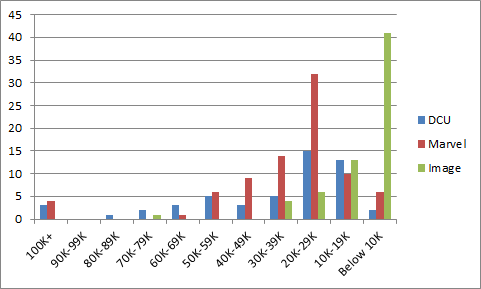

And finally, the comparison chart of DC, Marvel and Image. So we can see where the biggest sales sit on the Direct Market Landscape.

On the surface, that’s not a horrible chart. Multiple titles over 100 – from DC _and_ Marvel both. While the 90Ks sales band is empty, there’s at least one issue in every other band. The 70Ks and 60Ks aren’t bare. Still way too high a percentage of the total market is selling under 30K copies though.

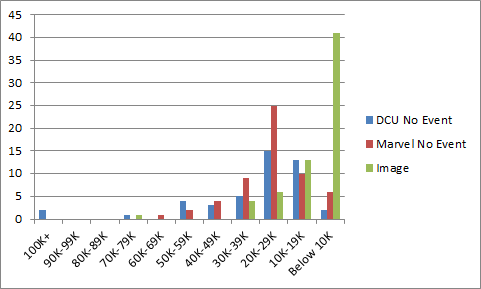

But that’s the total sales picture. What happens when we take out those Events and Marvel gold rush of variants and incentive discounts on the #1s?

Oh, there I go again. I just had to think about sustainable markets and go and ruin that first chart.

That no man’s land between 100K and the 50Ks bracket is still there.

Batman back up over 100K after a spill into the mid-90Ks. Walking Dead as the #2 ongoing with ~73.7K. Sean Murphy’s Batman: White Knight right behind it at ~73.6K. (If you want to throw that off the list and count it as an event, feel free. I’m treating it as a placeholder for All-Star Batman… although the Bendis Bat-book I suspected would follow it turns out to be a Walmart exclusive. Silly me.) Avengers #2 did arrive at ~66.6K, but it’s not at all certain that it will still be over 60K when the June numbers come out. Why is it so hard for a comic to sell 60K copies in the Direct Market these days?

Look, it’s likely that Justice League will show up as an ongoing title somewhere in that 60K-99K range, starting in June. The first issue might even break 100K. The relaunched Superman and Action could appear in that range again when Man of Steel is over. For Marvel… we need to wait and see. Marvel launches big and then falls off dramatically. You need to see the 4th or 5th issue before you really know what everyone is dealing with there.

Were things a little better in May? Probably. You’d like to have seen No Justice ordered a little higher, particularly the later issues, but it’s a big improvement on recent Justice League numbers (and indications are the ongoing may have been a little better received… we’ll see). You’d have liked to have seen a slightly higher number on Man of Steel #1. You’d have like to see Avengers #2 ordered at a little higher than 51% of #1. But, are any of these things a huge shock? Not really. None of that is tanking, although you could question whether Avengers is going to be doing anything other than treading water after a successful weekly run, once it settles down. It’s just the low end of expectations.

It is interesting, especially when you toss out the DC and Marvel Event titles, how Image looks more like a peer than it has in a while. Walking Dead outsold any ongoing Marvel title without an anniversary or debut issue to juice the numbers. It outsold every ongoing at DC except Batman. It can more or less hang with DC, in terms of issues in the 30K band.

This is a combination of Image getting some of their non-Walking Dead top list back and having more popular books shipping at the same time. Let’s face it, Image had a slow winter and a lot of titles on break at the same time.

- DC sales distribution chart

- Marvel sales distribution chart

- Image & the independents sales distribution chart

Standard disclaimers: The numbers are based on the Diamond sales charts as estimated by the very reliable John Jackson Miller. These charts are pretty accurate for U.S. Direct Market sales with the following caveats: 1) you can add ~10% for UK sales, which are not reflected in these charts; 2) everyone’s best guess is you can add ~10% for digital sales – while some titles do sell significantly better in digital (*cough* Ms. Marvel *cough*), that’s the average rule of thumb; 3) it’s not going to include reorders from subsequent months, although reorders will show up in subsequent months if they’re high enough. So if you’re a monster seller in Southampton and it took the US audience 3 weeks to reorder, it’s probably not going to be reflected here.

What’s a sales band? It’s another way to have a higher level view of the market. The general idea is to divide the market into bands of 10K copies sold and see how many issues are in each band. How many issues sold between 90-99K copies, 80-89K copies, etc. etc. In very broad terms, the market is healthier when there are several titles selling in the 70K-100K+ range because titles that move a lot of copies give the retailers some margin of error on their ordering. When you see titles selling in the 20-29K band and especially below, there’s a pretty good chance a lot of retailers aren’t ordering those titles for the shelf (pull box/pre-order only) or minimal shelf copies at best.

Want to learn more about how comics publishing and digital comics work? Try Todd’s book, Economics of Digital Comics

“how Image looks more like a peer than it has in a while.”

Image is not a peer to either Marvel or DC. They still work on the business model of you pay them a flat fee and they publish your comic, right? Well, it looks like they are close to publishing more titles that sell under 10,000 a month than all of DC’s publishing slate combined. Essentially, Image stays in business by publishing a bunch of stuff which few people read and which creators make little to no money on.

I’m glad for the opportunity Image provides people but it’s an entirely different business model than DC or Marvel.

Mike

Comments are closed.