April 3rd will be a big day for Disney. No, it’s not the launch of a new movie or a new theme park ride: it’s the date of their 2024 shareholders meeting, when a new board will be voted in.

As we’ve been reporting for a while, this has turned into an epic battle between current disney head, Bob Iger, and would-be board member Nelson Peltz, who hopes to win a seat on the board along with his ally, former Disney CFO Jay Rasulo.

When last we looked in, Peltz, an activist investor/corporate raider of renown, had just launched his bid, promising to make big changes in how Disney does business in order to “Restore the Magic.” Since then, there has been almost daily drama in the trades and financial papers….and in message board comments, where many wail “Disney has lost its way!” while others put their trust in Iger and his team. Big names have stepped up to favor one side or the other – mostly Iger. And most recently, Peltz made some statements that raised eyebrows about his ability to help oversee a major movie studio.

As you settle in for this pre-Wrestlemania clash of titans, here’s a run down of some of the most significant developments:

February 5th: Disney releases a video starring Prof. Ludwig Von Drake urging shareholders to back the Iger slate of board members. The Vote Disney website includes all kinds of statements and information urging voters to stick with Iger. When the going gets tough, turn to an educated duck.

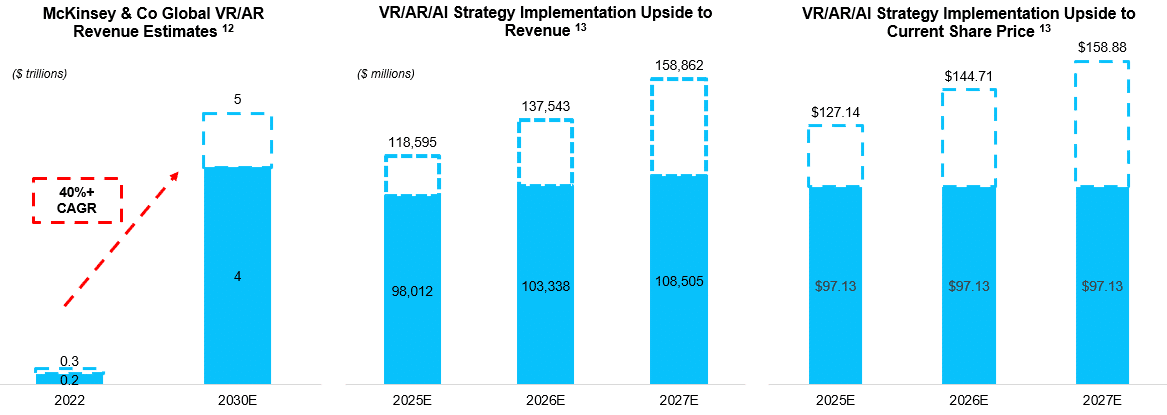

February 6th: Blackwell Capitol, ANOTHER group that is trying to take over the Disney board, releases their own proxy statement explaining why they should get a say in running Disney. Blackwell offers some in the weeds advice for making Disney profitable, including real estate and augmented reality:

Among other suggestions, Blackwell urges Disney to consider spinning off its real estate holdings (including presumably Disney World and Disneyland) into a REIT, which it could leverage for cash. Blackwells also suggests that Disney invest more heavily in virtual and augmented reality. “The Board must be more focused on this once in a lifetime shift in consumer behavior and interaction,” the company writes.

Like many of these statements, it is heavy on charts and graphs:

February 12: the Disney Board of Directors sends a letter to shareholders, warning that the invaders just don’t know how to do this mega entertainment company thing:

The Disney Board of Directors does not endorse the Trian Group nominees, Nelson Peltz and Jay Rasulo, or the Blackwells nominees, Craig Hatkoff, Jessica Schell and Leah Solivan, and believes that they do not possess the appropriate range of talent, skill, perspective and/or expertise to effectively support the Board’s ongoing efforts to drive profitable growth and shareholder value creation in the face of continuing, industry-wide challenges.

February 29: Disney grandchildren, descended from both Walt Disney and his influential brother Roy O. Disney, release two letters urging voters to vote for Iger. “We may not agree about everything, but we know that our grandfather would be especially proud of what Disney means to the world today. We also know that, like us, he would be very concerned by the threat posed by self-anointed ‘activist investors’ who are really wolves in sheep’s clothing, just waiting to tear Disney apart if they can trick shareholders into opening the door for them,” wrote Roy’s grandchildren.

March 4th: Blackwell unveils its entire whitepaper on Disney at TheFutureofDisney.com. Under their plan, the Magic Kingdom will be turned into a blacklight poster. Not really, but there is way too much stuff to wade through for this reporter! However they seem to be very big on technological upgrades, writing

“Eliminating technological fragmentation is a necessary first step

Disney’s CTOs are buried under a corporate bureaucracy

Blackwells Suggests a New Overarching CTO

Multiple CTO positions must be rationalized”

They also keep mentioning AI which…well, if you think Disney movies are bad now, just wait until they’re written by AI.

