That Image #1’s chart we posted the other day and the need for comics industry sales charts continued to be the main topic of conversation in what was a slow week for news (more on that in a bit), and to the relief of all, John Jackson Miller, of Comichron.com fame, our living sales chart guru, weighed in on Twitter. With his express permission, I’m posting his comments here, with related charts.

By John Jackson Miller

Without speaking as to the provenance of the purported Image memo ranking its series launches over the last decade, as long as everyone’s searching Comichron for the figures I’ve appended here the most complete data appearing on the site.

Most figures here are the end-of-year copies shipped by Diamond to North American stores. While Diamond didn’t put out monthly reports for most of 2021, it DID release an end-of-year chart. Meanwhile, it didn’t in 2016 and 2022, so those are collated from months it did report.

The top four clearly match; lower down it gets bumpier. It should NOT be expected to sync up perfectly: Diamond was only reporting North America, and an internal Image chart might be based on something different, like lifetime sales on issues, or first-month sales before returns.

We’re now over a year removed from the last monthly distributor chart release. While many have discussed options, my position remains that distributor-level reporting of actual copies shipped remains the most useful metric, and the one closest to what we had for 80+ years.

Circulation is copies shipped minus returns, and it tells retailers how much material is on the market, while telling buyers now and in future years what’s rare and what isn’t. Rankings without numbers may interest publishers, but aren’t as helpful to collectors or historians.

Consider you’re looking back at the Top 20s from two years just five years apart: 2010 and 2015. If you’re going from raw rankings, you don’t have much of a way of comparing the charts. You might remember some of the comics on the right were big, but readers in 2040 might not.

Now look at the same charts with Diamond’s end-of-year data — and see that every top 20 title in 2015 list outsold 2010’s top seller. Diamond sold 29% more comic books by units in the latter year. That’s valuable added context that goes far beyond the monthly “horse race.”

It’s true there are 1980s and 1990s distributor charts on Comichron which are just rankings, but they’re based on actual data from those distributors and the numbers behind them are discoverable. That’s what much of my research time has gone into since the flow of new data ended.

