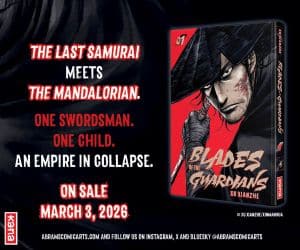

Sponsored by Battle Quest Comics

By Brian Hibbs

So, Heidi asked me that for the third of the “New World Order for Retailers” columns that I cover the variety of brand-new distributors that are starting to spring up in the wake of Diamond’s collapse. And there are quite a few. The most visible might be “Philbo“, but there’s also “Power Pulp” and “Curator of Comics” and probably a few more that came into my inbox then almost immediately fell out.

There’s an issue however: I genuinely don’t want to yuck anybody’s yum (seriously!), but most of these new businesses are trying to take pathways that are essentially antithetical to retailers actually making any profit on the sale of comics, and to make this point properly understandable, I must go fairly deep on several subjects. So… I’ve been slow to start writing this one.

First off, let’s begin with cursing Diamond for what it ended as – poor inventory control and record keeping, which ultimately led “Sparkle Pop”‘s Diamond2 iteration to selling material that had no or at least uncertain title upon; terrible communication which cause massive amounts of confusion and strife, and so so so much extra work and losses for retailers and publishers alike. Diamond should be very rightly castigated for all of this, and probably much more. And yet, it grows gravely tiresome listening to folks with little day-by-day, week-by-week stake or interaction with what Diamond was and did cheer on the demise of what was an utterly central pillar of not only what the Direct Market was, but all of the things that it allowed the primarily mom-and-pop Direct Market stores to build and accrete over the years.

Here’s the thing you really need to understand: the very model of non-returnable periodical comics that are (relatively) low priced, and which also allows serializations with sub-2000 copy print runs to have national (!) distribution, was really only even slightly economically viable overall because of the profit from the best-selling comics that flow through that same system.

Now this wasn’t too big of a problem, I suppose, when you had 100% of the volume and velocity of all periodical comics flowing through. The profit you make from the best-sellers (from Marvel, DC, Image, and the rest) really covered for a ton of the losses coming from the poorer sellers. But once DC pulled themselves out of Diamond, that was a significant and mighty Jenga block to remove from the underlying structure that was supporting the industry. And once Marvel followed suit, then the math became completely impossible for Diamond. Losing ~70% of your volume? That’s simply not sustainable in any fashion to viably distribute periodical comics.

“We got rid of a monopoly, hurray!” declared people who don’t actually understand the underlying math. Because without that monopoly, most creators and publishers are ending up with less access to the marketplace – and all we actually did was replace one monopoly with two different ones. At the moment right now I still have zero choice where I can viably purchase DC or Image periodicals other than Lunar. Or Marvel, Dark Horse, IDW or Boom periodicals other than Penguin Random House. That PRH and Lunar “compete” in the overall “distribution of periodicals” means exactly nothing if we retailers don’t have freedom of movement between distributors, and the ability to leverage competition in order to get better deals.

In fact, I think it actually means less than nothing, because it did nothing whatsoever to help with margins for most retailers – costs have basically done nothing but increase for most of us since DC left Diamond in 2020; both from the direct changes in discount calculation, as well as the substantial indirect costs involved in needing to navigate parallel, but mostly un-interchangeable, distribution systems.

That’s so much time, and energy, I can barely begin to tell you. Because the other thing that Diamond did, besides enable the bottom third or so of the market to even exist, was to smooth and organize the data that was coming in to make it significantly easier to both order, as well as market (through tools like the all-publishers Previews magazine), comics products. I’m now losing, quite literally, at least a full day’s work each and every month to now having to fix, relink, reorganize and rename data just so I can reliably do the most basic part of my job: ordering comics.

Here is what I believe is a reality for a lot of stores: while retailing comics can supply a reasonable enough living, it is generally not a path to vast riches for most stores. As near as I can tell, the overwhelming majority of stores are essentially “mom & pop affairs” who have incredibly small staffs that are backing up the owner/operator. Most of those owners are working very long hours to keep on top of the increasing mechanical complexities of retailing comics, but can’t simply scale up staff to compensate, because our margins have been simultaneously eroded. While most stores are likely economically sound, I believe that it is by a smaller margin than it has ever been before now.

