We did it! We hit a billion! It’s been a slow and steady climb, and took a lot of hard work from the whole team, as chronicled by both ICv2’s Milton Griepp and Comichron’s John Jackson Miller, but we made it.

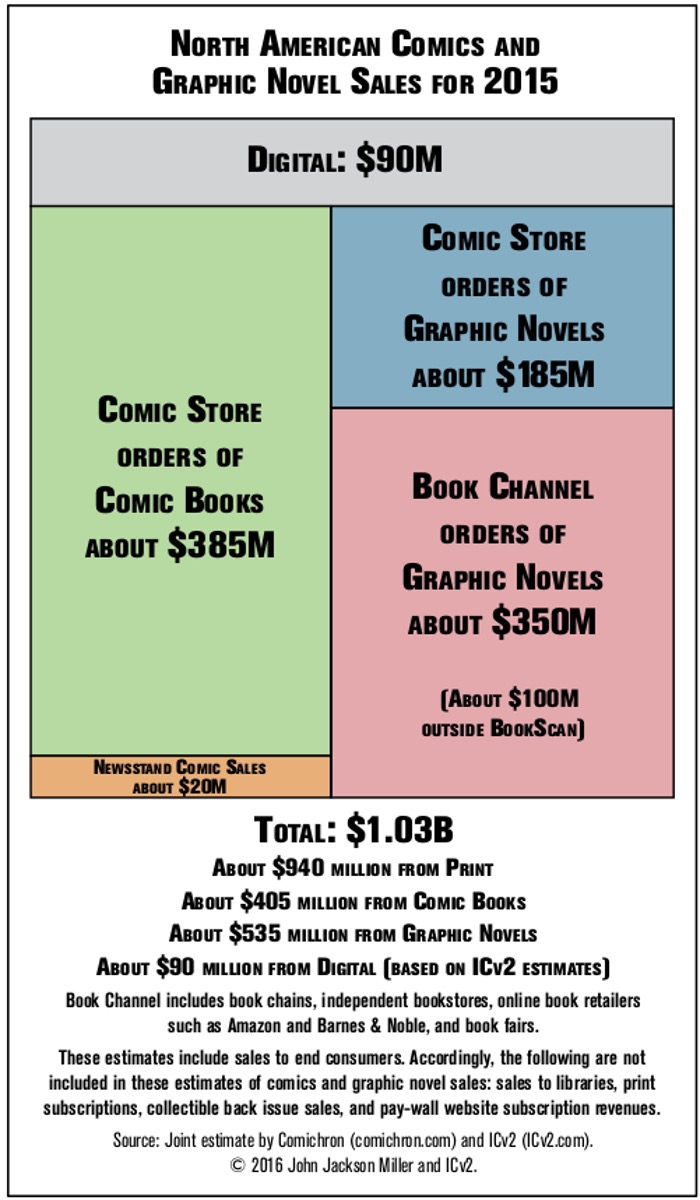

Griepp and Miller have just released their third annual sales chart for annual revenues, and combined sales in all channels just topped $1 bilion, up from $935 million in 2014. That’s a 10% rise:

“The audience for comics and graphic novels continues to broaden,“ Griepp said. “The increase in sales reflects not only the increased awareness of comics properties from other media, we’re also seeing rapid growth in new audiences for comics, including kids and women.”

“Sales of comics in print formats have finally eclipsed the $850 million modern-era high from 1993,” Miller said. “That 1993 total was $1.4 billion in inflation-adjusted dollars, though, so there’s still some ways to go to reach a new inflation-adjusted high for the last 50 years. But the book channel in particular is helping us make progress toward it.”

Graphic novels in the book channel represented the biggest area of growth, although every other area of print sales (except newsstand) grew in 2015 as well. Print grew over $100 million to $940 million in 2015, up 13% over 2014.

Sales of graphic novels through the book channel grew 23% to $350 million, after growing 16% in 2014, while graphic novel growth in the comic store channel was in the mid-single digits.

Sales of comic books in comic stores were up solidly to $385 million, roughly 8% over 2014 sales.