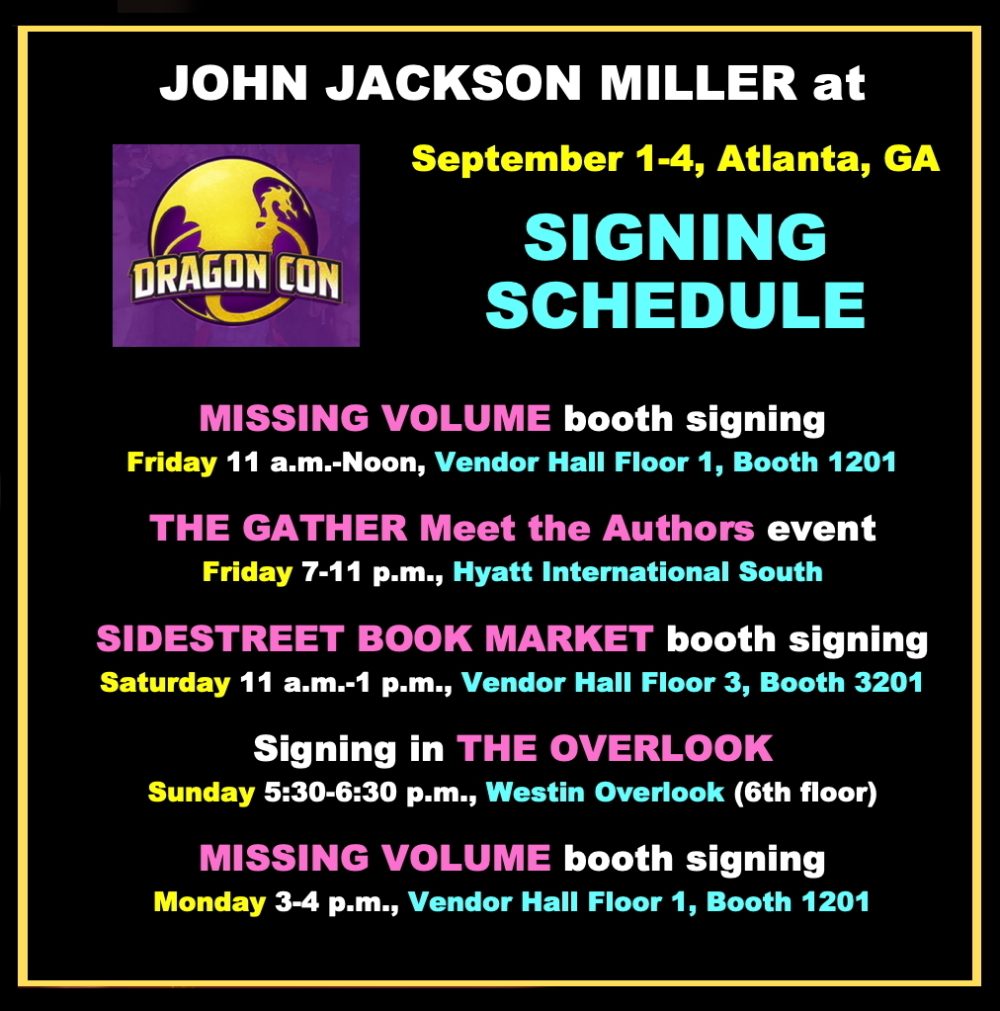

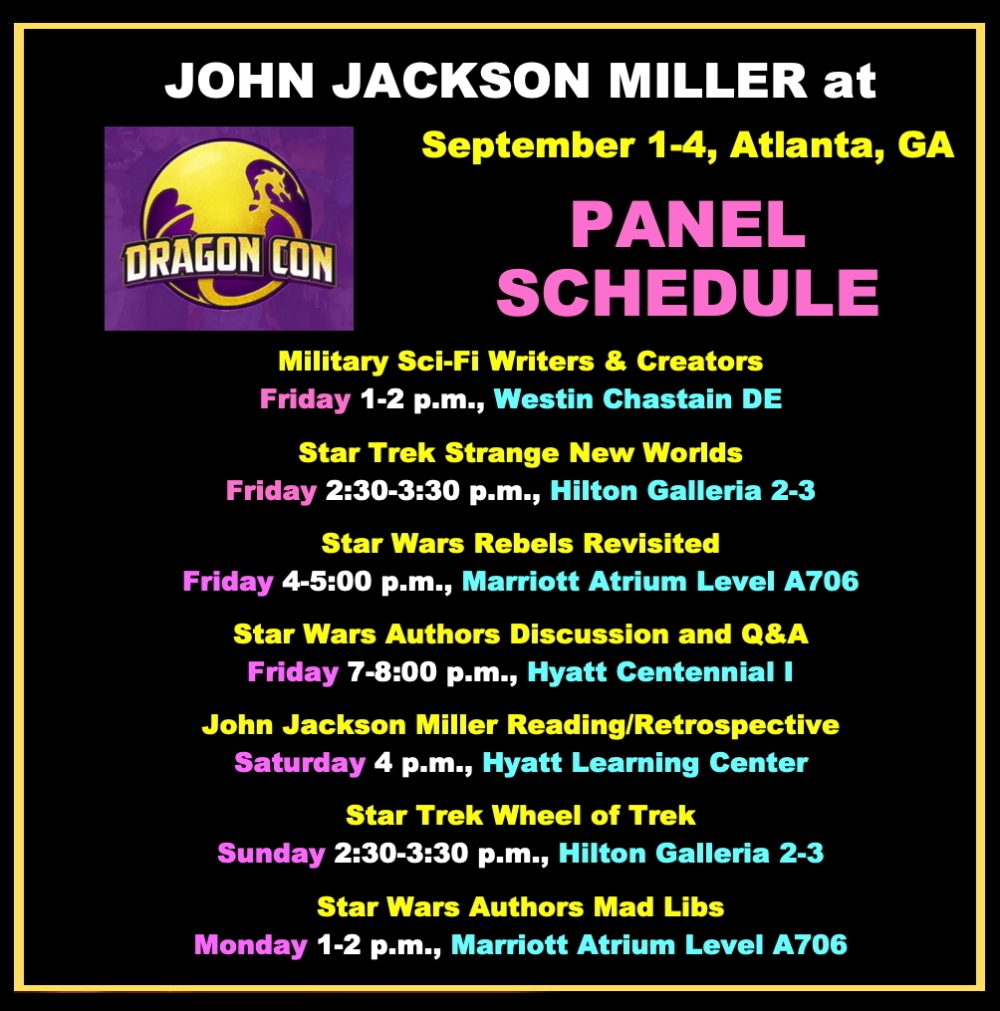

(Tangentially, I’m also finally able to accept invitations from conventions that fall early in the month — I’m a guest at DragonCon this weekend. It was never possible in the Diamond sales chart era — the sales numbers always had to be processed over Labor Day weekend!)

At any rate, that’s what the archives have to say about the memo — plus some of considerations future chartmakers need to look at. It’s been a busy spring and summer of travel and deadlines, but there’s more to come on the historic data front from Comichron later in the year.

While we eagerly await more sales data from Miller (and please go buy some of his books at Dragon*Con) some rather random thoughts that I gleaned from other conversations and bulletins this week.

