By Brian Hibbs

And the slow rewrite of how the Direct Market for comics functions continues its slouch towards Bethlehem (“part one” is here while “part two” is here)…

November was a pretty rough month, especially in the shadow of the scope of changes and rearrangements so far to date. The biggest and roughest change has stemmed from the general ongoing disaster of “supply chain issues” from which comics are not immune. On one side of the scale is “The Great Manga Shortage” where it is also surging demand that is causing books to be unavailable; while on the other side of the scale, there is also a raw materials and labor shortage to contend with. That squeeze on both ends makes being a book-focused store much more difficult – there are so many currently-un-reorderable books we are waiting for that represent roughly two weeks “worth” of sales for our store. That’s a big disparity, and for us, a roughly eightfold increase from how things were pre-COVID – and hardly the kind of product supply position you want to be in in what is supposed to be your biggest sales quarter of the entire year.

Let me give you a tiny, very stupid, in the weeds, example: Lunar (which, let’s never forget, is every retailer’s number one competitor: Discount Comic Book Services) has a “claim to fame” of extremely pedantic packing, and one of the central reasons why is that they individually bagged and boarded “ratio” variants (the ones where you can buy one copy of the variant for every twenty-five copies purchased). Well, between the paper shortages and trucking issues, that policy fell by the wayside due to lack of availability of bags and boards for comics. Not only are individual retailers unable to get basic supplies, but even at the “distributor” level those suppliers are not there to be packed in. Every domino knocks over multiple others.

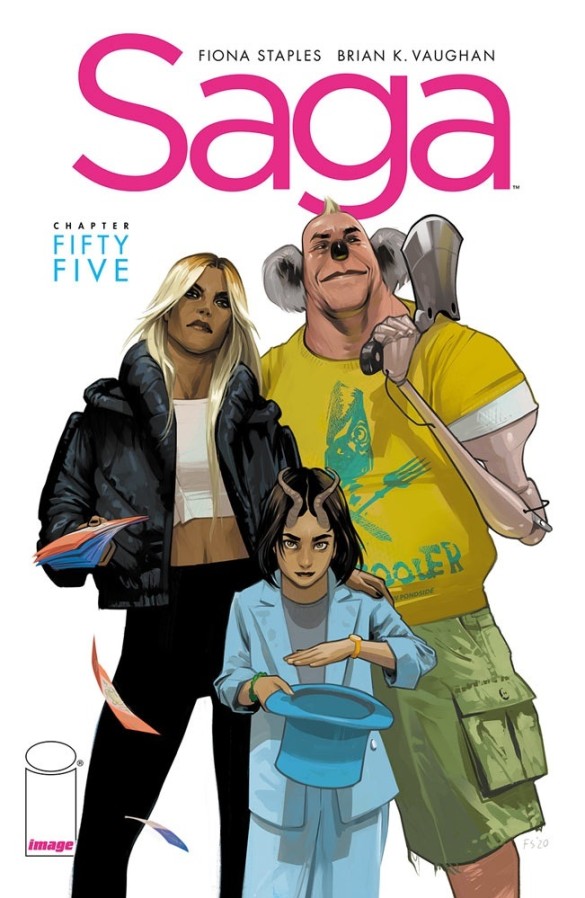

Or, here is a larger one: Image comics has announced that they will no longer be doing second prints of periodicals due in part to these paper shortages. Given that most Image comics are now relying on multiple variant covers, which inherently reduces the potential availability of returnable orders, the single most likely result of this plan is that many new Image published books will be unable to reach their maximum sales potential as they sell out quickly, and now can no longer go back to press. The somewhat ironic aspect of this is that Image had already previously tried to eliminate second prints in 2012, but very quickly had to walk that back in the face of demand for Saga #7 – because the struggle of just how to properly order the escalating number of SKUs in the market is terrifyingly real on both the retailer and publisher/creator level. There are far more books than the market can adequately support, and removing tools from the toolbox – even if they’re driven by practical, real-world reasons – are most likely to only sell fewer comics in the long run. Especially for the newest and least-tested new products on the market.

That, of course, is not Image’s sole problem in the last month – they’re also facing the majority of their “below the line” workforce demanding to unionize. Image has subsequently said that they will not voluntarily recognize this new union. This is a little frustrating as an observer, given the reasons and history of Image’s foundation for creator’s rights (at very least conceptually, although several of the founders went on to simply make their own sub-publishers that didn’t inherently favor other creators). My bigger question is how long has the resentment needed to want to form a union been simmering? These aren’t notions that form in a matter of weeks, I don’t think? It makes me think that these issues have been brewing for a very long time without being efficiently addressed, though I certainly have zero real insight into the circumstances.

I think the more tricky part is that Image’s base costs structure for creators is very low compared to other publishers, and it is my (decade old, perhaps very faulty!) understanding of Image Central’s operation that only a percentage of their smaller books even really make much of a profit at all, let alone pay a living wage, even with that low entry cost. So I’m not sure that I understand where the income to do some of what the union folks want would actually come from – if you increase the base cost of the Image deal, then logic says that fewer creators will be able to meet their costs, and so, ultimately, fewer comics will be made by smaller creators? Either way, I hope that the (absolutely critical!) workers are able to get a working environment closer to their wants, while still preserving Image’s ability to publish less-than-obviously-commercial books from a diverse variety of cartoonists.

