For the second year, ICv2’s Milton Griepp and Comichron’s John Jackson Miller have released a joint report on comics sales in the previous year, and they report that the state of the union is good, with graphic novel sales hitting a 20 year high. Sales are up in all channels except newsstand sales, where Marvel jumped ship and DC may have as well. SO STOP TELLING US TO GO BACK TO NEWSSTANDS, OKAY? Comics are doing just fine without “newsstands.”

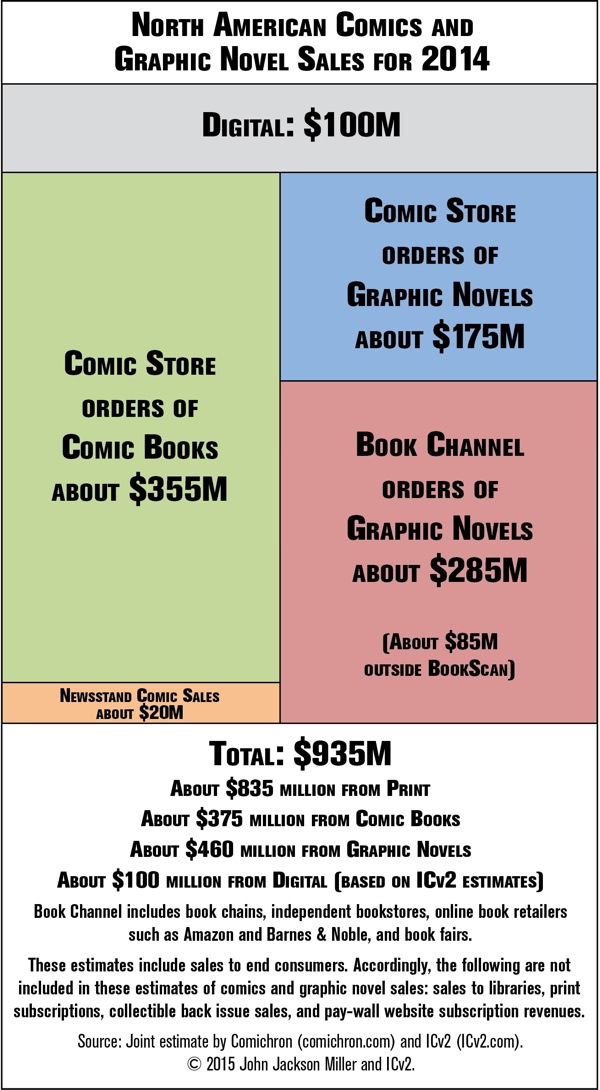

The comics and graphic novel market hit another new high for the century in 2014, and a new high since the mid-90s, according to a new joint estimate by Comichron’s John Jackson Miller and ICv2’s Milton Griepp. Total comics and graphic novel sales to consumers in the U.S. and Canada reached $935 million in 2014, a 7% increase over sales in 2013.

“It’s a very exciting time in the comics business,” Griepp said. “The broad range of titles being published, the wide variety of places they’re sold, and the great exposure comics are getting from other media are all very positive for the industry.”

“The market’s in great shape,” Miller said. “According to our tracking at Comichron, 2014 was the biggest year for print since 1995, adjusting for inflation; without adjusting for inflation dollar sales hit a mark unseen since 1993. And digital appears to be complementing, rather than cannibalizing, print.”

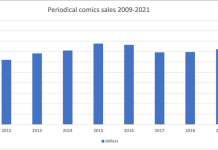

Increases were spread across all three formats. Print grew $55 million to $835 million in 2014, or around 7% more than the $780 million in print sales in 2013. That growth occurred in every channel and format except newsstand sales of periodical comics, which declined from $25 million to $20 million as Marvel withdrew from the market.

Sales of periodical comics through comic stores grew 4%, from $340 million to $355 million. Sales of graphic novels through comic stores grew at a slightly faster pace, from just under $170 million to just over $175 million.The book channel (bookstores, online, mass) was where the greatest growth was, with graphic novel sales in the book channel up 16%, from $245 to $285 million.

Download-to-own digital sales reached $100 million in 2014, but the growth rate declined to around an 11% increase over 2013’s $90 million in sales, compared to a 29% growth rate in 2013, according to estimates released yesterday by ICv2.So despite a slower growth rate in 2014 than in 2013, the signs of strength were broad, across channels and formats, a positive sign for the industry.

As presented above and in the accompanying infographic, the 2014 analysis by ICv2 and Comichron was divided up between periodical comics (what some call “floppies” or “pamphlets”), graphic novels, and digital download-to-own sales. All print figures are calculated based on the full retail price of books sold into the market, and do not account for discounting or markup. Digital sales do not include subscription or “all you can read” services.

This is the second joint market size analysis from ICv2 and Comichron; the first was last year for 2013 sales.