Ever since Wizard World’s lawsuit against former CMO Stephen Shamus was made public, you can bet there has been a lot of gossip flying about the company’s finances. This week’s SEC filing with the quarterly report did nothing to end that, with a deadpan announcement that there was not enough cash on hand to fund operations after December.

This backed up rumors we’ve been hearing that the New York city office had been closed down with employees told to work at home. Asked to comment, a Wizard World spokesman wrote that “The remaining N.Y. employees are still with Wizard World” which didn’t contradict that part of the story. Reportedly, the NY office was very small and located in expensive Times Square real estate, and a smaller more economical office will be opened eventually.

We’ve also heard from multiple sources that the Pittsburgh Wizard World show was…less than stellar (“a disaster”). The Pittsburgh show is not on the schedule for 2017. Also the talent booking staff has been reorganized following Shamus’s departure.

The most alarming part of the SEC filing is as follows.

Note 2 – Liquidity and Management Plans

As reflected in the accompanying condensed consolidated financial statements, the Company incurred a net income and net cash used in operations of $749,885 and ($1,245,272), respectively, for the nine months ended September 30, 2016. As of September 30, 2016, the Company had a working capital of $2,543,922 and an accumulated deficit of $15,263,411. As of September 30, 2016, the Company had cash and cash equivalents of $3,188,406. The Company estimates the cash and cash equivalents currently on hand as of November 21, 2016 is insufficient to fund its operations on a long term basis past December 31, 2016. In order to fund operations past that date is dependent on management’s plans, which include the raising of capital through debt and/or equity markets with some additional funding from other traditional financing sources, including term notes, or the significant reduction of operating expenses until such time that funds provided by operations are sufficient to fund working capital requirements. There is no assurance that the Company’s projections and estimates are accurate. The Company is actively managing and controlling the Company’s cash outflows to mitigate these risks.

Wizard World, which ran 19 shows in 2016 and expects to run 16 in 2017, had a net profit of $365,216 in the first nine months of 2016 compared to $754,817 in the comparable period of 2015.

ICv2 – which is much better at reading financial reports than The Beat – has a good analysis of all the numbers:

The company has been profitable so far this year (see “Wizard World Turns Profit in First Quarter”), so how is it running out of cash? The answer comes from its statement of cash flows, which show that its “Unearned Revenue” account is down $3,221,138 in the first nine months of 2016. That account reflects prepayments for tickets, booths, sponsorships, or Con Box subscriptions, or cash in before the service is delivered.

With few shows in the fourth quarter, Wizard will have to tighten its belt to get to the streamlined and probably more profitable show in Q1 2017.

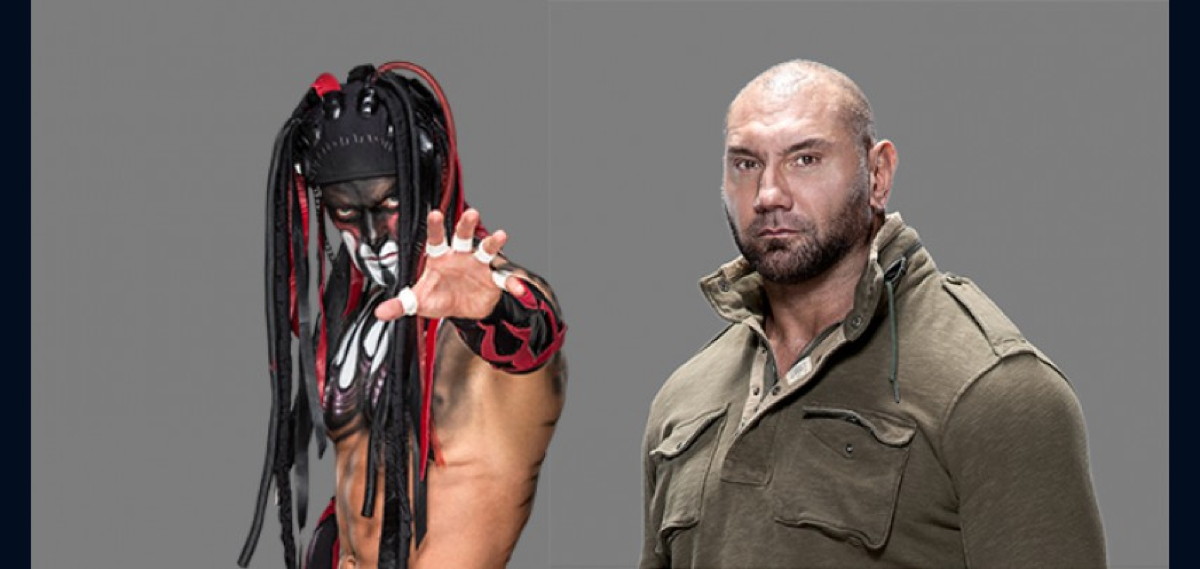

There’s a lot more to be reported on all of this — and on how Stephen Shamus’s setting the minimum guarantees for many popular nerdlebrities may have affected the entire convention business. I keep expecting some “con”solidation as shows that don’t live up to expectations become unprofitable. People who pay $30-75 a day to go to comic cons have high expectations for what they’ll experience, based on the mainstreaming of the whole “con culture” and the market is way over saturated. 2017 should be a very interesting year in the con space.

I went to the Pittsburgh show. It was awful. I don’t really have any interest in celebrities. There dealer line-up sucked because they jacked up booth rates. Instead of pop culture merchants, they had fudge dealers, tea sellers, shnapps tasting, and blood donating. That has what to do with comics?

I was there an hour and a half and saw everything there was. I actually thought I was missing part of the show.

I had a Groupon. If I’d paid full price, I’d have been really pissed.

Some of your and ICv2’s financial analysis isn’t exactly spot on (they should be able to support operations from cash past December and unearned revenue needs to be examined on a Q vs. Q basis rather than sequentially because of their asymmetric convention schedule. For example, unearned revenue will surge in their next report, but it won’t mean the company is certainly going gang busters just that the Q closes a mere few days before their NOLA show) HOWEVER they certainly aren’t in a good position and the lower they let those cash reserves get before finding debt/equity financing the worse the terms of the negotiations will become for them.

Isn’t this mostly about the money suck that was/is Con TV?

Mike

The ticket prices are way too damn high. My last sdcc 4 day plus preview night ticket cost me less than a wizard world 3 day. Only reason I’m going is i want to go to the city it’s in.

Give me heroes, em city, or baltimore over this crap.

Comments are closed.