By Brian Hibbs

(Originally published #189 – February 2010 – “Looking at BookScan: 2009”)

For the seventh year in a row, I’m going to try to figure out something that can only vaguely be seen and perceived: the size and shape of the sales of books through the book store market, as seen through the prism of BookScan.

Some preamble:

“Direct Market” stores (also known as “your Local Comics Shop”) buy much of their material for resale from Diamond Comics Distributors (though, not, by any means, all – many DM stores are also buying from book distributors, and in increasing numbers). DM stores seldom have Point-of-Sales (POS) systems (though this is rapidly changing), and, because we buy non-returnable, what we track is in our side of the industry is what sells-in to the store, not what sells-through to the eventual consumer. In a very real way, this means that the DM store owner is the actual customer of the publisher, as opposed to the end consumer.

The bookstore market, however, buys their material returnable, where they can send back some portion of titles that don’t sell. Because of this, sell-through is the data that is tracked and trended. Bookstores that have POS systems are able to report their sales to BookScan, a subsidiary of Nielsen.

Each week, BookScan generates a series of reports detailing the specific sales to consumers through its client stores. I have several well trained spies who have, for several years, provided me with access to the BookScan reports.

If you go over here [Jonah, place a link to the BookScan list there] you can find a copy of the 2009 BookScan Top 750 year end report for the comics category.

(For points of comparison, try these links [I can’t guarantee these will always work]:

2008: BookScan Report and My Analysis

2007: BookScan Report and My Analysis

2006: BookScan Report and My Analysis

2005: BookScan Report and My Analysis

2004: BookScan Report and My Analysis

2003: BookScan Report and My Analysis)

For the last four years, what I’ve been given is the actual end-of-the-year total report, as opposed to 2003-2005 where I only had the report for the last week of the year. The effective difference for a casual chart reader is probably very little, but it does change some of the value in the percentage changes year-to-year. Please bear it in mind when comparing this year’s report to the previous ones – comparing 2009 to 2006-2008 is probably as close to apples-to-apples as it can get, as is 2003-2005, but comparing the ’06-09 data to ’03-’05 isn’t going to be necessarily as valuable, and any analysis I can make of comparative growth is going to be off by some factor, possibly a significant one.

The biggest and most obvious difference when doing straight comparisons will be in the lower ends of the chart. This year, the “worst selling” book in the Top 750 is about 3900 copies (it was ~4300 copies in ’08). In ’03-‘05 there would be 200 or more items that didn’t have YTD sales in that amount.

Also of major note is that for 2007 to 2009, I have the full and entire BookScan listing, down to books that have only one copy sold YTD. However, I’m not going to provide that entire list because that’s too much data, even for a data-junkie like myself. I’ve cut the list off at 750 items because that’s what we’ve reported in the previous six years. Still, I have the deeper data, and I’ll summarize it as we go along. As long as I continue to get that much data going forward, I should be able to tell you a few things about “The Long Tail”. In 2009, I possess data on more than 19,600 items! We’ll talk more about this later.

This is not a list of every book that sold through every book store – the report is limited to those stores that report through BookScan. According to BookScan, more than 7500 venues report to them, but this still leaves many venues that don’t. Like I said in my first analysis:

But who are the retailers who report to BookScan? According to the list that I have, there are over 7400 potential BookScan venues. This list includes almost 300 independent bookstores, as well as chain retailers, B. Dalton / Barnes and Noble, Borders / Waldenbooks, Tower Music and Books, Musicland, Deseret Book Company (Mormon bookstores), Follett Stores (University bookstores), Hastings, Costco, K-Mart, and Target. BookScan also tracks online sales from Amazon.com, B&N.com, Borders.com, Buy.com, Fatbrain.com, and Powells.com.

That’s still a fair number of places that sell our product that aren’t represented – beyond traditional book retailers who don’t report to BookScan (Say, a number of indie bookstores), and mass market retailers like Wal-Mart. This also doesn’t track any number of other channels – like library sales, or other specialty markets like, say, LGBT stores, etc. This Publisher’s Weekly article [from 2003, I wish they’d check in on this story for the 2009 reality!] (you’ll have to subscribe to read it, sorry) says the following:

BookScan generally claims to represent between 70% and 75% of sales in the industry (Wal-Mart and some of the supermarket chains are among those who decline to report.) But a comparison with in-print figures supplied by publishers reveals that the numbers are more likely to represent about 65%, even after deducting for unsold books and returns.

For BookScan’s top ten nonfiction titles published last year – a list that include mass-market favorites like Phil McGraw’s diet books as well as indie hits like Benjamin Franklin: An American Life – no title had BookScan sales comprise more than 75% of total sales. For some of the books that had strong special-sales, they ran as low as 25%.

Frankly, I haven’t bothered to ask BookScan for a client list every year, so it is pretty likely that the number or percentage of reporting stores has increased significantly since 2003. However, I’m also going to continue to assume that the Publisher’s Weekly article is still accurate to the extent that these numbers are unreported by some potentially significant degree, and don’t, in any way, represent all “book stores” selling comic book material. Having said that, I have reason to believe that, for graphic novels, the number is much closer to right than it is to wrong.

Also, remember that this analysis represents RETAIL SALES. This absolutely doesn’t include anything like Library sales, or School Sales, or things like book clubs and so on. Those are not RETAIL SALES. This is all about “person with an extra $20 in their pocket”, so don’t conflate anything else from this.

There’s also a certain amount of miscategorization going on. As an example, every volume of the manga series Love Hina can be found in my full copy of the sales report, except for volume 2. In the Great Big Database there’s apparently an error and Love Hina volume 2 isn’t listed as a “graphic novel”. Conversely, a few prose books always sneak on to the list – Bloody Crown of Conan makes its seventh annual appearance as a not-comic. I do not know what the actual extent of miscategorization might be and how it would impact any of the general data analysis!

I’ve done the best I can to try and root out any items “of significance” that should be on the chart that I’m given – for example, I have to have The Complete Persepolis and Maus manually pulled for me because they are actually classified as (I believe) “Memoir” rather than comics. Because this relies on me thinking of things to get them on to the list – each item apparently only has one classification – there’s almost certainly comics material missing that I didn’t catch. The biggest 2009 release that I found not on the chart was Stitches, but I tracked it down and added it in.

Really, what I’m trying to get across to you is that this really is entirely unreliable data in terms of the absolute and total number of books sold, and is only able to give the broadest outline of what’s happening in book stores, based upon the data-set that I’m being given, which is in no way comprehensive. I still think that’s better than having no information, so I persevere in writing this each year.

As always, I strongly encourage you to look at the BookScan numbers on your own and make your own conclusions – I’m trying to be balanced and fair, but, of course, I have huge bookshelves worth of biases I’m dragging around with me, and your analysis might be more correct than my own.

Again, I want to stress that I’m doing my primary analysis on the Top 750 items: the reason for this is that is all that I was able to get in the first four years of this analysis, and otherwise the percentage changes I’m discussing will be even more wrong than they would be otherwise. The Top 750 represents just about half of the total of the full list. While there are significant sales below the Top 750 (at least $96 million in 2009), the Top 750 probably represents the majority of items you’d be able to “easily” find on the shelf of a bookstore in America. I’m flirting in my head with changing over to analyzing the full “long tail” list sometime soon, but I’m afraid that this might take these little essays to well over 20,000 words, and keeping your attention just through this seems hard enough to me!

* * *

OK, that’s the boilerplate out of the way, let’s start looking at the data.

2009 Overview

Here’s the big picture for the Top 750:

| Year | Total Unit | Growth | Total Dollars | Growth |

| 2003 | 5,495,584 | $66,729,053 | ||

| 2004 | 6,071,123 | 10.5% | $67,783,487 | 1.6% |

| 2005 | 7,007,345 | 15.4% | $75,459,669 | 11.3% |

| 2006 | 8,395,195 | 19.8% | $90,411,902 | 19.8% |

| 2007 | 8,584,317 | 2.3% | $95,174,425 | 5.3% |

| 2008 | 8,334,276 | -2.9% | $101,361,173 | 6.5% |

| 2009 | 7,634,453 | -8.4% | $93,216,014 | -8.0% |

Huh, well that’s not an attractive result at all.

The sum of the Top 750 in 2009 is down 8.4% in unit sales, taking the retail sales in the book channel back to near 2005 levels. This might be even worse than it looks at first glance because of the performance of a specific outlier (more on that in a bit)

I do, however, want to remind you that the nearly 20% of growth in 2006 was almost certainly overstated because of the difference in reporting methodologies between 2005 and 2006. Read 2006’s report for more detail. My estimate was that it was probably closer to 10-12%.

More worrying, perhaps, is that gross dollar sales had its first drop since I’ve been able to track this information, taking dollars to their lowest level since 2007. Of course, we don’t know what percentage of the books sold being reported to BookScan are, in fact, being sold at full retail, and what percentage is being sold at a discount, whether in store or on the internet.

Obviously, a certain amount of this can be blamed on the general level of the economy, and more specifically, problems at the largest brick and mortar retailers like Borders. But, regardless of the specific reasons why, the notion that the bookstore market for comics might offer limitless growth seems to be on the rocks.

