A little surprise this morning as Dark Horse announced they would be moving to PRH (Penguin Random House) for periodical distribution to the direct market, joining IDW and Marvel.

As soon as the story broke, Diamond Comics president Steve Geppi released his own statement, pointing out that Diamond would continue to be the distributor for Dark Horse’s very extensive merchandise line, and then throwing in a little shade about how they were only losing 1% of their volume. Oh snap!

Dark Horse has been our valued partner for close to thirty years and we are pleased that Diamond remains a key source for Dark Horse comics and graphic novels to the Direct Market domestically and internationally. We are also pleased to maintain our role as distributor of Dark Horse merchandise worldwide.

It is important to note that while Dark Horse is an established name in the industry, the expected impact of this change to Diamond’s Dark Horse direct market sales represents only approximately 1% of Diamond’s top line sales inclusive of comics, games, merchandise, and pop culture items. We are so much more than just comic book distribution! Diamond and all the Geppi Family Enterprises companies have worked strategically and successfully to diversify over the years, with our most recent example being the launch of Overstreet Access, an online subscription comic collection management platform and price guide.

I remain proud of the role Diamond plays in the industry and steadfast in my commitment to the Direct Market. I look forward to our continued service of the Direct and book markets as well as the continued growth of the GFE portfolio of companies.

In the letter to retailers, Geppi also encouraged them to attend this October’s Diamond Retailer Summit, and that will be interesting.

Losing Marvel, DC, and now 2 more of the Top Five comics periodical publishers, Diamond has been retrenching for a while, putting more emphasis on its role as a toy and game distributor, and continuing to be a wholesaler for Marvel, IDW and Dark Horse. Despite worries that they may be in danger, these seem to be sensible moves aimed at long term survival.

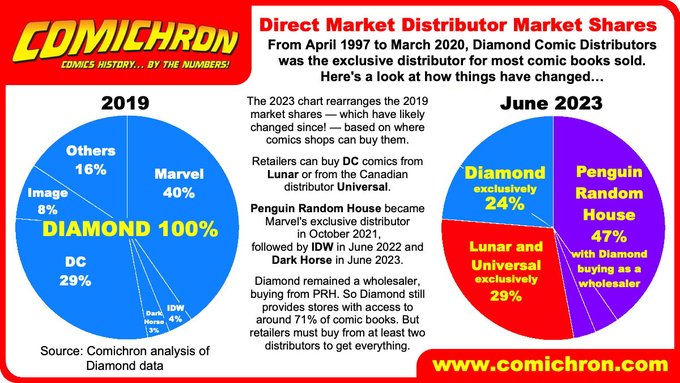

But as numbers cruncher John Jackson Miller pointed out, this has led to a bit of a true shocker: PRH will soon be the biggest distributor to the Direct Market!

Comics distribution news: @DarkHorseComics announced today it was joining @Marvel and @IDWPublishing at @penguinrandom for single-issue comics sales to comics shops. Diamond remains as a reseller, so it offers a majority of comics, even as PRH nears 50% as a primary distributor. pic.twitter.com/BbXiuz6AmI

— Comichron.com (@comichron) September 21, 2022

Lots more fascinating info in this thread.

Nearly a year ago I fashioned a “distributor scorecard” – time to update!

| Publisher | Comics Shops | Bookstores |

| Ablaze | Diamond | ? |

| Ahoy | Diamond, Lunar | S&S |

| Andrews McMeel | ? | S&S |

| Aftershock | Diamond | ? |

| Archie | Diamond | PRH |

| AWA | Diamond, Lunar | S&S |

| Behemoth | Diamond | S&S |

| Black Mask | Diamond | S&S |

| Boom | Diamond | S&S |

| Dark Horse | PRH | PRH |

| DC | Lunar, Universal | PRH |

| Devil’s Due | Diamond | S&S |

| Dynamite | Diamond | Diamond |

| Heavy Metal | Diamond | S&S |

| Hiveworks | ? | S&S |

| Humanoids | Diamond | S&S |

| IDW | PRH | PRH |

| Image | Diamond | Diamond |

| Keenspot | Diamond | S&S |

| Kodansha | Diamond | PRH |

| Legendary | Diamond | S&S |

| Mad Cave | Diamond | S&S |

| Marvel | PRH | PRH |

| Oni | Diamond, Lunar | S&S |

| Rebellion | Diamond | S&S |

| Red 5 | Diamond | S&S |

| Rocketship | Diamond | S&S |

| Scout | Diamond, Lunar | ? |

| Seven Seas | Diamond | PRH |

| Source Point | Diamond | S&S |

| Titan | Diamond | PRH |

| TKO | ? | S&S |

| Valiant | Diamond | ? |

| Vault | Diamond | S&S |

| Viz | Diamond | S&S |

| Yen Press | Diamond | Hachette |

| Z2 | Diamond, Lunar | S&S |

| Zenescope | Diamond | ? |

Additions and corrections welcome in the comments. I’ll update when I can.

PRH is currently trying to buy S&S (DOJ is trying to block the deal). While all of those stories are about the publishing side of things, I assume that the distribution arm would also be absorbed. So, look at the “scorecard” and see the potential future.

For DC, Comics Shops it should be Lunar, Universal Distribution.

https://www.comicsbeat.com/dc-announces-distribution-deal-with-universal-distribution/

Hi! Do you think you could include info for Avatar Press in the list?

Also, it looks like there are two different entries for Vault.

Another correction for the table: Z2 is with S&S for bookstore distribution, not PRH.

Heidi, this site places URL posts in Limbo, so I’ll share distributor links on the FB post.

On the comics shop column, how many of those are exclusive to DCD? (Officially? They’re the last man standing?) I guess that’s determined by the discount percentage offered, based on if Diamond is a redistributor?

How many publish just books, like Andrews McMeel or Cartoon Books?

I kinda expected this on the GN side back in 2010 when Archie shifted trades to Random House. If Archie could ankle, why not the much more lucrative clients like Image? (And they’re next…)

Keenspot is distributed by Diamond to comic shops (non-exclusive) and is a FOC publisher.

Interesting.

Comments are closed.