Please understand that while certainly there are many days we are able to meet or beat $2000 in a sales day, there are also days we absolutely only gross three or four hundred bucks. This is the nature of retail. And I know that this isn’t just me: at least in my own micro-environment of San Francisco proper, when I opened in 1989 we had twenty-four comic book stores, and now we’re down to just eight in 2025. I’ve spent thirty-six years keeping my head above water – just like most of my local peers — but running a retail store in meat space isn’t, even slightly, a trivial matter, and we, by and large, spend much of our year just barely staying above water.

Now, similar calculations can get made when the ordering process happens – again among the many things that Diamond brought to the industry was consolidation and concentration of time involved for retailers for ordering, tracking orders, receiving packages, having to potentially handle damages, shortages and returns, paying bills and so on. Simply placing an order has costs! When you add up all of the various steps involved, it is essentially impossible to make a profit for our operation, at least, until we are generating at least enough money to pay for all of the steps of labor involved from stem to stern. Even removing general operational costs it still means that, minimally, orders placed and being received by my store that are below at least $50 pretty much automatically lose money. This is because from the initial order through to the paying for the product and all of the steps in between invariably take at least an hour, all told.

This assumes “industry standards” are being met – 50% off, free freight, normal payment terms. In that circumstance, a $50 order can generate $25 of “profit”. But change any of those inputs, and the math gets worse. And here is where we start running into heinous issues with “small press only” distributors. Most of them are offering just 40% off, and charging non-optimized freight costs, as well as making us pay in advance of receipt! Suddenly, that $50 order is only generating $15 (or less) of “profit” – and tying up money for months to boot. So, thus, to generate enough money to at least pay for labor (no rent, no taxes, no utilities yet), my “break even” point shifts from a $50 order to at least $75. This is untenable towards the goals of staying in business.

This is probably an overly broad statement, but generally speaking creators/publishers who are only able to land at a “small press” distributor are ones who are dealing in bespoke quantities to begin with, the kinds of books that are generally “special order only” at the vast majority of stores. There are multiple periodical-focused publishers right now that I absolutely carried for special orders before the Diamond collapse – some who have been in business 20-30 years, even! – but who sell such a specialized product that there’s no real growth opportunity, where the sole reason it made sense to stock their works for the 1-2 interested customers was because it was truly incidental additional labor to the fully-profitable ordering from the largest vendors. But going out of my way to ordering them from a distinct distributor that doesn’t have twenty other publishers that have broadly commercial prospects? (Or worse yet, directly from the publisher itself?) That almost never is going to make sense as a regular, profitable action in the normal course of business.

Like I said at the top of this piece, I sure don’t want to yuck anyone’s yum. I love comics too much for that! But without either sheer margin to allow for profit, or a huge amount of velocity and volume, adding new distribution for periodicals, at under the minimum understood requirements for retailers just is never going to work out. The math doesn’t math. It absolutely takes unified and national distribution to have a chance for periodical publishing to be even theoretically profitable for the majority of retailers.

Sorry.

Brian Hibbs has owned and operated Comix Experience in San Francisco since 1989, was a founding member of the Board of Directors of ComicsPRO, has sat on the Board of the Comic Book Legal Defense Fund, and has been an Eisner Award judge. Feel free to e-mail him with any comments. You can purchase the two collections of Tilting at Windmills (originally serialized in Comics Retailer magazine) published by IDW Publishing. You can also find an archive of pre-CBR installments right here.

Photo by Stanislav Kondratiev via Pexels

Sponsored by Battle Quest Comics

How much of this is unique to the non-returnable nature of the direct market operations model? Do other brick and mortar retailers (traditional bookstores, clothing retailers, electronics retailers, etc.) have a business model built upon having only one distributor? If they have multiple distributors, how do those retailers make that model work? I’m not in retail, so I’m just curious.

“You also have to pay the marginal costs of warehouse rent and utilities (not trivial) – you add all of that together, and it would seem pretty obvious to this observer that the bottom third, to maybe the bottom half of comics, that were moving through Diamond’s systems weren’t making a penny in profit!”

There wasn’t any profit in the premiers either, Brian. Diamond only received a handling fee, something like twenty cents a book, with the rest going to the publisher. Steve Geppi said as much in a video he did during COVID, talking about Dark Horse and their contract. These handling fees were set in the 90s and never adjusted. That’s why Diamond could never offer free shipping; there wasn’t enough profit in, for example, a case of DC going out to a store, to cover the expenses (pick, handling, shipping) that would make it viable.

