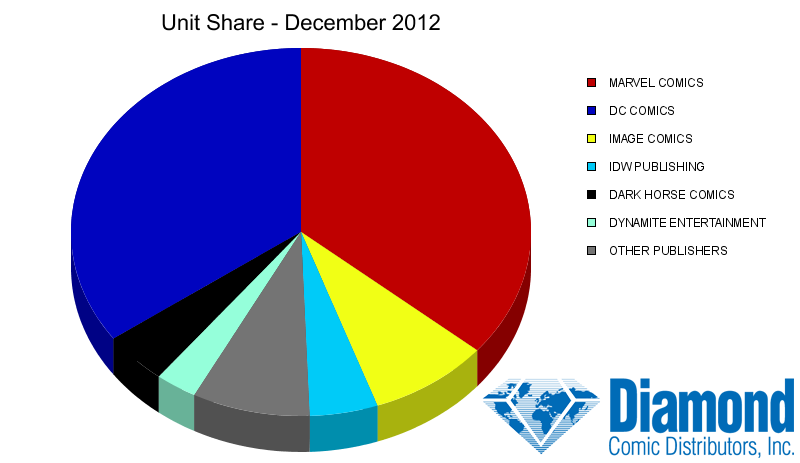

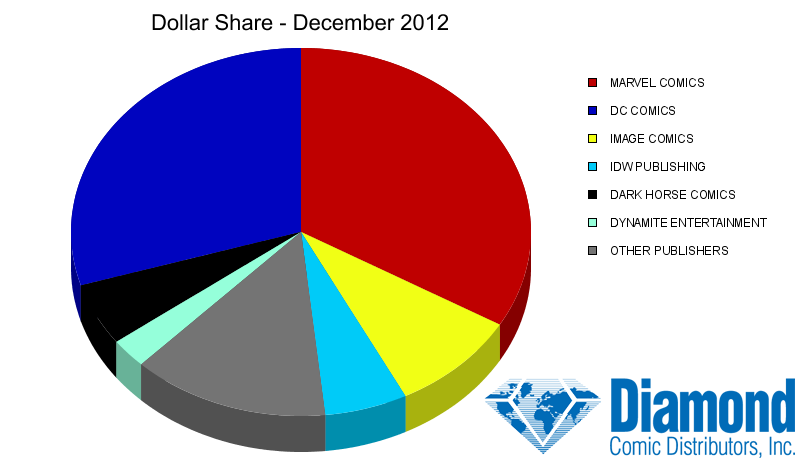

Marvel maintained its top publisher spot in both inits and dollars for December, as Diamond released preliminary charts for last month. The Marvel Now books made up 6 out of the top 10 comics, topped by the final issue of Amazing Spiderman. DC’s Batman titles had a strong showing, however.

Over in graphic novels, Image pretty much crushed it, not just with The Walking Dead but strong showings for Saga, Chew and Fatale as well, making for one of its strongest monthly shares in a while.

In comparative sales, 2012 was up in every category over 2011, although down less than 5% from November 2012.

Overall 2012 was a big honking year for comics.