Meanwhile, on the “bigger” side of the street, Penguin Random House and Marvel seem to be still struggling deeply with meeting DM retailer’s needs and preferences. Although it’s always dangerous to draw inferences from things like Facebook, there certainly appear to be a meaningful number of retailers who are publicly saying that they’re moving their Marvel periodicals business back to Diamond because PRH isn’t making needed changes fast enough – especially in “backstage” places like Final Order Cutoff and data flow. As noted previously, PRH’s biggest challenge is that they are built around an assumption that traditional booksellers are their primary customers (not unreasonable!). Some aspects of PRH’s divisions date back to the eighteen hundreds! So there are a hundred or more years of baked in assumptions about “how” they should broadly publish and distribute – even if some of those assumptions look suspect or wildly inefficient from the outside (which they occasionally do to me). But the assumptions that periodical-driven Direct Market stores have at our core are wholly different for many things and more because the core nature of our business (them pesky periodicals) is dramatically different from perennial-intended product.

One of the big problems is that PRH uses far too many shipping centers for comics product, so it’s usual that a single graphic novel reorder is split into at least two distinct shipments. And weekly new comics come in a third. If you placed an advance order for a graphic novel, it’s possible for them to send you individual packages for each and every book in that order – we’ve had week where we have received three or more books in individual packaging. And then, of course, a comics reorder will ship singly as well. Sometimes as few as a single comic, packed more intensive than a week’s worth, in a box just as big! There’s absolutely no consolidation of orders, which I sort of get from an Operations perspective, although I cannot for the life of me figure out how they’re eating all of the shipping and packaging and labor on these individual orders.

And, yeah, each and every one of these shipments (I think my current record is eight in an individual week?) generates distinct and individual paperwork and invoicing with it. Trying to fathom this (compared to single weekly invoicing from Diamond or Lunar) is a giant black hole of a time sink.

Another thing that happened this November was that the Final Order Cutoff process – where we order the next issue the week following the previous issue, so that we are not ordering “blind” and have at least a single week of sales data – has pretty much been thrown out the window (or perhaps “under the bus” is the better metaphor?). By far the greatest malefactor is Marvel, which actually has us FOCing a few books before their “initial orders” were due – now those most extreme examples are due to poor intra-distributor communication, it seems, but trying to keep track of what is do when and where and how has gone from a smooth and clear process, to a confusing mess that dumps all of the risk of selling periodical comics directly onto the retailer. Thanks!

Right now, we are at seven issues of Amazing Spider-Man ahead of shipment – this is horrifying behavior that utterly breaks the economy of “how to order comics”, putting us back to 1994 or something. Because of the heinous way in which publishers have decided variant covers and line expansion is more valued than increasing the number of readers, this means that for many retailers ordering periodical comics is now more akin now to going into a casino than it is having a consistent and dependable cash-flow mechanism. The only rational response that I have found is to cut back on rack copies, and try to reduce all risk on our side that way. That is, we’d hope you understand, not a sustainable model for the future.

And while Marvel is the worst, this winter virtually every publisher of any significant size has abandoned the formerly rock-solid commitment to retailers having a week’s worth of sales data before ordering the next issue. The risk is now all ours.

As a result, I know that our Wednesdays are getting slower and weaker as the customers start “untraining” themselves as the day to buy comics – why would you if not all comics are received and on hand that day? Things that we’ve invested hundreds of thousands of person-hours into building as a community for the last quarter century are all being unraveled in just a matter of months – and it’s all down to the publishers breaking the very system that supports them. I find it unfathomable.

Finally, we can’t let the Nov 2021 review go past without mentioning the attempted Ransomware attack of Diamond comics. Three weeks later, all of Diamond’s systems still aren’t fully functioning correctly and together. Reorders are only just starting to move now, a month late, shipment tracking and reporting is spotty, and there are wild amounts of missing and incorrect data – all of which that just gums up the system even more. Eventually this too will pass, but… yeah, it’s been a rough month for those of us in the retail trenches.

It is certain that “the regular Direct Market functionality” wasn’t at all perfect – but the new status quo which appears to be replacing the Diamond hegemony is pretty solely making things worse. “You don’t know what you’ve got, ‘til its gone” has always been a truism, but I’m just sad and depressed that we’re proving the aphorism out in the comics market in real time right now.

Will any of this even start to heal before summer?

**************************

Brian Hibbs has owned and operated Comix Experience in San Francisco since 1989, was a founding member of the Board of Directors of ComicsPRO, has sat on the Board of the Comic Book Legal Defense Fund, and has been an Eisner Award judge. Feel free to e-mail him with any comments. You can purchase two collections of the first Tilting at Windmills (originally serialized in Comics Retailer magazine) published by IDW Publishing, as well as find an archive of pre-CBR installments right here. Brian is also available to consult for your publishing or retailing program.

“Tangled shipping issues just multiply these problems – last week PRH shipped three Marvel comic s (X-Men, X-Force: Killshot, and Hawkeye: Kate Bishop) two full weeks before many DCD accounts got those same comics; and Marvel has been absolutely dead silent about holding them to preserve market balance.”

Why is this the framing? Why isn’t it that Diamond, as a wholesaler, sent three Marvel books two weeks late?

Image central takes 25% of all trade/hc/gn sales dollars.

RJT: Because I don’t hold Diamond to blame because PRH sent them the books late? It’s Marvel’s responsibility as the publisher to give guidance to the market on how to fairly address these issues, in my view, because they are the only one with the ear of all retailers.

Guy: I am specifically and solely thinking about periodical comics in that framing.

-B

Brian,

I ask this not as a “gotcha” or anything, but have you considered doing a follow up on your November 2020 column about DC? I was reading this article and recalled that one, where you stated your “firmest expectation” was that DC would be out of the periodical business by this coming January.

I’d be curious to know where you stand on DC’s near/long-term future now.

Interesting.

Comments are closed.