There has been a lot of talks about why the comics industry is struggling, despite now knowing that isn’t exactly the case. The truth is that almost everything in the entertainment industry is being disrupted and it couldn’t have happened at a more complicated time.

Student loan repayments have resumed in 2023 and upcoming data will unveil how it’s affected spending. The recent conclusion of a writers and actors strike has led to a slow revamp of productions. Unfortunately, all of this coincides with an election year, setting the stage for a tumultuous second half of the year filled with chaos, pivots, and broken promises.

This piece is here to analyze the state of the entertainment industry on a macro level scale, looking at larger more corporatized parent companies and their streaming services. We will also discuss the ‘as service’ model and how that’s changed the industry with intellectual property having spread into numerous types of entertainment and consumables. Why this has changed the industry and what’s evolved over the years is what we’ll be looking to understand better, and so we’ll be breaking it down in this critical analysis of the state of entertainment, and doing so in three parts.

Everything is Being Disrupted

Now let me begin by talking about the elephant in the room: the well-known rise in sales of Manga – a thriving market that only keeps growing. Almost every bookstore I’ve been to these past few years has a much larger Manga section than they do American comics, which is in part due to a major shift in the globalization of Asian culture as a commercial product since the 21st century (K-Pop has done wonders for this in the past decade).

There have been low barriers of entry to anime and manga culture since the mid-2010s thanks to low-cost subscription services, faster turnarounds in manga production, and overall – the increase in popularity of Asian-influenced IP. For instance, Crunchyroll has seen a whopping level of growth, increasing its subscription base five-fold between the years of 2017 to 2023. Then you have services such as Webtoons, whose revenue has gone from 17 million in 2013 to 1.6 billion in April 2023.

Still, something to keep in mind is that measurement of the medium’s success should also be taken with a grain of salt over the past two years, as finances have been incredibly uneasy for the everyday consumer. The economy has been rough from the turn from mid-2022 to 2023, mostly because of the cost of inflation, something which is finally cooling thanks to reduced costs in gas and shipping, driven down thanks to measures such as the US producing more gas than ever before.

Why is all of this important?

Despite all the gloom and doom regarding the economy, the SP 500 recorded a 24% gain end of the year thanks to record profitability, despite being one of the worst years for layoffs in media and technology since the pandemic (and in past weeks it’s gotten even worse.) Some of these layoffs were a correction in overhiring. A lot of this was because of promises based on generating profits and the potential of chasing scaled profitability regarding AI, something the tech sector has been riding all year. Yet, something is amiss regarding entertainment and it goes well beyond comics.

Add in the startling reports regarding spending patterns we can now see that the average consumer is spending like there is no tomorrow, depleting not only personal savings but also, getting into a record-breaking surge in credit debt to fund the hard-to-kick habit of spending beyond your means. This was caused by the early surge of spending post-covid’s worst days. When people were locked indoors and splurging on at-home entertainment. Comics of course being no exception doubling their rate of trade sales both in 2020 and 2021.

So what’s going on and why does anyone who works in entertainment right now, whether it be production, creative, or editorial, feel bleak despite there being more options of choice in entertainment than ever recorded in human history?

The truth is not even the world’s greatest economists could explain what’s happening right now as almost everyone (myself included) thought a recession was coming. What we can extrapolate from what’s happening is that entertainment is changing – fast and drastically – and the actual things we spend our time and money on seem to never get portrayed in the right limelight – mostly because of how much money goes into bigger product lines meant for mass product consumption.

For instance, it’s not just a comic book character like say, Spider-Man featured in 2023, but rather, it is also an Across The Spider-Verse movie character based on a Dan Slott comic, who then conveniently, also has its marketing release not far from a PS5 Spider-Man 2 video game.

Comics have changed because of the stuff that makes them: their stories and their ideas, gets distributed everywhere, becoming a basis for an entire yearly strategy that permeates not just our time, but also, our identity. Fandoms become a part of who we are. They give us comfort, meaning, and a place to feel like we belong. It’s a pleasant distraction but one that also pulls us away from the realities, and the overall messiness, of our current situation.

Let’s look at the disconnect of how we look at the entertainment industry versus reality, starting with a look at the MCU and box office performances.

