We’ve taken a break from our Daily Diamond Updates, and to be honest, the case has now entered what might be called the Slog: months and months of administrative filings and motions. It’s not uncommon for bankruptcies to drag on for years, and this one will likely go on for at least that amount of time, especially given all the related lawsuits and such.

Of course, a few future bombshells remain: will the court approve the liquidation of the consignment stock? The hearing for this has been put off until later this month, but that’s still only a hearing about a hearing.

In the meantime, I’ve been catching up on the filings, and a few things caught my eye. Maybe you will find them of interest as well.

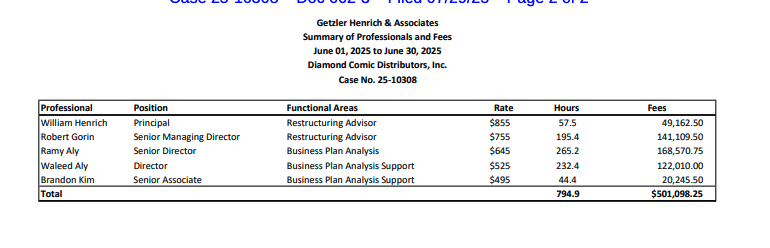

Monthly expense reports for the various lawyers and bankruptcy administrators are being regularly filed. In June alone, Getzler Henrich & Associates LLC, the firm overseeing the bankruptcy proceedings, ran up a bill of $524,767.21, including expenses, but mostly billable hours for employees working on the bankruptcy. Robert Gorin is the main restructuring advisor, whose name pops up here quite often. In June he filed 195.4 billable hours at $755/hour for a total of $141,109.50. I don’t mean to disparage anyone for getting paid for the work they do (although this goes to the firm not Gorin), but subtracting this from the amount of money owed to publishers is a sad math.

There’s actually a breakdown by hours and tasks, and it’s grim reading. One typical entry:

REDACTED 6/16/2025 2.7 $1,741.50 – Began preparation of cash flow variance analysis and reporting to assess weekly progress as well as future financing needs

Given the 738.8 billable hours Getzler Henrich & Associates racked up, couldn’t someone along the way have taken a few minutes to tell creditors why they haven’t been paid since May 16th? Wishful thinking, I know.

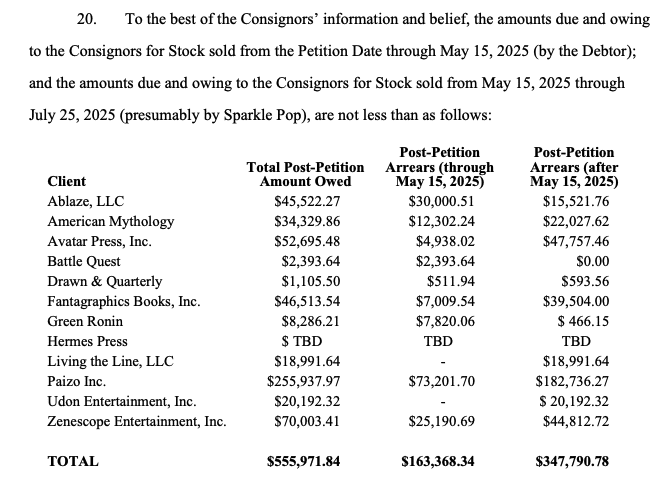

These numbers are particularly ironic in light of another filing, which might be fairly important. Brett Schenker has the details: The Ad Hoc Committee of Consignors is asking “just who the heck is still selling comics from Diamond?”

The Ad Hoc Committee of Consignors is a group of creditors, aka publishers, impacted by Diamond’s chapter 11 and also Diamond’s motion to try to sell consignment goods to help pay back its debts. The committee includes Ablaze, American Mythology, Avatar Press, Battle Quest, Drawn & Quarterly, Fantagraphics, Green Ronin, Hermes Press, Living the Line, Paizo, Udon Entertainment, and Zenescope.

At the heart of this motion is the question as to whether anyone can legally sell goods still held by Diamond and if Ad Populum or Universal Distribution properly continued any of the previous Diamond contracts.

In short, who the hell are currently selling and profiting from the comics and games being “sold by Diamond”?