The majority of the decrease comes from the manga category (more on that in a bit), and the main reason that the dollar drop isn’t even worse appears to be a greater number of Western-created comics selling, at higher price points.

The softening of book sales isn’t limited to bookstores, John Jackson Miller calculates that the Direct Market’s Top 100 books are 15% lower than they were in 2008 – obviously, this isn’t even close to an apples-to-apples comparison, with that figure comparing the monthly Top 100s, rather than 750 items here on the BookScan figures. Adding in periodical comics, the Direct Market ended up just 2% down from 2008.

(The good news for 2010 and beyond in the Direct Market is that we’ll be able to compare the Top 300 – Diamond made a switch in reporting in December of 2008 – which could yield up to 3600 datapoints in the DM going forward)

Looking a little bit wider, into the whole of the BookScan report over the last three years where I have more data past just the Top 750, here is what the Long Tail looks like:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total Dollars Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 13,181 | —– | 15,386,549 | —– | $183,066,142.30 | —– | 1167 | $13,888.64 |

| 2008 | 17,571 | 24.98% | 15,541,769 | 1.00% | $199,033,741.57 | 8.02% | 885 | $11,327.40 |

| 2009 | 19,692 | 12.07% | 14,095,145 | -9.31% | $189,033,736.31 | -5.02% | 716 | $9,599.52 |

Almost 20k items are now being tracked through these BookScan charts, a 12% increase from last year. Total pieces are down by nearly 10%, with dollars off by 5%. Given that raise in the number of SKUs (“Stock Keeping Units”, or, in normal English “number of titles”), it seems clear to me that there are more graphic novels and reprint collections being published than there is shelf space or customer dollars for. It might also be worth underlining that the “Long Tail” is roughly the same size as the best-selling 750 titles – those best-selling 750 titles sell about as many copies and dollars as the 18,942 items below them.

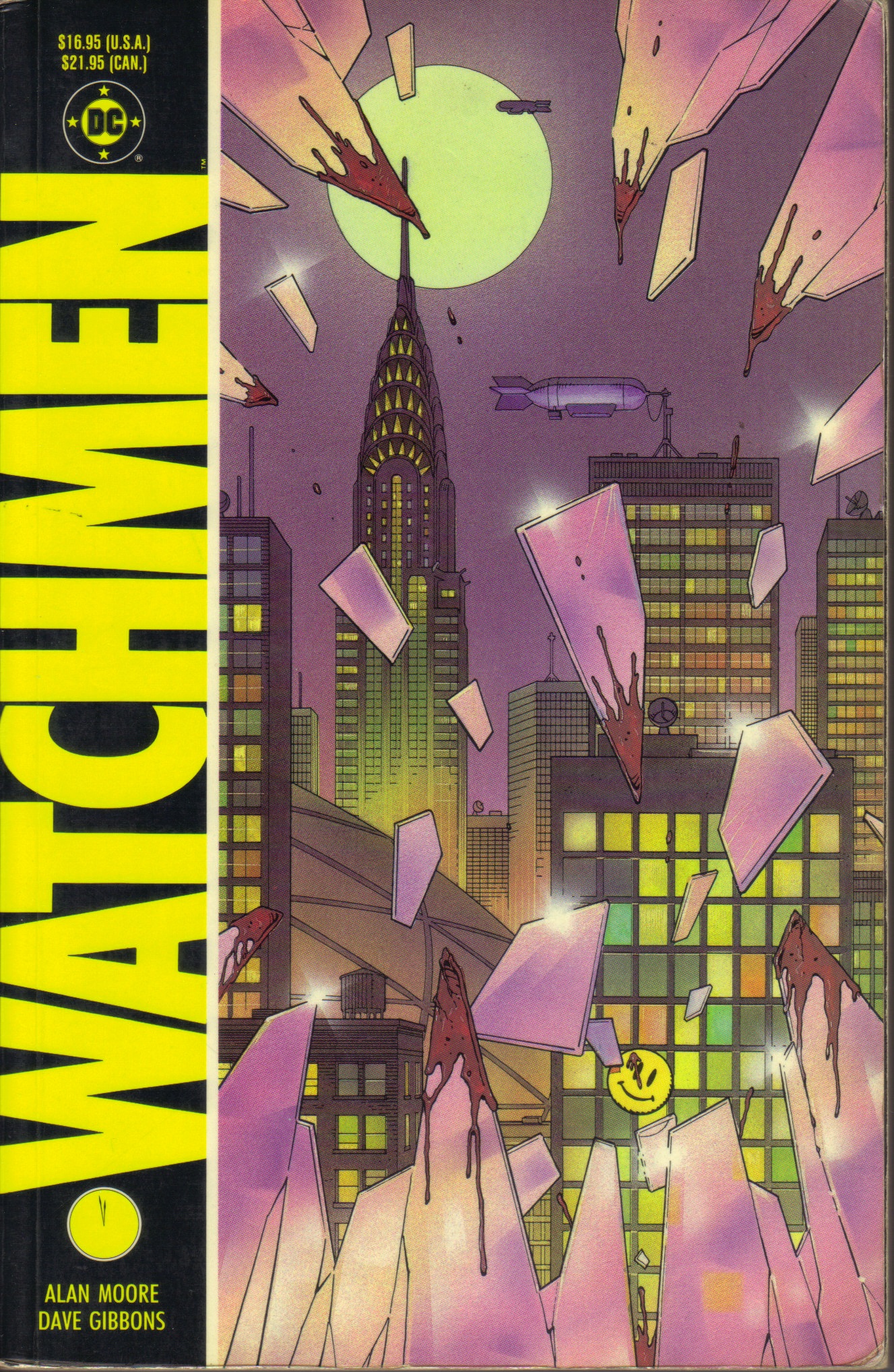

The book of 2009 is the same as the previous year: Watchmen. The big story, however, is that while Watchmen in 2008 was the biggest TP sale we’d ever seen before (nearly triple was the best seller of 2007), for 2009 Watchmen’s sales broke even that record. Watchmen sold 424,814 copies in the BookScan report.

That’s kind of crazy.

Just for grins, here’s Watchmen’s seven-year performance:

| YR | QTY | % |

| 2003 | 14,336 | — |

| 2004 | 11,340 | -26% |

| 2005 | 17,384 | 35% |

| 2006 | 37,554 | 54% |

| 2007 | 45,449 | 17% |

| 2008 | 308,396 | 679% |

| 2009 | 424,814 | 27% |

Watchmen, the movie, was released early in the year – March 9, 2009 – and yet, breaking conventional wisdom, as Watchmen often does, it appears to have continued to sell significantly past the movie’s release date. That is a rare thing, something we’ve never really seen in either the book market or the DM (and, in fact, didn’t see in the DM in 2009 – where the title plummeted in April and never really came back through the end of the year), and really makes this the comics-in-bookstores success story of the year.

Clearly those stellar unit sales also makes Watchmen the number one book in terms of dollars sold, as well – nearly eight and a half million dollars, or, if you really want to be scared, nearly 5% of all of the dollars for the entire BookScan list in 2009 (all 19k+ items)!

And that’s just the paperback.

Watchmen also charts in the hardcover version for 2009 for another 37k copies (making it the #22 best-selling book via BookScan for the year), or another nearly $1.5 million dollars (making it the #3 dollar item for the year). There’s also the “Absolute Edition” of Watchmen, selling 4627 copies (which, at its $75 cover price, makes it the #45 dollar item of the year)

Watchmen is also a book, I would expect, that did well outside of the BookScan reporters – adding in presumed sales from WalMart, etc, and school sales, and international sales, it is conceptual that Watchmen could be near or over a million copies sold in 2009.

It’s a crazy performance, absolutely crazy.

And, as far as I can tell, that was done nearly purely from simply having the copies out on the shelf. While one can make the argument, perhaps, that the film was an extended advertisement for the book, I personally can’t recall seeing any ads for the book, as a book.

The insane thing about this is that the Watchmen film was considered, at least critically, a flop. US Domestic ticket sales are said to be nearly $108 million dollars, making it the 31st highest grossing film of 2009. That would mean that the book did something like 8% of the theatrical ticket sales. Not bad for a 23 year old story!

That’s clearly the Best News of 2009, but it might not bode well for 2010, as I don’t think anyone can expect Watchmen to keep up to those lofty heights, and may, in fact, make 2010’s overall sales visibly lower, all by itself.

The second best-selling item (68,657 copies) on the BookScan list for 2009 was something that I don’t imagine most of us would call “comics”, per se – Dork Diaries by Rachel Renee Russell – it has words and it has pictures, but I’m not going to say that they really work together in the unified whole that most would consider “comics”. If anything I would compare this more to Diary of a Wimpy Kid, yet those titles aren’t listed on this chart whatsoever. So it’s one of those categorization problems I was discussing earlier, really. Dork Diaries is very close to “comics”, so we’ll let the cognoscenti argue that one out.

#3 on the BookScan charts is Robert Crumb’s adaptation of the Book of Genesis, with 68,442 copies sold. This, actually, is also a pretty incredible number, if not for the least reason that the book wasn’t even released until late October, and went nearly-immediately out-of-print from the publisher, making it very difficult for non-chain stores to stock to its full potential.

