Rounding up some of the business news and trends of the last few days:

§ The big, big news is that Simon & Schuster has been acquired by the private equity firm KKR in a $1.62 billion deal. S&S is the largest distributor of graphic novels in the US, according to ICv2, handling VIZ, BOOM!, AWA, Oni , Mad Cave, Andrews McMeel, and soon, Image.

While being acquired by a private equity company sounds like it could lead to a grim future (often resulting in companies being downsized and then sold for parts), KKR has a decent sounding track record and brave smiles are being put on everywhere. CEO Jonathan Karp and COO/CFO Dennis Eulau will stay on board and Karp sent out an optimistic email to employees. Publishers Weekly has more:

In making the announcement, KKR promised to “support numerous growth initiatives, including extending Simon & Schuster’s strong domestic publishing program across various genres and categories, expanding its distribution relationships and accelerating growth in international markets.”

That promise signals a change in direction for S&S employees, who have received little support from Paramount following the failed PRH deal, as Paramount viewed the publisher as a discontinued operations while it looked for a new buyer. Despite this, S&S employees managed to produce a record year in 2022.

In his letter to employees, Karp noted that KKR’s “commitment to growth is one of the reasons I’m so glad KKR will be our next owner.”

Simon & Schuster was previously owned by Paramount/Viacom, which wanted to get out of the book publishing business to concentrate on the wonderful world of streaming and strikes. A sale to PRH was blocked by the Justice Department, to the relief of authors and agents who thought having one company own so much of the publishing business would lead to decreased competition. HarperCollins was also major suitor once S&S went back on the block but that didn’t pan out.

Obviously, the health of S&S and their distribution arm is crucial to the graphic novel business. For now things look good, but Vanity Fair digs in a bit with a lot of analysis and quotes, noting that KKR’s media team is led by Richard Sarnoff, who has a solid track record as a publishing executive.

The icing on the cake is that the S&S crew will get an ownership stake once the sale closes. (And it is expected to close this time, since KKR ownership won’t raise the kind of antitrust alarms that a rival major publisher would.) For context, as part of KKR’s flip of the audiobook company RBmedia, now being offloaded to the investment firm H.I.G. Capital, the average payout once the ink dries is expected to be a year’s pay or a minimum of $50,000. Here’s Karp again: “Of all the prospective buyers we spoke to—and there were a lot of them—KKR was the only one that discussed its plans to support Simon & Schuster in creating an equity ownership program to provide all of our employees with the opportunity to participate in the benefits of ownership after the transaction closes.”

The vibe I’m picking up on from inside S&S is that this deal, brokered by Aryeh Bourkoff’s LionTree, has been met with both a curiosity about what the future holds and a sense that KKR’s ownership is perhaps the best outcome. This jibes with reactions I’ve gotten from the outside. “If there’s any publishing house that can handle the pressure of a private-equity owner, it’s S&S. The PRH offer was too good to be true. This is the reality check,” said a veteran editor at a rival house. Adding a dash of caution, this source continued: “S&S is known for being the leanest, most bottom-line-driven publisher in the business. How much leaner can they get? We’re about to find out. Atria will probably thrive, but [fellow imprints] Scribner and Avid Reader could be facing some serious belt-tightening.”

Still, KKR was also partly responsible for putting Toys R Us out of business when KKR went with bankruptcy rather than restructuring. You can read a 2019 summary of KKR investments here, and it’s kind of hair raising.

This story is extremely developing, but where it ends up may not be known for years. On a positive note, while publishing sales have been slipping from pandemic highs, it’s still a profitable business overall, so an urgent firesale isn’t called for.

§ On Monday, UK cartoonist Will Robson tweeted that a creator owned comic he was working of for IDW comic had been cancelled mid stream:

Well. This sucks. My creator owned book with IDW just got cancelled midway through making it. I’m devastated. After spending years on the pitch I’m truly gutted. This was a huge opportunity for me as a creator & now it’s gone. Guess I’m free if anyone wants to hire me…

Robson tweeted a few WIP pages and they looked very good!

Might as well share some of the art with y’all since it ain’t seeing the light of day and I’m super proud of these pages! pic.twitter.com/41sFp0QQAi

— Will Robson (@robsonink) August 7, 2023

This fine work immediately drew interest from other publishers on Twitter, as Robson explained that he all owned the rights to the book, although he was constrained from saying anything else.

However this did lead to a few more tweets from disparate sources saying that other IDW Originals that were in the works had been cancelled, backing up the idea that selling all new all original comics periodicals in this market is hard. But at this point its all rumors and nothing confirmed.

I reached out to IDW and they had no comment.

§ By chance, yesterday ICv2 had an interview with IDW’s co-publishers Mark Doyle and Tara McCrillis, part of their annual series of check ins with publishers at SDCC. It’s been a rough year for IDW, with layoffs and restructuring, but things are moving forward:

What are IDW’s key publishing initiatives for the rest of the year?

McCrillis: Leaning into our licensing as much as we can, getting as much as we can out of that, letting the fans have what they want, but then also pushing our Originals. We’ve got some big talent coming up, some great stories to be told, so a nice balance.

Doyle: Exactly, a good balance. Also, I’m glad you gave a shout‑out to Originals. We just announced three new projects with the Originals. Scott Snyder and Hayden Sherman returning with Dark Spaces and doing some new books in that line as well, and trying to help that grow.