Superhero Movies Did Not Fare As Badly as You Think…

Almost every single headline in 2023 has criticized the MCU for flopping that year even though most of these movies are still the top-grossing movies of today. Financially, a lot of these big-budget superhero blockbusters were misses in 2023 more than hits, and yet, the reality of the situation is that almost nothing has changed regarding market share of who dominates the box office. It’s just that the overall trend of movie watching in the theatres has changed.

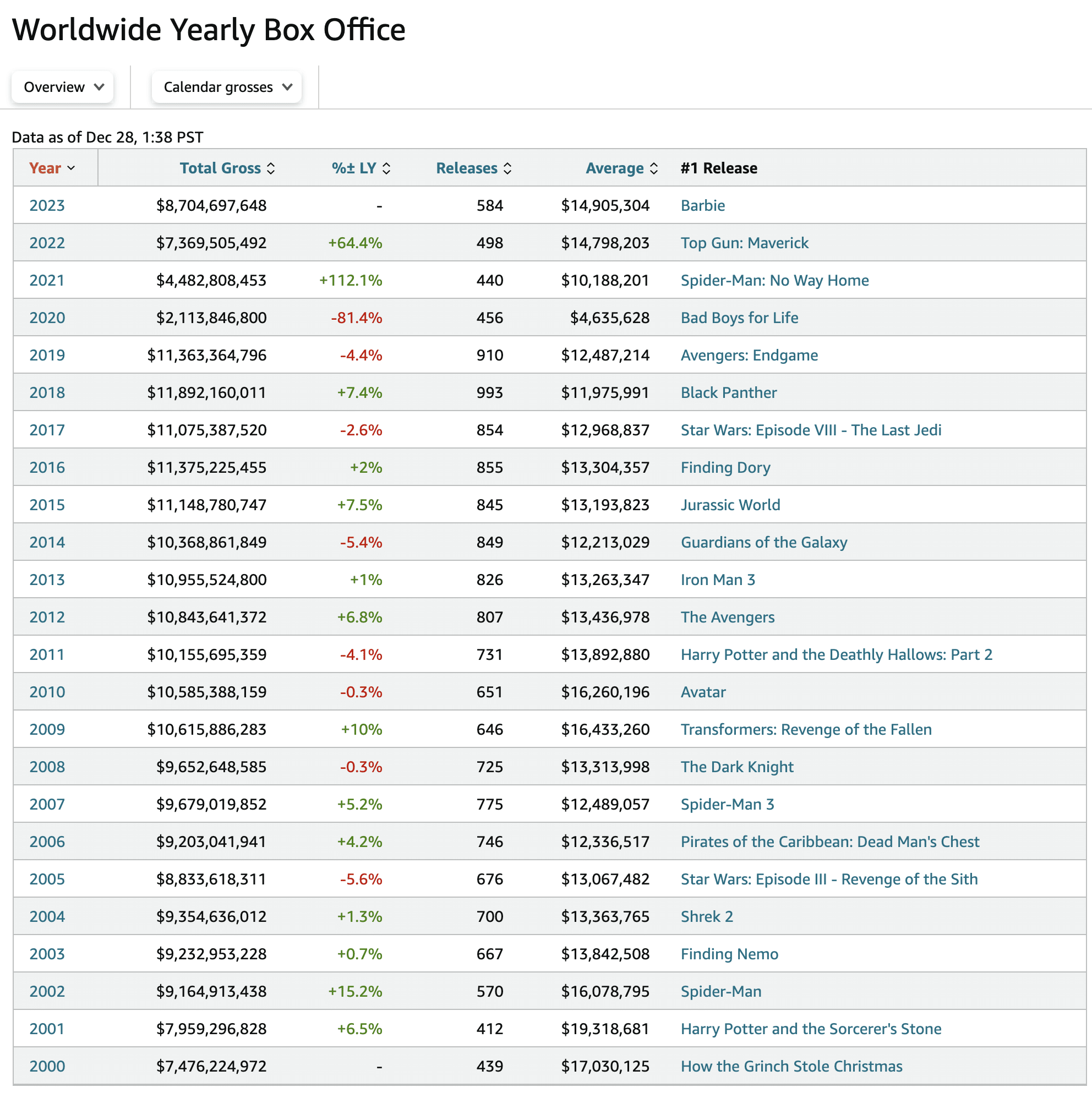

In fact, the domestic box office total for Hollywood is estimated to be at a mere 9 billion dollars for around 580 released movies. This number identically matches the number of releases and gross returns of movies as far back as 2002, not even factoring in the rise of inflation – meaning reduced ticket sales but still sold at higher price-point scales. The movie industry has not fully recovered from the Pandemic, remaining 20% lower than its pre-pandemic levels of 2019 and around 25% below its peak of 2018 when we had films such as Infinity War, Black Panther, and Jurassic World.