While I generally try to avoid universalizing and editorializing too much in the BookScan reports, I will say that I know I could have sold triple, maybe quadruple of the number of copies of Book of Genesis had I been able to restock them during the holiday season. No distributor had them – DM or bookstore market – and I even ended up breaking down and buying copies from Barnes & Noble because they were offering them online at a price superior to any distributor’s wholesale cost. Which is kind of screwed up and wrong, if you ask me. The more I learn about the “mainstream” book business, the more I conclude it is kind of irrevocably broken at its core. End editorialization!

The #4 best-selling book, as reported by BookScan, was, woo hoo, the ninth volume of Jeff Smith’s Bone: Crown of Horns. 65,235 copies, and I think we all know that number is going to be epically higher once school sales and Scholastic book fairs and the like are figured in. It literally couldn’t have happened to a nicer guy in comics, and I think that Bone is really the standard bearer of a “mainstream” comic, appealing equally to kids and adults, and being cracking good at the same time. Smith also captures the #6 spot with the first volume of Bone: Out From Boneville, and each and every volume of Bone places within the Top 50.

As a somewhat interesting aside for those of us who think about such things, Bone: Crown of Horns has a simultaneous hardcover and softcover release. However, the hardcover only shows 639 copies sold via BookScan – or under 1% of the softcover. Discuss.

Coming in at #5 is our first Manga title, Naruto volume 43, at 61,144 copies. While this is, of course, a tremendous performance, that’s a huge comedown from 2008, where Naruto v28 sold nearly 104k copies, and 2007, where Naruto v13 sold 80k.

All 46 volumes of Naruto chart within the Top 750 for a total of 971,119 copies and nearly $7.8 million in dollar sales. This is virtually identical to the total of Naruto in 2008 – about 1% higher – though with 28% more SKUs, so it does not appear that the Naruto expedited release schedule’s success (“Naruto Nation”) was infinitely repeatable. One oddity I found, deep down in the Long Tail – despite it not having a release date of until February, 2010, BookScan shows 18 copies of Naruto v47 sold in 2009. Evil employees breaking official release dates with preview copies?

Naruto basically sweeps the rest of the Top 20 after that, with only the Complete Pokemon Pocket Guide v1 (#13) and v2 (#8) and Fruits Basket v22 at #20. And, again, those Pokemon Guides really are no more comics than the Official Handbook to the Marvel Universe might be. Naruto v34-42 & 44-45 are the rest of the Top 20.

As I said, taken as a whole, Naruto comics are $7.8 million at full retail, via BookScan. That’s just under 4% of the total 2009 BookScan list. In fact, if you add that to the Watchmen numbers then 8.8% of all book-format comics reported to BookScan in 2009 were from one of those two properties. Looking only at Manga, Naruto is just over 9.5% of all manga sold in 2009, as reported by BookScan.

In terms of gross dollars, obviously, as I said, Watchmen was #1 (and #3!) with a bullet. The Book of Genesis was #2 with $1.7 million at full retail. That’s three “million dollar” books in 2009, the same number as 2008, still down from five in 2007. Last year’s #2 dollar book was The Complete Persepolis ($1.3 million) – it was down about 50% in 2009 to $716k.

There are twelve books in the Top 750 listed with Alan Moore as the author. Collectively those books sold $12.6 million – that’s about 14% of all of the dollars sold of the Top 750.

Since I was looking at Authors, I decided to see who the most popular authors of 2009 were. Here are authors with more than 10 books placing in the Top 750 this year:

Masashi, Kishimoto – 52 titles with him listed as author

Kubo, Tite – 30

Takaya, Natsuki – 26

Arakawa, Hiromu – 17

Gaiman, Neil – 15

Hino, Matsuri – 14

Kagesaki, Yuna – 14

Kirkman, Robert – 14

Wilingham, Bill – 14

Vaughan, Brian K – 13

Moore, Alan – 12

Smith, Jeff – 12

Clamp – 11

Loeb, Jeph – 11

Ohba, Tsugumi – 11

These 15 authors, collectively, have 258 of the Top 750 titles – just over a third of the titles. That adds up to 3.6 million books sold for $44.8 million – or, for both ways of thinking, nearly half of all of the books sold (47% and 48% respectively) in the Top 750.

If we assume that the article referenced at the beginning is correct, and that BookScan represents 65% of the sales through bookstores, it might be surmised that the total dollar volume of comics in 2009 through bookstores might be around 18.3 million pieces and $246 million in gross retail dollars. It also might not, there is no way to know.

Historically, I’ve arbitrarily divvied the Top 750 list into one of five categories: Humor, Manga, DC, Marvel, and the ever-wonderful Everything Else. While such categorization is horrifically subjective, I did it so to try and track the distinctions between “traditional” bookstore material (e.g., humor books like Garfield, or Far Side); Direct Market-driven material (i.e., Marvel, DC, and much of the “Everything Else” group); and Manga.

In 2008, however, I bowed to the inevitable and gave up on the “humor” category, because it only came in at 4 items that year (and only 2 in 2009). It is virtually certain that this is because most of those kinds of items (typically strip collections like Calvin & Hobbes, etc.) have been recategorized to not appear on the charts I receive. I will now throw whatever comes into this category into the “Everything Else” section. That will throw the percentages off a bit, but I think it will make intent a good deal clearer. We’ll talk about that more, a few sections below.

Here are the year-to-year comparison between my categories:

2009 Manga

Once again, the largest section of titles, by far. In 2009, Manga continues to dominate with 451 spots (out of 750) on the charts for 4.4 million pieces (58% of the Top 750), and $41.1 million in retail dollars (44%).

Here’s a year-to-year comparison chart for the Top 750:

| Year | # of placing titles | Unit sales | Dollar sales |

| 2003 | 447 | 3,361,966 | $34,368,409 |

| 2004 | 518 | 4,603,558 | $45,069,684 |

| 2005 | 594 | 5,691,425 | $53,922,514 |

| 2006 | 575 | 6,705,624 | $61,097,050 |

| 2007 | 575 | 6,837,355 | $61,927,238 |

| 2008 | 514 | 5,624,101 | $53,033,579 |

| 2009 | 451 | 4,414,705 | $41,068,604 |

Despite still being the dominant “kind” of comic on the BookScan charts, manga is down massively in 2009 – posting the second lowest numbers in the seven years charted. If manga continues to decline as it has, 2010 could be lower than 2003.

It isn’t just within the Top 750, either, here is a look at the entire BookScan charts

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 6231 | —— | 11,323,487 | —— | $108,770,537 | —– | 1817 | $17,456.35 |

| 2008 | 7842 | 20.54% | 10,173,091 | -11.31% | $100,800,283 | -7.91% | 1297 | $12,853.90 |

| 2009 | 8756 | 11.66% | 8,148,490 | -19.90% | $81,770,442 | -18.78% | 931 | $9,338.79 |

Total pieces and total dollars sold dropped precipitously – by nearly 20% – this is despite (or perhaps because of) an escalating number of manga books hitting the market.

So, the question is: why is manga declining overall? Obviously one key reason might be the overproduction of manga titles beyond the rack space that is available to them. If one has one hundred linear feet in which to display a category of items, and one hundred and fifty feet worth of books are made available, then clearly something has to give. There simply does not appear to be the physical room to display all of the comics produced each year. But this would logically be as true for “Western” comics as it is for the “Eastern” manga. Yet manga appears to be suffering a far greater contraction.

There are a couple of possible reasons. One contender might be that key buyers at the large bookstore chains are not (I think) the same people that they were in 2007. Different buyers are naturally going to bring a different emphasis. Another possibility is that the “rising tide” of cultural acceptance of comics-driven material has made “Western” comics more attractive to book buyers. “Western” comics generally have higher price points than manga. If one is looking at a bottom-line oriented analysis of dollars-per-square-foot, that $19.95 copy of Watchmen looks a lot more attractive than the $7.95 Naruto, presuming they’re selling an equivalent amount of copies from roughly the same amount of rack space. This is, of course, what pushed comics off of the “newsstand” – bottom-line oriented numbers crunchers saying that a rack of sunglasses generated more dollars-per-square-foot than a rack of comics, so the comics went away.

Further most (not all, but most) Manga is deep in the number-of-volumes per series. Naruto now has forty-four volumes in print, with more to come. A bottom-line oriented look at what to stock and what not is going to say “Well, Naruto sells very well, but to stock it all takes something like eleven linear feet – maybe we don’t need to stock this thing which is somewhat similar to Naruto, and also takes another four feet to display”. “Western” comics tend to be more self-contained, and, even in multi-volume series, taking up less rack space due to thinner volumes.

I also think it may be probable that manga has begun to hit some of the audience truths that Western comics have known for a long time. Historically, for the periodical comic, it was generally understood that the younger portions of the audience were only onboard for, say, four to six years – they started reading comics at age eight, they continued until twelve or thirteen, then they discovered girls or sports or cars or drugs, or whatever, and they stopped reading comics at that point. The modern Direct Market allowed the production of work that appealed thematically to adults, and brought people back to the form once they became of college age, keeping them as customers for another twenty years or more. What I suspect is very likely is that some of the longest term readers of modern manga production may now be starting to “age out” of material that was aimed at them as younger readers, but have not yet found the properties that engage them as older readers; or maybe even have switched over, to some degree or another, to “western” comics.