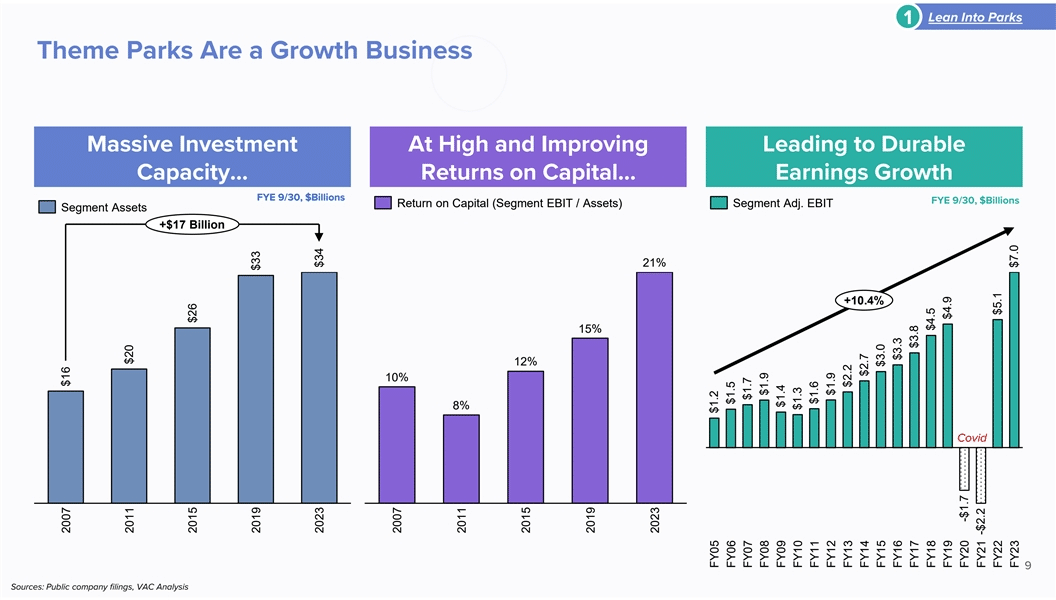

March 4th: Trian partners ALSO releases their whitepaper, a 130 page treatise called “Restore the Magic” on How to Fix Disney, which boils down to “Get rid of Bob Iger!” I’m no expert in financial matters, and found this a slog, but it does directly address Disney’s repeated claims that Peltz and Co. have no ideas for actually fixing Disney. Let’s look at one response:

| “Mr. Peltz… has presented no strategic ideas for Disney…”–Disney Letter to Shareholders, 02/01/24 |

|

Cutting costs and focusing on Disney’s world famous parks hardly seem like boldly visionary plans. Likewise, suggestions elsewhere that Disney invest less in struggling linear TV is about as obvious as it gets.

But anyway, I know what you came here for: what about Ike? Peltz and Ike Perlmutter are longtime lunch pals, and Perlmutter pledged his $2.5 million in voting shares to Peltz’s efforts. Many think Ike is the shadow cabinet behind this whole board bid. Sadly, Ike is relegated to the sidelines in the Peltz Plan.

| Mr. Peltz is “in partnership with Isaac Perlmutter… [who] has voiced his longstanding personal agenda against Disney’s CEO, [Bob] Iger, which may be different than that of all other shareholders.”–Disney Statement, 11/30/23 |

|

March 7: ValueAct Capital, yet another player which is backing Iger, releases yet another whitepaper. More charts and graphs!

March 11: Ludwig Von Drake was not enough; Disney releases a “campaign style” video on why Peltz and Rasulo are wrong for Disney.

That same day, Trian fires back: “The recent Disney video contains false and misleading statements designed to divert from Disney’s poor performance over many years. To suggest that Nelson Peltz is an ‘infiltrator’ (he has been elected overwhelmingly by shareholders in 48 elections) is offensive and highly dismissive of shareholder democracy.”

March: Chase Bank head Jamie Dimon, Star Wars creator George Lucas and perhaps Disney’s single biggest shareholder Laurene Powell Jobs all release statements supporting Bob Iger.

“Creating magic is not for amateurs,” writes Lucas. “When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership. When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better. I remain a significant shareholder because I have full faith and confidence in the power of Disney and Bob’s track record of driving long-term value. I have voted all of my shares for Disney’s 12 directors and urge other shareholders to do the same.”

As the showdown nears, more influential investors back Iger.

