Next up in our look at the June sales distribution charts: Image and the independent publishers.

Standard disclaimers: The numbers are based on the Diamond sales charts as estimated by the very reliable John Jackson Miller. These charts are pretty accurate for U.S. Direct Market sales with the following caveats: 1) you can add ~10% for UK sales, which are not reflected in these charts; 2) everyone’s best guess is you can add ~10% for digital sale – while some titles do sell significantly better in digital (*cough* Ms. Marvel *cough*), that’s the average rule of thumb; 3) it’s not going to include reorders from subsequent months, although reorders will show up in subsequent months if they’re high enough. So if you’re a monster seller in Southampton and the it took the US audience 3 weeks to reorder, it’s probably not going to be reflected here.

What’s a sales band? Its another way to have a higher level view of the market. The general idea is to divide the market into bands of 10K copies sold and see how many issues are in each band. How many issues sold between 90-99K copies, 80-89K copies, etc. etc. In very broad terms, the market is healthier when there are several titles selling in the 70K-100K+ range because titles that move a lot of copies give the retailers some margin of error on their ordering. When you see titles selling in the 20-29K band and especially below, there’s a pretty good chance a lot of retailers aren’t ordering those titles for the shelf (pull box/pre-order only) or minimal shelf copies at best.

For the purposes of these sales band charts, we really are looking for titles that are selling 10K and over, so only publishers with an issue that topped 10K will be listed here. There are also going to be plenty of titles/issues that didn’t make the chart, which generally means they sold under ~4739 in June, but some lower selling titles are reported and that’s not a hard and fast rule. The sad fact is, most independent comics sell under 10K and it’s when they cross that line that they really start getting noticed.

Image is always going to vary a little bit by what’s shipping, what’s taking a break for the tpb and the odd book that missed shipping. This month, Walking Dead had just under 83K in orders. The second bestselling ongoing series after Batman and straight up dwarfing the regular Marvel Universe ongoing titles. Then you’ve got Saga ahead of the pack with 43K. With the right titles, Image can play on the same field as DC and Marvel and they do pretty well with ex-Marvel writers.

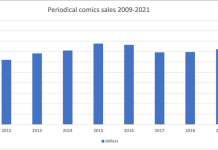

This chart shows why we usually compare Image to DC and Marvel sales. It just throws off the scale when you put it in with the rest of the indies.

Your big titles, the ones in Image’s “normal,” non-Walking Dead / Saga top list or a perfectly acceptable (in the current terrible market) number for DC/Marvel are Babyteeth #1 at 26.5K for Aftershock, Neil Gaiman’s American Gods Shadow at 25.9K for Dark Horse and Secret Weapons #1 at 21.9K for Valiant.

Yes, two of them are first issues that might fall below 20K with #2, but wait and see. Similarly Dynamite’s crop of titles in the 10K-19K band is 5 out of 6 first issues. With the non-Image indies, you’re happy to take something selling over 10K even if it’s just the first issue, because it means there should be some profits.

Next up: Comparing DC, Marvel and Image

Want to learn more about how comics publishing and digital comics work? Try Todd’s book, Economics of Digital Comics or have a look at his horror detective series on Patreon.