Still, regardless of the return to 2004 levels of sales, 60% of the Top 750 are manga volumes. Manga represents 58% of pieces sold within the Top 750, and 44% of the dollars. It is still the clear category leader. Looking at the full “long tail” list of 2009 titles, manga represents 58% of pieces sold, and 43% of the dollars sold, while being about 44% of the number of items tracked.

The winner of 2009, just as it has been since 2006, unquestionably is Naruto. With 46 volumes in print in 2009, Naruto racked up about 971k copies sold, for $7.8 million, or about 12% of all manga sold, and about 10% of the total dollars. That’s an astounding percentage, either way you look at it – however it is down from both 2007 and 2008.

Naruto volume 43, at 61,144 copies, is the top manga performer for the year, and #5 overall, manga or not. While this is, of course, a tremendous performance, that’s a huge comedown from 2008, where Naruto v28 sold nearly 104k copies, and 2007, where Naruto v13 sold 80k.

There would appear to me to be a clear softening in the Naruto brand, and yet Naruto is selling an increasing percentage of manga, as a whole. The category is in trouble, and perhaps it could be characterized as “freefall”

Naruto volumes are four of the Top 10 items, fourteen of the Top 50, eighteen of the Top 100. The “worst selling” volume of Naruto (v21 with 5907 copies sold) places at #444 in the overall BookScan listing. This is far below last year (v14 at about 12.5k sold)

Naruto, of course, isn’t the only success story in the manga category: Pokemon Pocket Guides, Fruits Basket, Maximum Ride, and Vampire Knight all place into the Top 20 best-selling manga titles.

As is typical, most of the time if a series charts into the Top 750, all volumes of that series chart there – of the 451 “manga” titles that I have identified, there are only approximately 104 different properties represented. Again, the most popular titles appear to be squeezing the less popular titles from the racks, and as certain titles get deeper backlists (Naruto and Bleach chief among them), that puts even greater difficulty for newer titles to break through.

There are some series that once dominated the charts (examples: Love Hina, Chobits, FLCL) have been entirely pushed out of the Top 750 – Other series like, say, Inu Yasha, have only one or two volumes appearing in the Top 750. Inu Yasha is scheduled to have its 48th volume published by the summer, but its best-selling volumes are well below 5k copies sold in 2009.

Breaking down the manga portion of the chart by publisher, Viz takes 283 of the 451 manga spots, making them the overwhelmingly dominant player, with nearly 63% of the placing titles. Of the data set we’re looking at, Viz charted 3.2 million pieces, for about $27.6 million – that’s down about half a million books and about $5 million from 2008’s Top 750.

Looking at the Long Tail, this is what Viz’s recent performance looks like:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 2018 | —— | 6,249,324 | —— | $55,123,347 | —– | 3097 | $27,315.83 |

| 2008 | 2447 | 21.26% | 5,536,286 | -11.41% | $50,311,791 | -8.97% | 2263 | $20,560.60 |

| 2009 | 2793 | 14.14% | 4,819,407 | -12.95% | $44,310,790 | -11.93% | 1726 | $15,864.94 |

Viz’s strongest performers are (in rough order) Naruto, Pokemon, Vampire Knight, Legend of Zelda, Death Note, and Bleach. 65% of the Top 100 Manga titles are one of those six properties. Viz also did well with Rosario+Vampire, and Fullmetal Alchemist although neither of those had a volume chart over 20k copies.

Viz has four titles that passed 50k units, and thirty-one that passed 20k.

Tokyopop is the #2 manga publisher, with 78 titles charting in the Top 750 –Tpop brings in 598k pieces, $6.07 million retail dollars.

Tokyopop is down to being around a fifth of the size of Viz within the Top 750, and looking at the Long Tail, this is what Tokyopop’s recent performance looks like:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 1992 | —— | 3,073,193 | —— | $30,425,927 | —– | 1543 | $15,274.06 |

| 2008 | 2397 | 20.33% | 2,515,445 | -18.15% | $25,366,647 | -16.63% | 1049 | $10,582.66 |

| 2009 | 2559 | 6.76% | 1,431,424 | -43.09% | $15,135,598 | -40.33% | 559 | $5,914.65 |

This is really kind of a case of “Oh, how the mighty have fallen” – they’ve lost roughly half of their volume over the last two years. Further the “manga revolution” in bookstores was largely a matter of Tokyopop’s “authentic manga” efforts in formatting, so the fall is even more striking, coming from a category that, in some ways, they actually created.

I mean, way back in 2004, 518 of the Top 750 books were manga. Of that, Tpop was 265 of those – 52% – while Viz, which had been doing manga in America much longer, had only 174 slots. So this current performance in the BookScan chart is an astonishing fall.

So, why is the loss so completely brutal? Well, I’m not certain – it seems to me that it is entirely possible that, say, Tpop pissed off the big chain buyers or that there’s some other behind-the-scenes business-related reason for the fall. I will say that as a working retailer, Tpop strikes me as somewhat analogous to Marvel in the pre-HWD 90s where they thought they controlled the market, and, so, could do anything the wanted to – I’m thinking of Marvels “Heroes for the 90s” and other attempts to cram more material into the market than it could really support. Tpop’s official slogan of “Tokyopop IS manga” always rubbed me the wrong way.

Either way, former chart mainstays like Chobits or Love Hina, published by Tpop, have completely vanished from the Top 750, so that can’t be helping them – those were books that, at one point, looked like they were going to be selling-forever perennials, but they’ve dropped to virtually nothing. Really, at this stage, Tpop only has three properties that the sales figures say are especially meaningful – Fruits Basket (v22 sold just over 40k copies), Warriors Manga (v4 did just over 17k in 2009) and Chibi Vampire (v12 did just under 13k). They don’t have anything else that does over 10k beyond those three titles.

Tpop has nothing that does over 50k, and only two books (both are volumes of Fruits Basket) that sell over 20k.

Coming in at #3 is Del Rey, with 49 manga books charting, for about 375k pieces and just a hair over $4 million retail dollars.

Del Rey’s top selling “manga” is only really nominally manga – it fact, if I were being completely granular in how I determined what fit in which box, I’d more properly term them “fumetti”, but I went with the “manga” pile when I was up late that night figuring out what went in which box. Anyway, they are two volumes of Bakugan Battle Brawlers (v1 does nearly 22k) and Ben 10 Alien Force (nearly 16k), both of which are motion-captured stills from the Cartoon Network television shows (they’re even branded on the covers as CN books… which you’d really think DC should be publishing, wouldn’t you?)

In terms of “proper” comics really only has three properties of significance (or, for the purposes of this discussion, selling over 10k): Negima (v21 did almost 15k), Tsubasa (v20 almost made 11k), and Shugo Chara (v1 just squeaks that 10k line)

Del Rey only has a single manga title that sells over 20k.

Looking at the Long Tail, this is what Del Rey’s recent (Manga only) performance looks like:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 238 | —— | 745,175 | —— | $8,332,276 | —– | 3131 | $35,009.56 |

| 2008 | 373 | 56.72% | 824,339 | 10.62% | $9,375,440 | 12.52% | 2210 | $25,135.23 |

| 2009 | 480 | 28.69% | 767,728 | -6.87% | $8,480,225 | -9.55% | 1599 | $17,667.14 |

The #4 manga publisher, via the BookScan Top 750 charts is Yen Press, with 19 titles charting within the Top 750, for about 168k pieces, and a bit over $1.8 million retail dollars. This is a giant move forward for Yen, as they only placed three titles in the Top 750 in 2008.

They’ve got a giant success in the manga adaptation of James Patterson’s “Maximum Ride” – v1 almost hits 35k, with v2 doing nearly 17k. They have two “natively comics” successes in Melancholy of Haruhi Suzum v1 (about 12k) and Soul Eater v1 (just over 10k)

Yen has just the single title selling over 20k.

Looking at the Long Tail, this is what Yen’s recent performance looks like:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 10 | —— | 12,896 | —— | $147,449 | —– | 1290 | $14,744.90 |

| 2008 | 90 | 800.00% | 110,126 | 753.95% | $1,237,860 | 739.52% | 1,224 | $13,754.00 |

| 2009 | 211 | 134.44% | 330,962 | 200.53% | $3,697,113 | 198.67% | 1,569 | $17,521.86 |

That’s pretty nice growth in a down market for the material!

I think just about everyone expects that Yen is going to have a really terrific 2010, largely because of one specific property: the manga adaptation of Stephanie Meyer’s “Twilight”. Odds are pretty decent that it will be the #1 comic of 2010. It is also possible that it could be an epic publisher-killing flop, given that the first volume is going to have a 350k print run. I’m leaning towards the former, however.

One thing perhaps worth noting is that Yen’s Publishing Director is Kurt Hassler, who used to be the Comics Buyer for the Borders chain, during the period when manga had its meteoric rise.

The #5 publisher, as counted by the BookScan Top 750, is a toss-up, depending on which metric you want to use. Dark Horse and Bandai each place 6 titles in the Top 750. Dark Horse for about 34k pieces and $506k in dollars, while Bandai is about 37k pieces and $391k in dollars.

