ICv2 and Comichron have released their joint statement analyzing 2020 comics sales for the year past, and although it may seem shocking, 2020 was the biggest year ever for comics and graphic novels. Despite shutdowns, lockdowns, store closures, remote working, a a global pandemic and the upheaval of everything in our lives, comics improved upon previous years of growth, fueled by an increase in kids’ comics sales, a manga boom as more anime aired on streaming services, the surge in collectibles and increased digital availability.

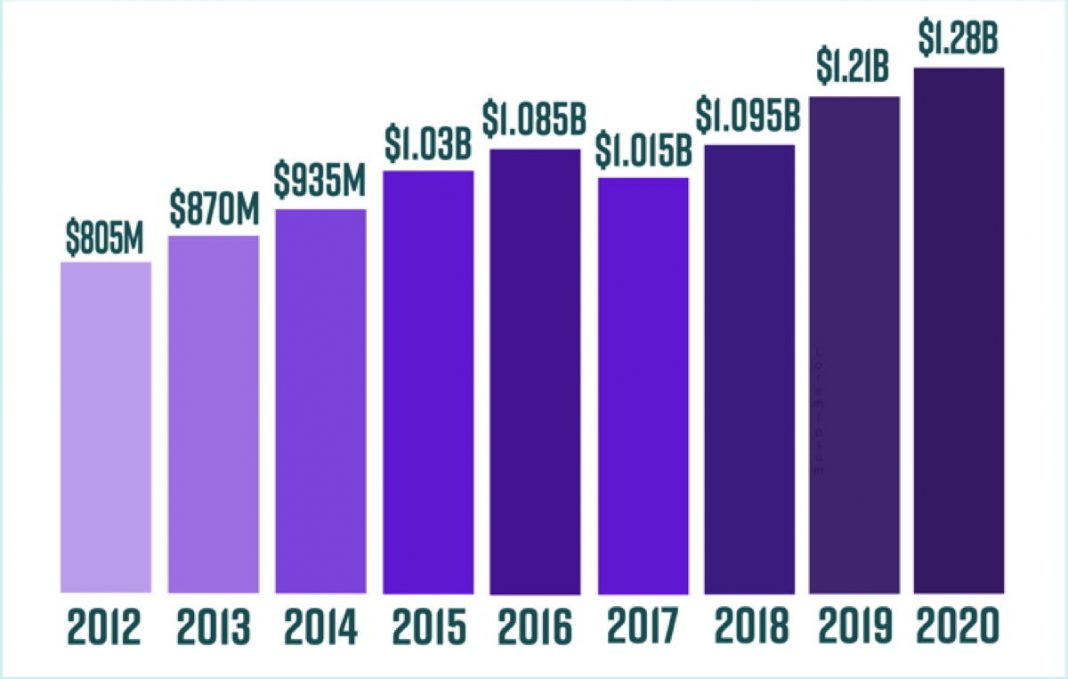

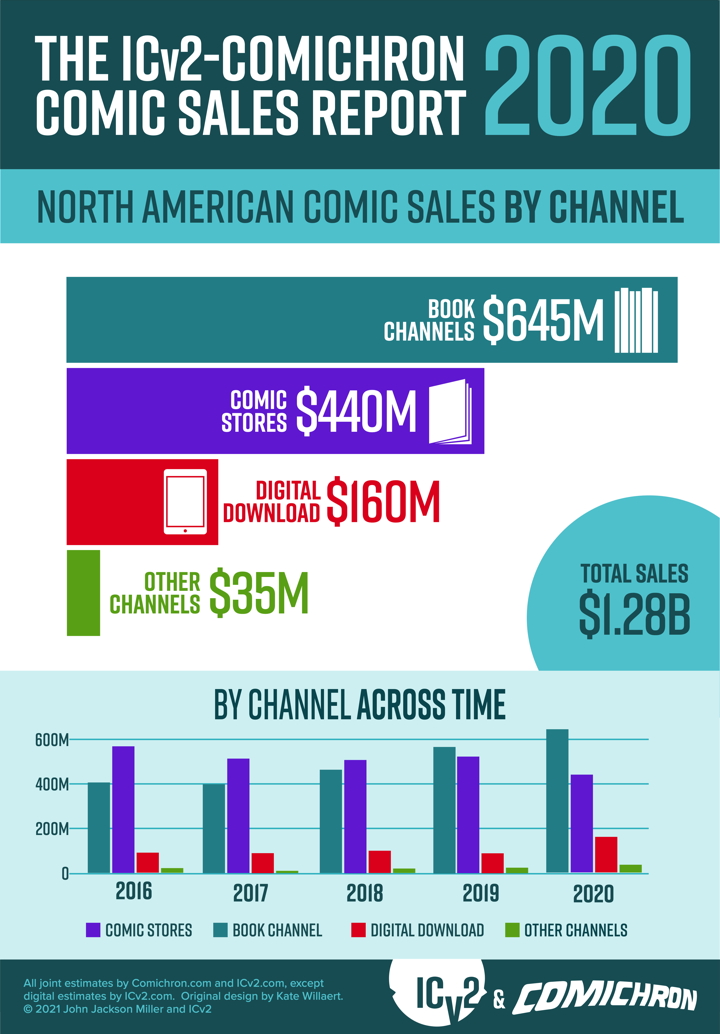

2020 comics sales were up 6% over 2019, coming in at $1.28 billion, according to a new joint estimate by ICv2‘s Milton Griepp and Comichron‘s John Jackson Miller. These numbers measure sales to consumers in the US and Canada. The increase came from online sales, big box retailers and digital sales, even in the face of a sharp decline in sales in brick-and-mortar comics shops and book stores.

Digital download comics sales also soared in 2020, up to $120 million from $90 million in 2019, a 33% increase. This came after years of flat digital sales, but obviously, a pandemic got people turning to different ways to read comics.

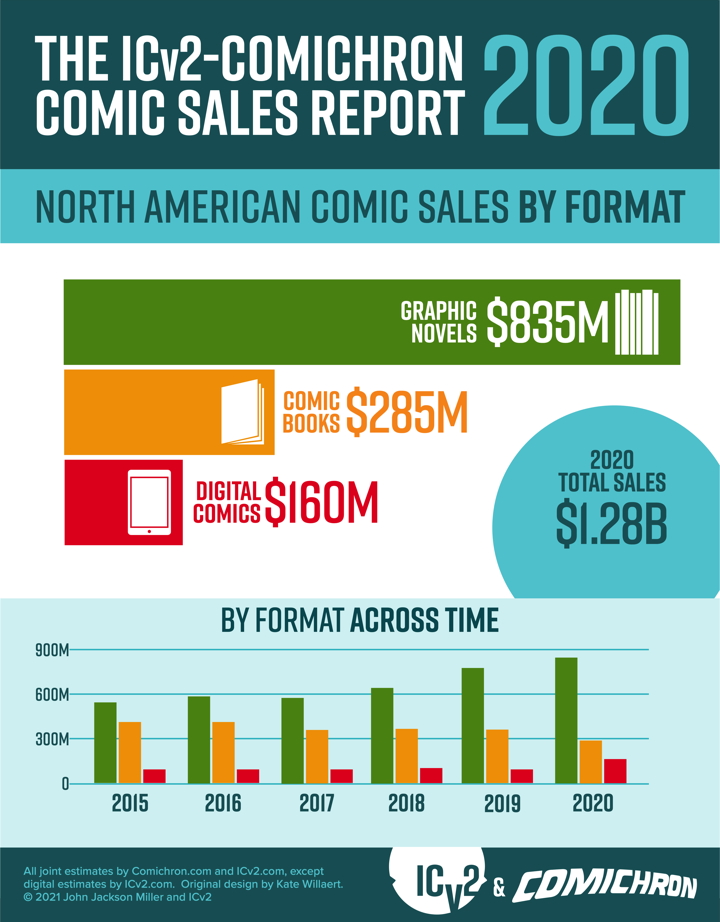

Graphic novel sales were up 9.1%, while periodical sales declined 19.7%.

The charts don’t break out kids comics and manga sales; hopefully Griepp will deliver his “White Paper” at some point in 2021 so we can get a better look at the growth in those channels.

The growth came despite an unprecedented year of setbacks:

“The challenges of retailing in the pandemic had profound impacts on the market, including the acceleration of trends that have been in place for years,” Griepp said of the 2020 estimates. “The book channel increased its share dramatically vs. comic stores, and graphic novels increased their share vs. periodical comics, while digital sales were turbocharged.”

Sales of kids’ graphic novels in mass merchants and online drove graphic novel sales early, and as the pandemic went on (and anime streaming grew), manga sales took off. In the comic store channel, the seven-week shutdown by Diamond Comic Distributors and subsequent publisher cutbacks in periodical releases were a drag on sales, even as demand surged in the second half of the year.

“The comic periodical market was ahead for the year before the pandemic struck, and the result of production cutbacks was that 30% fewer new comic books were released by the major publishers in 2020,” Miller said. “The fact that new comics sales were down by only 20% suggests that retailers did well with what they were able to get.”

More charts and graphs:

Because of the upheaval in comics distribution — DC leaving Diamond, and Diamond ceasing to put out overall sales charts — Miller and Griepp had to use new methods to compile the chart, using point-of-sale information from ComicHub which they used to build a sales model; because NPD BookScan also uses ComicHub data, they also changed how they use BookScan data.