Digital sales declined around 10% in 2015, back to 2013 levels. This was the only area of decline among all the segments of the market, reflecting trends specific to digital, and in some cases specific to digital comics.

As presented above and in the accompanying infographic, the analysis by Comichron and ICv2 was divided up between periodical comics (what some call “floppies” or “pamphlets”), graphic novels, and digital download-to-own sales.All print figures are calculated based on the full retail price of books sold into the market, and do not account for discounting or markup. Digital sales do not include subscription or “all you can read” services.

This is the third joint market size analysis from ICv2 and Comichron; the first was for 2013 sales.

You can read more analysis here and see Miller’s archives of yearly sakes here.

Just for comparison, Miller and Griepp estimate the total sales for comics and GNs in 2002 as $300-330 million. That’s sort of the early days of the movie/library/book store revolution, so as you can see, all of that did a lot of good!

Will sales rise to be more than $1 billion in 2016? That’s a bit trickier to guess. If DC and Marvel can relaunch their asses off and Marvel can raise prices to $5 for their whole line, maybe. If kids and YA graphic novels continue to grow, as they have in recent years, I’d expect to see a rise.

Although periodical comics remain a month to month thing, the manga comeback, more channels (however tenuous) and the continued growth of graphic novels seem to me to be a good trade off. We might not see 10% growth in 2016 but I feel the comics market will stabilize. Future growth sees likely, but who can predict where the current fractionalization of culture will take us? For all I know, in the future people will run around trying to find successive pages of comics at local landmarks and have no time to go to comics shops.

Just to put this all into perspective:

http://publishers.org/news/us-publishing-industry%E2%80%99s-annual-survey-reveals-28-billion-revenue-2014

“Washington, DC; June 10, 2015 — The U.S. book and journal publishing industry generated $27.98 billion in net revenue for 2014, representing 2.70 billion in units (volume), according to StatShot Annual, a yearly statistical survey of publishing’s estimated size and scope released today by the Association of American Publishers (AAP). This represents a slight revenue increase of 4.6% from 2013, which was $26.75 billion. The figures include trade (fiction/non-fiction), K-12 instructional materials, higher education course materials, university presses, and professional books.”

Also… libraries aren’t included in the above sales graph…

For FY 2013, PUBLIC LIBRARIES only (not schools or universities):

“Over $1.2 billion was spent on collections in FY 2013, unchanged from the prior year. ”

Book industry in 2013: $27.01 billion.

https://www.imls.gov/sites/default/files/publications/documents/plsfy2013.pdf

Remember… libraries are the other “direct market”… all sales to libraries are final, just like all sales to comics shops. Longer shelf life as well.

It would be a good thing if it meant more units are being sold, but it doesn’t. From all available metrics, the size of the comic buying audience appears to be shrinking. But let’s all be happy they’re extracting more money from the few customers they have left!

And for all the Sturm und Drang, the workhorse of the industry 15 years into the 21st century is still the lowly comic book. And considering how many so-called graphic novels are really just reprints of comic books, the printed periodical format probably accounts for over 85% of all material in the marketplace.

Mike

Single = “workhorse” maybe. But I notice the bookstore graphic novel/trade paperback category’s now almost even in sales with the traditional “floppy” comic book shop category, and is growing at a faster rate. (Trades also continue to outsell singles overall.) Even if floppies aren’t going anyway anytime soon, it seems that for the majority of customers, comics = trade paperbacks/graphic novels, not $4-an-issue pamphlets.

I’m not sure what metrics you’re looking at, Chris Hero, but unit sales are up and have been up every year starting with 2011. http://www.comichron.com/yearlycomicssales.html

Comics unit sales are up more than 20% in the Direct Market since 2010 — and June saw more copies ordered than in any month since December 1997. And unit sales in the book channel were definitely up last year.

I make no claim as to how many customers there are — but the statement that unit sales were down in 2015 is incorrect, unless you’re looking within individual titles.

And, yes, Torsten — we’d sure love to have library sales figures for graphic novels. It’s been a challenge finding sources that zero in just on the category we’re looking for,

Comments are closed.