Looking at the Long Tail, this is what Bandai’s recent performance looks like:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 20 | —— | 32,710 | —— | $327,215 | —– | 1,636 | $16,360.75 |

| 2008 | 27 | 35.00% | 23,850 | -27.09% | $238,295 | -27.17% | 883 | $8,825.74 |

| 2009 | 52 | 92.59% | 67,174 | 181.65% | $708,133 | 197.17% | 1,292 | $13,617.94 |

Bandai’s best selling manga title is Code Geass v1, for about 7800 copies.

Looking at the Long Tail, this is what Dark Horse’s (manga only!) recent performance looks like:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 341 | —— | 249,943 | —— | $3,329,464 | —– | 733 | $14,744.90 |

| 2008 | 420 | 23.17% | 248,981 | -0.38% | $3,176,870 | -4.58% | 593 | $7,563.98 |

| 2009 | 455 | 8.33% | 226,497 | -9.03% | $2,915,693 | -8.22% | 498 | $6,408.12 |

Dark Horse’s best-selling manga title is Clover Omnibus v1, for nearly 7500 copies. There’s more about Dark Horse further down the column in the “Everything Else” section.

The last spots of the Top 750 are taken by Go Comi (3 titles, 18k pieces, $199k dollars) and Digital Manga Publishing (3 titles, 14k pieces, $186k dollars) and, finally, the somewhat surprise appearance of Drawn & Quarterly’s edition of A Drifting Life, for just over 4k in pieces and almost $122k in dollars.

No other manga publisher places a single book in the Top 750 – therefore every other publisher’s wares sell under 3887 copies. The one that has become the perpetual mystery to me is the CMX imprint from DC – their best-selling title is Ballad of a Shinigami v1 for a paltry 1222 copies. Looking through the Direct Market figures, it doesn’t look like most of their output even hits 1000 copies in the DM (in November 09, their best seller seems to be Emma v10 for a pathetic 571 copies) – so I am at a complete loss as to where these comics are selling, especially since they continue to regularly solicit half-a-dozen or more titles each and every month. I can’t imagine that these books are better than break-even, at best, and, so, what can DC possibly gain by continuing to publish them?

Looking at things more generally, manga as a whole represents one of the Top 5, 10 of the Top 20, 29 of the Top 50, and 65 of the Top 100 for 2009 – almost exactly the same as 2008. There are four manga titles (from all publishers) that sell 50k or more copies in 2009 (none beat 100k), twenty-seven beat 25k, and one hundred and fifteen beat 10k – again, almost exactly identical to 2008.

-.

It will take a much more edumicated person than myself to divide out the chart by Japanese genre (shonen, shojo, josei, etc) – if you do so and come to any meaningful conclusions, drop me a line and let me know!

Let’s move on to the Western publishers…

2009 DC

2009 was another excellent year for DC, in the bookstores. They placed 93 titles in the Top 750, with total unit sales of over 1.2 million, and $24 million in retail dollar sales.

Here’s a year-to-year comparison chart:

| Year | # of placing titles | Unit sales | Dollar sales |

| 2003 | 74 | 336,569 | $6,151,258 |

| 2004 | 39 | 179,440 | $3,135,983 |

| 2005 | 42 | 298,484 | $5,440,001 |

| 2006 | 59 | 551,160 | $10,246,082 |

| 2007 | 58 | 487,467 | $9,953,976 |

| 2008 | 71 | 1,015,864 | $19,805,098 |

| 2009 | 93 | 1,223,733 | $24,061,834 |

DC is up about 20% in 2009, which is a great performance, though the crazy sales of Watchmen are the single largest factor. If Watchmen “only” sold what it did 2007 (prior to the buzz around the movie), DC’s sales would be down substantially from last year.

Actually, I tend to suspect that Watchmen’s “new” annual sales numbers will probably end up in the 60-80k range going forward from here.

Watchmen, in paperback, is DC’s #1 book, at almost 425k copies sold, a new one-year record since I’ve been tracking this. Watchmen, in hardcover, is DC’s #2 book in 2009.

I’ve said just about everything I might say about Watchmen, up in the overview of the year section – actually I have one more thing to note: last year I predicted Watchmen would sell about 400k in ’09 (“even if the film flops”), and I was only off by about 10%, so I feel OK about my prognostication skills – so let’s look at what else they have going on.

DC’s #3 title for 2009 is V For Vendetta, at almost 36k. That sold about 21k in 2008, and I would suggest that most of that rise came from “riding the coattails” of Watchmen, but I’d also be willing to entertain the notion that this is V’s new “floor” going forward.

Batman takes the next four spots, with The Killing Joke (29k, also likely riding the Watchmen/Moore wave to a certain extent), the Joker HC (26k), Dark Knight Returns (26k), and Batman RIP (26k) and. What’s somewhat exciting about this patch of books is that all things Batman had spiked upwards in 2008 thanks to Christopher Nolan’s The Dark Knight film, but they kept a good percentage of their sell-through, compared to 2007. DKR, for instance, only did about 18k in 2007.

DC’s 8th best-selling book in the BookScan charts in 2009 was Final Crisis (19k), #9 is Sandman v1 (19k), and #10 is Arkham Asylum (19k). That last one is pretty much on par with 2007 numbers, so I’m going to say that the success of the “Arkham Asylum” video game didn’t have a gigantic impact upon the same-named graphic novel.

#11 to 13 goes back to Batman books: The Long Halloween (19k), Year One (16k), and Neil Gaiman’s Whatever Happened To The Caped Crusader? (15k). That last one seems a bit low to me, given Gaiman’s otherwise star-power in shifting books.

Most of #14-19 are things Vertigo-esque: League of Extraordinary Gentlemen v1 (13k), Fables v1 (13k), Y the Last Man v1 (12k), Sandman v2 (11k), Fables v12 (10k), Sandman v2 (9500), and, finally, at #20, Batman: Hush (9200)

So, here’s the bad-ish news for the Direct Market: of DC’s top 20 best-selling items in the bookstores (as reported by BookScan), seventeen of them sold better in the book stores. While this shouldn’t, of necessity, be much of a surprise – there are more bookstores than comic book stores, let alone good comic book stores; and through-the-internet deep-discounting retailers like Amazon deform things even more – this is still a shift that I think few of us were hoping for. As you go further into the charts, that swings way back towards DM stores, as the chain boxes are much more interested in our top-selling books, not the b-list (and below), but it’s a potentially worrying trend for DM retailers. You can see 2009 year end DM sales by going here.

In terms of dollars, DC has seven titles that grossed over half-a-million dollars in 2009. That’s the same as 2008.

Looking at it by “imprint”, DC-branded books are 45 of their 93 Top 750-placing titles, although three of those are Watchmen, not strictly DCU. 42 are Vertigo, and six are Wildstorm-branded.

Taking the last first, three Wildstorm books are the three League of Extraordinary Gentlemen volumes. V1 is about 13k, while “Black Dossier” (v3) is about 7400 copies. Wildstorm also has the two Heroes collections placing (6200 for v1, 4300 for v2), which surprises me a little, given the crashing performance of the show. Given that the seemingly last episode broadcasts this week, let’s see if that continues to sell into 2010. Finally, World of Warcraft: Ashbringer moves a modest 4775 copies in the bookstores. It might be worth noting that Blizzard has claimed at least 11.5 million subscribers to the game, so that’s not a massive success. Even Tokyopop’s Warcraft manga sell better than that (though not, of course, in gross dollars)

On the Vertigo side, as is usual, the bookstore market has cherrypicked the hits. Vertigo placing books are the 12 volumes of Fables (and Snowfall and Peter and Max), the 10 volumes of Sandman (and Endless Nights), and the 10 volumes of Y, The Last Man (plus the hardcover of v1). Snowfall (a stand alone volume) sells worse than any volume of Fables proper, and Endless Nights (a stand alone volume) sells worse than the first seven numbered Sandman volumes.

The first three Preacher volumes have moved into the BookScan Top 750, as has the first hardcover volume of Saga of the Swamp Thing (though not any of the softcover releases). Finally, there is V For Vendetta and Pride of Baghdad.

What you don’t see in the Top 750 are books like DMZ or Scalped, nor any of the new Vertigo Crime imprint. You have to dive deep into the Long Tail to find these books, and DM numbers beat them significantly – from more to twice to up to five times more. For example: DMZ v1 is 2243 in the BookScan charts, and 5400 in the DM charts. Scalped v1 is more lopsided: 973 in BookScan, 4900 in the DM.

And the crime imprint? Well, I, for one, would have expected the Ian Rankin Dark Entries book to do the best in the book market (though, actually, the Azzarello Filthy Rich oddly sells better). Either way, Dark Entries did 1857 via BookScan, and 5300 copies in the DM – clearly that doesn’t mean that those copies sold-through in the DM, but I find the dichotomy striking. Between this and the spectacular failure of Minx (And, of course, Piranha and Paradox before them), I would strongly suggest that this indicates that creating a line of OGNs “for the bookstore market” simply doesn’t work.