• Image Comics sent out a release noting that “Multiple issues of James Tynion IV & Fernando Blanco’s best selling W0RLDTR33 are being rushed back to print this week in order to keep up with escalating demand. W0RLDTR33 issues #1-4 reprints will hit shelves this September.”

The fifth printing of WORLDTR33 #1 brings the number of copies in print to over 150,000, it’s noted. Publisher Eric Stephenson said “James and Fernando are at the top of their game with this series, and anyone who has read these first five issues will tell you it’s been thrilling to watch this disturbing world take shape. The reception for this book has been nothing short of astounding, but just like The Department of Truth before it, the demand for additional copies has been relentless.”

Tynion IV added: “I really can’t believe the continued support you’ve all shown this book, as it grows and finds its audience. W0RLDTR33 is going to be on the stands for many years to come, and it’s a thrill for Fernando, Jordie, Aditya, and I to see it find so many more new readers every month.”

That 150,000 copy figure is useful for those of you keeping score at home, and while we don’t know what else was big this month, Stephenson and Tynion’s statements could stand in for an imaginary sales chart where WORLDTR33 #1 is the top selling book, if you squint a little.

• Fairsquare Publishing joined in the fun with a sassy tweet noting that four of their graphic novels had sold out. I’ll summarize their little sales chart here.

1- NOIR IS THE NEW BLACK – “It took two years, but our massive second edition is now gone. The two combined editions sold over 5000 copies to date. A third edition should arrive in February 2024 and will contain a few surprises.”

2- A BOY NAMED ROSE -“Gaelle Geniller, the writer/artist is a sensation on Instagram with over 100K followers. Initial orders were anemic, but we persisted. And re-orders have been spec-ta-cular! It took 30 days for A Boy Named Rose to sell out. Yes, a new printing is on the way.”

3- ULTRALAZER – “Another book many retailers overlooked. But we knew we had a middle grade winner here. Once we delivered, the book sold out in two weeks, this August. Reprint will arrive in the Spring alongside volume two.”

4- NOT A NY LOVE STORY – “Fastest sellout ever at the company! The Voloj/Gefe supernatural romance effort did not even reach bookstores and it’s already gone at the distributor! Released August 23rd in comic book stores, it is scheduled for September 5th everywhere else books are sold. Well… No more copies. Reprint on the way.”

This is a nice achievement for a publisher that puts out mostly non-kid/ya graphic novels – the toughest sell in the bookstore market. (h/t to Brigid Alverson for pointing the tweet out to me.)

• Taken together, these little news items suggest to me – once again – that at least some publishers are itching to see sales charts once again, so they can tout their successes. As I discussed this with colleagues – both in person and online – the general consensus is that we need sales charts. One well informed person even suggested that without them, the periodical might be in real trouble. I’m not sure that’s true, but it is a concerning matter.

• All that said, more than one person pointed out that the Image #1 chart is kind of…meaningless to show long term success. #1’s sell a gazillion copies and by issue #3 it’s 1/3 that….if you’re lucky. Standard attrition. Saga – the book that everyone seems to agree we need a new one of – did not make the top 25 chart but has gone on to be one of Image’s steadiest sellers, with Vol. #10 Image’s second best selling book of 2022, according to BookScan. #1 sales are also dependent on all kinds of stunts and variants. The chart is interesting but not really useful.

• To reiterate what I reported at SDCC this year, at the ComicsPRO retailer meeting, the board emphasized that they are working to clean up comics metadata, which is a very urgent matter to allow all the different distributors to work together. Once this is done, the group will turn to sales charts, but this is years away. A key interview with ComicsPRO president Jenn Haines from right after the annual ComicsPRO meeting that was published at ICv2 stated this all pretty clearly. Since I’m trying to keep all the information in one place, here are the relevant comments.

HAINES: The biggest focus was on data. We did a big session on how to get consistent metadata, which is critical for how we present and promote new material. We had a data summit attended by people from the POS side, the distributor side and publishing partners to see what’s going on and how to get more consistency and transparency. Publishers are heavily invested in that, especially the Big 2, who have corporate reporting requirements. They need sales charts that show how they are doing relative to each other and the rest of the market. Diamond used to handle all of that, but now that they are no longer in a position to do so, ComicsPRO can step up and be that neutral party to bring everyone together.

What are the big areas of focus moving forward?

HAINES: Getting the data sorted out, as we discussed earlier, is a big one. Also, gradually moving from sell-in sales to sell-through data is going to be huge. I don’t want to get people’s hopes up as it might take us a couple of years, but progress is being made and ComicsPRO is in a great position to push it forward.