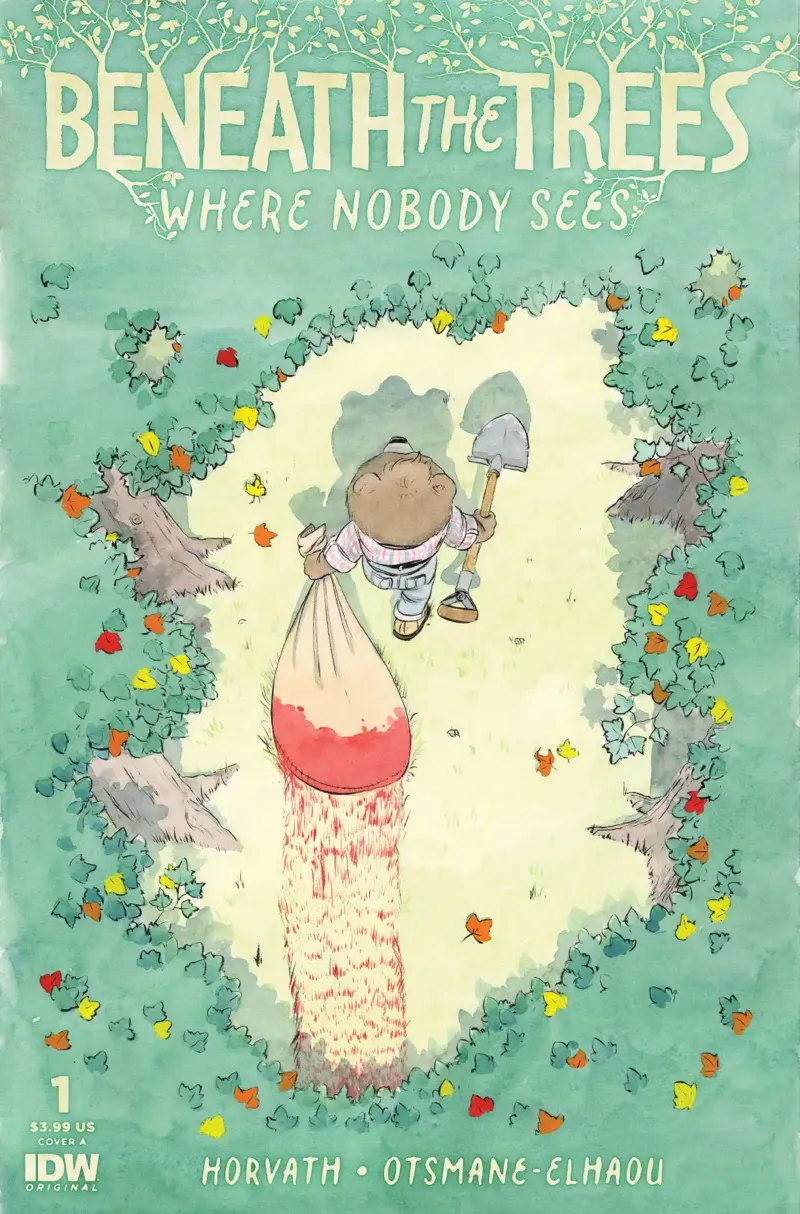

We also announced a book called Beneath the Trees, which is very quirky and strange

It does look nice!

I definitely recommend reading the whole interview at ICv2. I recommend just subscribing to ICv2, as they cover the business of comics like no one else, at witnessed by the number of items I’m linking to from them.

§ ICv2 also sat down with Mad Cave Studios’ Publisher Chris Fernandez and Vice President – Business Development Mark Irwin, and they are also looking at a mix of licensed and originals and creator owned titles, which they see as a different kind of publishing.

So the mix changed between originals and licensed. Why did you change the mix? Do you see that changing going forward or staying the same?

Irwin: I think our mix has always been one‑third of each, licensing, originals, and creator‑owned. That’s always been our goal at least. Over the last couple years, that’s been our growth goal.

What’s the difference between originals and creator‑owned?

Irwin: The big difference there is that what we call originals are what we create and develop in‑house. Then we hire work‑for‑hire talent to work on those things. Creator‑owned are outside creators that we talk to, that bring their IPs to us. We do a creator‑owned deal with them to publish those titles.

How is the overall publishing output of Mad Cave going to change as a result of all these new licenses, or is it?

Chris Fernandez: It’s similar to what Mark was saying about the one‑third of each, about every month. Next year, for example, you’re going to see a strong influx of strong creator‑owned titles to start out the year. We’re never going to lose focus on our originals.

There’s a lot more in the interview, so once again, the whole thing is recommended.

§ Against all this, a retailer report from a month ago on SKTCHD that you can believe was the topic of much conversation at SDCC. The whole article is free to read, and reveals lowered sales and heightened anxieties at retailers as we survive the “Post Pandemic Sale Slump” – or PPSS as we might just call it. And author David Harper floated a pretty alarming idea:

Earlier this year, I was talking with a retailer who had a big thought about the state of things. He wondered whether comics retail had died already, effectively, and what we were existing in now was a “zombie direct market.” It continues to operate simply because it doesn’t know how to do anything else — with the massive boost the pandemic proved to be for comic sales fueling its second life.

I bring this up because Field said something that reminded me of that. The veteran retailer emphasized that “publishers are not producing periodicals in a value-driven way,” electing to “pump out more and more variant covers in the vain hopes to find more buyers.” Field doesn’t see that as a winning formula, at least not for a healthy direct market.

I was reminded of that when I saw an email cross my desk yesterday morning with the headline “SEVEN MORE WALKING DEAD TEAM-UP VARIANTS REVEALED OF THIRTY-FIVE TAKING OVER SHELVES THIS OCTOBER”

The covers are nice and people like zombies, but that seemed like yet another example of the “variant cover pump” that publishers are falling back on.

Another story, or trend, that is extremely developing. We’ll link to more ICv2 publisher interviews as they come out.