It might also be worth noting that the Vertigo Crime line had a little bit of TV advertising. Now, given that this corresponded with “Doctor Who” ads in the print comics, I’m strongly suspecting that this was a straight ad swap and didn’t cost DC any money to put together in the least, and was, instead, a cheap way of finding out if that kind of advertising could move the needle whatsoever. I wouldn’t really expect a small number of ads on a single station would do very much, even if the base editorial quality of the work was astoundingly high (which it really wasn’t in this case), and I doubt those ads were any major thrust for the Marketing department at DC, but it was the first time in recent memory that comics have been actually directly advertised on television, and the results are effectively nil. I’m unsure if television advertising can really do much to sell reading to begin with (LeVar Burton notwithstanding).

Looking at “DCU” books, of the 45 listed in the Top 750, 20 of them are Batman-related. 7 of them are Superman-related (counting Superman/Batman as “Superman”, otherwise it goes to 22/5). 7 of them are Green Lantern-related comics. Three of them are “event” comics (Identity/Infinite/Final Crisis). There are also all three volumes of the Alex Ross Justice series, as well as Kingdom Come, and JLA/Avengers.

Looking past just the Top 750 down into the Long Tail shows solid growth for DC:

| Year | # of listed items | % Change | Total Pieces | % Change | Total Dollars | % Change | Av. Sale per title | Av $ per title |

| 2007 | 1644 | — | 1,181,218 | — | $22,033,212 | — | 719 | $13,402 |

| 2008 | 2057 | 25.12% | 1,719,330 | 45.56% | $33,609,704 | 52.54% | 836 | $16,339 |

| 2009 | 2264 | 10.06% | 1,902,181 | 10.64% | $37,816,864 | 12.52% | 840 | $16,704 |

DC had one book that topped 100k (Watchmen, duh), no titles that topped 50k, and five titles that top 20k.

2009 Marvel

Marvel suffers pretty badly in the bookstores for the Top 750 in 2008. They placed just 34 titles for 227k units and a hair over $5 million in retail dollars.

Here’s the year-to-year comparison chart:

| Year | # of placing titles | Unit sales | Dollar sales |

| 2003 | 73 | 455,553 | $8,428,962 |

| 2004 | 50 | 227,985 | $3,756,764 |

| 2005 | 26 | 153,317 | $2,459,027 |

| 2006 | 33 | 294,852 | $5,702,307 |

| 2007 | 37 | 376,918 | $7,599,057 |

| 2008 | 38 | 303,639 | $6,446,359 |

| 2009 | 34 | 226,541 | $5,019,216 |

It is another down year for Marvel in the bookstores, despite the release of “X-Men Origins: Wolverine”, and the announcement of their purchase by Disney. When one compares Marvel’s performance to DC’s growing successes with the “new” distribution deal with Random House, one imagines that Disney will pull bookstore distribution in-house as soon as they can.

Marvel is over half of the periodical comics sales in the Direct Market, typically beating DC by 5% market share, or more, but in the bookstores they’re barely a fifth of DC’s size, which is a fairly brutal comparison. In fact, if Marvel’s performance doesn’t get a whole lot better very soon, I may be re-jiggering the way I write this column in future years – the fact is that Marvel’s 34 placing titles isn’t enough larger than Dark Horse’s placing of 32 titles in 2009 to really justify continuing to give them their own, dedicated section of the analysis any longer. Hell, Dark Horse sells within just 1100 pieces of Marvel within the Top 750! Marvel is simply not, currently, a significant enough player in the bookstore market, which is amazing given how globally known their brand is.

The “long tail” for Marvel looks a smidge better, but it’s still down a lot:

| Year | # of listed items | % Change | Total Pieces | % Change | Total Dollars | % Change | Av. Sale per title | Av $ per title |

| 2007 | 1230 | — | 1,034,023 | — | $19,947,737 | — | 841 | $16,218 |

| 2008 | 1559 | 26.75% | 1,032,394 | -0.001% | $20,128,825 | 0.01% | 662 | $12,911 |

| 2009 | 2067 | 32.58% | 954,335 | -7.56% | $19,608,696 | -2.58% | 462 | $9,487 |

Marvel’s number one book in bookstores in 2009 is Stephen King’s Dark Tower: Treachery HC with almost 19k copies sold. That is the third “Dark Tower” collection. The previous holder of this spot was Stephen King’s Dark Tower: The Gunslinger Born HC, which sold about 30k copies in 2008, and 52k in 2007. That’s a serious degradation of the property. (“Gunslinger Born” is their #4 book in 2009, down to about 11k copies). The second “Dark Tower” collection, The Long Road Home has two editions on the charts – 5232 copies as a “Barnes & Noble Exclusive” (#20), and 4597 copies of the “regular” version (#24). Together, those 9829 copies would have otherwise been Marvel’s #7 best-selling title.

I’m curious about those two versions: does this imply that B&N is selling that high of a proportion of comics in general; of Marvel in particular? Or is it just because it is their own inventory, they’re more motivated to move them through? I sure don’t know, but in asking the question out loud, maybe someone will answer.

In the number 2 position it is the Halo: Uprising HC with about 13k copies sold, while #3 is Civil War in paperback with about 11k sold, while book #5 is Secret Invasion, also with about 11k sold.

At #6 is a new printing of Origin (or as they’re finally now calling it, Wolverine Origin) at 9987 copies. I’d love to be able to compare this to last year, but most of last year Origin was out of print. Origin goes out of print a lot, actually. Much of any interest in Marvel’s backlist goes out of print fairly frequently, for that matter. But they got Origin back in print for the release of the Wolverine movie. “X-Men Origins: Wolverine” made about $180 million domestic, which is like $73 million more than “Watchmen”. It did not seem to sell very many comics.

Other Wolverine comics on the Top 750 are Old Man Logan (5996), a new printing of Weapon X (5303), Tales of Weapon X (5187), and Worst Day Ever (4508). The first looks roughly in line with a normal “higher profile” Wolverine release in the bookstore market – last year Jeph Loeb’s Evolution did 4292 – while the latter two are interesting because they’re the essentially “kid oriented versions” of Wolverine. The first reprinting several “Wolverine: First Class” minis, and the second basically being “Diary of a Wimpy Wolverine”

Looking at Wolverine titles in the Long Tail, there’s essentially no movement – for example, Wolverine Origins v2 sold 1374 copies in 2009 compared to 1637 copies in 2008. I’m going to conclude that despite having the 13th highest-grossing film of 2009, the net impact on sales through BookScan was probably something under 25k copies, across the entire in print spectrum of Wolverine titles. Diamond Book Distributors really didn’t do their job this year.

Marvels #7 book for 2009 is the adaptation of the Wonderful Wizard of Oz with 8900 copies. #8 is Civil War in hardcover (8539), #9 is Marvel Zombies in softcover (7556), and #10 is Marvel Adventures: Iron Man v1 at 6593 copies. That last one sold 12.5k in 2008.

Last year’s second best selling Marvel item was the hardcover of Laurell K. Hamilton’s Anita Blake, Vampire Hunter: The First Death, a title so long that it truncates badly on the charts. It sold just over 17k copies. This year, I had to go deep into the Long Tail to find that book – it dropped to just 1871 copies in 2009! The paperback release of that book, despite being released of January of 2009, only sells 3300 copies through the year. I am at a loss to explain why it was spiked like that last year, or why it crashed down so hard this year. One other LKHABVH book made the Top 750 this year – the subtitle is The Laughing Corpse v1: Animator, though none of that actually appears on the BookScan chart. Either way it sells 5660 copies.

I am also amused that Marvel’s adaptation of Pride and Prejudice is their 33rd best-selling title (4005 copies) – easily outselling the overwhelming majority of their new Marvel Universe releases. In fact, 9 of the 33 placing Marvel titles are adaptations or licensed titles. Another 11 don’t take place in the “Main” (“616”) Marvel universe.

There’s not a lot to say about Marvel, other than they don’t place a single title at 20k or over. Marvel’s absolute dominance in the Direct Market doesn’t translate at all into the bookstores.

2009 Everything Else

As I mentioned more towards the top of this piece, I’ve gave up keeping Humor as a separate category in 2008. Calvin & Hobbes and most other classic strip collections seem to have been moved entirely away from the numbers that I’ve been receiving the last three years, and the few books like that that I can track are, I think, a mistake on BookScan’s end for not moving everything overly properly. Presumably we could still add another at least $8-10 million in sales to “comics” as a category (or, at least, insomuch as the percentage of sales that BookScan reports represents that category accurately, (which, like I said, it probably doesn’t), if comic strip numbers were included as well.

Before y2k, “Humor” was the comics chart, taking much of the top spaces in dollars and in pieces. But I don’t have that data any longer. I’ve performed some pretty ugly surgery on the historical record, so, I should remind you of what things once were presented as. Here is what “humor” looked like for my first five reports:

| Year | # of placing titles | Unit sales | Dollar sales |

| 2003 | 125 | 1,246,141 | $16,095,800 |

| 2004 | 108 | 829,279 | $11,460,533 |

| 2005 | 35 | 428,941 | $5,904,947 |

| 2006 | 34 | 357,424 | $5,060,097 |

| 2007 | 8 | 54,093 | $1,990,296 |

And this is what “Everything Else” used to look like in those first five reports:

| Year | # of placing titles | Unit sales | Dollar sales |

| 2003 | 32 | 95,355 | $1,684,624 |

| 2004 | 36 | 230,831 | $4,360,522 |

| 2005 | 39 | 435,178 | $7,733,180 |

| 2006 | 48 | 486,135 | $8,306,366 |

| 2007 | 72 | 828,484 | $13,703,858 |

Crashing those two charts together, makes it instead look like this, with 2008 onwards added at the bottom:

| Year | # of placing titles | Unit sales | Dollar sales |

| 2003 | 157 | 1,341,496 | $17,780,424 |

| 2004 | 144 | 1,060,110 | $15,821,055 |

| 2005 | 74 | 864,119 | $13,638,127 |

| 2006 | 82 | 843,559 | $13,366,463 |

| 2007 | 80 | 882,577 | $15,694,154 |

| 2008 | 127 | 1,390,672 | $22,076,137 |

| 2009 | 172 | 1,769,474 | $23,066,360 |

172 items on the Top 750 are “not Manga, DC or Marvel”, and combined they sell about 1.8 million pieces, for $23 million at full retail. This is where the real growth in comics is coming from.