Assuming Marvel’s deal with PRH is similar, I imagine PRH is taking a loss on Marvel free shipping and treating them as a loss leader to get customers (ie., retailers) in the door. And I imagine Lunar’s deal with DC and Image is similar to their Diamond deals. I can’t really see the publishers taking less of a cut than they had with Diamond. But I don’t know, nor do I particularly care.

I raised the question a time or three if we were actually making any money on, for example, some of the variants publishers were offering, and I laid out an argument that there were opportunity costs involved as well (spending time managing product data that could be spent instead on more profitable products) and was told that, yes, that’s a good question, and no, that was not a bear to poke.

I came to Diamond from a retail background (video games), and margin was something we talked about day in and day out. Margin, if it came up at Diamond, never came up in Marketing. None of our efforts were ever oriented around margin. Instead, especially in Dateline and Daily, the publisher coverage was contractually dictated, and there was never the manpower beyond that to do the content necessary to push the higher margin products. Diamond was pathologically indifferent to protecting its own business.

Daniel, yeah, in book retail, there are multiple distributors but you can order any given publisher’s books from several of them rather than just one (that was a smaller point Brian made earlier in the column). For example, Penguin Random House distributes all of their own titles as well as a dozen or more smaller publishers. You can order these titles from them, or from a wholesaler like Ingram, Bookazine, or Gardners who carry almost every book published. Beyond that, some publishers sell through Faire, a kind of gift shop distributor that normally deals in stuff like stationery and home goods. So, if I wanted to order a copy of something published by a Random House imprint, I could order it directly from them, or Ingram, Bookazine, Gardners, Faire, and potentially others like Olympia Wholesale. Every one of them has different pricing, shipping structures, and returnability terms, and we have the leeway to make our decision based on lots of factors; Random House is cheapest, Ingram is fastest, but I’m currently building a Faire order and I don’t feel like opening another browser tab, etc.

For our first few years we ordered everything in the store from Ingram because, like Diamond, it was super convenient and predictable. As I’ve added other suppliers for different reasons, I’ve definitely seen the opportunity costs Brian describes go up, which is always what I feared. Ordering and receiving used to take me about 20 minutes a day, while now it’s more like two hours, with the benefit of a bigger proft margin and better returnability. But at least in book retail I have the option to go back to that if I want!

Comparing Powet Pulp to Philbo shows that you don’t know what you’re talking about. They are different models. If you can’t make a profit by getting amazing comics at a 50% wholesale, then that says more about your business than anything else. Especially when lots of fantastic shops across the country are carrying and selling out of Power Pulp distributed comics. Shops like Howling Pages, Floating World, and Atomic Books do very well stocking and selling indie and self published titles. The industry doesn’t need more Diamonds catering to corporate comics. That’s not where the energy, ideas, or quality is found in modern comics. If you need higher profits, then I suggest you stock better material and grow your readership. Everyone can decide or themselves, though. Check out the catalog at powerpulpcomics.com and then tell Hibbs which books you want him to order.

It depends on the type of store you want to curate, and the type of customer you want to sell to. Do you just want to sell mainstream books to an aging base and fill your store up with Funko Pops? Those types of stores are a dime a dozen. Wouldn’t the profits be better if you you have books that the other stores don’t stock and the customers are loyal to those offerings? It’s easy to be just another Marvel/DC only type of pop culture shop but it’s more intersesting to me as a consumer if you have books that offer something else and value comics as an artform and less as a commodity.

For John Coats and Scott Ruhl, you are, sadly, both talking out of your asses. I am positive that Comix Experience is within the top 10% of comics-as-an-artform oriented stores in the US. We carry zero “merch”.

-B Once you start trying to imply otherwise, you have lost any possible shred of plausability whatsoever.

@Allyn: it was my understanding that, at least in the original DC deal (and therefore in Marvel’s return as well) that there were were several different steps and stages of fees that were cumulative and therefore kept Diamond in a financially healthy place. These could have be renegotiate away in the intervening years, I have no direct knowledge however!

@Daniel, the difference is largely the amount of revenue one can take in. Most of electronics and clothing retail appears to be driven by a small number of national or international players so they have resources that mom and pop comic stores simply don’t.

Glad to see a new installment of my favorite Comics Beat column. Been too long between.

Comments are closed.