Despite all of these changes, none of these shifts are stopping companies like Disney from releasing 30 films in 2024 alone. Why should the company pivot when there’s almost a guarantee that most audiences are in theatres to watch a Disney movie? Disney makes up the majority of the top-grossing films amongst the blockbusters and it has been that way for quite some time.

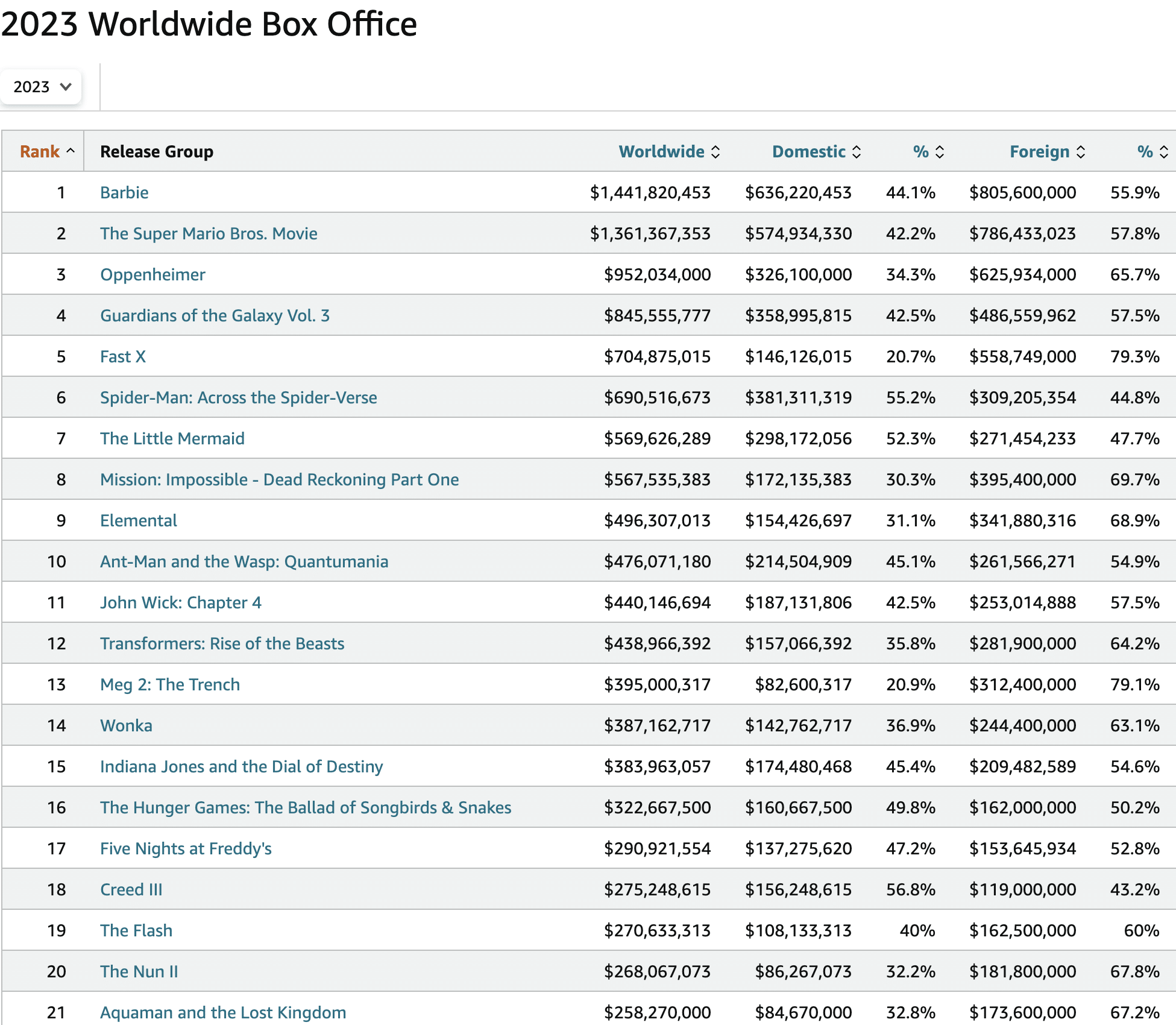

In 2023, Guardians of The Galaxy Vol. 3, Spider-Man Across the Spider-Verse, and Ant-Man and the Wasp Quantumania nabbed the 4th, 6th, and 10th top-grossing spots in worldwide gross revenue. When you extrapolate further, you have The Flash at 19, Aquaman at 21, The Marvels at 26, and Shazam 2 and Blue Beetle rounding out at 37 and 38.

What should shock you is when you look at the data, only half the amount of total movies are even being released in theatres compared to pre-pandemic levels. By this measure, market dominance is technically stronger given the lack of competition in the spaces.

Yet, industry pundits and critics worldwide do have every right to be critical given the outrageous costs of these budgets which often cost around $250 million. In comparison, Barbie’s budget was only $145 million, Super Mario $100 million, and Oppenheimer, also about $100 million. These films dominated the top three spaces in the box office even when you factor in the $100-150 million on average in additional costs due to film marketing.

To that note, the lower-cost film era may also be returning, especially noting such hits as Godzilla Minus One, a major success with a mere $15 million budget and $85 million in profits and Five Nights at Freddy’s $20 million budget with a whopping $290 million return.

I will admit that all this data taken from Box Office Mojo, which was used for over a decade as an industry standard, though unfortunately, has become paywalled and less reliable thanks to the pivot of its services to IMDB Pro.

It also should be noted how much has changed tracking data in the movie industry in the past decade alone, and that strangely, most pundits are still discussing domestic US box office performance as a measure of success despite the fact this tells us little given that films were created for, and are still commodified as, global product releases.

Take a movie like Furious 7 with a $350 million domestic release – at first glance it’s a decently profitable movie. But when you pull further back and see it made $1.1 billion internationally with a gross of $1.5 billion worldwide – it’s now suddenly a groundbreaking industry achievement.

This is strangely why domestic revenue is a somewhat terrible metric regarding a movie’s success, outside of looking at an individual country’s performance for a cross-analysis with other countries. Yet, almost every single news outlet focuses on it, in almost misleading ways. Especially, when it comes down to measuring box office yearly success yet failing to clarify – these are domestic numbers. About as relevant as comparing Fast and The Furious 7 in the US versus the entire world.