A couple of other trends from looking at previous reports:

• Back-issue sales were way up as housebound fans sent collectible sales soaring. This helped offset some of the lack of new product to some degree.

• Comic funding on Kickstarter was up 60% in 2020, helping fuel growth in the “Other” category, which also includes what remains of newsstand sales; this category was up 40%.

Miller expanded on the report a bit on Twitter, here, here and here:

Graphic novel sales swelled as online retailers and mass market outlets never closed. Diamond’s shutdown and publisher cutbacks meant 30% fewer new comic books were released — yet new comics sales were off by much less, so comic shops made the most of the new issues they did get.

The late-year surge in comics sales coincided with an explosion in aftermarket activity, as collectors shifted convention dollars to comic books. Our figures don’t include markup, but a big portion of that revenue did wind up in comics shops, helping to supplement their earnings.

In sum: comics showed signs of strength — and resilience — in a historically challenging year.

Also:

A bit more context on the smaller new comics slate sizes: DC and Marvel were off 30% in 2020, marketwide closer to 27%. DC started to shrink its offerings in 2018, but Marvel and others basically took every free rack space. DC was ramping back up a bit when the pandemic happened. pic.twitter.com/rNQ3sTwvLX

— Comichron.com (@comichron) June 29, 2021

The replies to these tweets are full of what I assume must be Cmicsgters who keep asking if they can get the numbers MINUS kids comics and manga, so as to prove that comics aside from the comics that are doing really great, are not doing great, I guess? But actually they are.

TL;DR — comics are not dying. They are thriving.

If you would like to make your own charts and graphs, you can use the data from the eight previous reports: The first six reports were for 2013, 2014, 2015, 2016, 2017, 2018, and 2019 sales. ICV2 and Comichron also previously collaborated on revised estimates for 2011 and 2012.

More archived sales chart information here.

I’d clarify only that it was the biggest year in the history of the report — and also likely the biggest year in nominal dollars. Inflation-adjusted, 1993 is still king, north of $1.4 billion today. I actually tend to believe that the Golden and Silver Age numbers, when I’m done with them, will not find a higher inflation-adjusted total, because comics cover prices lagged inflation for a very long time.

Is there any way to know how massive that manga boom is in the US? It’s been the big story in publishing here in France during the pandemic. The numbers in 2020 were impressive already but the first semester of 2021 has been insanely huge. I’m really curious to know if it’s a global trend.

Does anyone in the American comic industry actually think 2020 was one of their greatest years ever? I really, really, really, really doubt that huge surge in bookstore sales was because ANYONE from the established U.S. comic book business suddenly started selling more books outside the DM then they ever had before.

Mike

Manga getting it done.

@MBunge – Tough to say. This is purely anecdotal, but I know of people who were pretty casual comic book fans or even lapsed, that got back into the hobby because of the pandemic. People who had a Bachelor’s degree or higher fared pretty damn well through the pandemic in terms of retaining employment and had discretionary money to burn with so many other entertainment options shuttered.

Do I think the 2020 numbers are on the backs of American DM publishers? No, but I also don’t think it’s crazy to think that Amazon and some of the other mainstream book sellers didn’t see some extra saturation into the broader book market.

Anecdote here but I never lost employment, have a really good salary, but because of the lockdowns for entertainment and recreation and travel, I had a LOT more disposable income for most of 2020 and early 2021. I spent more on GNs and Omnis and OHCs and TPBs than I ever have before. And for now, I’m keeping most of that discretionary spending going in the comics market in lieu of movies, eating out as often, travel, etc.

Marvel, and to a much lesser extent, DC, have really upped their publishing schedule for omnis and OHCs the past year (or so it seems), and having missed a lot of the first printings for various omnis I’m snapping up reprints as soon as they hit the pre-orders.

I also have a subscription to both Marvel’s and DC’s comics apps, and the past year I have also enjoyed rediscovering Archie Comics. Getting almost all of Archie’s classic output (digests and GNs) right now. I’ve also bought a small number of books from IDW and Fantagraphics.

It just seems a really good time for those of us who enjoy the non-periodical format. We’ll see if it lasts.

I can see periodicals (especially those priced at $4 or $5) declining, and graphic novels, manga, and digital (especially streaming) growing. Marvel’s incentive covers seem like a good way to kill the periodicals. (Are fans really buying multiple copies of one comic that end up in the dollar bin a few months later? How many more years will people buy all these #1s?) I’m curious what percent of the market is Dav Pilkey. He seems capable of producing a lot more material than Raina, and his books all become bestsellers.

Comments are closed.