U.S. Congressman Pat Ryan has written an open letter to Federal Trade Commission Chair Andrew N. Ferguson, calling for an investigation into the recent sale of card grading company Beckett to Collectors Universe. Collectors, founded in 1986, provides authentication and grading services for a wide variety of collectibles. Since 2000, the company has significantly expanded through a series of strategic acquisitions.

Ryan, a Democrat from New York’s 18th District, urged the FTC to investigate possible antitrust violations by Collectors. With the acquisition, the company now owns three of the industry’s top four grading companies, a video game grading company, and SGC, an authentication and grading company.

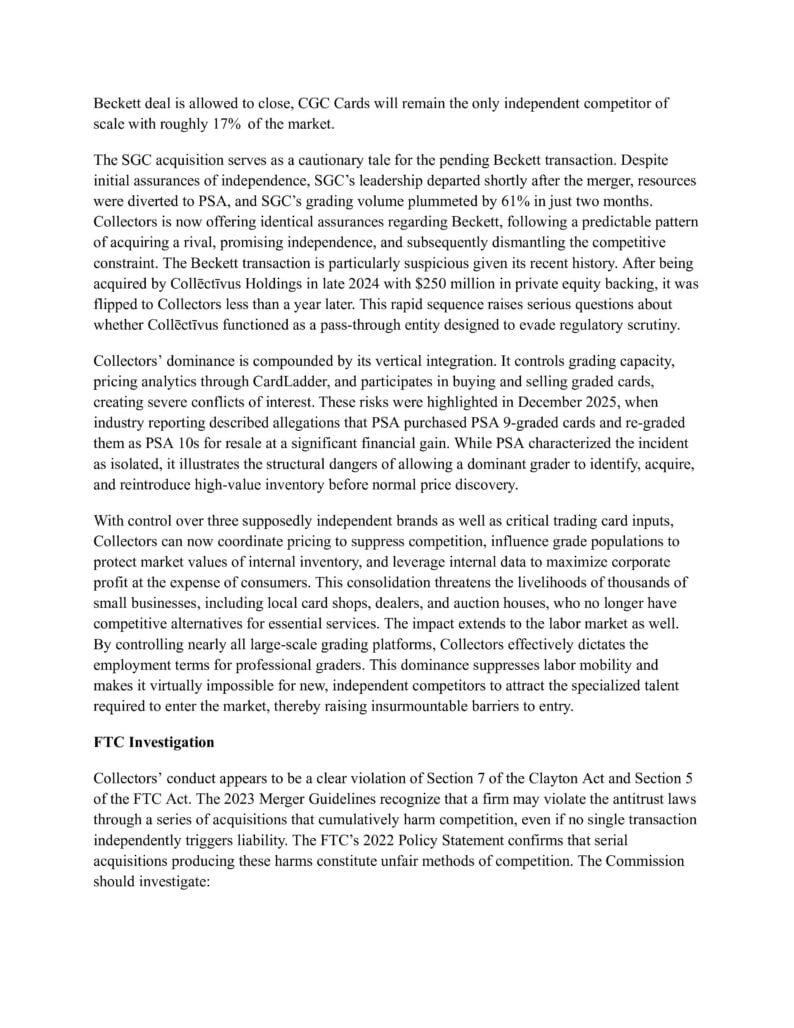

“In less than five years, Collectors has systematically eliminated its competitors through serial acquisitions,” reads the letter published on Friday, December 19.

In his letter, Congressman Ryan urges the federal government to investigate Collector Holdings’ alleged monopolistic practices following the acquisitions of PSA (2021), SGC (February 2024), and Beckett (announced earlier this month).

”Collectors have consolidated over 80% of grading volume, leaving only one independent competitor. Collectors’ dominance is compounded by vertical integration; it controls grading capacity, pricing analytics through CardLadder, and participates in buying and selling graded cards — creating severe conflicts of interest,” wrote Congressman Ryan.

Read the full letter here (Click on the images to enlarge):

Beckett was founded in 1984. Collectors said in their announcement that the company will continue to operate independently, which is what they said about SGC at the time of that acquisition. While SGC remains a technically independent entity, industry observers seem to think the company is in steep decline.