|

PUBLISHER |

DOLLAR SHARE |

UNIT SHARE |

|

MARVEL COMICS |

33.40% |

36.12% |

|

DC COMICS |

29.69% |

34.84% |

|

IMAGE COMICS |

9.10% |

8.49% |

|

IDW PUBLISHING |

5.82% |

4.79% |

|

DARK HORSE COMICS |

5.49% |

4.56% |

|

DYNAMITE ENTERTAINMENT |

2.60% |

2.93% |

|

BOOM! STUDIOS |

1.69% |

1.88% |

|

EAGLEMOSS PUBLICATIONS LTD |

1.13% |

0.20% |

|

VIZ MEDIA |

0.94% |

0.39% |

|

AVATAR PRESS INC |

0.91% |

0.75% |

|

OTHER NON-TOP 10 |

9.23% |

5.05% |

COMPARATIVE SALES STATISTICS

|

|

DOLLARS |

UNITS |

|

DECEMBER 2012 VS. NOVEMBER 2012 |

||

|

COMICS |

-1.67% |

-3.45% |

|

GRAPHIC NOVELS |

-4.27% |

-4.03% |

|

TOTAL COMICS/GN |

-2.42% |

-3.49% |

|

DECEMBER 2012 VS. DECEMBER 2011 |

||

|

COMICS |

19.03% |

12.93% |

|

GRAPHIC NOVELS |

8.25% |

6.65% |

|

TOTAL COMICS/GN |

15.74% |

12.50% |

|

FOURTH QUARTER 2012 VS. THIRD QUARTER 2012 |

||

|

COMICS |

5.90% |

6.71% |

|

GRAPHIC NOVELS |

-1.57% |

-11.29% |

|

TOTAL COMICS/GN |

3.50% |

5.19% |

|

FOURTH QUARTER 2012 VS. FOURTH QUARTER 2011 |

||

|

COMICS |

9.51% |

4.42% |

|

GRAPHIC NOVELS |

14.53% |

13.86% |

|

TOTAL COMICS/GN |

11.00% |

5.04% |

|

YEAR 2012 VS. YEAR 2011 |

||

|

COMICS |

14.94% |

11.41% |

|

GRAPHIC NOVELS |

14.26% |

13.66% |

|

TOTAL COMICS/GN |

14.72% |

11.58% |

TOP 10 COMIC BOOKS

|

RANK |

DESCRIPTION |

PRICE |

ITEM CODE |

VENDOR |

|

1 |

AMAZING SPIDER-MAN #700 |

$7.99 |

OCT120626-M |

MAR |

|

2 |

AVENGERS #1 |

$3.99 |

SEP120526-M |

MAR |

|

3 |

BATMAN #15 |

$3.99 |

OCT120183-M |

DC |

|

4 |

JUSTICE LEAGUE #15 |

$3.99 |

OCT120147-M |

DC |

|

5 |

DETECTIVE COMICS #15 |

$3.99 |

OCT120187-M |

DC |

|

6 |

AVENGERS #2 |

$3.99 |

OCT120565-M |

MAR |

|

7 |

CABLE AND X-FORCE #1 |

$3.99 |

OCT120568-M |

MAR |

|

8 |

BATMAN AND ROBIN #15 |

$2.99 |

OCT120192 |

DC |

|

9 |

ALL-NEW X-MEN #3 |

$3.99 |

OCT120589-M |

MAR |

|

10 |

THUNDERBOLTS #1 |

$2.99 |

OCT120559-M |

MAR |

TOP 10 GRAPHIC NOVELS & TRADE PAPERBACKS

|

RANK |

DESCRIPTION |

PRICE |

ITEM CODE |

VENDOR |

|

1 |

THE WALKING DEAD VOL. 1: DAYS GONE BYE TP |

$9.99 |

JUL068351 |

IMA |

|

2 |

THE WALKING DEAD VOL. 2: MILES BEHIND US TP |

$14.99 |

SEP088204 |

IMA |

|

3 |

CHEW VOLUME 6: SPACE CAKES TP (MR) |

$14.99 |

OCT120481 |

IMA |

|

4 |

SAGA VOLUME 1 TP |

$9.99 |

AUG120491 |

IMA |

|

5 |

FATALE VOLUME 2: DEVIL’S BUSINESS TP (MR) |

$14.99 |

OCT120474 |

IMA |

|

6 |

THE WALKING DEAD VOL. 3: SAFETY BEHIND BARS |

$14.99 |

NOV082245 |

IMA |

|

7 |

BUFFY THE VAMPIRE SLAYER SEASON 9 VOL. 2: ON YOUR OWN TP |

$17.99 |

AUG120067 |

DAR |

|

8 |

GREEN LANTERN VOLUME 2: REVENGE OF THE BLACK HAND HC |

$24.99 |

SEP120232 |

DC |

|

9 |

THE WALKING DEAD VOL. 17: SOMETHING TO FEAR TP (MR) |

$14.99 |

SEP120449 |

IMA |

|

10 |

DAREDEVIL BY MARK WAID VOLUME 2 TP |

$15.99 |

SEP120699 |

MAR |

TOP 10 TOYS

|

RANK |

DESCRIPTION |

ITEM CODE |

VENDOR |

|

1 |

JUSTICE LEAGUE: SUPERMAN ACTION FIGURE |

OCT120316 |