There is a lot of juicy detail in this filing, including a chart showing how much the consignors are owed from both Old Diamond and New Diamond:

They are owed almost the same amount as Getzler Henrich made in June alone! Looking at these numbers, it’s clear that making comics is not very profitable, and instead people should look to go into the business of “corporate turnarounds, process design and improvement, corporate mergers and acquisitions, and management consulting,” as Gorin’s bio puts it.

Another total bummer is the letter that “Diamond” – which one is open to question – sent to its vendors on May 27th. I’m embedded this below but the text reads:

Important Update on Outstanding Invoices and Future Payments

Dear Diamond Consignment Vendor:

As we navigate the transition in ownership, we wanted to address questions we’ve received regarding outstanding invoices and future payment expectations.

Bankruptcy Estate Responsible for Invoicing Related to All Sales Dated May 15 or Earlier

Invoices dated May 15 and earlier fall under the responsibility of the bankruptcy estate. These obligations were incurred during the Chapter 11 proceedings and pertain to consignment inventory held in our warehouse. We understand the estate is reviewing these outstanding amounts; however, no payment timeline has been provided to us at this time.New Ownership Responsible for Invoicing Related to All Sales Activity May 16 Onward

These obligations are fully separate from the bankruptcy estate and are actively being processed and paid under normal operating procedures. Our goal is to rebuild trust through action and consistency moving forward.The Difference Between the Bankruptcy Estate and the New OrganizatioN

We understand that the distinction between the bankruptcy estate and the new organization may be confusing. To clarify: the bankruptcy estate is a separate legal entity responsible for settling obligations incurred prior to the May 15 sale.Diamond, now operating under the ownership of Ad Populum, is a new entity and the new organization, responsible for all obligations from May 16 onward. Our focus is on moving forward with a clean slate and restoring stability for our partners.

We are committed to maintaining strong, ongoing relationships with our vendor partners. If you have questions about specific invoices or need help determining which payments fall under which period, please contact your AP contact.

Thank you for your patience as we work through this transition.

I imagine you threw up in your mouth a little when you read “Our goal is to rebuild trust through action and consistency moving forward.”

Publishers, toy makers, shops and customers have largely moved on from Diamond over the last seven months. It’s over and new players are entering the field. While the proposed liquidation remains a huge matter, Diamond is dead and we’re all moving on.

But there are still so many unanswered questions about all of this that I can’t let it go. The above suggests one nagging question: Why has the cordyceps known as Diamond been insisting it’s business as usual and moving forward and trying to “rebuild trust” when nothing of the sort has happened? It could just be legal posturing but it’s still baffling.

And then there’s the mystery at the heart of the matter: Why did Getzler Henrich and Raymond James insist on putting together the Universal and Ad Populum bids and doing everything possible to reject the higher bid from Alliance Entertainment? Even some of the legal filings use some variations of the phrase “The fix was in” and it certainly seems that way. But why? And who benefitted?

At San Diego Comic-Con, I asked three of the smartest, best informed people I know this question, directly, and they all said exactly the same thing. “I don’t know.” I asked if they knew but couldn’t tell me, but all of them said they honestly didn’t know and I believe them.

It’s been suggested that there is some connection between Ad Populum and Getzler Henrich – indeed, Ad Populum has been involved with lots of distressed assets, and Getzler Henrich pops up in some of the proceedings. One of my sources suggested that bankruptcy administration is a small world and it’s likely that people involved will run in the same circles. That’s a logical assumption but it doesn’t quite solve the mystery.

The most charitable solution – one that I leaned towards early on – was that Universal Distribution was the most suitable candidate to take over Diamond’s comics and toy distribution business, and maybe that was looked on as the best outcome for all. This theory would need someone behind the scenes actually caring about Diamond’s creditors though, and I haven’t seen much evidence of that in the following months.

Will we ever know the answer? I honestly don’t know. Lawsuits over bankruptcies are fairly common, but the creditors in this case will probably take the write off and go about their business instead of engaging in another long and costly lawsuit that might shed light on some of the murkier elements of the Diamond case. Perhaps the Alliance vs Diamond lawsuit will get to the heart of the matter. In the meantime, I’ll keep investigating and asking questions. It’s quite a perplexing case ad I can’t quite let it rest.

Click to access cbf812d6-0a5f-4ee7-8c04-0d07711360f9_679-dragged.pdf