There is, however, a fair amount of chaff here. The “other” section is usually the one I do the last, because it often is the one that needs the most research (every book that I got “added back” to the chart, like Persepolis, Maus, or Stitches was in this section). The converse, however, is also true. I mentioned in the introduction section how the second best selling “comic” of the year is Dork Diaries by Rachel Renee Russell with almost 69k copies. I don’t actually think it is comics, however. Close, yes, but not really comics anymore than, say, Goonight Moon might be.

So, after already breaking down the charts and writing all of the previous sections, I started diving deeper into some of the titles in the “other” category I found 3 books that are actually Juvenile Chapter Books (Super Friends Going Bananas, We Are The Super Friends, and Superheroes in Action), 4 books that are comics-related, but not actually comics (DC Comics Encyclopedia, Marvel Encyclopedia, Wolverine [encyclopedia], and Marvel Chronicle), 6 books that are educational tools, not comics (the six “Phonics Comics” entries), and 3 things that aren’t comics, and are only vaguely “comics related” (Zombies [an encyclopedia-style book], and the Tokidoki Journal and Stationary Set from Dark Horse). These 16 items equal 144,821 pieces sold, and $2.1 million dollars. I sadly count those kinds of entries as part of the price of analyzing BookScan, with all of its imperfect tools, and I provide this information here for the more-anal among you who might want to go and re-rig the charts on your own. I wish you luck. For my part, I will simply ignore the entries in this paragraph for the rest of what I present here in this section.

There are some great sales here in the “other” section, ones that make me feel pretty good about the next age of comics in the bookstores. One of the ways I split up the books in this section is by whether they’re “native” comics productions, or if they’re there to serve someone else’s Intellectual Property. A comic book based on a movie, or a book, or a toy line, or whatever isn’t inherently bad of course, but as a creative artform it is generally healthier if new ideas and new content is being generated. It’s funny, because a lot of hot air is expanded in our industry between “mainstream” vs. “indy” or “corporate” vs “artcomix” or whatever tool we use to try and imperfectly get our point across, but in a way, I think that the real conversation is between “new” vs “old”. As a fan, as a retailer, as a patron, I get more excited by new things I’ve never seen before than I do of iterations (even great, well done ones) of the already familiar. As much as I love, say, “Star Wars”, it has crossed from the point of being a passionate creator with a story to tell, to being a property looking to expand for the sake of doing so. That’s not bad or wrong, and I’m positive it is possible to create truly great “Star Wars” stories, but even if you don’t create great ones, they’re going to create more “Star Wars” stories anyway.

Anyway, if you split the list up between “created-for-comics-first” books and “adaptations or expansions from a not-natively-comics source” (and, yes, that would include Crumb’s Bible retelling), you find that just under two-thirds of the comics in this section are Native. And I think this is a good sign.

Right, so, we’ve talked about the best-sellers here a little in the Overview, but to recap: Number 1 is Dork Diaries (69k), which I don’t really think is “comics”. Number 2 is Crumb’s Book of Genesis adaptation at 68k, which could have been much higher had it been fully available during fourth quarter. In fact, I suspect when we look at 2010 this book will probably sell at least that number of copies again as it matches the demand.

Spots #3-5 all go to Jeff Smith’s Bone. Awesome awesome awesome! It couldn’t have happened to a nicer guy, and it’s completely on the strength of the comics themselves. Bone v9 hits 65k, an amazing number, while v1 does 55k – a stellar increase from last year’s 49k. v2 rounds out the Top Five at 36k.

But wait, there’s more! Bone volumes are also spots 7, 8, 10, 11, 13, 14 and 16! The ten Bone color paperbacks, collectively, sell 356k copies, up dramatically from 266k in 2008. There’s also 8300 copies of a boxed set of the first trilogy. Jeff also manages to shift almost 12k copies of the black and white Bone One Edition version.

This is an epic performance, and one that’s probably only the tip of the iceberg. As these are Scholastic editions, it is probably safe to say that there are significant numbers of Bone being sold into schools (oh, and libraries!). How significant? Man, no idea, but if you told me it doubled or trebled bookstore sales I’d probably believe you. And there is no reason to believe this will stop anytime soon. I suspect when we get to the 2019 charts, Bone will still be selling at least 20k copies a year of each volume.

So, yay for Jeff Smith!

The #6 best-selling book on the “Everything Else” portion of the BookScan list is art spiegelman’s Maus v1 with 32k copies. Twenty-three years after publication, and it is still a best-seller. Maus is, in fact, the 30th best-seller overall for the entire comics category. What I continually find odd is that v2 (and, really, this is one story, and it goes against my grain to see a work like this broken up) only sells about 20k copies – this is a pretty consistent percentage year after year. The complete hardcover sells about 5600 copies.

Marjane Satrapi’s The Complete Persepolis comes in at #9 on this section, with almost 29k sold, down significantly from last year’s 54k when it was still coming off the bloom of the animated version. I suspect this, too, will continue to be a strong seller for years to come.

#13 is the adaptation of Max Book’s Zombie Survival Guide with 27k copies sold, and maybe this is the place to note that six of the Top 20 are in black & white. #15 is Logicomix: An Epic Search For Truth which sells about 23k copies, and like the Crumb book, had some bad availability problems for much of the year, and otherwise might have been much higher.

#18 is IDW’s Star Trek: Countdown prequel to the film with 18k copies, and IDW’s largest success in the bookstores to date. #19 is Shaun Tan’s The Arrival with 18k (his new book Tales From Outer Suburbia, launches with 9500 copies).

And to wrap up the Top 20, it is v4 of Buffy, The Vampire Slayer: Season 8 with 15k copies. All five volumes make the Top 750

Since I didn’t do it up above, here’s a quick look at the Long Tail for this “category”:

| Year | # of listed items | % Change | Total Pieces | % Change | Total Dollars | % Change | Av. Sale per title | Av $ per title |

| 2007 | 4076 | — | 1,847,821 | — | $32,614,656 | — | 453 | $8002 |

| 2008 | 6113 | 49.98% | 2,616,954 | 41.62% | $44,494,930 | 26.43% | 428 | $7279 |

| 2009 | 6605 | 8.05% | 3,090,079 | 18.08% | $49,837,734 | 12.01% | 468 | $7545 |

Diving in past the Top 20 for Everything Else, here’s some of the things I see…

The 21st best-selling book is Jennifer Holm’s Babymouse v9, another comics series aimed at kids – it comes in at 15k. Ten volumes of Babymouse make the chart, in fact. It isn’t big as Bone (what is?), but it shows there is a thriving market for “comics for kids”. In point of fact, there are sixty-three books in the “Everything Else” section that are primarily aimed at children. You might not have heard about Babymouse, or the “Lunch Lady” series, or Dragonbreath, or Stone Rabbit BC Mambo or Black is For Beginnings or Club Penguin, but kids clearly have, and they’re selling well. In fact, I suspect that if you were to sort the entire list out by “intended audience”, comics aimed at Young Adults or younger would actually dominate the listings. It might also be worth noting that most of the titles that I just mentioned haven’t been carried by Diamond, whatsoever.

Robert Kirkman’s Walking Dead continues to grow in the bookstore market – v9 comes in at a smidge over 14k. That’s roughly half of what it sells in the DM, but that’s still a pretty prodigious number. All ten Walking Dead softcover volumes make the Top 750, as does v1 of the hardcover.

The book that I personally thought was the best book of 2009, David Mazzucchelli’s Asterios Polyp, is #27 on “Everything Else” with just over 12k copies. This, like Logicomix and Crumb’s Genesis, had huge availability problems in 2009, likely leading to significantly lower sales than it otherwise would have had.

Another well-reviewed outside of the DM book was David Small’s Stitches – it comes in just a hair under 10k copies.