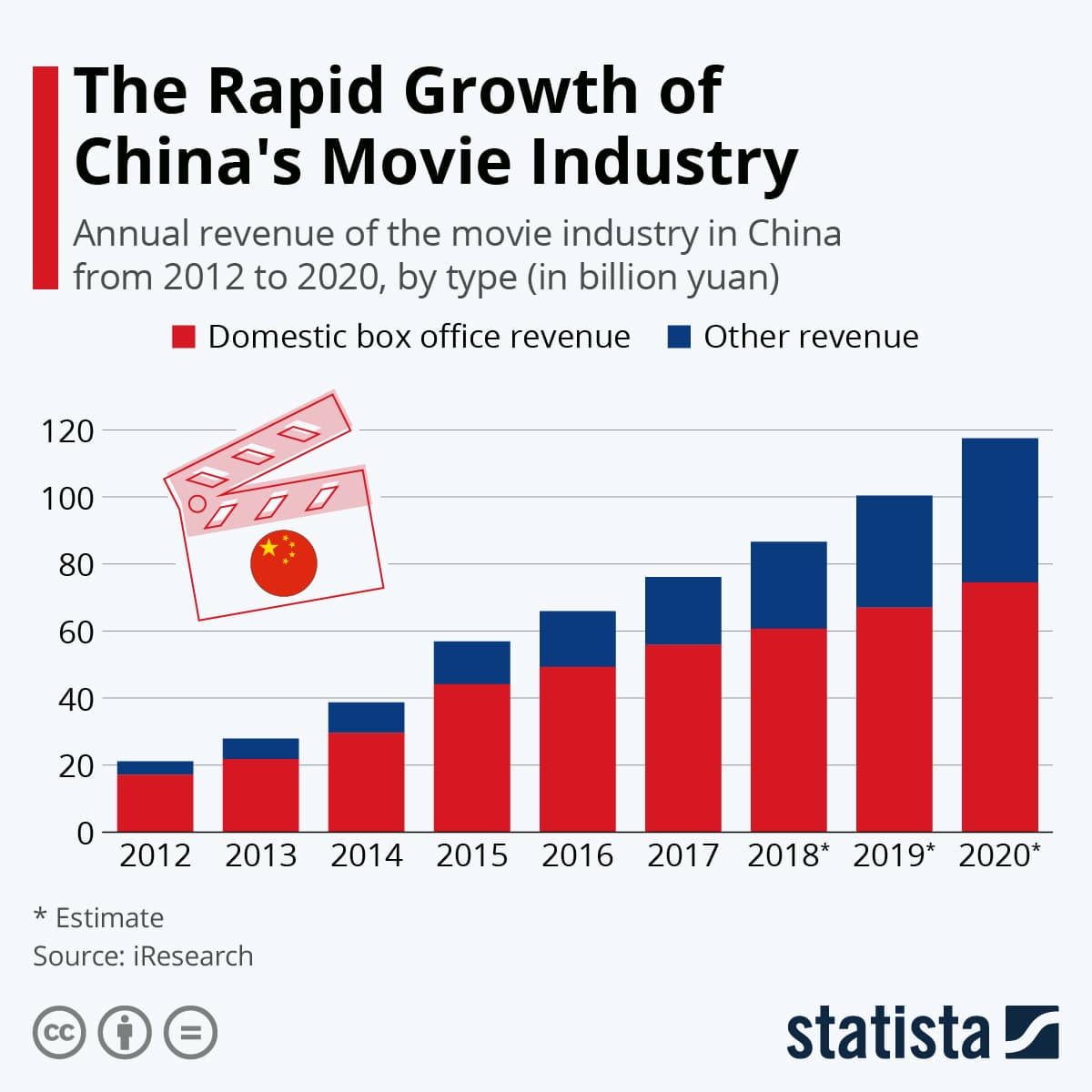

I say this because some of the data could be more accurate. The global box office totals have gotten murkier, especially when you start factoring in geopolitical issues between US and China relations. In fact, in 2020 the Chinese Box Office had surpassed ours in terms of revenue.

This soon became a major reason why films created here had kept adjusting to meet Government censorship standards in countries outside of our own, as the US changed Hollywood into something else entirely – a byproduct meant to cross-pollinate some of our ideals and beliefs across the world.

China, whose film industry for years has been rivaling the US regarding revenue, has gone from something whose ticket sales were coveted by the US film industry, to something that has had US movies outright banned by its government for topics deemed undesirable by its government such as depicting on screen, LGBTQ themes (as the country is concerned with censorship and understands its population decline issue).

As it stands now, the Chinese film market has reopened up to US releases, and yet, it seems to have not made as much of an impact in Hollywood anymore. US films are generating very little now in the country compared to pre-pandemic and pirating of big US Blockbusters has always remained a big problem internationally. The country on its own has also created a very profitable film industry and its box office is merely a billion shy of rivaling our own, so who knows if movies will ever be able to generate that same level of revenue ever again as the market has become divided.

All of this is sort of a quiet call to action regarding the needs for accurate reporting, much like how the comic industry needs to account beyond e-purchases and look at their subscription services and their data when it comes to sales. Communication and transparency have become blurred in almost every sector of entertainment, a concerning issue now in the entertainment economy that’s starting to look beyond growth and into profitability.

Because in this new age, what’s changed is not the quality of the things we once loved, but rather, our world, along with how we spend our time. For better or worse, the means of distribution have affected quite a lot of legacy media, and a lot of this has to do with the change in technology.

[In part 2 we look at how technology and video games are affecting the entertainment ecosystem.]

this is great. thank you

Comments are closed.