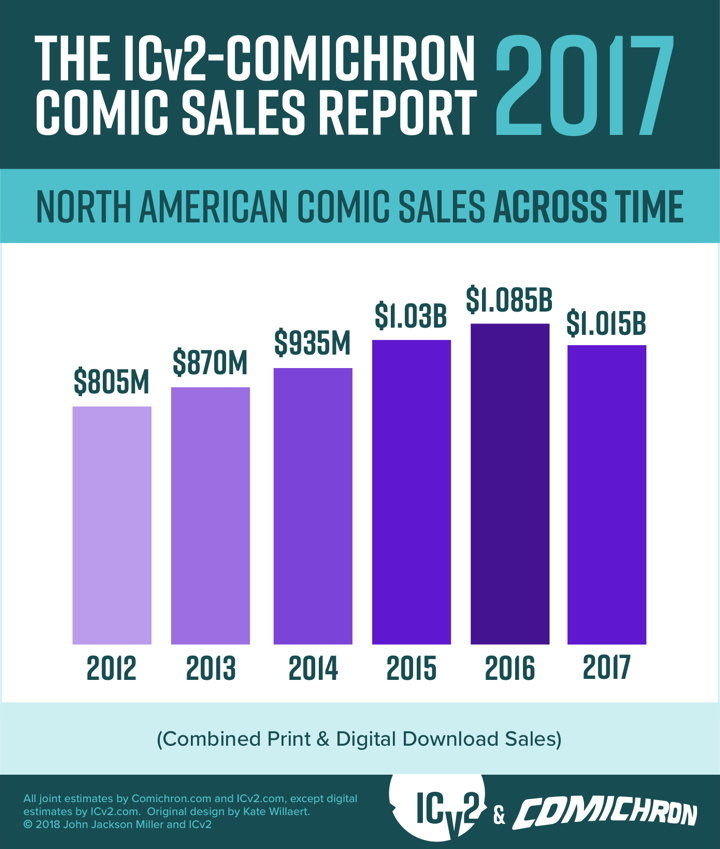

ICv2’s Milton Griepp and Comichron’s John Jackson Miller have released their annual report on comics and GN sales , and it confirms that sales were not boffo in 2017 – in fact overall comics and Gn sales were down 6.5%. However the marker remained over $1 billion in sales for the year – so we can still say we work in a billion dollar industry.

This includes sales in both formats and all channels, including comics shops, bookstores, newsstands, and digital.

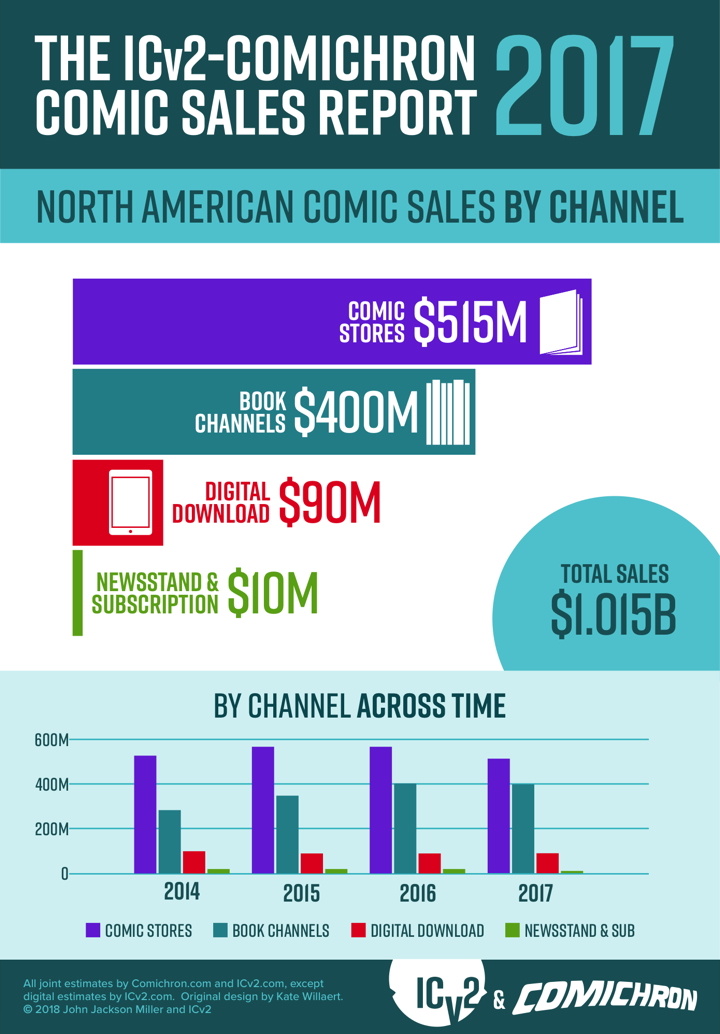

Digital was the most stable channel – flat from 2016 – while newsstand was practically non-existent.