DC |

|

2 |

DC COMICS COVER GIRLS: HARLEY QUINN STATUE |

SEP120277 |

DC |

|

3 |

“WE CAN BE HEROES” JUSTICE LEAGUE BOX SET |

AUG120308 |

DC |

|

4 |

MARVEL SELECT: BARBARIAN HULK FIGURE |

JUL121724-M |

DST |

|

5 |

THE DARK KNIGHT: BATMAN HD MASTERPIECE |

AUG128067 |

ENT |

|

6 |

THE DARK KNIGHT: JOKER HD MASTERPIECE |

AUG128068 |

ENT |

|

7 |

DC COMICS: POWER GIRL BISHOUJO STATUE |

JUL121879 |

KOT |

|

8 |

THE DARK KNIGHT RETURNS ACTION FIGURE BOX SET |

OCT120313 |

DC |

|

9 |

MARVEL SELECT: STORM ACTION FIGURE |

APR121690-M |

DST |

|

10 |

SPIDER-MAN RED MUSEUM STATUE |

JUL121855 |

BOW |

TOP 10 GAMES

|

RANK |

DESCRIPTION |

ITEM CODE |

VENDOR |

|

1 |

DC HEROCLIX: BATMAN STREETS OF GOTHAM |

SEP122103 |

NEC |

|

2 |

DC HEROCLIX: BATMAN STREETS OF GOTHAM FAST FORCES |

SEP122104 |

NEC |

|

3 |

STAR TREK CATAN BOARD GAME |

AUG128353 |

ALL |

|

4 |

RISK LEGACY |

JUN118204 |

HAS |

|

5 |

THE WALKING DEAD TV BOARD GAME |

JUL112137 |

CRY |

|

6 |

THE WALKING DEAD COMIC BOARD GAME |

JUL112185 |

ALL |

|

7 |

MONOPOLY: DOCTOR WHO 50TH-ANNIVERSARY EDITION |

AUG122147 |

USA |

|

8 |

DC COMICS DECK BUILDING GAME |

JUN122173 |

CRY |

|

9 |

MAGIC THE GATHERING TCG: RETURN TO RAVNICA BOOSTER PACKS |

AUG122136 |

WIZ |

|

10 |

STAR WARS RPG: EDGE OF THE EMPIRE BEGINNER GAME |

NOV122045 |

FAN |

Our 2012 numbers overall were up 26% from last year. We’ve now had 16 straight months of growth, and January is already shaping up to be #17.

Mr Jacoby- how are the Marvel NOW titles doing in your store?

Can’t see the unit share percentages. The right side of the column is getting cut off.

The must be a way to fix this consistent formatting problem.

It looks fine in my browser, Cerebro. I’m using Mac Chrome Can you email me a screen shot and let me know what browser you are using?

I do know there is a table problem and I”m working on it.

Google Chrome (PC) cuts off the publisher share.

Charles-

Marvel NOW is running the gamut from titles that have basically just held steady from pre-NOW numbers (Thunderbolts, X-Men Legacy) to moderate successes with initial growth of 20% (Indestructible Hulk, Iron Man) to titles that have been runaway hits with larger than 20% growth (Thor, Avengers).

If the NOW titles can hang onto their numbers for a while, then Marvel will help us fuel growth in 2013 the way DC did in 2011-2012, and Image did for us in 2012.

So already, in month two, Marvel’s premiere X-title is selling less than the 15th issue of DC’s third-tier Bat-title.

And Avengers #2, launching in the same month as #1, sold fewer copies than Detective Comics #15.

I’m not an anti-Marvel guy. I’m just pointing out some clear indicators of how Marvel Now is obviously not the sales revitalization scheme that it was supposed to be.

LT says

The bat books are in the middle of a crossover and selling more than usual.

In a couple of months it would be interesting to read a comparison between first 3-4 months sales trends of New 52 and NOW.

Comments are closed.