There’s also a single DC Zoom book in the Top 750 this year: “DC Super Hero Girls: Date With Disaster” – it sells just over 8k copies. I can’t explain what makes this one, which is actually v5, sell so much better than the other volumes – the next one listed is out of the top 750, and sells under half at around 3600 copies – the same thing is true in my comic shop, this is the one that sells best. So odd.

There are six books branded as Vertigo. “Sandman” v1 does the best with 11k sold (it is DC’s #7 best-selling book), and “Preacher” v1 does next best at about 5600 copies, way down from 11k the previous year.

The remaining 39 books are branded as DC Comics. The best-selling of these is “Watchmen” for 27k, but that’s down from 31k last year. Why?

#2 is the paperback of “Dark Nights: Metal” just over 19k (while companion book “Dark Knights Rising” [#6] brings in almost 12k, and “Dark Days: The Road to Metal” [#9] does about 9500 copies)

At #4 for DC is “Batman: The Killing Joke”, which moves almost 17k copies. That sounds good… but it sold 36k the year before, and 131k the year before that. Again: why the plunge?

#5 is “V For Vendetta” at 14k (18k the year before)

#8 is “Batman: Year One” at just under 10k – it’s dropped from about 11k; #10 is v4 of the “Rebirth” “Batman” (“The War of Jokes & Riddles”), and fallen out of the Top 10 at #11 is Frank Miller’s “Batman: The Dark Knight Returns” with under 9k sold – dropped from over 11k.

I don’t know, these are pretty depressing numbers. The layoffs make a lot more sense now.

Here’s DC’s Long Tail – this was not, even slightly, a good year for DC, and they are, year-over-year, pretty much worst performing major publisher in 2018, despite having one of the widest backlists.

| Year | # of listed items | % Change | Total Pieces | % Change | Calculated Retail Value | % Change | Av. Sale per title | Av $ per title |

| 2007 | 1644 | — | 1,181,218 | — | $22,033,212 | — | 719 | $13,402 |

| 2008 | 2057 | 25.12% | 1,719,330 | 45.56% | $33,609,704 | 52.54% | 836 | $16,339 |

| 2009 | 2264 | 10.06% | 1,902,181 | 10.64% | $37,816,864 | 12.52% | 840 | $16,704 |

| 2010 | 2442 | 7.86% | 1,320,262 | -30.59% | $25,982,910 | -31.29% | 541 | $10,640 |

| 2011 | 2423 | -0.07% | 1,323,630 | 0.26% | $27,130,811 | 4.42% | 546 | $11,197 |

| 2012 | 2452 | 1.20% | 1,206,198 | -8.87% | $26,729,997 | -1.48% | 492 | $10,901 |

| 2013 | 2551 | 4.04% | 1,369,850 | 13.57% | $29,881,153 | 11.79% | 537 | $11,714 |

| 2014 | 2746 | 7.64% | 1,638,901 | 19.64% | $35,388,570 | 18.43% | 597 | $12,887 |

| 2015* | 1690 | -38.46% | 1,997,577 | 21.89% | $43,031,546 | 21.60% | 1182 | $25,462 |