Griepp and Miller analyze their sales data and get estimates to help make the annual report. Despite the slump in 2o17, they remain bullish on comics, citing the growth in kids graphic novels.

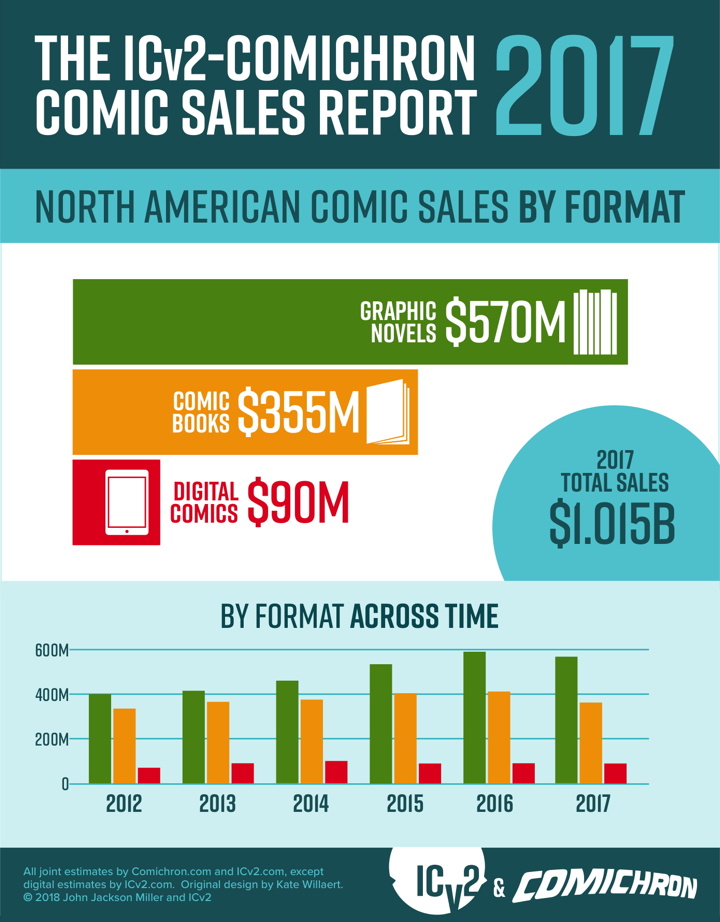

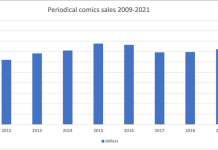

Looking at the accompanying graphs, the DM outperformed bookstores again, but by a smaller margin than in 2016. Also, GNs blew away periodical sales, $570m to $335m. You can see the 2016 report here.

2018 looks to be a similarly flat year, although GNs sales have dropped a lot more than in 2017.

“After a multiyear growth run, the comics shop market gave back some of its gains in 2017, with lackluster response to new periodical offerings and, consequently, graphic novel sales,” Miller said. “The third quarter of 2017 saw the worst of the year-over-year declines, leading into what has turned out to be a stronger spring for stores in 2018.”

“While there was some softness to the market in 2017 (which we attribute to cyclical rather than secular change), there were positive signs,” Griepp said. “The relative strength in the graphic novel and digital markets, especially the growing market for kids titles across print channels, bodes well for the future.”

Digital sales were flat, the strongest performance of any channel in 2017. The book channel (mass and specialty retail chains, online, independent bookstores, book fairs) was the strongest print channel, with only about a 1% decline, helped by booming sales of kids’ graphic novels. The comic store channel, the largest channel overall, dropped around 10%, while the smallest channel, newsstand, shrank to a size not seen since the dawn of comics as the last remaining DC comics left newsstands in August.

As presented above and in the accompanying infographics, the analysis by Comichron and ICv2 was divided up between periodical comics (what some call “floppies” or “pamphlets”), graphic novels, and digital download-to-own sales. All print figures are calculated based on the full retail price of books sold into the market, and do not account for discounting or markup. Digital sales do not include subscription or “all you can read” services.