There’s several publishers that place five or more books in this category. Let’s look at them alphabetically, I think:

First is Dark Horse with 24 titles here in “Everything Else”. Dark Horse’s strength in the bookstore is their licensed titles. They place twelve Star Wars volumes, five Buffy: Season 8 volumes, three volumes of Serenity, and Indiana Jones Adventures v1. They only place three non-manga books that aren’t licensed: Both volumes of Gerard Way’s Umbrella Academy (8200 copies of v1, 5100 of v2), and the first volume of Frank Miller’s Sin City (4200)

Looking at the Long Tail, this is what Dark Horse’s (non-manga!) recent performance looks like:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 597 | —— | 413,022 | —— | $7,607,264 | —– | 692 | $14,744.90 |

| 2008 | 734 | 22.95% | 552,815 | 33.85% | $9,329,828 | 22.64% | 753 | $12,710.94 |

| 2009 | 798 | 8.72% | 455,924 | -17.53% | $7,757,240 | -16.86% | 571 | $9,720.85 |

Dark Horse’s Manga offerings are up in that section. Dark Horse is one of the rare publishers that does a significant business in both Eastern and Western comics, and I’m sure they’d prefer all of their numbers to be represented together. In which case, their Long Tail actually looks like this:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 938 | —— | 662,965 | —— | $10,936,728 | —– | 707 | $11,659.62 |

| 2008 | 1075 | 14.61% | 801,796 | 20.94% | $12,506,698 | 14.36% | 746 | $11,634.14 |

| 2009 | 1253 | 16.56% | 682,421 | -14.89% | $10,672,933 | -14.66% | 545 | $8,517.90 |

Scholastic’s Graphix Imprint has 21 titles placing here. Much of that is, of course, Bone, but they also do well with Amulet (12k for v1, 7900 copies of v2), The Babysitter’s Club (four volumes, from 4300 to 6200 copies), Knights of the Lunch Table (5300), two Magic Pickle books (both about 4800), and Goosebumps v1 (just over 4k)

Their Long Tail looks like this:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 28 | —— | 203,900 | —— | $2,018,694 | —– | 7282 | $72,096.21 |

| 2008 | 39 | 39.29% | 346,134 | 69.76% | $3,498,012 | 73.28% | 8875 | $89,692.62 |

| 2009 | 52 | 33.33% | 432,070 | 24.83% | $4,654,686 | 33.07% | 8309 | $89,513.19 |

Harpercollins has seven books in this section: 2 from Scott McCloud (Understanding Comics at 9400, and Making Comics at 6800), and three from Neil Gaiman (Blueberry Girl at 13k – not comics, actually – and both the hardcover and softcover editions of P. Craig Russell’s adaptation of Coraline – 5400 and 6400 copies respectively). There is also a Simpsons Treehouse of Terror (5100) and Cartoon History of The Modern World (3900). Harpercollins has a lot of imprints (Harper, Harper Paperbacks, Harper Teen, Harper Festival, Harper Teen, and so on), and since I don’t have that particular roadmap, this Long Tail chart is just imprints with the word “Harper” in them…

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 18 | —— | 36,940 | —— | $600,540 | —– | 2052 | $33,363.33 |

| 2008 | 36 | 100.00% | 48,264 | 30.66% | $863,808 | 43.84% | 1341 | $23,994.67 |

| 2009 | 42 | 16.67% | 81,774 | 69.43% | $1,308,891 | 15.53% | 1947 | $31,164.07 |

IDW places 13 books – Star Trek: Countdown (18k), five volumes of Transformers, all four Angel After The Fall volumes, plus Spike, a single Classic Gi Joe volume, and Darwyn Cooke’s adaptation of Richard Stark’s Parker: The Hunter (just under 5k sold)

Their Long Tail:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 233 | —— | 102,118 | —— | $2,090,647 | —– | 438 | $8,972.73 |

| 2008 | 335 | 43.78% | 146,125 | 43.09% | $2,766,505 | 32.33% | 436 | $8,258.22 |

| 2009 | 477 | 42.39% | 215,907 | 47.76% | $4,346,836 | 57.12% | 453 | $9,112.86 |

All that Image places in the Top 750 is 11 entries that are all Walking Dead, but expect that to totally blow up if the AMC TV series gets made. Their Long Tail is pretty steady:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 438 | —— | 116,015 | —— | $2,313,477 | —– | 265 | $5,281.91 |

| 2008 | 515 | 17.58% | 121,001 | 4.30% | $2,445,765 | 5.72% | 235 | $4,749.06 |

| 2009 | 571 | 10.87% | 156,466 | 29.31% | $3,207,033 | 31.13% | 274 | $5,616.52 |

Oni Press places five books into the Top 750 – all of them Scott Pilgrim. V5 sells about 8300 copies. That is extremely likely to explode in 2010 with the film version.

Their Long Tail is looking good:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 125 | —— | 11,294 | —— | $141,829 | —– | 90 | $1,134.63 |

| 2008 | 138 | 10.40% | 21,843 | 93.40% | $320,799 | 126.19% | 158 | $2,324.63 |

| 2009 | 149 | 7.97% | 51,584 | 136.13% | $713,121 | 122.30% | 346 | $4,786.05 |

Pantheon as an imprint places six books in the Top 750. We’ve already discussed Maus, Persepolis and Asterios Polyp, so that just leaves Charles Burn’s Black Hole with almost 6k.

Pantheon’s Long Tail is deformed a great deal by the 2008 performance of Persepolis:

| Year | # of listed items | Percent Change | Total Unit Sold | Percent Change | Total $ Sold | Percent Change | Av. Sale per title | Av $ per title |

| 2007 | 30 | —— | 12,596 | —— | $2,244,703 | —– | 420 | $74,823.43 |

| 2008 | 33 | 10.00% | 207,837 | 1550.02% | $4,069,742 | 81.30% | 6298 | $123,325.52 |

| 2009 | 36 | 9.09% | 125,403 | -39.66% | $2,571,920 | -36.80% | 3483 | $71,442.22 |

Some other notes from the bottom of the charts:

There are three other books at over 10k that haven’t been mentioned anywhere else in this piece: The adaptation of Patricia Briggs Mercy Thompson: Homecoming pulls in over 14k copies, Dean Koontz’s In Odd We Trust does 11k, and Ellen Schreiber’s Vampire Kisses v3 brings in almost 11k.

Top Shelf doesn’t hit with five or more titles on the list, but they do have four: v1 of the new League of Extraordinary Gentlemen: Century almost brings in 9k copies (versus almost 43k in the Direct Market), From Hell does 7800 copies, Blankets is listed at 6400 copies, and Surrogates which comes in about 6500 copies. That’s a huge step up from the 790 copies that Surrogates sold in 2008, and that’s probably all from the Bruce Willis film adaptation – but still, under 5k additional copies sold because of having a film in the theatres.

(Even more depressingly in the “how does a movie sell a comic” sweepstakes is Rucka and Lieber’s Whiteout. In 2008, Whiteout sold 1440 copies. In 2009, with a badly received film? 1486 copies. Ugh.)

(Astro Boy seems to have had about as great of an impact – the best selling Astro Boy volume, the collected edition of v1 & v2 from Dark Horse, did 422 copies in 2008, and all of 1333 copies in 2009. Watchmen is the exception, not the rule…)

Other than the titles mentioned before, the only other “art” or “literary” comics that show up in the Top 750 are What It Is (6900), Squee (4769) and Johnny, The Homicidal Maniac (7334) – both regular, steady sellers – Fun Home (9400), French Milk (5100), The Photographer (6000), American Born Chinese appears twice (8987, and 5459 – the first is listed as being published by “Square Fish”, which might make it the Library Bound version? Hard to say…), and 2009’s entry of The Best American Comics (4900). No Clowes, no Tomine, no Bagge or Hernandez Brothers except deep into the Long Tail – v2 of Love & Rockets New Stories lists with a meager 374 copies this year, about half of what v1 launched with last year.

That, to me, is the downside of the move to All-Graphic Novels, All-The-Time: creators benefit from being on the racks regularly. I know for my individual store, the number of people who walk in looking for Los Bros. work is now extremely low in any given week, because they’ve shifted production to an annual format. In my one single little comic book store, we used to sell 50-60 copies of the quarterly-ish L&R series. Now that it is an annual, we sold 32 copies of v2 in 2009. Yeah, my one store sold almost 10% of what Everyone-Who-Reports-To-BookScan did, single-handedly. And I’m disappointed by that performance because it’s half or so of what L&R used to sell as a “comic book”

Once we’re in the long tail, I can find you 100 books without even trying where my one little DM comics shop is selling 1% or better than the reported national BookScan sales figure.

What else? Mm, Wanted stays in the charts with just over 6k copies sold – no movies, no recent expansions of the IP, looks like it is there to stay.

Archie hits for three places this year – all Sonic books, but still, good to see them represented. 2010 will bring the TP of the Archie marriage issues, those should place decently, I’d hope.

8400 of Tim Hamilton’s adaptation of Ray Bradbury’s Fahrenheit 451 seems like an exceptional number to me. So does 5500 copies of the Amazing Spider-Man Pop-Up (even if that isn’t comics, darn it.)

Four “everything else” books sold over 50k in 2009. Twelve more sold over 20k.

And that’s pretty much what BookScan in 2009 looks like to these eyes.

How does it look to you?

**************************

Brian Hibbs has owned and operated Comix Experience in San Francisco since 1989, and is a founding member of the Board of Directors of ComicsPRO, the Comics Professional Retailer Organization. Feel free to e-mail him with any comments. You can purchase a collection of the first one hundred Tilting at Windmills (originally serialized in Comics Retailer magazine) from IDW Publishing. An Index of v2 of Tilting at Windmills may be found here. (but you have to insert “classic.” before all of the resulting links)