March 21: Given all the firepower and influencers backing Iger, things are looking good for Disney Bob. But SWERVE! Yet another investment group comes out backing Peltz! Institutional Shareholder Services urges its members to vote for Peltz noting Iger’s biggest weakness in all this: his lack of a succession plan.

“Because the company has made positive changes to its board as well as operational changes that have been well received by the market, we recognize that some shareholders may feel that the company has sufficiently course corrected. These investors have likely drawn comfort from Iger’s return. Nonetheless, given the major missteps and severe consequences of the failed 2020 succession, particularly for a company that already had a history of succession drama, it may be difficult for others to simply trust that the board, albeit refreshed, will get it right this time. These shareholders may be concerned about post-Iger DIS. Our analysis favors this latter view.”

March 22: Yet another voice in favor of Iger: former Disney head Michael Eisner.

“[I]n 1983, Disney was under attack by corporate raiders trying to take over the company,” Eisner wrote in a post on X, referring to the unsuccessful attempt by financier Saul Steinberg to stage a hostile takeover of the company. “That would have ended the Disney Company as we know it, for the studio, theme parks, and hotels were suggested to be sold off. The board turned to me and [then-president] Frank Wells, and a different story was written, one that was continued by Bob Iger and his executive team. Today, a similar situation exists, so let’s remember the lessons from 40 years ago. Bringing in someone who doesn’t have experience in the company or the industry to disrupt Bob and his eventual successor is playing not only with fire but earthquakes and hurricanes as well. The company is now in excellent hands and Disney shareholders should vote for the Disney slate.”

March 22: Peltz sits down for an interview with the Financial Times over what sounds like some rubbery food, and finally says something that alarms many comic book movie sites and fans, seemingly echoing the “Disney is too woke” narrative: “Why do I have to have a Marvel that’s all women? Not that I have anything against women, but why do I have to do that? Why can’t I have Marvels that are both? Why do I need an all-Black cast?”

(Peltz may not be aware that the MCU actually has both. It also has blue and green people.)

And this about whether Marvel Studios head Kevin Feige should step down: “I’m not ready to say that, but I question his record.”

Well, now Peltz stepped in it. Both Black Panther and Captain Marvel made more than $1 billion at the box office, and Black Panther is the only MCU film to get nominated for Best Picture – and it WON four Oscars. The sequel was the only MCU film to get a Best Acting nomination (Angela Bassett.)

Both comments go back to complaints that Ike Perlmutter made over the years, which Iger has made clear. Perlmutter long opposed both a Black Panther and Captain Marvel movie, and at one point urged Iger to fire Feige, which led to Ike getting let go instead.

As one might expect, social media had a field day with these clumsy sentiments from Peltz…..and may have just buried his attempt to get elected to the board by proving he doesn’t know much about show biz after all.

March 25: Trian, Peltz’s investment company withholds its votes for Iger as a board member, while claiming to back him.

While the statement said that “Trian supports Mr. Iger as a candidate for the board and as CEO,” the investment firm has withheld its votes for Iger’s board candidacy. Asked for clarification on the matter, a rep for Trian declined to provide an official comment.

Trian’s statement asserted that the Disney board “botched its most important job – CEO succession – by installing Bob Chapek in that role seemingly without appropriate vetting or oversight. The board then renewed Mr. Chapek’s contract just months before firing him for poor performance. Ultimately, the board had to call Bob Iger out of retirement to fill the void.”

Meanwhile: I’ve somehow gotten on the mailing list for Restore the Magic and get almost daily newsletters telling me how bad Disney’s doing. (I WISH I had some Disney stock to pledge in this fight.) Trian has also taken out tons of ads on Twitter (and doubtless other places) which is a bit of a shock to see in my feed:

Does restore the magic and robust ideas mean no more Black Panther movies or woman-led films? (The Marvels had males in the cast, in case you were wondering.) The Trian board nominees include a disgruntled employee and a corporate raider backed by another disgruntled former chairman, who haven’t done much in their campaign much except complain about Disney’s obvious problems, but without really presenting a vision for how to solve them in an extremely complicated entertainment landscape.

Observers say that Iger and Co. look to be in the lead for the board vote but….it ain’t over until it’s over. April 3rd is just a week away and the future of the world’s most beloved film franchises could hang in the balance. Stay tuned!

This whole Disney board drama has been fascinating…but it does seem to be a proxy fight by Perlmutter to get back for being fired and opening up yet another round of the right wing’s culture war on everyone else.

And I don’t think Disney is “struggling” the way people make it out to be (they could, for example, cut prices at Disney parks and still make money hand over fist). It just feels, as I mentioned above, another conservative attack on anything they dislike and anyone trying to embrace a wider audience.

This is always fascinating stuff. Thanks for the business updates, Heidi!

Curiouser and curiouser.

Comments are closed.