This is the fifth joint market size analysis from ICv2 and Comichron; the first four reports were for 2013, 2014, 2015, and 2016 sales. ICV2 and Comichron also previously collaborated on revised estimates for 2011 and 2012.

Thanks for the analysis! It will be interesting to see if there is any resurgence this year, or if the first half of the year is enough to match 2017’s pace.

Something we didn’t call out specifically: book fairs — counted as part of the book channel in our reporting — were up significantly in 2017. A growing subcategory.

Something that confuses me is the book channel sales compared to comic shops. I was under the impression that the book market sold much more than the direct market, just by sheer market share. Like, the Bookscan analysis for 2017 had the Direct Market at 7%. It made me think that more money was made outside the direction market.

https://www.comicsbeat.com/tilting-at-windmills-268-looking-at-bookscan-2017-and-this-time-its-certified/

Hmm, so the report is only in dollars, not units? I mean, at the end of the day, I know dollars are what matter, but I would be curious to know if fewer *comics* were actually sold, or if deep discounts on the digital/Amazon side of things are skewing the numbers.

Heidi, you report (or they do) that “newsstand was practically non-existent.” Newsstands indeed are practically non-existent. I live in Denver, the 19th largest city in the US and described as “one of the fastest-growing major cities.” There are no newsstands, not really. None in the grocery stores here, and none freestanding downtown. There are only five Barnes and Nobles and they all have dwindling newsstands; the many used bookstores don’t have them at all. The convenience stores and coffee shops here don’t carry magazines. Usually just 2-3 newspapers – which are also dying! This is why DC wanted in Walmart, I guess.

Oh – another point! (Excuse me if I am overstaying my welcome…) I teach at an elementary school, and we usually have one very successful book fair each year, sponsored by our PTA. I’m not surprised there’s an encouraging trend there. But it is a very rare school that has more than one book fair a year. They are just too time-consuming and work-intensive for even the best PTAs. It’s something to consider along with all this other helpful information.

@Nick Piers — in the above chart “Direct Market” = periodicals and books COMBINED. “Book stores” sell essentially zero periodicals

My look at BookScan *only* is looking at books.

Hope that makes sense?

-B

@Ladies Making Comics: JJ can correct me if I am off in their methodology, but even the “dollars” calc is a little suspect — I suspect they’re simply multiplying bookscan-reported qty sold against cover (like I do for BookScan)…. but a meaningful percentage of those books are going for *some* discount through Amazon.

-B

@Brian Hibbs: Yeah so this is basically what revenue the market *would* have generated if *everything* were sold at cover prices. It’s better than nothing I suppose, but it seems even more strange in light of this that they don’t disclose units sold as well (unless it’s one of those trade secrets BookScan won’t let you share publicly?)

So another thing not entirely accounted for is how many traditional prose publishing houses may have lowered prices on their graphic novel imprints as they have more confidence to print larger and larger runs (esp. since they still overwhelmingly publish black and white comics)

We are indeed doing quantity sold times cover price — there are far too many kinds of discounts to consider to make it wholesale, and of course we don’t get to see what price rang up at the register.

So we’re not accounting for discounting — but then again, we are also not accounting for markup, and there are quite a lot of variant comics that are clearly sold for more than what Diamond invoices them for. I would speculate (no pun intended) that trade is at least in the tens of millions of dollars annually, but there’s no way to know.

As to units, we do regularly report periodical units sold by Diamond on Comichron at http://www.comichron.com/yearlycomicssales.html; we were at 89.44 million copies in 2017, versus 99 million in 2016. While I can now compute units for graphic novels at Diamond (and Brian has them from Bookscan), I seldom report them because the variance in pricing is just too much — every price point between $5 and $150. We get a lot of months where units suddenly balloon because a $5.99 book with an ISBN number appears in the graphic novel list.

We certainly wouldn’t want to mix comics and graphic novel units together for the same reason; it just doesn’t tell you very much.

Yeah, to JJ’s point, BookScan 2017 was (*runs to check*) just over 18 million units (books only, right?), while Comichron’s estimate of periodicals (only!) through the Direct Market is slightly more than 89 million units. WAY more periodicals are sold than GN/TP…. but that’s not precisely a meaningful comparison.

-B

Comments are closed.