Ryan’s letter calls the Beckett acquisition “a textbook roll-up strategy producing rapid and potentially irreversible competitive harm.” Citing the changes to SGC, Ryan argues, “The SGC precedent demonstrates that delay enables acquired competitors to be dismantled within months.”

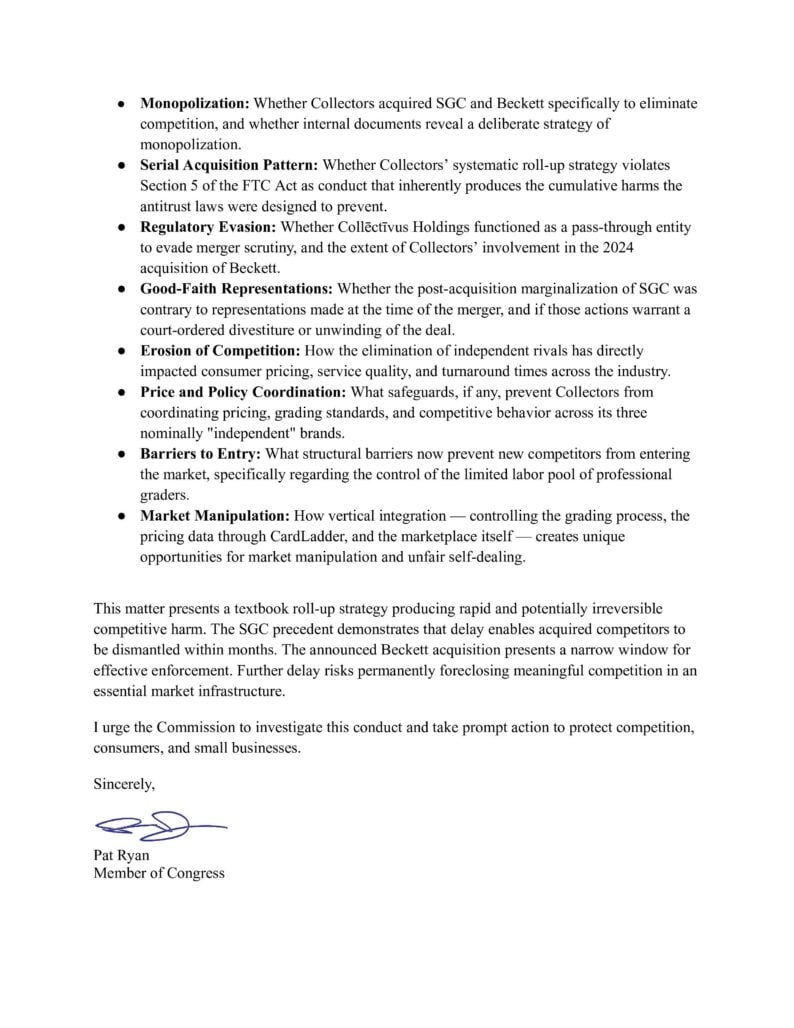

In the letter, Ryan asks the government to look into allegations of monopolization — “Whether Collectors acquired SGC and Beckett specifically to eliminate competition, and whether internal documents reveal a deliberate strategy of monopolization” — as well as whether Collectors’ aggressive series of acquisitions was designed to evade merger scrutiny and avoid regulation. He argues that the end result of such “erosion of competition” will be to drive up prices and create almost insurmountable barriers to entry for potential new competitors.

Congressman Ryan wrote that the company’s serial acquisition pattern potentially “violates Section 5 of the FTC Act as conduct that inherently produces the cumulative harms the antitrust laws were designed to prevent,” and further argues that the way SGC has been gutted may have violated the good-faith negotiations that led to its acquisition in the first place.

Ryan also contends that Collectors’ deep integration in the collectibles market has the potential to create obvious conflicts of interest that arise when a company can help set the “fair market value” for their own goods.

“Even my four- and six-year-old boys, who just started their collections, know this behavior is wrong,” Congressman Ryan said in a press release. “Attempts to corner the trading card market are not only deeply unpopular, they are unethical. Kids, collectors and local card stores shouldn’t have to worry that the system is stacked against them, and the FTC needs to step in before this hobby is controlled by one powerful company.”