That the fact that they were able to have a data summit at all is another tantalizing hint that it’s not just snoopy journalists who want this information out there.

• If you want more than a hint, there’s this piece which reports that Marvel, DC and Image indeed all want sales charts, but won’t share their information unless everyone shares, and there isn’t enough trust to make it happen. I’m reminded of this great meme.

In other words, a stalemate! The above linked piece rejects myself, Graeme McMillan and James Vicardi as independent enough to handle such red hot data, and as much as I love Jim and Graeme….none of us are even vaguely qualified to do such a thing! You need someone who actually handles data AND has a reputation for integrity. I would suggest John Jackson Miller, but let’s face it, JJM is busy being a notable author. He’s a gentleman of leisure number cruncher now.

My feeling is that there is quite a bit of distress in the industry right now that makes this project more urgent than before, however. In the olden days, someone like the late Mel Thompson would have been ideal. I don’t think finding someone impartial and fair is an impossible task though….far from it. The world is full of data analysts, and some of them even like comics.

• This deserves a longer analysis, but even allowing for people to be on an end of summer vakay (and a lot of people were) I was shocked that all of this discourse took place…in conversations, emails and dms, not on Twitter like it used to. Straight up, Twitter doesn’t exist any more, and its relevance as a place for breaking news and conversation has been killed dead, with no replacement. I’m sure there were a bunch of YouTube videos and TikToks about it, but I don’t have time for two hour livestreams and my TikTok feed is all hairdos at the moment. In other words, you may be stuck reading blogs and websites again for your comics news analysis.

• In the meantime, I’m always open to leaks, links and individual charts – heidi at comicsbeat.com. Anonymity guaranteed. Have a nice holiday!

I think we need both monthly sales to retailers as well as monthly sell-through at retailers. Together, they show the total picture.

I’m stoked Twitter is dead! I’d much rather read comics news on blogs and websites!

I don’t know whether blue sky is the true twitter heir, but it feels like most of old comics twitter has migrated there.

Int.

Any retailer with any common sense, will NOT make their Sales Data available. You would have to be really dumb to do this. It could affect so many things, in such a bad way.

“That 150,000 copy figure is useful for those of you keeping score at home, and while we don’t know what else was big this month, Stephenson and Tynion’s statements could stand in for an imaginary sales chart where WORLDTR33 #1 is the top selling book, if you squint a little.”

It seems like the purpose of the recent spate of sales chart articles is to give the perception that the Direct Market part of the comics industry is profitable . Why this impression needs to be given when the demographic for the Direct Market is shrinking, I don’t know.

If the purpose of talking about sales was was about sales, Heidi and Rich could have just tallied the sales of copies sold from a number of comic stores across the United States.

The market for original graphic novels seems to be the same as “young adult” fiction: librarians otherwise the Big Two would have switched to ogns with a high markup.

When librarians were interested in comics being mature we got a lot of original graphic novels that were mature. Now, they want “young adult” fiction and the American comics industry is producing a lot of original graphic novels for “young adults”. Frank Miller and Garth Ennis, supposedly “mature reader” creators have produced YA content.

“lefsetz 09/03/2023 3:59 am At 3:59 am

Any retailer with any common sense, will NOT make their Sales Data available. You would have to be really dumb to do this. It could affect so many things, in such a bad way.’

Sharing with the public what is selling and what isn’t is bad for business. Customers who shop in the Direct Market don’t want to be associated with an industry that’s in decline. Same for the publishers. It is important that sales numbers are presented in a positive light. It’s not cooking the books. It’s called providing the correct context to interpret data.

It might be “my fault” ULTRALAZER sold out? We picked it for the Kid’s GN Club for Sep, and so grabbed up ~325 copies after FOC time.

I found the Image list to be semi-useless, because, yeah, just issue #A1, and not #13 — Am I wrong that a number of those were returnable and a different number has hardcore exclusive cover deals.

@Chrishero: as a rule of thumb, one should always assume that (on most books, selling , oh, 75k or under?) that sell-in = sell-through, because exceedingly few retailers are stocking inventory that they’re not selling in 90 days any longer. Diamond GNs likely had a much bigger gulf because, oh, lets call it 40% of GNs that retailers buy don’t sell that copy within the first six months, necessarily.

@lefsetz: For example, I report GN sales data to the NY Times charts. I trust them to not doing malicious things with it. I could potentially trust BookScan. But I didn’t trust Diamond, so I sure wouldn’t trust Lunar or PRH. The nice thing about DCD sell-in charts were that, “thanks to ‘monopoly'” they reflected 100% of what it said on the tin.

@layman: it seems lazy to declare the “Direct Market demographic is shrinking” — things are much more complex than that!

-B

Comments are closed.